Have you ever faced a problem in your life where you were standing at a fork in the road? Maybe you had a tough decision to make with a friend or a spouse. You’re standing there asking for someone to just give you the exact steps to take. “Just lay it all out for me!” you shout.

Unfortunately, I’ve come to learn that in life we aren’t always given a checklist (trust me, I wish I could get my hands on one). There aren’t always step by step instructions on how to get through something. However, budgeting can be just that simple. Yes, I know that dealing with money can be overwhelming. Lots of questions arise. But if you need a plan or checklist to know if you’re doing this whole budgeting thing “right,” then the 50-30-20 method might be for you!

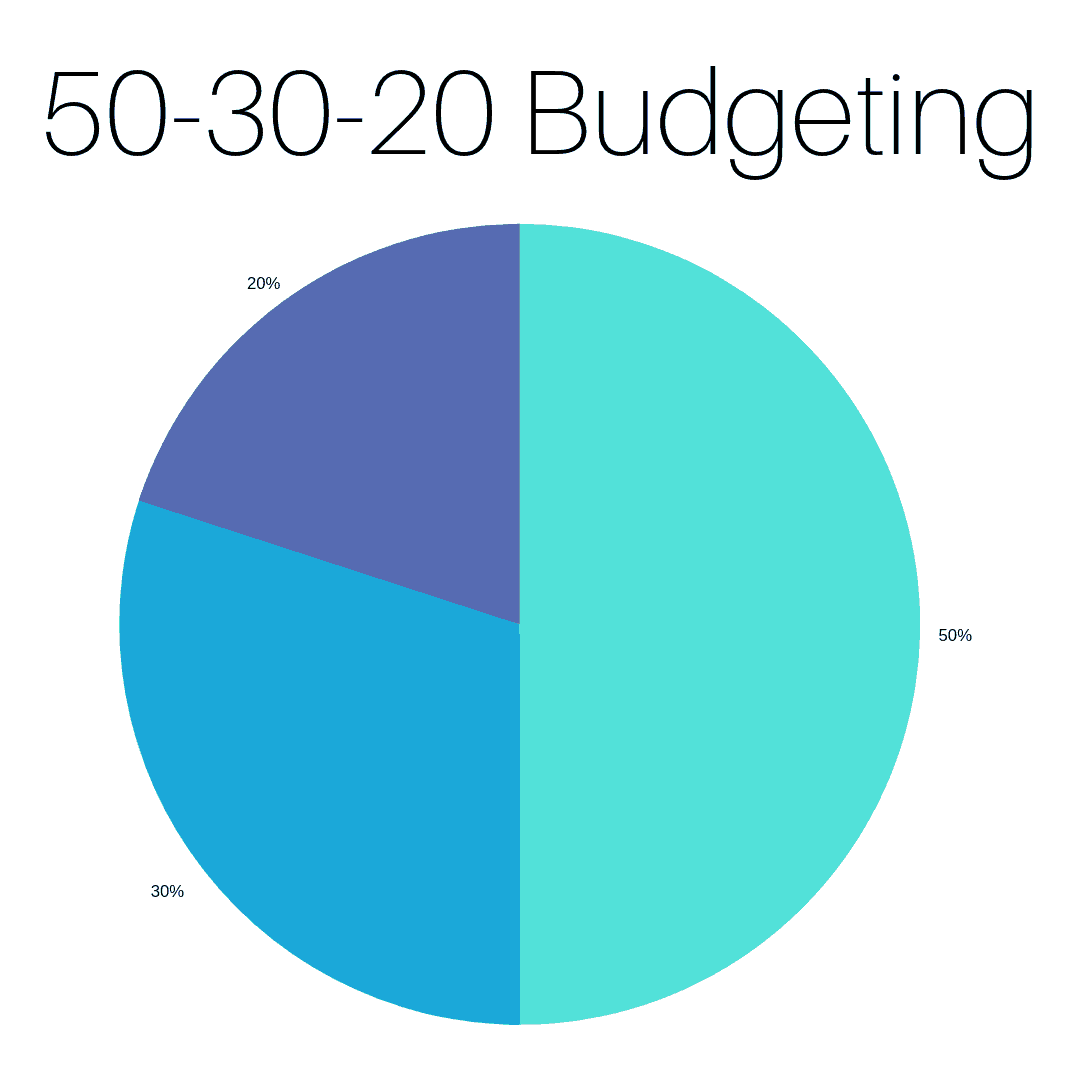

The 50-30-20 budget tells you exactly how much you should be spending on each category of your budget based on how much money you bring home each month. It’s rather simple. The budget allows you to spend 50% of your take-home pay on your needs, 30% on your wants, and 20% on savings/debt. Let’s explore each category more!

50% – Needs

When following the 50-30-20 rule, set aside half your income to cover your basic needs. This includes your rent/mortgage, utilities, health insurance, car payment, gas, and groceries. For instance, if you bring home $4,000 each month, then you’ll be spending about $2,000 on your needs. This means if your mortgage payment is $1,700 that it’s probably too much!

Below is a list of expenses that would fall under the “needs” column.

- Groceries

- Housing

- Utilities

- Health Insurance

- Life Insurance

- Car Payment

- Gas

30% – Wants

In this type of budget, set aside 30% of your take-home pay for wants. This means that when you’re wandering through Target and that cute lamp is calling your name, you pull money from this category to pay for it! People get in trouble when they end up overspending in their “wants” category (I know that’s how it was for me!). Below are the types of purchases or expenses that would be considered “wants.”

- Restaurants

- Dining Out

- Hobbies

- Extra Curricular Activities

- Target trips for home decor!

20% – Savings & Debt

The last 20% of your monthly take-home pay will be sent to savings or debt. If possible, you can always send more toward savings or debt! Or if you’re interested in the idea of giving or donating, then you could simplify your other categories to increase this category. The following expenses fall under the 20% category:

- Debt Payments

- Retirement

- College

- Emergency Fund

What if you want to become debt free?

If you’re ready to work towards becoming debt free, then you might want to make some changes to the 50-30-20 budget. The truth is that the more you’re willing to sacrifice, the faster you’ll be able to get out of debt. And if that’s the case for you, then feel free to lower the percentages in the other categories. Imagine if you could cut your needs down to 40% and your wants down to 20%. That means you’d be able to send 40% of your take-home pay to debt! That’s not an easy task, but it might be possible for your family. To read more about paying off debt, click HERE.

Is the 50-30-20 budget right for you?

This particular budget, or “guide” is great if you are getting started with budgeting need some guidelines to follow. If it helps you know if you’re overspending in a certain category. But over time, you should be able to make your budget unique to you and your family. Your budget might not match these rules perfectly, and that’s okay! So don’t give yourself a hard time if you change these percentages up a bit. Just be sure that you’re keeping your goals in mind and that you’re being responsible with your spending!