Saving money doesn’t have to feel boring or difficult! If you are looking for a money-saving challenge, this is the most complete guide you will find. These 20-plus money challenges for 2024 will help you save big!

Something I learned when I was a kid is that when you make something a game, even the most mundane task can be fun. That’s what is so magical about these money-saving challenges.

Instead of needing to create a new habit or discipline, doing a challenge makes saving your money so much more fun.

21 Money-Saving Challenges To Try in 2024

If you want to kick your savings into high gear, these challenges are where you need to start. Read through all of them and pick out the ones that sound the most enjoyable to you.

You’ll be even more successful if you do these challenges with your family and friends. Invite them to save money along with you.

The good news is that it’s never too late to get your finances in order!

1. No-Spend Challenge

The No-Spend Challenge is one of the most popular money saving challenges you will find. I wrote a guide to the No-Spend Challenge that lays out how to do it and get the most out of it.

At the most basic level, a no-spend challenge is where you go for a set amount of time and don’t spend any extra money. I’m talking about money beyond the basics of food/house/gas.

It’s like fasting, but with your spending habits.

You can do this for as long or as short of a time period as you want. Try it for a month or start out with just a week.

2. 52-Week Money Challenge Backwards

The typical 52-week money challenge is where you save $1 the first week, $2, the second week, and so on. By the end of the year, you would have saved $1,378.

Turn this challenge upside down and do it backward. This is how it will look:

- $52 into savings: week 1

- $51 into savings: week 2

- $50 into savings: week 3

- $49 into savings: week 4

Continue that pattern and decrease the amount you put away by a dollar each week. This is a great way to save money because by the time the holidays hit, you’ll be able to pay for Christmas gifts!

3. 8-Week Vacation Savings Plan

You can complete this challenge in just two months – talk about instant gratification. With this challenge, you’ll save $1,000 in 8 weeks instead of all year long.

The Soccer Mom Blog has all the details – and it has two parts. You have to put a set amount into savings each week. You also have to cut back on spending a certain amount over this time frame too.

4. Holiday Helper Fund

This is a way to get ahead of the huge expenses of the holidays. Starting January 1, set aside $20 from each week’s budget and put it into savings.

You can use this for holiday gift buying, or use it to save up for a vacation or another major expense. By the end of November, you will save an extra $960 on a bi-weekly budget.

You can even set aside your money in a Christmas Cash Envelope. Grab yours for free here.

5. 52-Week Savings Challenge

This is probably one of the most popular savings challenges on this list. If you follow this correctly, at the end of a year, you will have saved an additional $1,378.

Here’s how it work:

- $1 into savings: week 1

- $2 into savings: week 2

- $3 into savings: week 3

- $4 into savings: week 4

Keep doing this until week 52, when you will put $52 into savings!

If you want a free printable, A Helicopter Mom has one that is easy to follow and will help you stay on track.

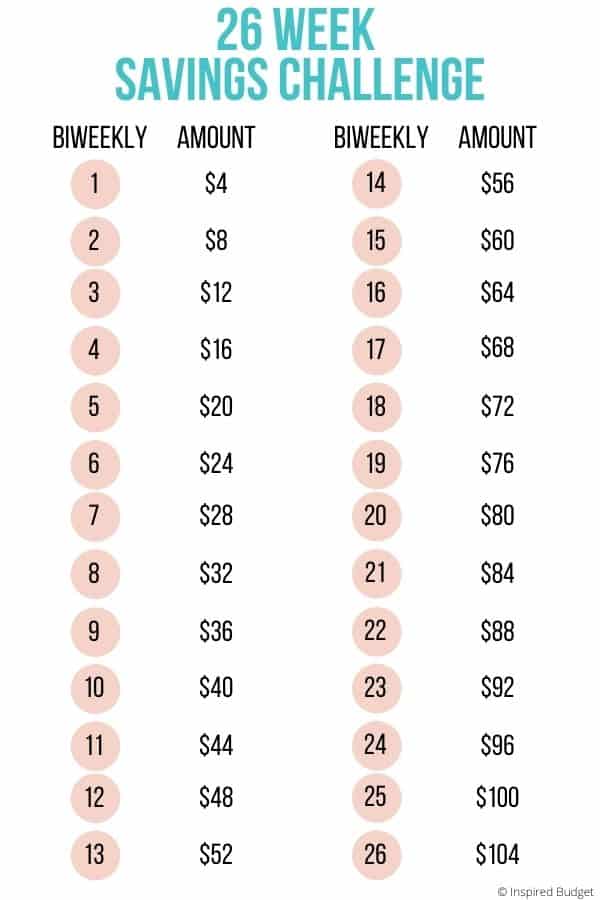

6. 26-Week Bi-Weekly Savings Plan

Instead of a weekly challenge, this one challenges you to save money every-other week.

This is a better idea if you prefer to deposit money into savings on the same schedule as your paycheck.

By the end of this challenge, you could save $1,404 – it takes a year, just like the 52-week challenge.

This is how it will look:

- 1st week: put $4 into savings

- 3rd week: put $8 into savings

- 5th week: put $12 into savings

- 7th week: put $16 into savings

You simply increase the amount by $4 every two weeks, then you can enjoy watching your savings account grow.

7. 365-Day Nickel-Saving Challenge

This challenge is for anyone that feels overwhelmed making weekly or bi-weekly deposits – and you end up saving even more money with it.

This post explains how to do the challenge in detail.

Here is how this challenge works:

- 1st day, deposit $0.05 into savings

- 2nd day, deposit $0.10 into savings

- 3rd day, deposit $0.15 into savings

Basically, you add a nickel to the previous day’s savings every single day. Then by the last day, you will deposit $18.40.

When you look at those numbers, they seem so doable! The best thing is that when you add it all up, the total you will put into savings will be a whopping $3,300!

8. $1 Bill Save

The $1 bill challenge is super self-explanatory. Every time you get a one dollar bill as change, put it in your savings envelope.

This challenge works best if you already use the envelope system. If your envelope becomes too large, then consider adding all your $1 bills to a large jar. Count it out at the end of the year and use it on something FUN. You’ll be surprised just how much money you can save!

9. Weather Savings Challenge

This is a really fun challenge that is really random! This blogger in Arizona came up with this idea. Once a week, you deposit money into savings that matches the high temperature that day.

If you live somewhere mild, this will be easy. Living in Arizona, this blogger deposited as much as $105 some weeks.

Don’t want to make weekly deposits? Then look back at the end of the month for the average high temperature each week. Multiply it by 4 and deposit that much into your account!

10. 31-Days To Improve Your Financial Life

Want something that is a lot more challenging? Follow this challenge from Part-Time Money. It will take you step-by-step through an entire month of financial habits that will completely change how you save and spend your money.

They give you a brand new task or challenge each day, and then give you the tools and resources to do them. This is the perfect 31-Day challenge for beginners!

11. 3-Month Savings Money Challenge

This challenge only lasts for 3 months, so if you don’t want to commit to something all year long, this is the one for you.

If you follow this challenge, you can save up to $1,000 in those three months.

You’ll do this by saving exactly $84 per week. Sound tough? Browse our saving money tips for insights and inspiration.

12. Spare Change

Lots of people have used this challenge as a way to save money. Remember the opening clip in the movie Up? They did it too.

Whenever you get loose change, you put it in a jar or piggy bank. When that jar fills up, take it to the bank and put it in your savings account.

If you have never tried to save your loose change, it might surprise you how much you can accumulate.

The only downside to this challenge is that it won’t work that well if you never pay with cash.

13. Expense Tracking Challenge

Have you ever tracked your expenses before? It’s a really effective way to visually see where your money is going and how to save more.

If you haven’t tracked expenses, use this as an opportunity to start. Challenge yourself to write and categorize every single purchase for an entire month.

You might be shocked at how much you spend on certain things!

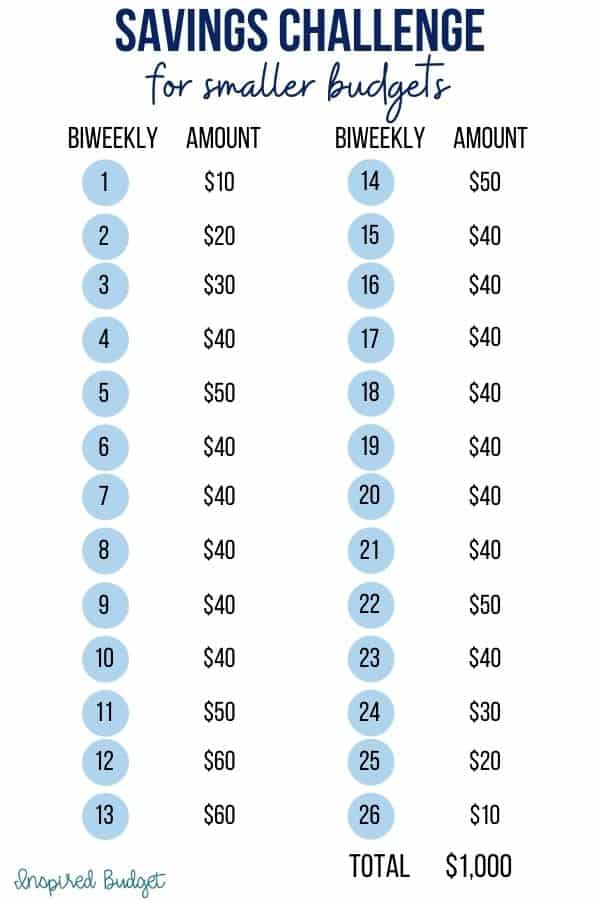

14. 26 Paycheck Challenge For Smaller Budgets

This challenge is for anyone that budgets every paycheck – which is a lot of people!

You increase the amount you put into savings by $10 each week. The first week you deposit $10 and the 2nd week you deposit $20.

The cool thing about this challenge is that it caps at $60 which is perfect for those with smaller budgets.

At the end of 26 paychecks (which is about a year), you will have an extra $1,000 in savings!

15. No Eating Out Challenge

This challenge is for anyone that needs something with a quick-win! If saving up money seems too intimidating, try to just stop eating out for an entire month.

This one habit might help you save more money than you realize. That’s the fun thing about these little challenges.

You can even choose 3 months out of the year for this savings challenge. You’ll be shocked by how much money you can save when you cut out restaurants. Plus, you can pair this challenge with another easy one like the $1 bill challenge and save even more.

16. The Penny Challenge

This challenge is a lot like the spare change challenge. The only difference is that you are saving all of your pennies, not all of the loose change.

It’s pretty surprising to take a large jar of pennies to the bank and discover how much you have.

Put all of this money directly into savings as soon as your jar fills up.

17. Cancellation Challenge

The cancellation challenge is just as simple as the “no eating out” challenge.

Sit down with your spouse and look at all of your subscriptions. Cancel as many as possible.

Then, take it a step farther. What about other places you spend money? Do you spend money each month on any apps? What about reloading cards like a Starbucks account?

Cancel as many things as possible and put the money you would spend on them directly into savings.

18. Little Vices Savings Challenge

The little vices challenge will take a little more effort and time. You’ll have to think about every single purchase and decide whether it is a vice or a necessary one.

Vice purchases are things you can live without. This includes impulse buys at the register or coffee while you are out doing errands.

You have a few options with this challenge. You can either cut out all vices for an entire month or cut out certain vices for an even longer period of time.

Do what works for you and pick a method that you will be able to follow.

19. Round-Up Money Saving Challenge

Some banks allow you to round up purchases to the nearest dollar and then deposit the change into a connected savings account.

If your bank doesn’t offer this, pick from one of these apps that can do it for you.

20. 1% Challenge

This is another challenge that you can do without even lifting a finger. Go into your workplace and increase your 401(k) contribution by 1%.

Then, in 2 months, go in and increase it by another 1%.

If you don’t have a retirement account or want to do this challenge without using one, just calculate 1% of your gross pay. Then, divide that by your total paychecks for the year, and put that amount into a savings account after your first paycheck.

Follow the same process when you increase your savings to a higher percentage, then enjoy watching your nest egg get bigger and bigger.

21. Money Throwdown

This one is a lot of fun! Challenge a friend or family member and see who can save the most money in a month.

You’ll just need to work out the rules and how you will evaluate how much you saved.

Stay Motivated During A Money Saving Challenge

Smaller and quicker challenges allow you to make progress without losing motivation. But what about the challenges that last all year?

The best way to stay motivated throughout a money saving challenge is to visually track your progress.

Grab the free printable below to track your progress. Simply color in a box each time you save $100. Post this page somewhere you’ll see it often to stay motivated!

Final Thoughts

Sometimes, doing a challenge is a really fun way to kickstart a new lifestyle of budgeting and saving money. Pick out a few of these challenges and discover how much you can save!