Creating a budget calendar every single month is essential to writing a budget that will work for you and your family.

Years ago, my husband and I were only paid once a month. This made paying bills super easy. Each month we’d get paid (on the same day!) and then automatically pay all of our bills. We never once missed a due date!

But after 7 years of budgeting, my husband and I both took jobs where we were paid twice a month. This threw us for a loop and we had to figure out how to make sure we didn’t miss any bills or payments. That’s when we started using a budget calendar to help us create a budget schedule that would work for our family.

If you’re finding yourself stuck when it comes to paying your bills and keeping yourself organized, then a budget calendar is for you! In this article, I’m breaking down the exact steps for how to get started!

What is a budget calendar?

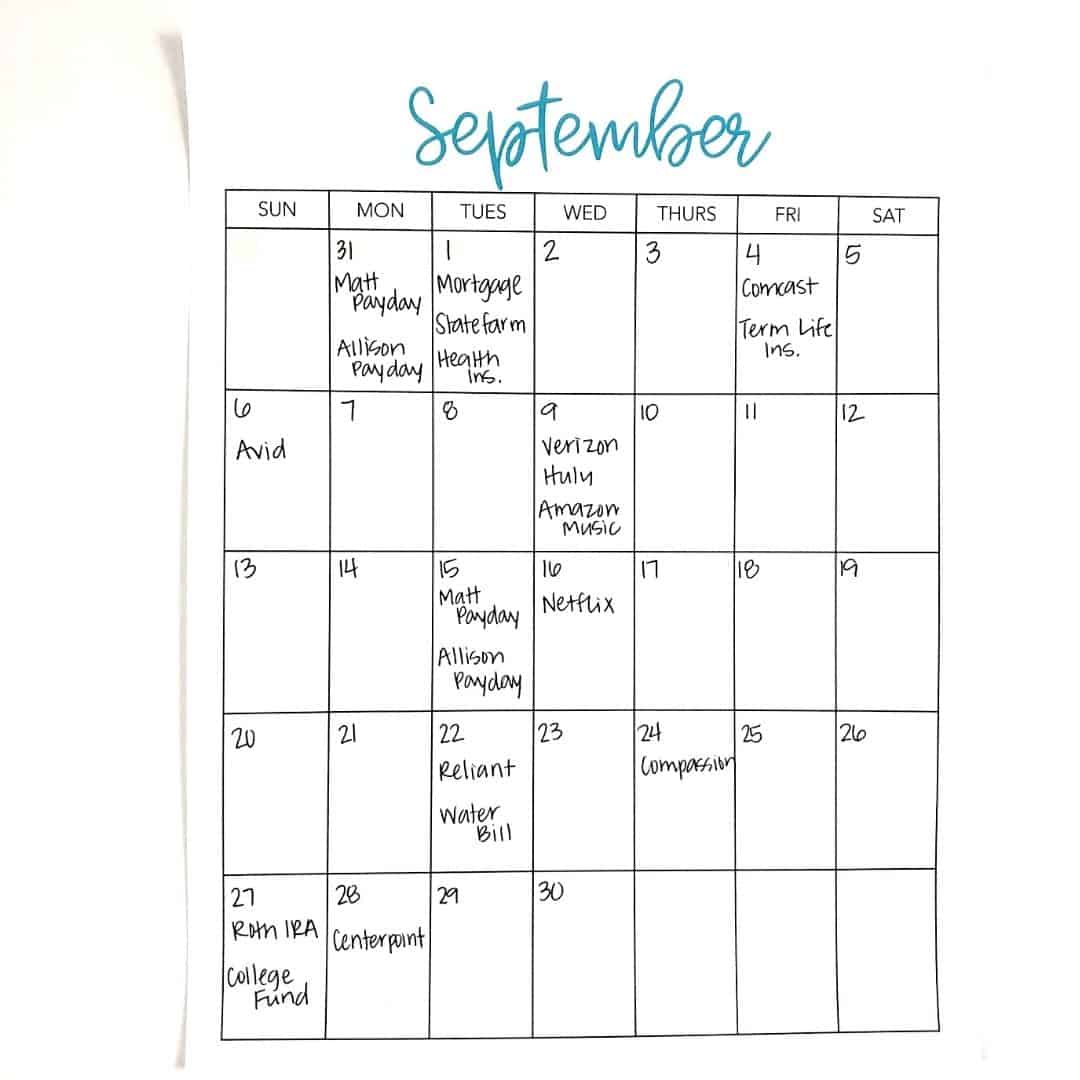

A budget calendar is just what it sounds like – it’s a calendar where you keep track of items that make up your budget. This doesn’t just include your expenses. There are several things that you’ll want to include in your calendar:

- Paydays: Be sure to include your paydays (and even your income!) on your calendar. This will allow you to visually see what days you’ll be getting paid.

- Bill Due Dates: Write down all of your regular monthly bills onto your budget calendar. Once you have them listed, you’ll be able to decide which payday will cover each and every bill.

- Automatic Savings: If you have any automatic savings accounts set up, then list them on your calendar as well. This way you’ll know exactly what days of the month you’ll have money automatically withdrawn out of your account for savings.

- Special events or holidays: Each month is different which means you’ll want to include any special events, birthdays, or holidays on your budget calendar. This will help you remember to include these extra or bonus expenses in your budget.

Why you should use a budget calendar

Ultimately, a budget calendar helps you stay organized. It also helps ensure that you don’t miss another due date. You’ll no longer be paying late fees when you have your bills and income organized all in one place!

Budget calendars are perfect for people who are paid several times a month or on an irregular schedule. If this is you, then you’ll be able to color code your budget calendar so that you always know which paycheck will cover certain bills. This is essential if you’re currently living paycheck to paycheck.

Using a budget calendar also allows you to preview your month in advance. This way you’ll be prepared for any specific expenses such as birthday gifts, holiday gifts, or annual memberships that might be due this month.

Finally, a budget calendar allows you to see where you can save more money. You can easily set monthly reminders to transfer money to savings or put money aside for your long-term money goals. Just simply add them to your calendar!

How to create a budget calendar

Creating a budget calendar is easier than you think! In fact, I’ve started looking forward to creating mine each month.

I feel much more organized and less stressed when I can see all my bills and paydays in one spot.

Below are 7 simple steps to creating your own budget calendar.

1. Print off a monthly calendar.

You can easily grab a free printable calendar online, use a large calendar you already have, or grab your own free budget calendar printable at the bottom of this article.

2. List out your paydays on the calendar.

No matter how often you’re paid, list out every single payday on the calendar. You can even write out how much the paycheck will bring in as well!

3. List out your bills on their due dates.

You’ll want your budget calendar to be as accurate as possible. Start off by logging into your accounts and write down when each bill is due. It would be helpful to create a list of all your bills and due dates so that you can look back on it each month. Then, add these bills and expenses to your budget calendar.

4. Include any automatic savings to your calendar.

If you have any money being automatically drafted out of your account and into a savings account (like a Roth IRA or college fund), then include these as well!

5. Add any special birthdays or holidays.

The last thing you want to do is completely forget that you were supposed to buy your mom a birthday gift. By adding any birthdays, holidays, or special events to your budget calendar at the beginning of the month, you’ll be more likely to not forget these gifts when you write your budget each paycheck!

6. Check for annual subscriptions.

Be sure to include any annual or bi-annual subscriptions that might be coming out this month! It’s best to keep a list of these types of subscriptions handy so that you can refer back to them often.

7. Color code your calendar.

Once you’ve included everything on your budget calendar, it’s time to keep it organized by color coding it based on your paydays. Let’s jump into how to do that below!

Quick Tip: Put an asterisk next to the bills or expenses that are automatically drafted out of your account. This will help you know which bills you’ll need to pay manually versus which ones will be paid automatically.

How to color code your budget calendar

If you’re paid several times each month, you’ll want to color code your calendar so that you can easily see how to pay your bills each month.

Follow these steps to color code your budget calendar:

- Assign each paycheck or pay period a color.

- One by one, look over your expenses you listed out. Highlight the bills or expenses with the paycheck color that will cover each expense. Be sure to do the math and make sure you have enough money for those bills and extra expenses such as groceries and gas!

- If you have to use money from several paychecks to cover a large expense such as rent or mortgage, then underline the bill with both colors.

Color coding your calendar is not only fun, but will help you get a better picture of how you’ll be able to pay your bills!

How to use your budget calendar throughout the month

Now that you’re done, what do you do with your calendar?

To help keep you on track when it comes to paying bills on time, refer back to your budget calendar throughout the month. Each time you pay a bill, place a checkmark next to the bill. You can do the same for any bills that are automatically drafted out of your account.

Once the month is over, you can place your budget calendar inside your budget binder. This allows you to always refer back to previous months if you need to quickly remember when a bill was due.

Where to keep your budget calendar

Have you ever written a budget, placed it inside a binder, and then never referenced it again?

I know I’m guilty of this!

Instead of putting it away where you can’t see it, hang it up somewhere so you can reference it often. I personally either keep mine in my office or on the refrigerator. This allows me to easily see when my bills are due and what I have coming up!

Plus, this helps keep the entire family on board with the finances. Your partner will likely start checking the budget calendar themselves.

Need more help with budgeting?

Check out these other articles to help get your budget and money under control.

- 14 Budget Categories You Need In Your Budget

- One Family’s Budget – Get A Peek Inside Their Money!

- The Easiest Way To Write A Budget: Your Complete Budget Guide

Do you enjoy using a budget calendar each month? If you’ve never tried one before, do you think you’ll give it a shot?