Making a budget and sticking to it can seem like an overwhelming task, especially if you get paid biweekly! There are hundreds of tips out there for how to manage your monthly income. But what about when you get paid every other week?

If you need to budget on a biweekly income and you aren’t sure where to start, then you’re in the right place. I’ve laid out simple steps to help guide you in the right direction. These are the exact steps that I’ve used to help our family budget when we are paid biweekly.

Below are the 5 steps to help you budget biweekly:

- List Out Your Bills

- Fill Out A Bill Payment Calendar

- Write Your First Biweekly Budget

- Write Your Second Biweekly Budget

- Track Your Spending

Before we go into depth on each of these steps, let’s cover what being paid biweekly actually looks like.

What is biweekly pay?

There are 52 weeks in a year. If you are paid biweekly, you will receive 26 paychecks throughout the course of the year. Most months you will receive two paychecks, but 2 months out of the year you will receive 3 paychecks.

Wondering what you should do with this third paycheck? Don’t worry! We will cover that in this article.

Is biweekly pay the same as getting twice a month?

Biweekly pay isn’t the same as getting paid twice each month. Those who are paid twice each month will only receive 24 paychecks. They won’t have the opportunity to enjoy those third paycheck months.

No matter if you are paid biweekly or twice a month, the following steps will help you write a budget that you can stick to!

Step 1: List Out Your Bills

Grab a piece of paper and list out all your bills, the amount due, and their due dates. To make sure you don’t miss any bills, print out your last 2 month’s bank statements. Go through every transaction and highlight the bills that come out every month. Add these to your list of bills.

If you forget to add a monthly expense to your list, your entire biweekly budget can be thrown off. Although no budget will be perfect, this is when so many people give up on their budget. The more prepared you are for your budget, the more likely it is to work!

Step 2: Create Your Bill Payment Calendar

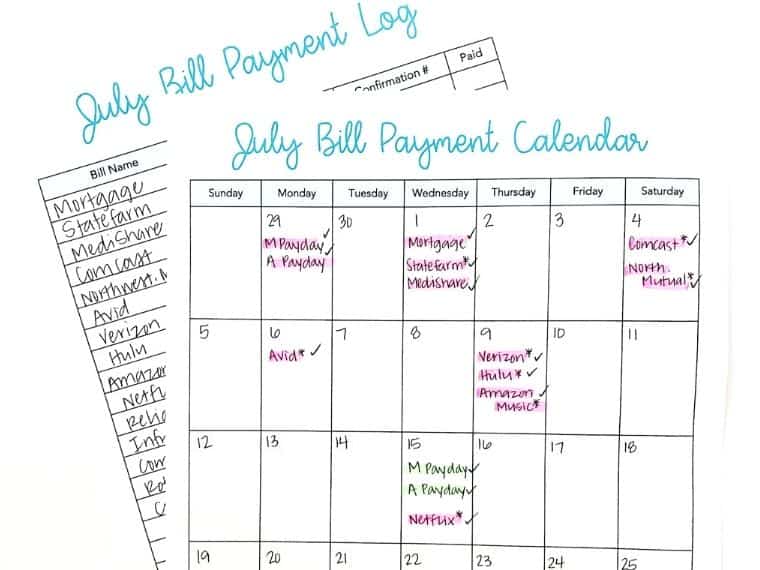

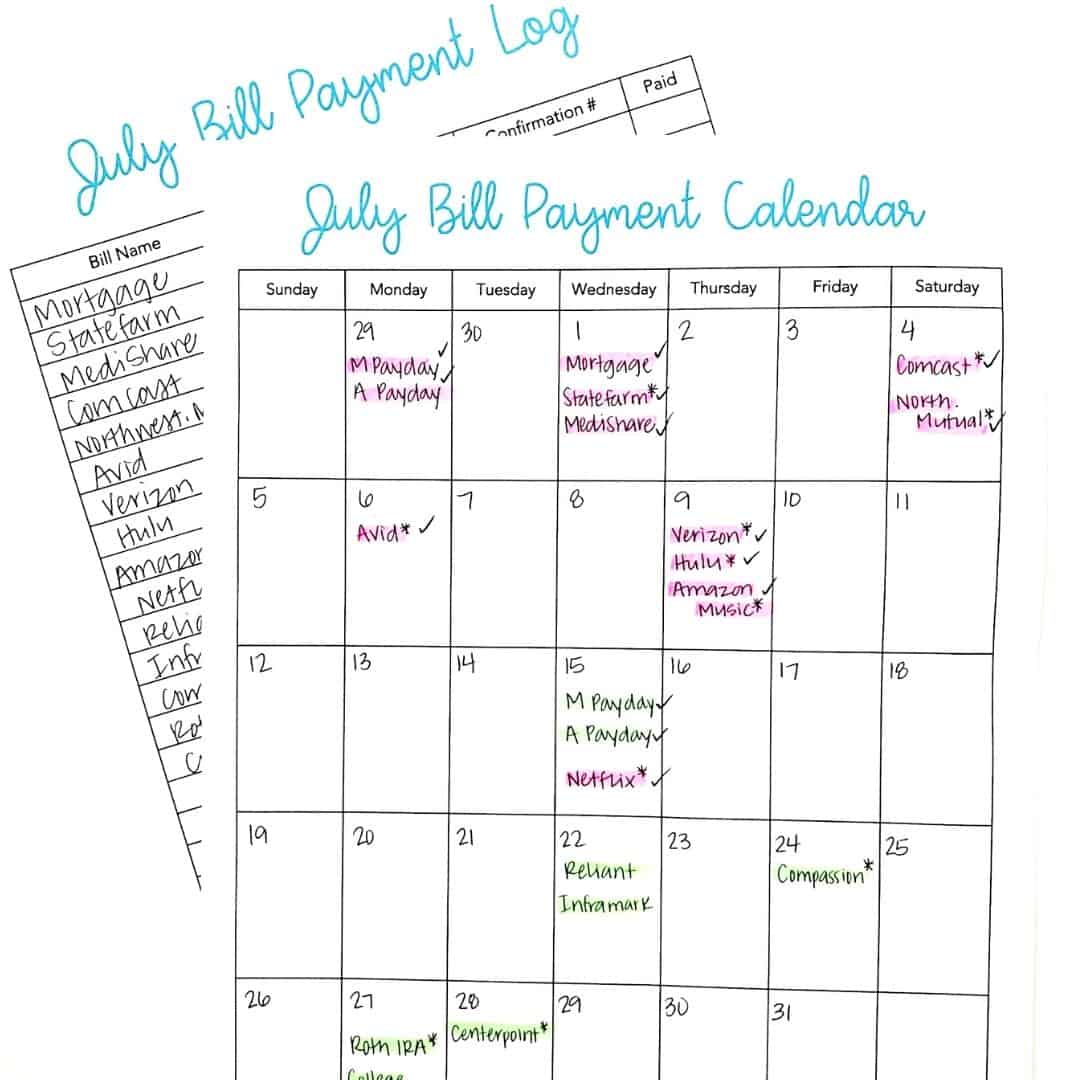

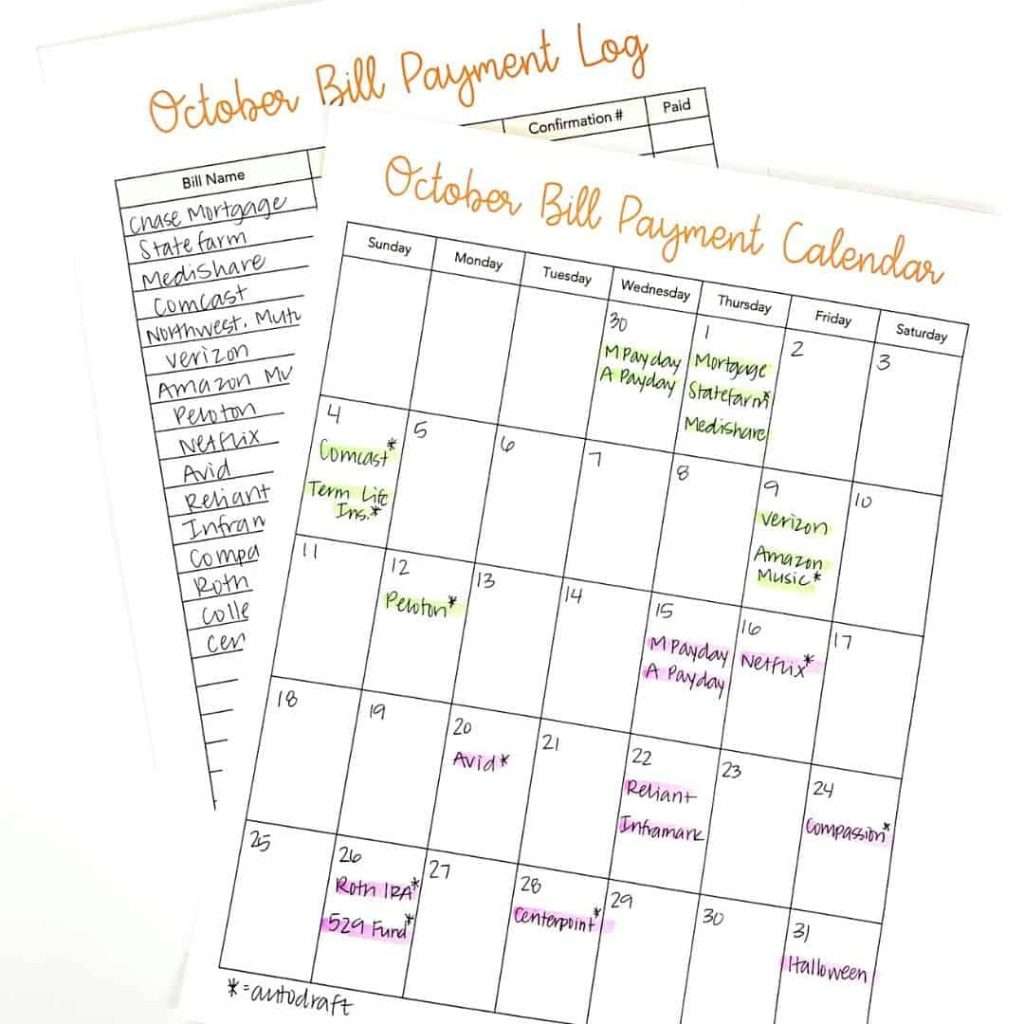

Once you’ve listed out all your bills, it’s time to add them to your Bill Payment Calendar. This type of calendar helps you organize your bills based on when they are paid. If you’re a visual person, then this is a must!

A simple monthly calendar will work, or you can use this page from my Budget Life Planner.

As you write your biweekly budget, highlight all the bills that will be paid from your first paycheck with one color. Then, highlight all the bills that will come out of your second paycheck with another color.

Bill payment calendars are perfect for tracking when you’ve paid bills. I always put a checkmark next to each bill after I’ve paid it or after it has been automatically drafted from my account.

You can even draw an asterisk next to every bill that will be automatically drafted out of your account. This way you know which bills will be paid automatically and which ones you are responsible for paying.

Another great tip is to add other notes or special dates to your bill payment calendar to help you with your budget. For instance, add any birthdays, holidays, or other special occasions to your bill payment calendar.

Keep your bill payment calendar somewhere you can refer back to it often. Don’t tuck it away or else you might forget to reference it throughout the month. A bill payment calendar is the perfect way to keep yourself organized and make budgeting biweekly an easy task!

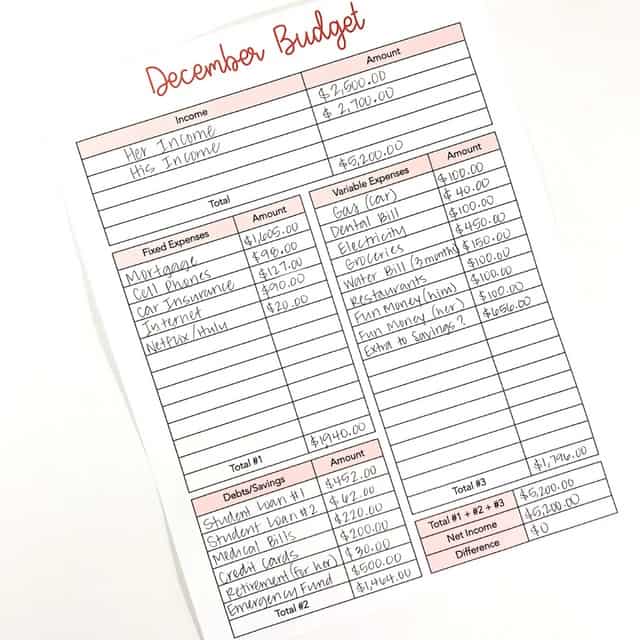

Step 3: Write Your First Biweekly Budget

Once you’ve filled out your bill payment calendar, you’ll know which bills need to be paid with your first paycheck. Next, add any extra expenses into your budget such as groceries, gas, and spending money. Be sure to include every expense you’ll have before your next payday in your budget.

By creating a thorough budget, you’ll be setting yourself up for success!

If you have any money leftover you can send it to your sinking funds or make an extra payment towards debt! This will help you reach your savings and debt freedom goals faster.

Step 4: Write Your Second Biweekly Budget

After your second check has hit your bank account, then you can pay the rest of your bills for the month. You’ll also need to set aside money for groceries, gas, and other expenses.

Don’t forget to include these 10 items that are most commonly missing from budgets!

If there is any leftover money after you have budgeted for all your expenses, send it to savings or debt.

Step 5: Track Your Spending

Once you have your biweekly budget written, it’s important to track your spending. By tracking your expenses and spending, you’ll get a good idea of whether or not your budget is realistic. It’s not uncommon to write a budget that you think is perfect only to find that you’ve blown your budget within a week of payday.

Tracking your spending has many benefits, but by far these 3 benefits stand out above the rest:

- You learn more about your money habits. As you track your spending, you’ll start learning more about yourself and even your partner’s spending habits. The more insight you have into your spending, the easier it will become to write a budget that you can actually stick to.

- You can find ways to save money. As you start to track your spending, you might be surprised by just how much money you’re spending! This will allow you to find areas in your spending where you can cut back and save more money. Try to find one new expense to cut out of your spending each month.

- You will be more in control of your money. Tracking your spending allows you to face your financial truth. When you know exactly where your money is going, you’ll be more confident and feel in control of your finances. This is the best benefit of knowing where your money is going.

Budgeting Biweekly Tips and Hacks

Learning how to write a budget every other week might seem difficult at first, but these tips will help make it simple!

Get Yourself and Finances Organized

No matter how you get paid, getting yourself and your finances organized will not only make budgeting more efficient, but even fun!

How you choose to get yourself organized depends completely on you. Are you more technical and prefer spreadsheets? Perfect! Keep everything organized in Excel or even in Quicken. If you enjoy making budgets and handling your finances with paper and pencil, then a Budget Binder is perfect for you!

You can even have a mixture of the two. Our family personally uses Quicken to track our spending. We also have a budget binder where we keep any papers, bills, and our budget calendars organized.

When you can get your finances organized, you’ll stress less about your money. You’ll know that writing a budget or paying bills doesn’t have to be daunting. Who knows, you might even enjoy it one day!

Include a buffer in your budget

No matter how you budget, consider including a buffer into your budget each pay period. A buffer is simply an amount that acts as a cushion so that you don’t overspend. It covers any extra expenses that might take you by surprise.

Likewise, a buffer can also help cover bills that end up costing more than you had planned. You know, like that electricity bill that ended up being $50 more than you had expected!

Buffers can help you stick to your budget. They leave room for grace in your everyday finances. To include a buffer in your budget, simply write the word “buffer” as a line item in your budget. Decide how much money you want to have as a buffer and make it a priority to include the same amount each paycheck!

Set a day and time to work on your budget

Life happens. And sometimes the last thing you want to do is sit down to review or write a budget every other week. Look, I get it. I could easily find 100 things I’d rather be doing than sitting down to work on my finances.

But if you want to reach your money goals, then you have to make budgeting and your finances a priority.

Even when you don’t want to.

The best way to make your budget a priority is to set a day and time that you’ll work on your finances. Treat this time as an appointment with yourself that is non-negotiable.

If you were sick, you’d see a doctor. If you had a cavity, you would see a dentist. You’d never miss a dentist appointment if your tooth ached! Treat these appointments with yourself just as important as a doctor’s visit that you have scheduled!

During these scheduled budget meetings, you can:

- pay bills that are coming up

- write a new budget if payday is near

- track any expenses or spending from the last few days

- track how much money you have in savings

- find ways to cut back on your spending so that you can save more money

This small tip can truly change your finances and help you budget better than ever!

Move your due dates around

If you don’t have enough money to cover all your expenses in your biweekly budget, then consider calling your bill companies and moving the due dates of your bills around. This is an incredibly easy task that will help make budgeting easier for you every single month.

For instance, if your cell phone bill is due on the 18th, but you’d rather pay it with your first paycheck, then call the company up and simply request that the date be moved. Most companies will be willing to work with you because they know that this means you’ll be more likely to pay your bill on time.

Traps To Avoid When You’re Paid Biweekly

There are 2 main traps that people fall into when they start working on their biweekly budget. Let’s cover them below so that you don’t fall into the same traps.

Trap #1: Don’t Spend Your Entire Third Paycheck

We will go into depth below about what you should do with your third paycheck, but just know this: it has a purpose. These third paychecks should not be seen as your bonus or extra spending money. You’ll want to be specific with how you use this extra paycheck so that you can continue to make progress toward your money goals.

Trap #2: Don’t Get Off Track

If you’re paid biweekly, then you have to check in often to make sure you’re on track with your budget and bill paying. Unlike someone who is paid once a month, you’ll likely have to pay bills several times each month.

Don’t get off track with your bill paying schedule. Keep your bill payment calendar visible so that you don’t miss any bills. The last thing you want to do is be faced with late fees!

What To Do With A Third Paycheck

Twice a year the clouds will part, the heavens will shine down on you, and you’ll receive that glorious third paycheck! Everything will feel right in the world and the spender in you might want to head straight to the Target home decor section. But let me encourage you to send that “extra money” elsewhere.

First, you’ll need to set aside any money that you’ll need for the next 2 weeks. This will include any bills that might come up and everyday expenses. Don’t let any expense go overlooked.

Then, take all your leftover money and throw it at your debt snowball or savings account. If you’re trying to save up for a vacation, then this is a great opportunity to send more money toward that goal. Plus, if you have money set aside in savings, you won’t have to put any of your vacation expenses on a credit card.

You can also use this money to set up a large buffer in your checking account. The third paycheck is a wonderful tool, but it should be used as such.

The Bottom Line

Writing a budget is just like any other task. Practice makes progress! The more you write a biweekly budget, the easier it will become. Give yourself time and I promise that you will be a budgeting pro in no time!

Looking for motivation to stop living paycheck to paycheck and FINALLY pay off your debt for good? This simple and actionable FREE Budgeting and Debt Cheat Sheet will help you get your money under control once and for all. You don’t work this hard to live paycheck to paycheck, right?