Are you feeling overwhelmed with medical debt or hospital bills? If so, you aren’t alone. 137 million Americans are struggling with medical debt.

Even a simple procedure or unexpected hospital visit can be costly in the long run. And because you might have other debt (like credit cards or student loans), medical bills tend to get pushed down the priority list.

But it’s possible to negotiate medical bills for less than you owe, even after insurance has paid for their share!

If you’re trying to negotiate your medical bills for less than you owe, you basically have two options:

- Negotiate your bills before treatment.

- Negotiate your bills after treatment.

Let’s take a deeper dive into how to negotiate your medical bills for far less than you owe either before treatment or after treatment. I’ll also be sharing tips to help you be more successful during the negotiation process as well as a script you can use when you call billing companies!

How to negotiate medical bills before treatment

When it comes to getting the best price on your hospital or medical bills, you’ll want to negotiate rates before you or a family member receives treatment. This is perfect for elective procedures or even childbirth.

Do these 3 things before treatment to help reduce the cost of medical bills.

1. Find someone that is in-network.

One of the most important steps you can take when it comes to paying less for medical bills is to use your insurance’s website to find a doctor that is in-network. This can save you thousands!

If you’re having a procedure, be sure to also ask that any doctor that sees you is also in-network. Those out of network charges can add up quickly.

2. Shop around for a doctor beforehand.

One smart thing you can do before treatment is to shop around for a doctor. This even works for simple urgent care visits as well!

Simply call the clinic or doctor’s office and ask them what their rates are. You can even provide your insurance information in advance so that you have a good idea of how much you’ll owe.

By shopping around for a doctor beforehand, you’ll not only be able to find a doctor or clinic that you’re comfortable with, but one that fits your budget too!

3. Negotiate with the doctor or office manager.

You can even negotiate your medical bills and rates with the office manager before your treatment begins. For instance, if you’re going to have a baby, you can meet with the billing person at your doctor and negotiate a payment plan or a pay-in-full option.

Negotiating with the billing office or office manager doesn’t have to be scary! Utlimately, these professionals want to be paid. And they are willing to work with you to ensure that they receive payment.

Check out the tips at the end of the article for how to negotiate properly.

How to negotiate medical bills for less than you owe after treatment

Yes, you can negotiate your medical bills for less than you owe even after insurance kicks in.

This is great news for people with a high deductible or little in savings. When it comes down to negotiating medical bills after you’ve received treatment, you have 4 options available to you.

1. Double-check that all your bills are accurate.

No one is perfect, especially your insurance company or medical billing departments. Ask for an itemized receipt or EOB (explanation of benefits) before you pay your medical bills. Check every bill, receipt, and EOB for anything unusual.

It’s not uncommon to find that you’ve been double-charged on your receipts. You’ll want to call and bring this to the office manager’s attention. They should be able to fix it quickly and send you and updated bill and itemized receipt.

2. Ask for a pay in full discount.

The easiest way to get a discount after treatment is to offer to pay the bill in full. If you have the money in your bank account and can cover the entire bill (or most of it), then you have serious leverage to get your bill lowered.

Here’s the truth: these medical offices want their money now. And they are willing to offer a discount to get their money today!

Here are the exact steps you can take to ask for a pay in full discount.

Do the math before you call.

Before you call to pay your bill, do the math to see what you’re willing to pay. For instance, most places are willing to offer you a 20% discount on your bill. But it doesn’t hurt to ask for a deeper discount (I’ve personally received up to a 40% discount on a medical bill after insurance paid their part!).

Let’s pretend that you have a $1,000 medical bill. To calculate a 35% discount, you would multiply the balance by 0.35. Then, subtract that amount from the original bill.

$1,000 x 0.35 = $350 (discounted amount)

$1,000 – $350 = $650 (amount you will pay in full)

Now when you call, you can tell them that you are willing to pay $650 today and pay the bill in full. This is a 35% discount! The benefit of doing the math before you call is that you are ensuring you are getting as big of a discount as possible. It can be difficult to do the math while you are on the phone with the billing department.

Use this script when you call to negotiate your medical bill down.

If you’re struggling with what to say, here’s an easy script to have on hand when you call the billing department:

“Hi, I’m calling in reference to my bill. I see here that the balance is $_____, but I can pay you $______ today and settle the bill as a $0 balance.”

I personally used this script and called about 10 places total and only had 2 that refused to settle.

In terms of how much to offer: the higher the bill, the deeper discount you will be able to get. We were able to cut about 25%-40% off most of our medical bills. I would start by offering 40%-50% of the bill and see what they can do. I even had one person put me on hold and talk to her manager. When she took me off hold, she gave me the highest discount that they could offer.

Lastly, get a confirmation number.

Once you’ve made the payment (this can even be done over the phone), make sure you get a confirmation number for the bill payment. If a confirmation number is not available, get the name and phone number of the person that you spoke with. You can also request for a receipt to be sent to you in writing or an invoice before you pay your bill. You’ll want to make sure that the person you are talking to set your remaining balance at $0.

3. Set up a payment plan.

If you don’t have enough money to negotiate your bill in full, then you can set up a payment plan with the hospital or medical company. These types of payments usually have a 0% interest rate which is great! Just be sure to get everything in writing and stay current on your payments.

4. Ask about a financial assistance program.

Most hospitals have financial assistance programs available for those with a lower income that are unable to pay for their hospital bills. In many cases, bills will be greatly reduced. You will have to meet certain eligibility standards to qualify. You can call the hospital to discuss their financial assistance programs.

Tips on negotiating medical bills

If you’ve never tried lowering your medical bills, then you might be nervous. But don’t worry, it’s not as scary as it seems! Remember, the worst they can say is “no.” Below are a few tips that will help you be more successful when it comes to negotiating medical bills.

Be kind and polite.

It goes without saying that if you’re trying to negotiate any bill down, the kinder you are the further you will get. Remember that the other person on the line is just that – a person. Speak nicely and use a polite tone and they will be more likely to work with you. Avoid any accusatory tones and name-calling. Overall, just be kind and polite.

Call the office manager if you have to.

Some doctor’s offices hire out a third-party company to handle all of their billing needs. If you call to speak with your doctor’s billing department and they aren’t willing to negotiate, try calling the office directly instead.

I personally have tried this and it has worked! After receiving a medical bill in the mail, I called the number on the bill and spoke with the billing department. The only option they gave me was to spread the amount out over several months.

Reluctantly, I hung up with them and decided to google the actual office phone number for the doctor. I spoke with their office manager (not in the billing department) and they lowered my bill by 35%!

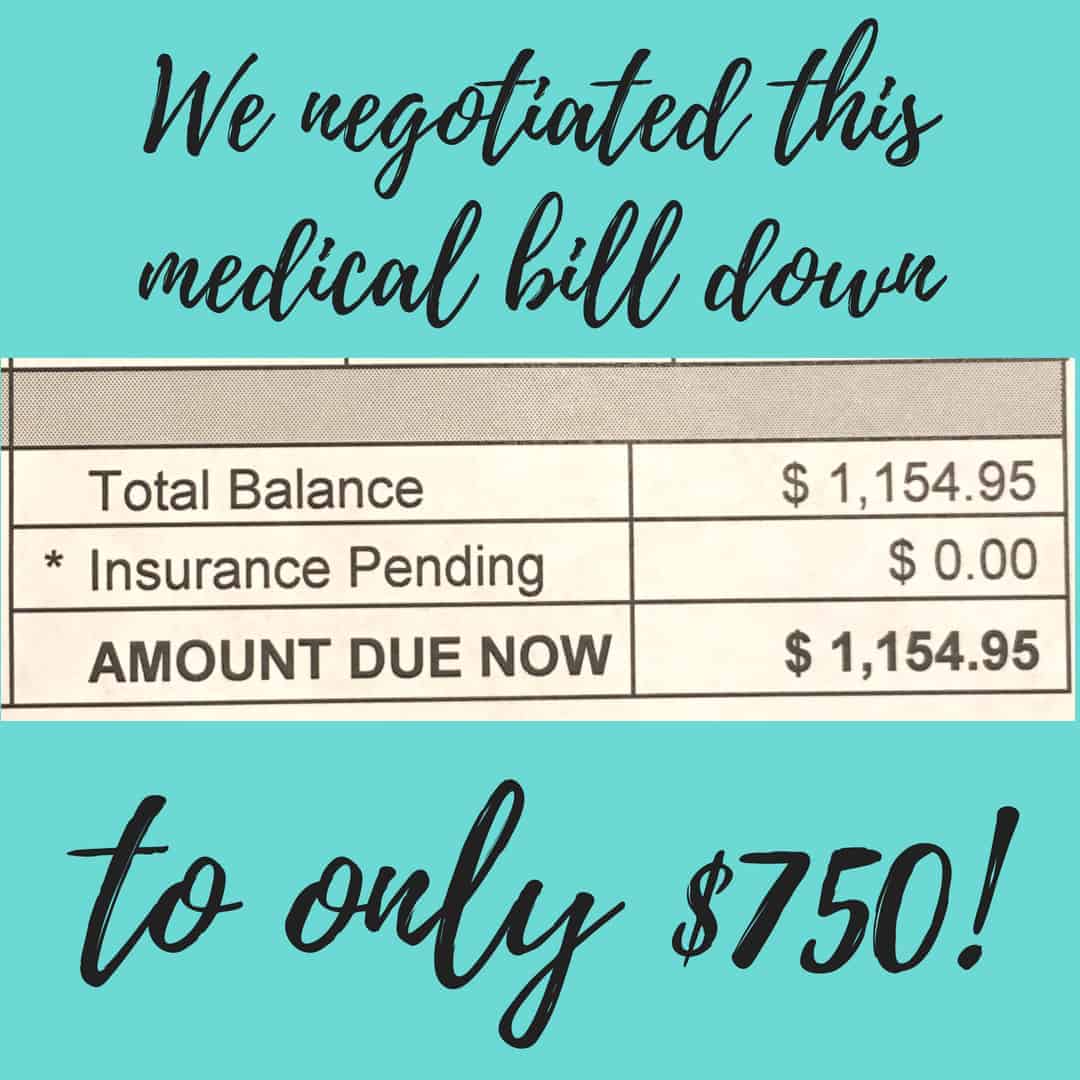

I just said “Hello, I know I owe you $1,154.95. I’m willing to settle today in full for $750 over the phone.”

She took about 15 seconds to respond “okay we can do that!”

I was amazed. That’s 35% off the original bill! Had I never thought to call the actual office, I would have had to pay the full amount. It might not work for every medical bill you have, but it’s worth a try!

Be honest and upfront.

When you’re calling to speak with someone, be honest with them. Tell them that you want to pay what you owe, but that you can only pay a certain amount. Let them know that you are doing your best to get ahead of your bills and finances.

What to avoid when it comes to negotiating medical bills

Sooner or later you’ll be dealing with medical bills in your life. It’s just going to happen. The worst thing you can do when a medical bill arrives in your mailbox is to completely ignore it. You will have to deal with the bill eventually. So instead of tossing it in the trash, set it aside and take time to negotiate your bill for less than you owe.

Our experience with negotiating medical bills.

In early 2018 our youngest son had what we thought was a stomach virus. We kept him home from daycare, cuddled him, and tried to get him to keep liquids down. It wasn’t until the second day at 11:00 pm that my gut told me something else was wrong.

He was 3 at the time and could only tell me that his “tummy hurted.” At 11:00 pm I grabbed my purse and took him to the hospital near our house. After multiple tests and blood draws, they granted us a special ride on an ambulance to a children’s hospital in Dallas. We arrived at 4:00 am and had a CT scan where we learned that his appendix had ruptured and his entire belly was infected.

If you’ve ever had to have your appendix taken out, you know the pain that our little guy was in. And if you’re one of the unlucky ones that had it rupture inside them, then you know how miserable the aftermath is. Needless to say, James had to have surgery to remove his appendix and clean out his abdomen. He was then on antibiotics around the clock.

The doctors said his situation was very concerning and told us we would be in the hospital for a minimum of 2-3 weeks. Well, our strong boy had hundreds (if not thousands) of people praying for him. To the doctor’s surprise, we walked out of that hospital 7 days later with a prescription for antibiotics, and a follow-up appointment scheduled.

Dealing with medical bills

I’m so thankful that I was able to focus on our son during those tiring and stressful days. I’m not going to lie and tell you that I wasn’t concerned about the medical bills. We were debt free by this time and had 3 months of savings in our account, yet still the idea of paying all these bills kept me up at night.

I had never dealt with the blow of such large medical bills, so I turned to the internet and started searching for ways to settle medical bills. With the help of certain articles and the advice of my amazing mom, we were able to cut our medical bills down significantly using the strategies that are shared in this article.

The Bottom Line

Medical bills can be paralyzing. And in most cases, people are never taught that you can call and get your bills lowered. However, you have options when it comes to dealing with medical bills. Whether you negotiate bills down before treatment or after treatment, you can get your hospital and medical bills lowered.

The best way to deal with your medical bills is to be on top of them. Don’t drag it out and let it hang over your head. You are in control and you can get these bills lowered using the strategies from this article.

Get your Medical Expense Checklist!

Want all this information on one nice, neat page? Perfect! Sign up to get the Medical Expense Tracker page sent straight to your inbox!