If you’re new to budgeting, then you’re likely searching the internet looking for a sample budget so that you can truly SEE budgeting in action.

I totally get it! If you’re a visual learner, you probably want to see a real family’s sample budget so that you will be motivated to tackle budgeting once and for all.

And because money tends to be something that most friends don’t discuss, a sample budget is important to help you know if you’re on the right track. It’s a great way to help you learn how to make budgeting doable so that it’s something you can stick with it in the long run.

By looking over a sample budget, you will likely learn tips and tricks to help make budgeting easier for your family. Before diving into this particular budget example, you should know a few important things about budgeting.

What A Basic Budget Should Include

If you’re new to budgeting, then you’ll want to be sure that your budget includes fixed expenses, variable expenses, and debt/savings.

Fixed Expenses

Fixed expenses include bills that do not change from month to month. You can expect to pay the same amount on these bills or expenses every single month. Below are examples of fixed expenses that you’ll want to include in your budget:

- Mortgage/Rent

- Life Insurance

- Car Insurance

- Health Insurance

- Daycare/Childcare

- Prescriptions

- Gym Membership

- Cable

- Internet

- Streaming services (Hulu, Netflix, Spotify, etc.)

Variable Expenses

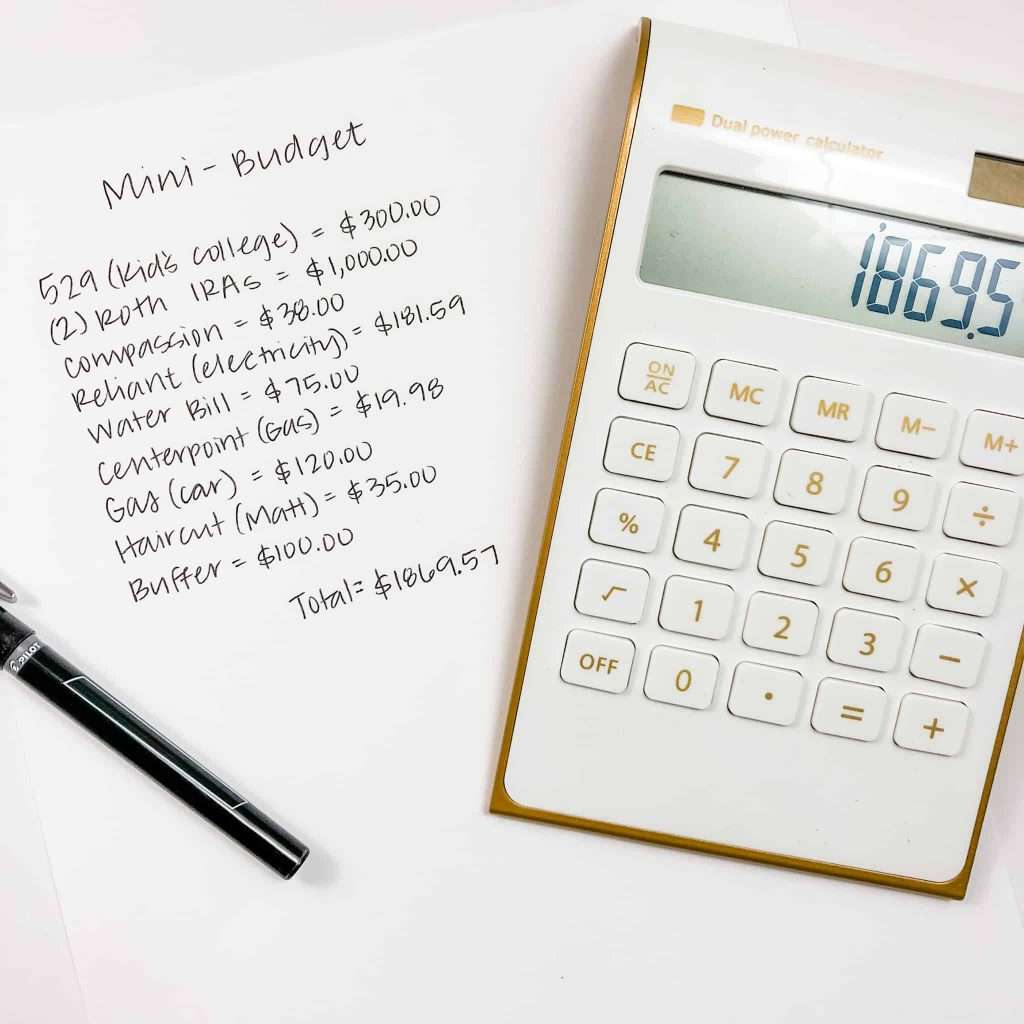

Variable expenses include bills that will change from month to month. They won’t necessarily match your budget from the month before. For instance, you might budget a different amount for groceries from one paycheck to the next. Below are examples of variable expenses that you will want to include in your budget:

- Electricity

- Water

- Transportation (including gas)

- Groceries

- Restaurants

- School Lunches

- Spending Money

- Clothing/Dry Cleaning

- Gifts

- Family Fun Money

- Beauty Products

- Haircuts or Other Personal Care Appointments

Debts and Savings

If you currently have debt payments, you will need to include those in your budget. Likewise, if you’re saving for a future vacation, back to school shopping, or Christmas then you’ll want to add these savings categories to your budget as well. Below are a few examples of debts or savings that you’ll want to include in your budget:

- Car Payments

- Student Loan Payments

- Credit Card Payments

- Personal Loans

- Christmas Savings

- Vacation Savings

- Other Gift Savings (like birthdays or anniversaries)

- Emergency Fund Savings