Out of all the things we do when we’re adulting, one of the most important skills we can acquire is how to manage money. This life skill is of vital importance to how we structure and run our lives and our households.

Today, I will be sharing 29 tips on gaining control of your finances and how to manage your money most effectively.

So, why should anyone learn how to manage money? Is it really that important? The answer is YES. It will set you free!

Learning how to manage money and becoming fiscally responsible is your greatest defense against the worst effects of ad and media culture.

Why? Because it keeps you focused on your household and what you need instead of what outside influences are trying to tell you that you should have or want. It’s a full immersion into your own lifestyle as opposed to an advertised lifestyle designed to entice you.

In short, managing your money will make you happier and less stressed in the long run. It all starts with what you spend and where it comes from!

Note: If you feel like your finances are really all over the place, I recommend taking a look at this post to help you get back on track with your money. It is a great post to go along with this one today.

Tips On How To Manage Money Effectively

While some might feel they manage their money effectively, others struggle and want to change their spending patterns to really become cost-effective.

Learning to manage your money can affect lots of things. Everything from your budget to your savings and even your retirement fund! Managing your money and spending lucratively is of the utmost importance.

With that being said, here are some of my go-to tips to help you set up a process for managing your money.

1. Stare at your money.

Yup. Stare at it until it blinks.

If you struggle with your money, it’s natural to look away and try to ignore it. You may be aware that there is a problem, but it’s easy to trudge forward without making the necessary adjustments to get on track financially.

If you are in debt or feel like you can never quite get to your savings goal, try looking at your money often. Check your accounts daily and study what they do.

Pretend you’re a celebrity chef making over a restaurant. You have to identify the problems first, then yell at the restaurant owner for a while and hire an interior decorator!

All joking aside, when you watch your money, you can see your situation more clearly, and yes, you do identify problems. Even if you think you know what the problem is, staring at your money keeps the issue of personal finance front and center, and it will frustrate you into dealing with the situation.

Badly managed financial accounts are like cluttered rooms in your house that you can’t walkthrough. Don’t put your blinders on. Confront them before you hurt yourself!

2. When in doubt…invest.

If you are like most people, you run out of money by the end of the month. You probably wonder where it all goes. No matter how much money you make, you are not immune to this phenomenon without proper money management skills.

Those who know how to manage money invest it regularly. They don’t wait until the end of the month when they have no money. They do it right away!

With the power of compound interest, investing early and often can help you build millions…leaving you with a nice nest egg when you’re ready to retire.

Investing can feel complicated and overwhelming, but it doesn’t have to be. When you’re willing to invest in simple index funds, your money will grow on autopilot.

Not sure how to get started with investing? Check out my friend Jeremy’s course on building wealth using index funds. It’s an easy to follow and budget friendly course that is perfect for beginning investors!

3. Get help from a free app.

To help you manage your money, get help from an app.

Apps do more than help you invest; they help you track your spending, too. They can help you save and budget your money.

To make a long story short, there are apps to help you manage money in every facet. They do so much of the work for you, and all you need to do is wire yourself to be attentive to them.

The great news is that we all spend so much time on our phones anyway. These apps help you put that screen time to more productive use.

Money-Saving Apps

Money-saving apps are the most popular. There are a lot of them, but one of my favorites is Rakuten!

Rakuten allows you to earn cash back for purchases you make online, and they even search for coupons online for things you’re already buying. Sign up for Rakuten now and get $10 free when you make your first $25 purchase.

These apps really can help, but don’t forget that they are marketing-driven. Without money management skills, these apps can increase your spending habits rather than curb them.

Money Tracking Apps

Money tracking apps can help you budget and save.

Two of my favorite apps are Every Dollar and Mint! They are both a great way to track your spending and take control of your money management. It’s a great starting point for anybody who isn’t quite sure how to manage money.

But, it’s also a good accountability tool, even if you’ve been budgeting for a while.

4. Be intentional with your spending.

Before you even start to put together your budget binder to figure out your household spending, you can still begin money management. It all starts by addressing your spending habits.

When you stare at your money, you should start to see red flags flapping all over the place. It’s normal when you aren’t intentionally managing your money. It’s especially easy to lose control because everything flies in and out of your account automatically.

Unless you bring your finances into focus, you’ll remain blind to what really goes on week after week in your financial accounts.

You may be aware of your bottom line, and you may not be. The most important thing is taking back your ability to make conscious decisions about every transaction that takes place. In a subscription-driven world, that might mean making some hard choices and sacrifices.

Some people go so far as to switch to cash-only transactions and use the cash envelope system, while others only use debit cards.

The benefit of cash is that you carry a finite amount with you that you can’t go over. Another advantage to using cash is that you can keep the change and save it up.

With a debit card, you have as much as your checking account has, and you can even overdraw the account and pay the penalty. A benefit to debit cards is that you can actually save your change (like cash) electronically using a round-up app, such as Acorns, and invest it.

5. Simplify.

Managing your money takes focus. The less you have to oversee, the better.

So, consider limiting the number of active accounts you have for banking and transactions. Keep it all together as much as you can.

It makes sense sometimes to have a credit card that you use for specific rewards that benefit you. However, in most cases, you should keep your lines of credit limited so that you can avoid spreading your income too thin.

If you already have a lot of credit card debt to different lenders, simplify your budget by using a tried and true method for getting out of debt.

Although consolidating debt may be an attractive option, try this snowball method of focusing on one debt at a time, starting with your smallest!

This tool of money management works because it allows you to systematically reduce debt and roll your payments over until they are big enough to tackle even the hardest debt.

The best part is, you don’t have to think about it. You just follow the basic principle, and you will see progress very quickly.

6. Refinance your private student loans.

If you have private student loans, your interest rates might be high. Because you financed these loans when you either didn’t have a credit score or your credit score was low, chances are you were given a higher interest rate.

By refinancing your private student loans, you’ll save money each month. This will also allow you to pay off your student loans faster!

Juno helps you find the best rates when it comes to refinancing your student loans. Plus, they don’t charge you one penny! Take a few minutes to see which rates you can get when you refinance your student loans today.

7. Save an emergency fund.

Emergencies happen. From unexpected medical bills to cars that eventually break down, there will come a time when you will need access to money set aside for emergencies.

An emergency fund can keep you from going further into debt when something unexpected arises. Wondering how much money you should have inside your emergency fund?

A good rule of thumb is 3 months of necessary expenses.

Necessary expenses include expenses such as rent/mortgage, minimum debt payments, food, and utilities. List out how much your necessary expenses add up to be and then multiply that number by 3. That’s a good starting point for your emergency fund!

8. Find easy ways to make more money.

If you want to increase your income so that you can do things like save for an emergency fund faster or pay off more debt, then you’ll want simple and easy ways to make more money.

Below are my favorite ways to make money or earn free gift cards:

Survey Junkie is a market research company that needs consumers’ opinions…and is willing to pay for them. When you sign up for Survey Junkie, you’ll take online surveys and accrue points. These points can be redeemed for gift cards, PayPal cash, or can be transferred to your bank account.

Branded Surveys is an online survey company who pays you for giving them your opinion. It’s super easy to sign up and you can start earning right away. You can earn money through Branded surveys by completing online surveys, collecting points, and then redeeming those points for gift cards or cash.

Fetch Rewards is a free app that gives you points by simply scanning your receipts. Each time you scan your receipts, you can earn points. You can redeem the points for gift cards. This is a super simple way to earn extra cash or gift cards. Sign up for Fetch Rewards now and earn 2,000 points when you scan your first receipt!

Swagbucks is an online website, browser extension, and app, that will allow you to earn points by completing certain tasks. You can exchange points for gift cards to several amazing stores! You can earn points by shopping online through their site, watching videos, using their search engine, or even taking surveys.

9. Plan in advance for large expenses.

Planning for large expenses in advance is a great way to manage your money and stay debt free. The easiest way to plan for large expenses is to start a sinking fund. A sinking fund is simply a savings account that you add to each month for a certain expense.

For example, if you want to save $1200 for Christmas, you would need to save $100 a month in your Christmas sinking fund.

The budget categories that you use for sinking funds really depends on your unique situation. These funds are to help you cover the expenses you couldn’t (or don’t want to) cash flow with your monthly budget.

Common sinking fund categories include:

- Auto Repair

- Pet Fund (Vet bills, boarding bills, etc.)

- Vacation

- School Shopping

- Christmas

- HOA Fees

- Home Maintenance

To learn more about sinking funds, check out this post. Want a free sinking funds tracker? Get access to yours inside my Free Resource Library. Sign up below to grab your freebie!

10. Create a budget the right way.

Creating a budget is the best thing you can do to manage your money. The best way to create a budget is by paycheck. That means you’ll write a budget on payday to last you through the next payday.

A budget calendar is the best way to organize this so you can see everything laid out and determine which bills will be paid with each paycheck.

Create your budget by payday:

11. Setup a weekly money meeting.

Setting up a weekly money meeting will help you stay on top of your finances. It will help you be more accountable and likely to stick to your budget.

If you want to see a peek inside how my husband and I organize our meetings, check out this family business meeting printable. We go through this same form every Sunday night to stay on top of the week and our money.

The biggest reason people ditch their budget is by not keeping up with their money. This weekly meeting will help make sure you’re always aware of how you’re doing this week.

12. Surround yourself with positive influences.

The power of who you listen to and follow on social media is incredible! It can be easy to be thrown off course when you’re following people on Facebook or Instagram that tempt you to spend. Instead, fill your social feed with positive influences.

If someone is making you want to go against your money goals and spend money or even make you feel bad about where you’re at now, unfollow them.

13. Set up 3 savings accounts.

To help keep your money goals organized, set up 3 savings accounts with your bank:

- Short term savings account

- Long term savings in a high yield savings account

- Emergency fund savings

A short term savings account will help you cover the funds like your sinking funds and other small savings goals. These are goals for the next 3-6 months. For anything longer than 6 months, you need to keep them in a long term savings account that earns you a bit more interest, like a high yield savings account.

Your emergency fund amount is something that is debated in the financial community. There are so many different opinions about this. It really depends on your unique situation. If you’re self-employed, you might want to keep more money in your emergency fund. A good rule of thumb for an emergency fund is 3 months worth of expenses.

Here’s how to shop for the best rates on savings accounts:

14. Pay your credit cards off every month.

Paying your credit cards in full every month will help you stay on top of your credit and keep you from going into debt. Spending on credit cards can add up quickly. You have to be careful and disciplined to use them responsibly.

Remember: credit cards aren’t bad. They are simply a tool to help you manage your money.

15. Shop around for insurance.

Shopping around for home & auto insurance is something my family does at least every year. By simply finding a cheaper plan (with the same deductible, of course) can save you hundreds each year. This might take time, but it’s a one-time commitment to help you save money in the long run.

Curious if there’s better rates out there for auto insurance? Find out below!

16. Find an accountability group or person.

Accountability can help you reach your money goals faster. When you get to hang around with a group of likeminded people, it will help you find the motivation to keep going when you feel like quitting.

An accountability group will help you stay on budget, save more money, and pay off debt. Here’s an amazing group of women who are committed to winning with money and changing their family’s financial future if you need some accountability with your financial journey.

17. Determine your why.

It’s important to know why you want to manage your money better and reach your money goals. Knowing your why, like accountability, will help you stay motivated to just keep going and ultimately make a lasting change in your life.

Making a change is hard!! I get it. Defining your why will help make changing your financial habits and start to win with money a little easier.

18. Know your credit score.

Knowing your credit score is very important as it can impact your ability to qualify for a loan and the interest rate you’ll pay on that loan. It will also help you detect errors on your credit report. Any inaccuracies will lower your credit score and could cause you to pay higher interest on future loans.

You can check your credit score for free anytime with Credit Karma. This is the app I personally use to track my credit score and get access to my credit report. Download the Credit Karma app here for free. They have a free app that’s super simple and easy to use. It will help you stay on top of your credit score and credit report.

19. Create a debt payoff plan.

Creating a debt payoff plan will help you figure out the right steps to pay off your debt for good. You’ll want to list out the balance on each loan as well as the interest rate for each loan. The good news is that there isn’t a one-size fits all answer to paying off your debt. This means you get to make your debt payoff plan how YOU want it!

Personal finance is personal. You might need to flip flop between the debt snowball method and the debt avalanche method. You might need to “go out of order” when things come up in your life. Creating a plan will help you take out the overwhelm and make paying off debt easier.

To make it easier, I’ve created this simple Debt Free Guide. It has step-by-step instructions for figuring out your debt payoff plan and spreadsheets to help you keep track of everything along the way. It’s truly a game changer!

20. Find a way to increase your income.

Increasing your income is a great way to save more money or payoff debt faster. There are so many ways you can increase your income and make money from the comfort of your home in this day and age.

One of the best side hustles for anyone who has any type of computer experience is to become a virtual assistant. A virtual assistant is someone who is basically an administrative assistant from home. They help the business owner in a variety of ways.

Virtual assistants can help with social media, finances, emails, customer service, technical assistance, graphic design, and more. I pay my current VA $25 an hour to help me out from home.

Typical VA’s can make anywhere from $15 – $50+ depending on experience and level of difficulty. To help you get more acquainted with the tasks that VA’s can do, my friend Abbey has created a Free Virtual Assistant Checklist and Starter Kit.

21. Set money goals.

Setting money goals each month can help you reach your financial goals faster. Take time at the beginning of each month to set 3 money goals.

They can be as simple as sticking to your meal plan so you don’t spend as much money on takeout. They can also be as big as saving $1,000 toward your emergency fund. No matter what, your goals will help propel you in the right direction when it comes to managing your money better.

Want to see setting goals in action? Check out what happened when I tracked 3 money goals for an entire month. It might shock you!

22. Combat beliefs that don’t serve you.

We all have helpful and harmful money stories. The harmful money stories like “I don’t make enough money”, “I can’t be trusted with credit cards”, “I’ll always be in debt”, “I should have paid this off by now” and other negative beliefs will hold you back from your financial dreams.

Identify these negative money beliefs and start to slowly turn them around. You can journal or repeat affirmations to help you develop helpful money beliefs.

Here’s an example:

- Harmful Money Belief – “I’ll always be bad with money”

- Helpful Money Belief – “I’m learning to be good with money”

23. Negotiate your medical bills.

Negotiating medical bills is a great way to save money on medical expenses and doctor bills. A lot of people don’t know you can do this, but you can! If you have the cash to pay them off, you can negotiate as much as a 30% discount (or more) by paying in full at one time.

Grab my script for negotiating medical bills here.

24. Consider budgeting by percentages.

Budgeting by percentages is a super simple way to create a budget (especially if you’re just starting to learn how to budget). The 50/30/20 budget is the most common percentage budget.

Here’s the breakdown:

- 50% Needs

- 30% Wants

- 20% Savings & Debt

Of course, personal finance is personal. So feel free to use this as a guideline to create a budget that fits your specific needs.

25. Know what to do when you overspend.

Overspending can lead to a lot of shame, guilt, and sometimes panic. It happens to everyone. There isn’t a person alive that hasn’t gone over budget.

The important thing to know is that you can develop boundaries so that this is less likely to happen again in the future. Not sure where to start? Check out this post on 5 ways to recover when you overspend.

26. Calculate your net worth.

Learning how to calculate your net worth is important. Your net worth is an overall picture of your financial life, and can help lead you to building wealth.

Here’s how to calculate your net worth:

Net worth = Assets (What you Own) – Liabilities (What you Owe)

Remember that as you continue to manage your money better, your net worth will hopefully increase. This means you’re building wealth!

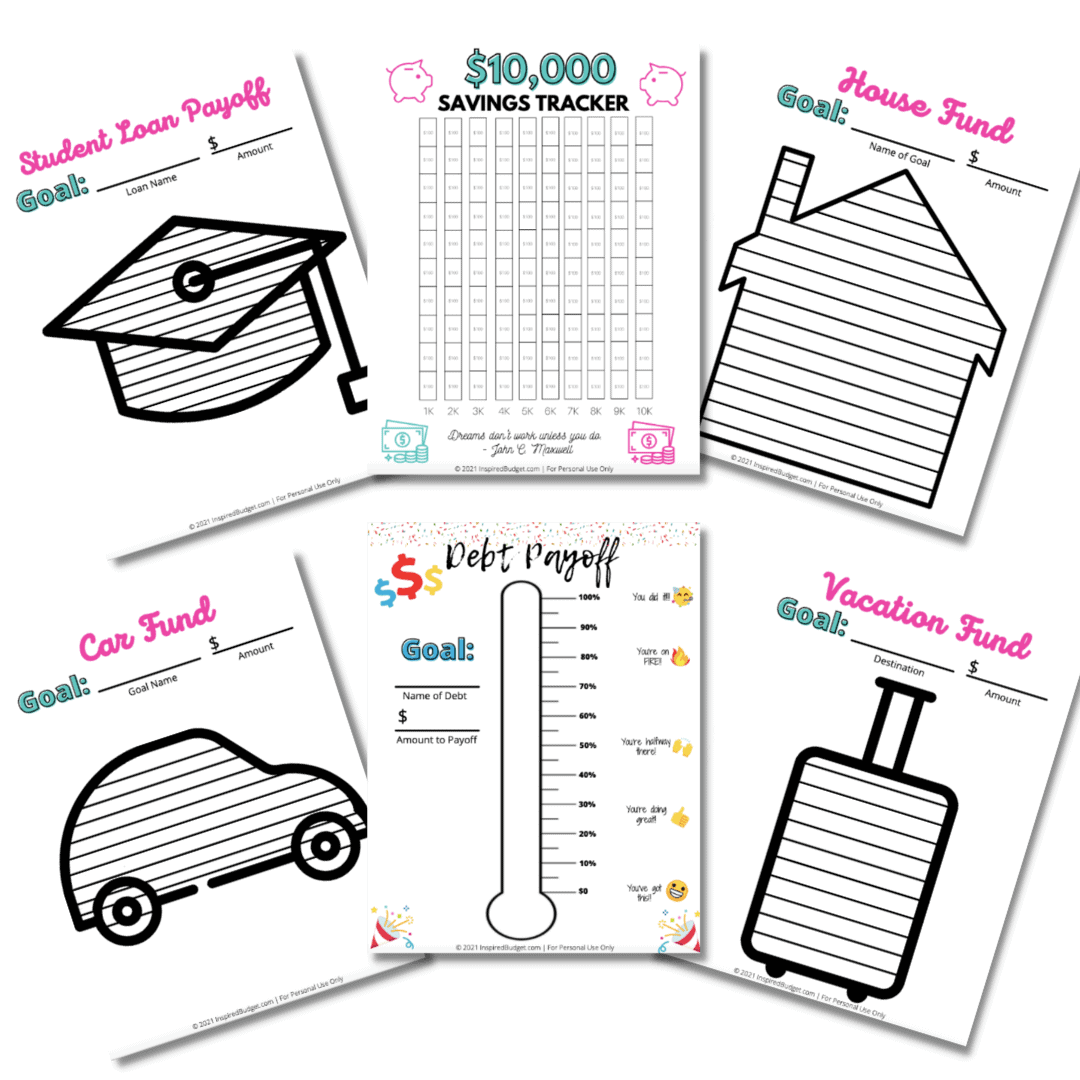

27. Track your progress.

Tracking your progress is essential for hitting your money goals. It tells you where you’re at and how far you have to go.

Studies have shown that people who visually track their dreams and successes are more likely to reach their goals. There are so many ways to track your progress. Want a free printable to help you track your progress? Check out these 27 money charts you’ll love.

28. Learn more about money.

Educating yourself and learning more about finances is so important to becoming financially stable and saving for retirement.

You don’t know what you don’t know, right?

While sometimes you may wish that your parents taught you about managing money, it’s ultimately up to you to make educated decisions about your finances. So, it’s time to make learning about yourself and your money habits a priority!

Learning more about money will help you create a realistic budget that works for your family, build wealth through saving and investing, and get out of debt.

Thankfully, you have access to a wealth of knowledge online to help you learn more about finances. The best ways to learn about finances are through books, podcasts, and courses.

Here are some of my favorites of each:

Finance books to read:

- The Simple Path To Wealth – this book is a must! You’ll have a roadmap to help you reach financial independence.

- Clever Girl Finance: Ditch Debt, Save Money, and Build Real Wealth – this is an all-encompassing guide to help you learn about managing your money better.

Financial podcasts to listen to:

- The Inspired Budget Podcast – This is my weekly podcast designed to help women live their best life and reach their money goals.

- This is Awkward Podcast – I co-host this podcast with my amazing friend, Chris from Popcorn Finance. In each episode, we’ll take your calls to help you with all of your awkward money situations without losing your friends or family along the way!

- The So Money Podcast – This podcast is one of my favorites. Farnoosh is having conversations to help you have a richer, happier life.

- Popcorn Finance Podcast – This podcast is hosted by my friend Chris. It’s a short-form podcast where he gives financial advice and answers all of your finance questions about the time it takes to make a bag of popcorn.

Financial courses to take:

- Budgeting 101 – step by step for beginners to create a simple budget that works.

- How to Build Wealth with Index Funds – This super simple introduction to investing course will help you figure out how to invest for yourself (in an easy way) to save a ton of money in fees and have more control of your money to build wealth.

29. Be willing to give.

Generosity and giving provide many positive benefits in your life as well as others. There are so many ways to give with your time or money. You can pay for the person behind you in the drive-thru, you can tithe at church, you can donate to charity, and more! I believe when one rises we all rise.

How To Manage Money: Final Thoughts

The simplest way to manage your money is to always be aware of how much goes into your bank account and how much goes out. Make sure the first number is always higher. There’s no trick!

You just need to be aware, focused, and intentional with your money.

Shop for what you need for the life you have because buying into a lifestyle that isn’t your own has the heftiest price tag.