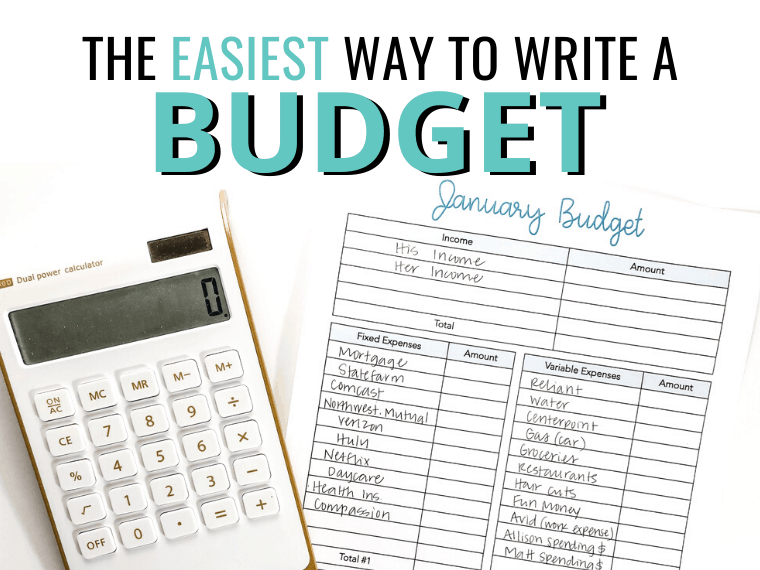

If you’re just getting started with writing a budget, then chances are you feel confused, overwhelmed and lost. Listen up…you are not alone. Writing a budget can be daunting when you are just starting to take back control of your finances.

But chances are you already know that a budget can help you reach your money goals.

Want to pay off debt so you’re no longer sending your hard-earned money to someone else? Then you’ll have to write a budget! Do you want to save for family vacations and pay for them in cash? Then you’ll want to live on a budget. Ready to stop feeling like you’re barely making ends meet each month? Then it’s time for a budget!

Budgeting can help you achieve more than you ever imagined. And as someone who’s walked the road before you, I know it can be overwhelming! That’s why I’m sharing the EASIEST way to start budgeting today. No confusing language. No difficult math. This will be just what you need to write your first budget with confidence!

Step 1: Figure out how much you get paid.

Before you do anything, you’ll need to know how much money you bring home each month. You can go back through your bank statements or talk with your employer about how much money you make.

Next, you need to know how often you get paid. Are you paid biweekly, monthly, or on an irregular schedule? Ask your employer for a calendar of pay dates so that your budget is correct.

Remember to add in any money you earn on the side (need side hustle ideas? Click here for my favorite ways to earn extra money!) as income. And if you are a two-income family, then be sure to include both incomes.

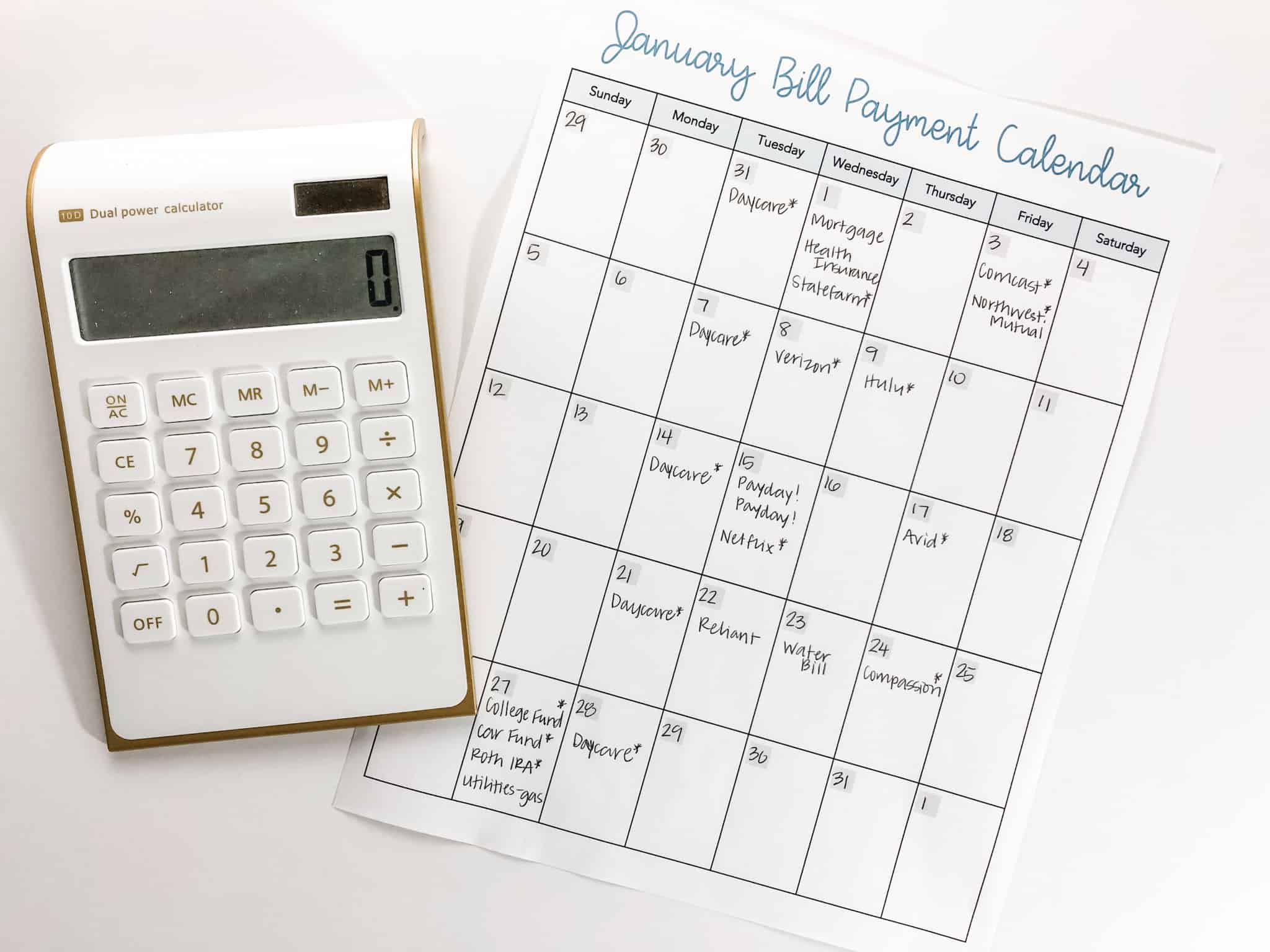

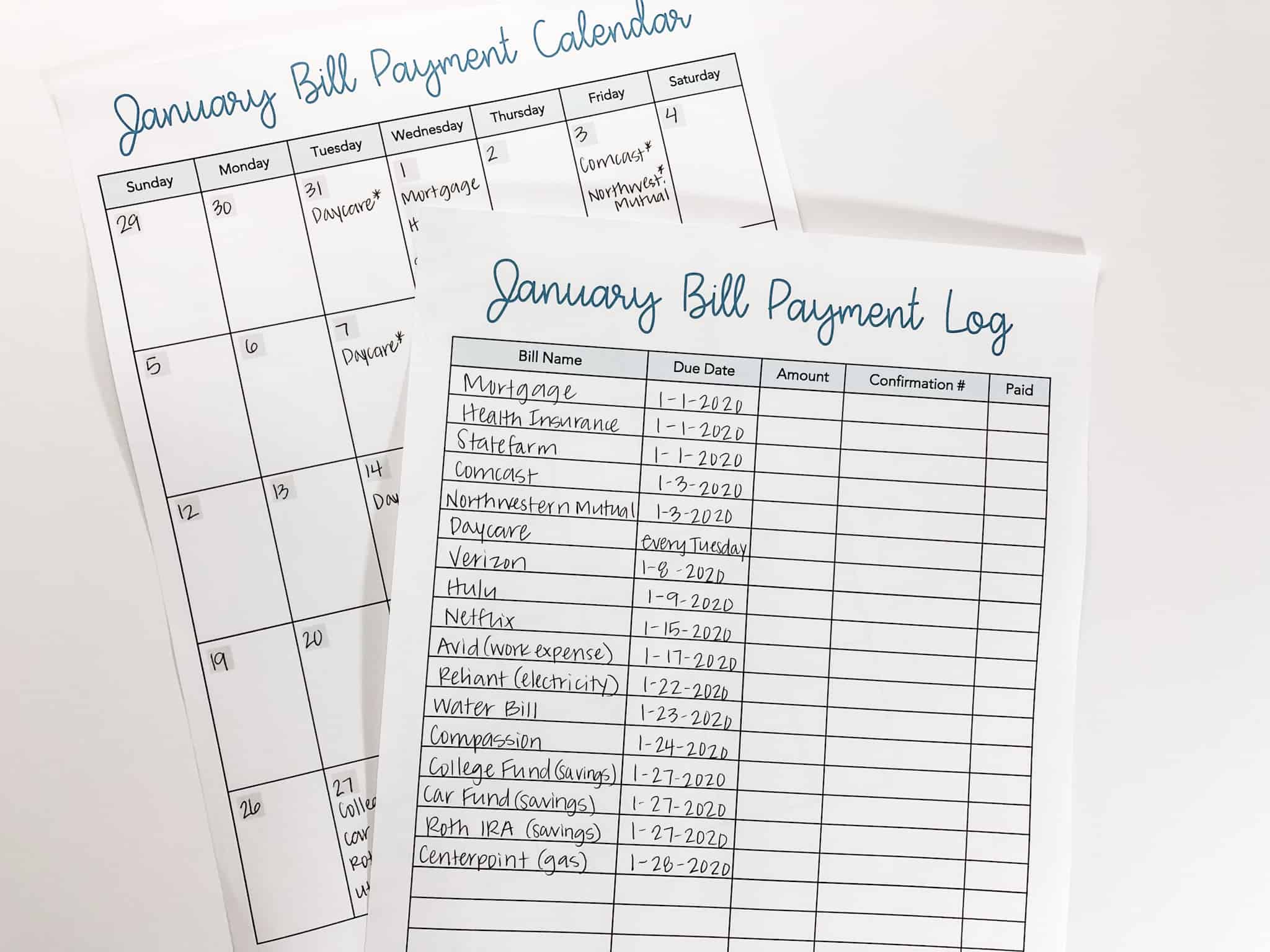

Step 2: List out all your bills and due dates.

Before you actually write a budget, you need to know exactly how many bills you have, how much they are, and when they are due. As a visual person, I love listing them all out on a calendar and bill payment tracker.

A calendar is a perfect place to list your bills and their due dates. Add a special symbol (like an asterisk) to the bills that will be automatically drafted from your bank account. This way you know which bills you’ll have to pay manually. Once each bill has left your checking account, add a checkmark next to the bill’s name (or cross it out completely).

As you’re paying bills for the month, it’s a good idea to list them out, the amount due, and a confirmation number. Not only will this help you stay organized, but you’ll have a record of each bill being paid just in case something goes wrong. Don’t skip this step because it helps make budgeting easy!

Having trouble remembering all your bills on the spot? Comb through the last 2-3 months of bank statements so you don’t miss any bills. Read through every single transaction. Highlight all your bills that come out monthly or yearly. Don’t forget to include any HOA dues, subscriptions, memberships, and all utility bills.

Step 3: Determine how much to budget for variable expenses.

Once you know how much you need to budget for all your bills, it’s time to tackle your variable expenses. This tends to be the place where most people get stuck, go over budget, or decide that budgeting isn’t easy.

I’ve never heard of anyone overpaying their electricity bill. But I always hear about people who struggle with paying too much on restaurants or entertainment.

The best way to do this is to think about your life. Remember that your budget should not match someone else’s. It should be different because your finances are unique. There will be places where you spend money and others don’t. And that’s okay!

To help make budgeting for variable expenses easy, go back through your last 2-3 months bank statements. Look at what you tend to spend money on. Of course, you’ll be budgeting for food, gas, and extra spending. But is there any other place where you are spending money?

Here’s a list of variable expense categories that you might want to include in your budget. Remember that you don’t have to include all of these categories in your budget!

Variable Expenses Include:

- Food (restaurants, groceries)

- Gasoline

- Daycare or Childcare costs

- Beauty supplies

- Hair Care

- Sports and extracurricular activities

- Clothing

Be realistic when it comes to determining how much you’ll spend on your variable expenses. For instance, if you have a family of 4, chances are you’ll need to budget more than $200 each month for groceries. You’ll have to find a balance when it comes to budgeting for variable expenses.

This is where tracking your spending comes in handy! You can learn how our family personally tracks our spending HERE. When you track your expenses and spending, you have a better idea of how to set a reasonable budget for every category.

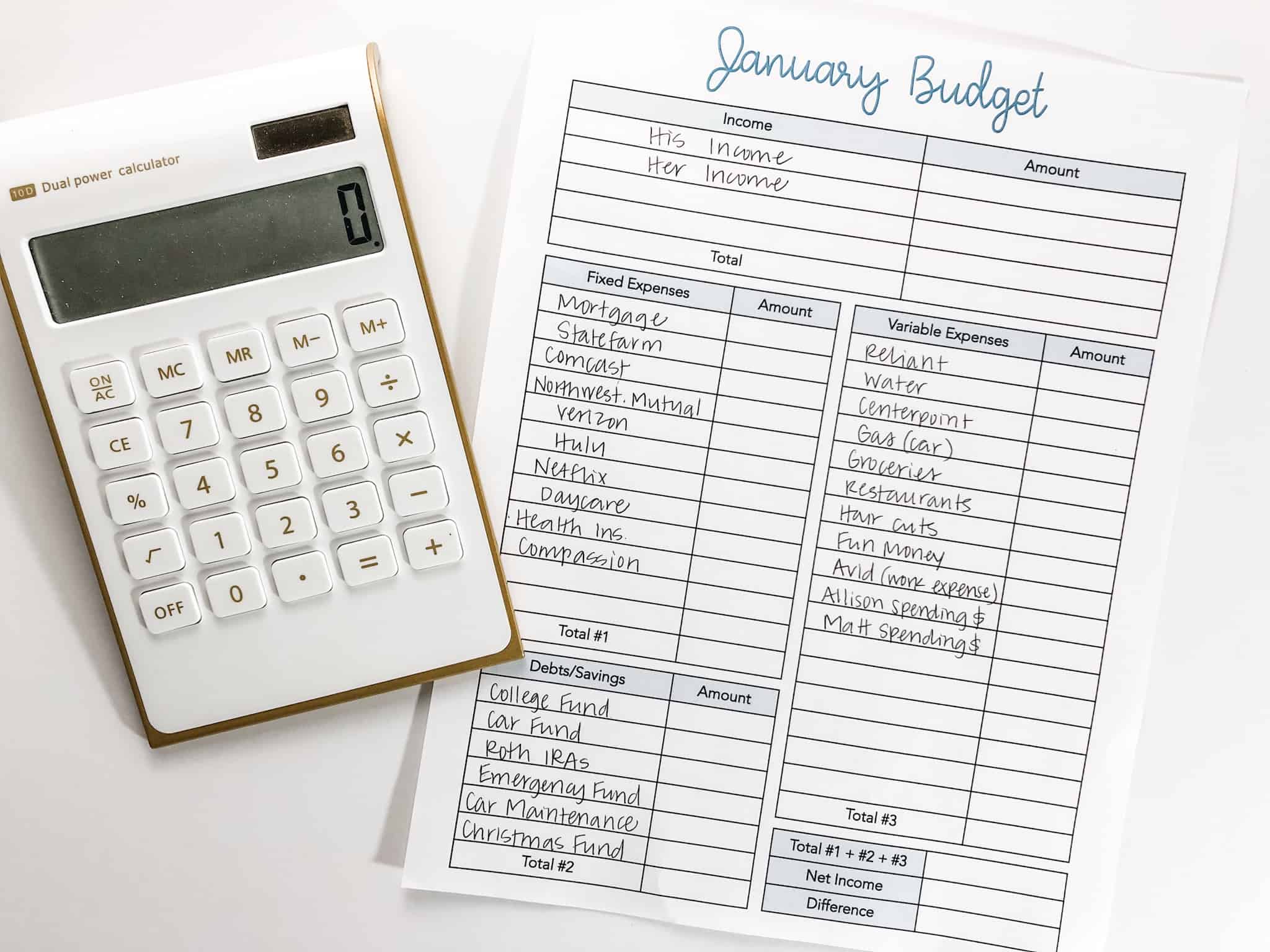

Want these budget pages? They are part of my Budget Life Planner. It’s the perfect digital download that will help keep you organized with your finances.

Step 4: Determine how much you want to send to savings.

Just like you’ll want to pay your rent or mortgage each month, chances are you’ll want to send money to savings as well! If you are working to pay off debt, then you won’t be sending as much money to savings.

However, you should still consider sending money to different sinking funds each month. This way, when you have an unexpected expense you will have savings set aside to cover what comes up!

If you want to budget for savings each month, then consider the following categories:

- Car Maintenance (for when cars break…because they will!)

- Home Repairs

- Christmas

- Gifts (Birthdays, anniversaries, etc.)

- Vacation Savings

- Retirement accounts

Want to learn more about sinking funds and saving money? Then check out these articles below:

Step 5: Determine how often you’ll write a budget.

How often you write a budget will likely depend on when you get paid. I recommend you budget per paycheck. If you are paid weekly, you’ll want to write a budget each week. If you’re paid biweekly, then make a new budget every other week. And if you’re paid monthly, you’ll only have to write one budget a month!

I’ve written an article for how to budget based on how you’re paid:

- Budgeting On A Weekly Income

- How To Budget On A Biweekly Income

- How To Budget On An Irregular Income

If you have a spouse or partner, then you might have to budget differently based on when they are paid. For instance, there was a period of time when I was paid monthly, but my husband was paid twice each month. We wrote a new budget based on his pay schedule, but we made sure to pay the largest bills (like our mortgage) right after I was paid.

No matter how you decide to budget, just know that it will take time to find the best schedule for you. Give yourself grace and know that the more you budget, the easier it will become.

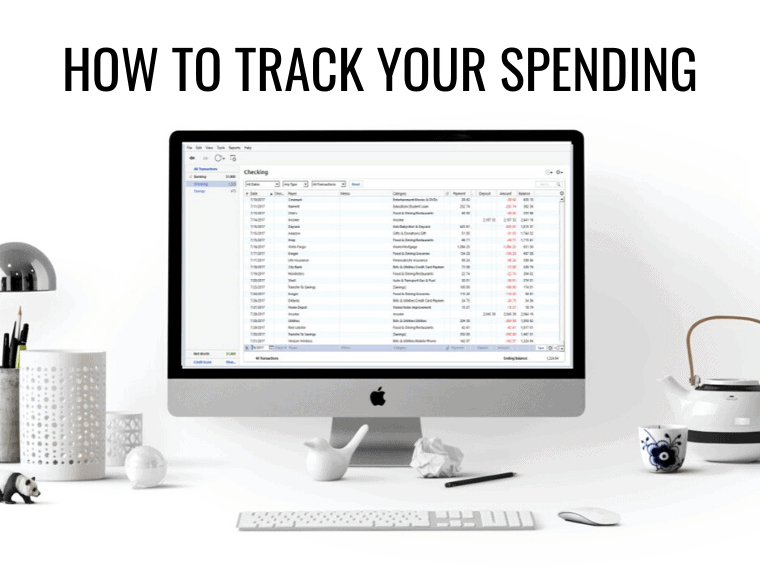

Step 6: Track your spending.

You’ve put in a lot of work to write a budget. But now comes the fun part…tracking your spending! If you don’t track your actual spending, then you won’t truly know if you’re over budget, on budget, or under budget each month.

Plus, when you track your spending, it makes budgeting easy for the coming months! You will be more aware of how you interact with money and where you tend to overspend.

There are a lot of ways to track your spending. Ultimately, you need to find what works for you and what you can keep up with. If you choose to track your spending with paper & pencil but realize that you never actually do it, then that might not be the best method for you.

Our family personally loves using Quicken. We’ve been using it for 10 years to track our spending and it’s super easy to use. You can learn more about how we use Quicken here.

There are tons of apps and digital ways to track your spending as well. But remember…it needs to be something that you can maintain every single day.

Step 7: Review your budget at the end of the month.

The last step of budgeting is one that most people will skip completely. And that’s to go back and check-in at the end of the month. This is your opportunity to be 100% HONEST with yourself.

For instance, let’s say you budgeted $200 for restaurants but you actually spent $275 on eating out. You need to know this and reflect on your overspending. Did you overspend because you gave up part of the way through the month? Or did you overspend because something unexpected came up and you couldn’t make dinner at home? Maybe your restaurants budget isn’t realistic at all.

No matter how your budget played out, it’s important to go back and face your truth. Face how you ended up spending your money. This will help you make a better plan next month and write a budget that will actually work!

Don’t give up on budgeting.

No matter what you do, don’t give up on your budget. Learning how to write an easy budget will take time. Chances are you aren’t going to get it right the first month. And guess what…that’s 100% okay!

It usually takes 3 months to get the hang of knowing your expenses and understanding how you spend money. When you feel like you’re failing with your budget, take a deep breath and make another one. I can’t tell you how many times we fail with our budget. But we don’t let that ruin the progress we make. Instead, we create a Mini Budget to get us back on track (you can read about those here).