Cash envelopes can truly change the way you interact with your money and finances. It’s no surprise that the cash envelope system has changed my husband’s and my finances in so many ways. It really is a game-changing experience!

But how on earth does it work? Can cash envelopes truly help you with impulse spending and your finances? And how do you buy something online when you’re using cash?!

I’ve had these exact same questions (plus more!). That’s why I’ve created this entire guide on how the cash envelope system works. Plus you’ll get free printable envelopes so you can get started today.

What Is The Cash Envelope System?

The cash envelope system is a way for you to take back control and track how much money you’re spending on certain categories in your budget. Instead of using a debit card or credit card, you’ll use cash for areas in your budget where you tend to overspend.

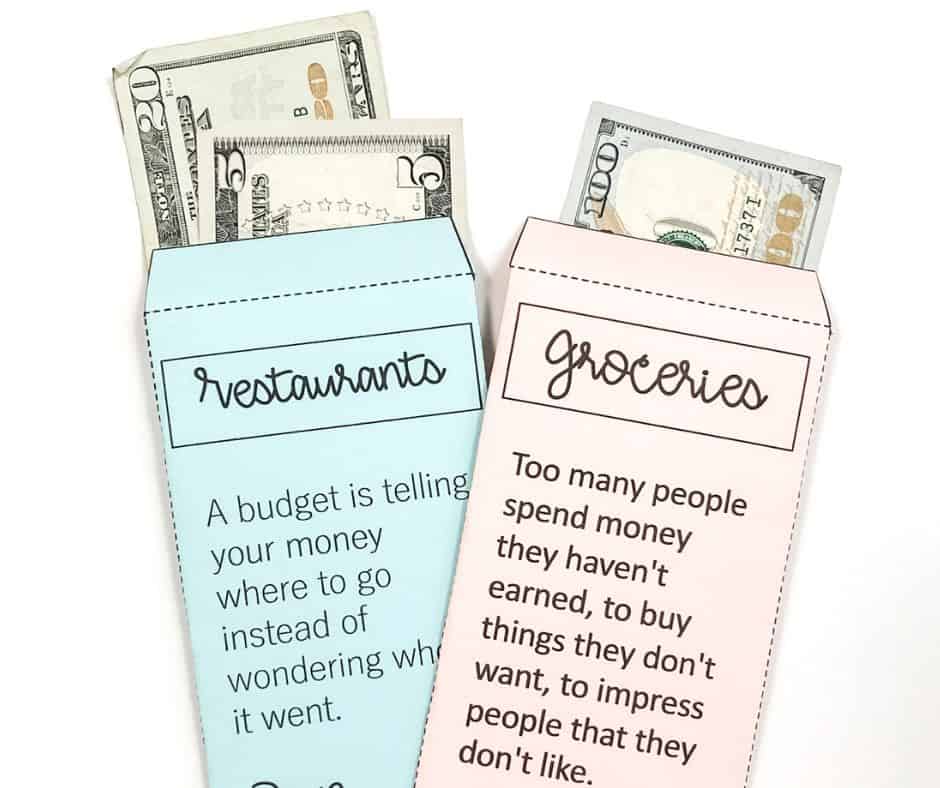

If you struggle with grabbing takeout or fast food too often, then you can have a cash envelope specifically for restaurants. Use the money you’ve set aside for restaurants any time you go out to eat.

Once you’ve used up your budgeted amount, you won’t have any cash left in your envelope! This helps keep you on budget and not overspend each month.

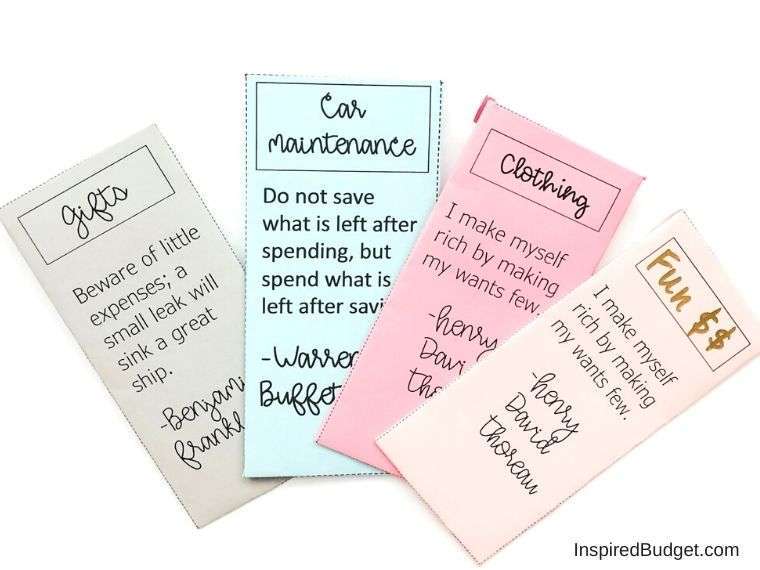

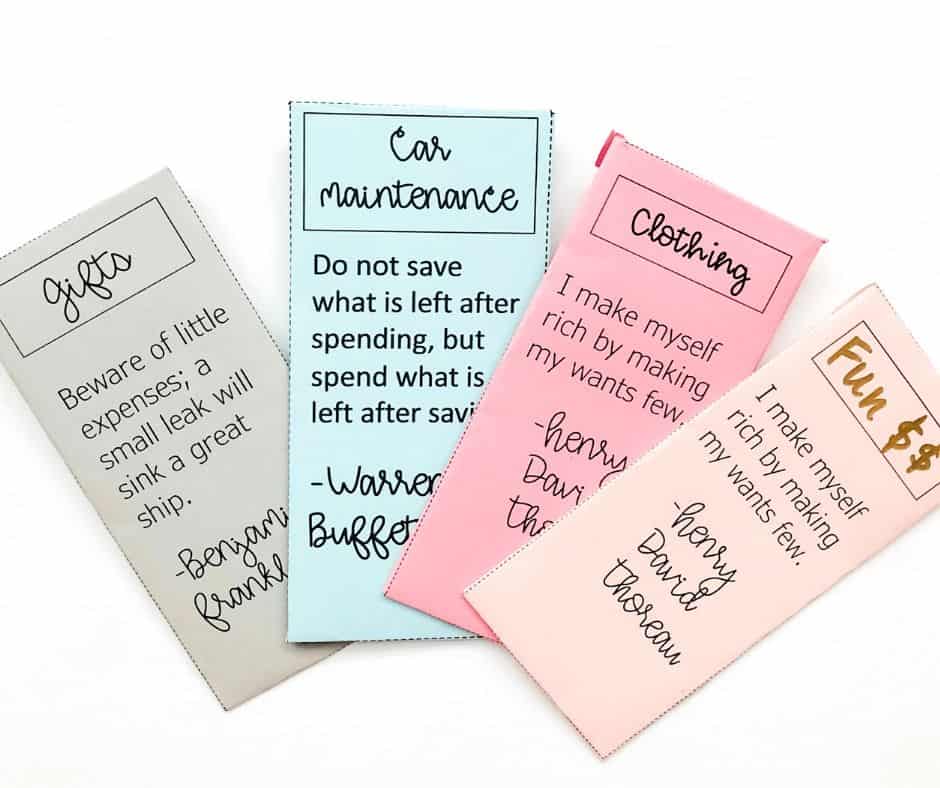

Free Cash Envelopes

To get your FREE cash envelopes sent straight to your inbox, sign up for my Cash Envelope Guide. Then, simply print your freebies at home on card stock and start using them today!

Not only will you receive printable cash envelopes, but you’ll get access to my Free Resource Library where you’ll find other budgeting and finance printables.

How Cash Envelopes Work: 4 Simple Steps

Because I’m a Type-A person and absolutely love step-by-steps, I’m breaking this down for you into easy to follow steps!

1. Know which categories you want in cash.

I recommend going back through your spending and figuring out where you tend to overspend. Also, decide if you’d like to use cash envelopes for saving money for future expenses (read more about saving money with sinking funds).

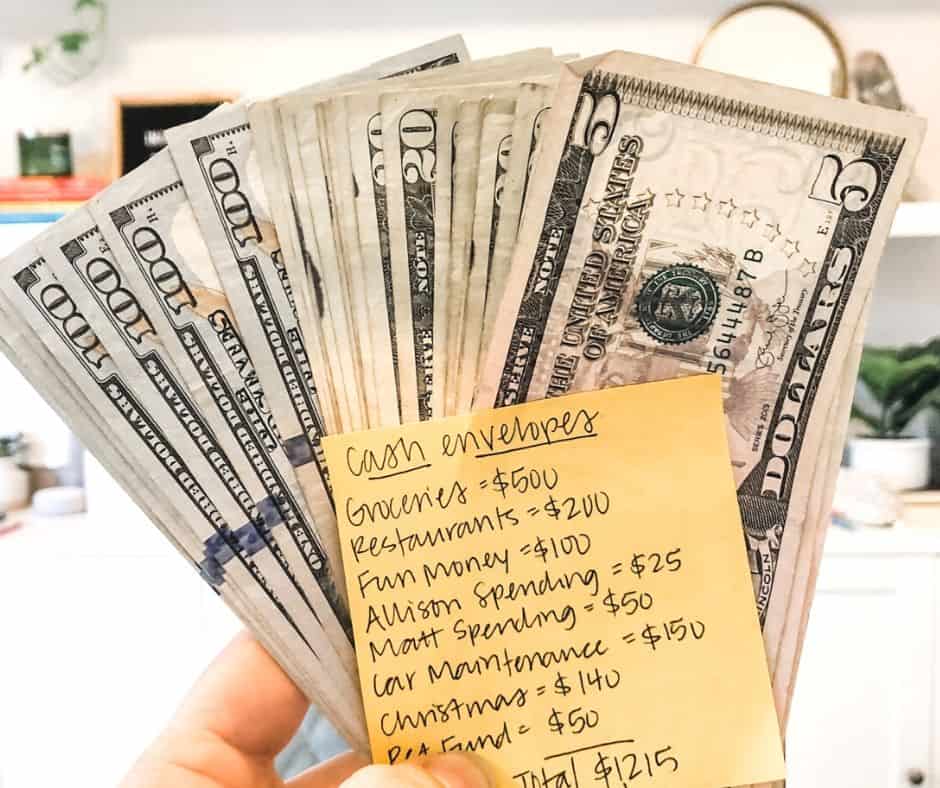

2. Go to the bank and pull out money.

Once you’ve made your budget, decide which denominations (hundreds, twenties, tens, fives, ones) you want in your envelopes. Make a tally sheet so you know how much of each bill you want to take out.

3. Organize your money into cash envelopes.

After you’ve pulled cash out from the bank, place your bills into your envelopes. For instance, if you plan to spend $600 this month on groceries, then plan on pulling out 6 one hundred dollar bills (or smaller denominations is you wish) and place them in your envelope labeled “groceries.”

4. Use your cash envelopes when you need them.

Take the envelopes with you when you need them. Once the money is gone, it’s GONE. This forces you to be careful with your spending and will help you to stay within your budget.

How Often You Should Withdraw Cash

How often you are paid will help you determine how often you should withdraw money for your cash envelopes. For instance, if you are paid once a month, then you’ll want to withdraw your cash envelopes monthly.

If you are paid biweekly, you might have to take cash out of the bank every other week.

The more you know your money and your budget, the easier it will be to determine when to get your cash out. If you’re budgeting per paycheck, then it’s probably best to pull out cash every paycheck.

Our family is paid two times each month, but we pull all our cash out at the beginning of the month. Due to the savings that we have automatically taken out of our account, it’s easier for us to withdraw all our money at once.

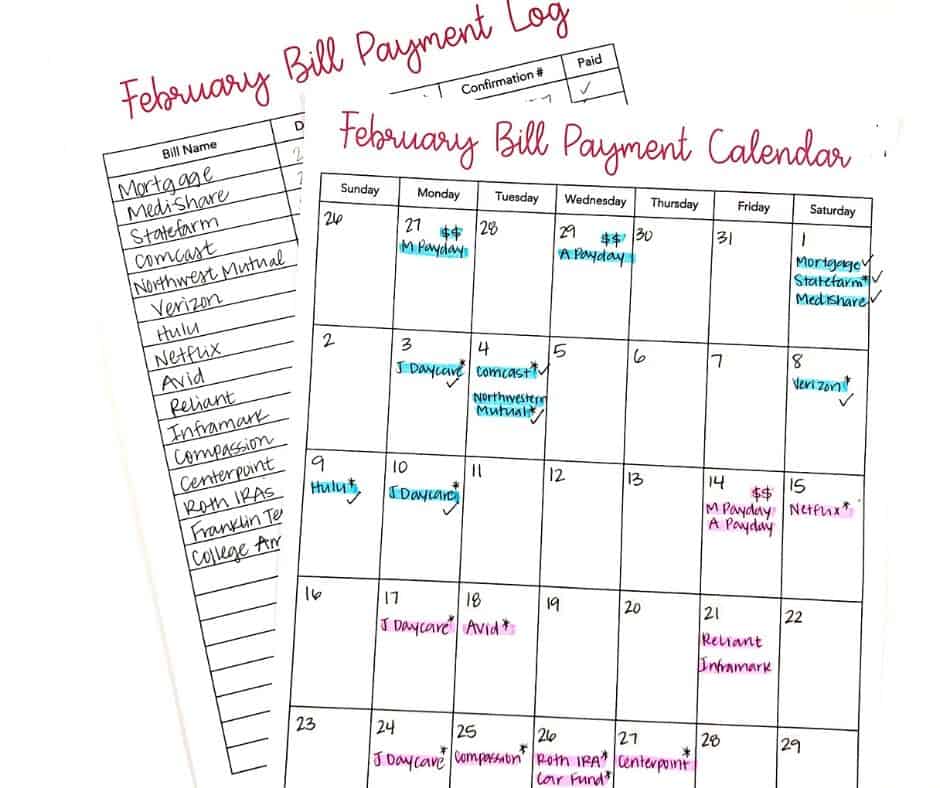

The easiest way to determine this is to know how to write a budget. I personally use a budget calendar to help me know which paycheck will cover which expenses. You can learn more about writing a budget here.

Why Cash Envelopes Help People Spend Less

Cash envelopes are not new. They have been used by people for years, and there’s a reason why more and more people are using cash envelopes each day.

Research shows that people overspend by $7,400 each year. Clearly, people tend to spend without thinking (I know I do!). It’s much easier to spend money when you’re using a debit card or credit card.

Handing over cash is harder. People have an emotional connection to physical money. It’s more difficult to part with a $20 bill than it is to spend $20 on a debit card.

The number one reason why cash envelopes work is that they help you stay on track with your budget. Cash envelopes train you to take back control of your budget and stop spending when you run out of money.

It’s pretty simple. If you have $50 to spend on clothes, and you end up at the register with $57 worth of clothing, something has to be put back. Using cash helps you develop better boundaries with your money.

If you stay committed to only using the money that you budgeted for each cash envelope, then you will, without a doubt, stay on track each month financially.

Have A Budget In Place

For cash envelopes to work effectively, it’s important that you have a budget in place. You should only be pulling money out of the bank for your envelopes AFTER you’ve written your budget!

Need help on how to write a budget? Don’t worry! I’ve got you covered. Head on over to The Easiest Way To Write A Budget to learn how to write a budget that actually makes sense!

Common Cash Envelope Categories

I don’t recommend pulling cash out to pay your rent or electricity bill. Those are both expenses where you aren’t likely to overspend each month.

Instead, pull cash out for areas in your budget where you tend to spend too much money.

Not sure where you are spending too much money? That’s okay! I recommend printing off your bank statements from last month. Go through each transaction and categorize it.

Highlight all the transactions where you went out to eat in one color. Then use a different color highlighter for all the times you ran to the grocery store.

Once you’ve categorized your transactions, add up how much you’re spending in each area. If you’re spending more than you had budgeted, then chances are you need a cash envelope for that category!

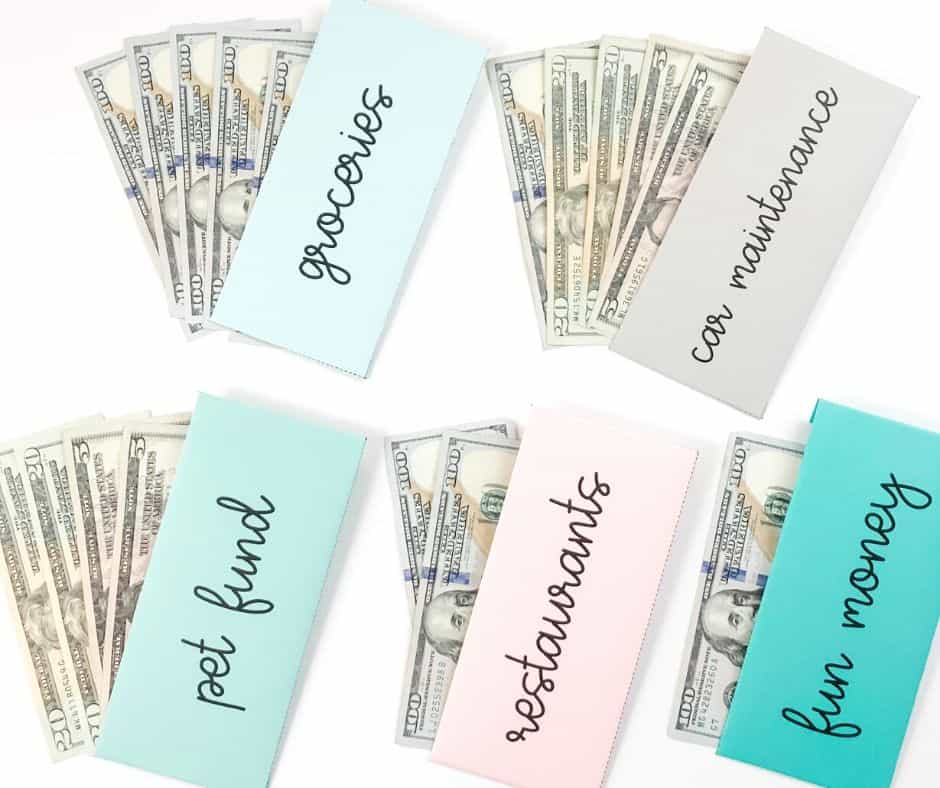

Below are common cash envelope categories:

- Food: Groceries

- Food: Restaurants

- Haircuts

- Fun Money

- Entertainment

- Clothing

- Car Maintenance (sinking fund)

- Home Repairs (sinking fund)

- Christmas (sinking fund)

Ultimately, find what works for you when it comes to using cash envelopes.

And my biggest tip: don’t start off with 8 different envelopes. You’ll get overwhelmed right away. Instead, choose 1 or 2 categories in your budget where you know you tend to overspend. Try using cash envelopes for a few months in these categories.

What To Do When You Pay Bills Online

“But I pay my bills online. Do I need to take cash out for those bills?”

The short answer: No.

The long answer: Absolutely not!

You should not take out cash for bills. The purpose of the cash envelope system is to help you develop better habits and stop overspending. I’m guessing you aren’t paying extra for your internet bill each month.

Continue paying your bills like normal. Take cash out for areas in your budget that are variable expenses such as food, gas, or spending money.

What To Do When You Buy Something Online

Just because you shop online doesn’t mean you can’t use the cash envelope system! When you buy something online, simply make a trip to the bank and deposit the money you spent from your cash envelopes.

Every now and then I order my groceries online instead of going to the store myself. They charge my debit card and I immediately run by the bank to deposit my cash into my account after I grab my groceries.

Although this does take an extra 5 minutes, I still use cash envelopes because they’ve helped me stick to my budget! I’d much rather spend a few extra minutes running by the bank than feel like I have no control over my money.

What To Do With Your Coins

One of the most common questions people ask about the cash envelope system is what they should do with the change they receive. I personally don’t like putting coins in my cash envelopes. The extra weight causes my envelopes to become heavy and it seems like coins are always spilling out into the bottom of my purse.

Instead, I’ve found that 3 options for dealing with change and cash envelopes:

- Option 1: Keep the extra change in your wallet. Chances are you have a zippered section in your wallet specifically made for coins. Simply put your change in your wallet and next time you pay with cash, try to make exact change. For instance, if the total is $20.07, then search for 7 cents in your wallet. This way you’re using your coins as you need them.

- Option 2: Collect your change in a jar at home. I love collecting extra change in a jar we keep in our house. Once the jar is full, I bring it by my bank and deposit all the coins into our vacation savings account. This is a great way to save money for something special!

- Option 3: My husband personally keeps extra change and coins in his car. He has a special spot in his console where he stashes this money. If he’s driving and wants to buy himself a coke, he stops and uses his extra coins to buy his caffeine.

How To Handle Leftover Money

If you have extra money leftover at the end of the month, then let me be the first one to congratulate you!

Give yourself a pat on the back and do a celebration dance. Clearly, you’re doing something right!

But what should you do with that extra cash?

Luckily, you have a few options on how to handle leftover money.

- Option 1: Leave the extra money in your envelope. If you have any extra money in your restaurant envelope, one option is to leave it in your envelope and have even more money to spend the next month.

- Option 2: Leave the extra money in your envelope, but budget less the next month. Let’s say you have $50 left in your restaurant envelope. If you normally budget $200 each month for eating out, this month you only have to budget $150 because you already have $50 in your cash envelope.

- Option 3: Send the extra money to savings. If you’re trying to save up for a big purchase or vacation, then consider sending any leftover money from your cash envelopes to that savings account. This is a great way to stay motivated to spend even less than you would have planned!

- Option 4: Send the extra money to debt. If you’re on your debt free journey, then consider taking any leftover cash and making an extra debt payment! This will help you make more progress on your debt journey.

What To Do If You Run Out Of Money

But what if you run out of money before payday?

I wish I could say this has never happened to me, but that would be a lie. There have been several times when our cash envelope was empty before the next payday. And THIS is when cash envelopes teach you a lesson. If you run out of money, it’s simple. You CAN’T spend any money.

Unlike using a credit card, you literally cannot buy anything if your cash envelope is empty. This is your budget’s way of telling you that you’re cut off.

If you have $100 in your Grocery envelope, you literally cannot spend more than $100. If your grocery bill is over $100 then you’ll be forced to put something back.

Using cash envelopes helps hold you accountable to the budget you set. As long as you stick to using your cash envelopes, you WILL stay on budget.

If you continue to run out of money month after month, then it might be time to take a look at your budget. Determine if you’re truly budgeting enough for that category in your budget. This is a sign it might be time to increase your budget!

Making Cash Envelopes Work With A Spouse

If you have a spouse or partner, you might be worried that the cash envelope system won’t work for your family. This is not true!

My husband and I have been using cash envelopes since the first year we were married, and they have helped us take back control of our money. Below are a few tips to make cash envelopes work for two or more people:

1. Always have a plan in place.

So often, people say that their spouse forgot to grab the envelope before work and then ran by the store on the way home that afternoon. What are they supposed to do? One of the greatest benefits of cash envelopes is that they force you to be prepared and think in advance.

Before you ever leave your house, think through your day. Will you need to run any errands during your lunch break? Did you plan on picking up dinner on the way home from work? If so, be sure to grab the envelopes that you will need!

2. Allow each person to have their own envelope.

Instead of sharing one “Fun Money” or “Miscellaneous” envelope, allow each spouse to have their own envelope. My husband and I both have our own “allowance.” We take $50 out in cash each month. Both of us are allowed to spend this money on whatever we want. We each keep our envelope with us at all times.

This is perfect for my husband who has a long commute. If he wants to stop and pick something up on the way home, he can! He has his own cash envelope with money inside. When he runs out, he’s out! He will have to wait until the next time we refill the envelopes to spend money on something he wants just for fun.

3. Check-in each week.

If you’re sharing cash envelopes with a spouse, then set a time each week to check in with each other on your budget and cash envelopes. I like to call this a Family Business Meeting. My husband and I sit down every Sunday evening to discuss our finances, a few goals for the week, as well as our meal plan. This is the perfect time to go over how we are doing with our spending and count how much money is left in our cash envelopes.

The key to using cash envelopes successfully with a spouse comes down to communication. The more you communicate about spending, the better off you’ll be!

Where To Keep Your Cash Envelopes

When I first started using cash envelopes, the idea of carrying my cash around terrified me! I used to walk around with ALL my cash envelopes tucked into my purse. When I walked out my door, I immediately felt like everyone knew I had hundreds of dollars with me.

Carrying around my cash envelopes all at once was a HUGE mistake that I made! Luckily, no one ever stole my money, but I’ve learned that cash envelopes are meant to be left at home.

Do not (I repeat) DO NOT keep all your cash envelopes with you at all times! It’s not wise to carry such a large amount of money with you everywhere you go.

Instead, store your cash envelopes at home in a very safe spot. You can hide your envelopes somewhere in your home or keep them locked up in a safe.

Simply grab the envelopes you need before you leave the house. Just remember to put them back when you get home!

Can I “Steal” From Other Cash Envelopes

A lot of readers will ask me if it’s okay to “steal” from other envelopes. Usually, they want to go out to eat, but they don’t have any money left in their restaurant envelope. Instead, they will take money out of their grocery envelope and head to a restaurant.

Although you’re technically not “stealing” money, you are taking money from one category to pay for another category in your budget. I personally try to limit how often this happens. Every now and then I’ll take money from one category for another, but it’s very rare.

If you’re “stealing” money often from your cash envelopes, then chances are you need to go back and take a look at your budget. It might be time to increase the amount you’re sending to that category in your budget. Be sure that you have a reasonable amount set for each category in your budget. The more reasonable your budget, the more likely you are to stick to it!

Tips On Getting Started

Ready to get started with cash envelopes? Below you’ll find my favorite tips on how to start the cash envelope system and see results!

Tip #1: Give yourself an allowance.

Allowances aren’t just for kids! Giving yourself (or other members in your family) an allowance allows you to have personal spending money that no one else can touch.

It will teach you how to be patient with money, save up for items you want, and think before spending.

Tip #2: Keep track of what you’re spending.

When you’re first starting out with cash envelopes, it’s helpful to keep track of exactly what you’re spending your cash on. You can do this by writing down your transactions on the back of your envelope.

If you’d rather not write on your envelope, consider listing out your transactions on a plain notecard. Slip the notecard inside your envelope for safekeeping.

Tip #3: Save money on ink by buying colored card stock for your envelopes.

I love printing my cash envelopes on colored card stock. Not only do I save money on ink for my computer, but my envelopes are stronger when they are printed on card stock. Use packing tape to secure them and you’re all set!

Tip #4: Start with just 2 cash envelopes.

The idea of using cash envelopes can be stressful. To keep it easy, start by choosing 2 cash envelope categories. Use those cash envelopes for a few months. If you end up liking the cash envelope system, slowly add to your cash envelope categories!

Tip #5: Find a friend or accountability partner to use cash envelopes with.

Everything seems to be easier (and more fun!) with a friend. If you’re just starting on this journey, ask a friend to join you. Offer encouragement to one another and consider checking in on each other with your spending.

You don’t have to share your entire budget with this person. But sometimes having a little extra accountability will help you be successful!

Tip #6: Don’t give up (try cash envelopes for at least 3 months).

Have you ever heard that 21 days form a habit? I honestly think it’s longer! Commit to trying cash envelopes for 3 months. This will give you time to learn how to use them well, and track your spending. You’ll be able to see if you’ve spent less and if your money habits have improved!

My Personal Experience With Cash Envelopes

Cash envelopes helped teach me how to not buy all the things and develop this lovely habit I like to call “patience.” Let’s back up first though. To understand the full story, you’ll have to know that my husband and I paid off over $111,000 of debt on 2 teacher salaries (you can read more about that HERE and HERE).

But to say that I jumped on the cash envelope system right away would be a flat out LIE.

In late 2011 our family hit rock bottom. We were young, married, newly pregnant, and had no earthly idea what we were doing. But we knew one thing for sure…we were spending way too much money each month.

As in, we didn’t have enough money left over to cover daycare costs when our bundle of joy arrived. To help retrain how we spent money, we learned how to write a budget and use the cash envelope system.

Fast forward 8+ years and this little system of ours has no doubt saved us THOUSANDS over the years. We have totally changed the way that we spend and save money.

But I know what you’re thinking right now. You’re thinking “But Allison, I’m different. I don’t think that could work for me.” And to that I would say “Yeah, it is different. But don’t knock it until you try it.” And that’s what I want you to do. Just try it. You never know how it can change your life!

Need more help?

If you’re tired of living paycheck to paycheck cycle and want to learn how to budget so you can get out of debt for good, I’ve got a free resource just for you. You can grab the Budgeting and Debt Payoff Cheat Sheet to get simple and actionable tips to take control of your money today.