Learn how to manage your money like a pro (and keep more of it). This financial guide will explain everything about fiscal responsibility- in the simplest way possible.

Follow these money-saving steps and you’ll be more fiscally responsible this year!

What Is Fiscal Responsibility?

Fiscal responsibility is a political term that refers to how the government balances the national budget. This term can also have personal implications for our lives and our families too.

Let’s look at both of them so we understand this term a little more.

The Meaning Behind Fiscal Responsibility In Politics

When politicians use the term “fiscal responsibility”, they are talking about the proposed spending of your tax dollars. They are responsible for using the money you send them in the best way possible.

They do this through:

- Increasing or decreasing taxes

- Spending on things that benefit the country

- Encouraging economic growth in the country

Personal Financial Responsibility

This term can have personal implications too. When we talk about personal fiscal responsibility, we are looking at how our actions with money affect our overall life.

Just like how politicians are responsible for balancing the national budget, we are responsible for balancing our personal budget. We must encourage our own personal economic growth, and make our money work for us.

The Importance Of Being Fiscally Responsible

Now that you know that “fiscal” means money and “responsible” means being accountable, why do we have to care so much about our money?

Other than the fact that nothing in life is free, it’s really important to understand that your actions today really do have an impact on how you will live in 5, 10, even 30 years down the road.

Preparing now for the future could mean the difference between fear about how to pay basic bills and having the freedom to travel to see the world.

When you hold yourself accountable for your financial decisions, you make better ones.

- Where is your money going?

- How can your money be working better for you so that someday you won’t have to work when you physically can’t?

Every decision you make today – from your job, to your budget, and even your daily spending habits – has an effect on your life years down the road.

That is what this guide is going to show you. You’ll discover 11 secrets to personal fiscal responsibility that will give you a better life in the future.

How To Be Fiscally Responsible This Year

Follow these steps and you will be on your way to being an owner of your finances and your future! You don’t have to do them in this exact order, but you should try to do all 11 of them.

They are very important pieces in the personal finance puzzle that will eventually give you less stress and more freedom.

1. Set Short and Long Term Goals

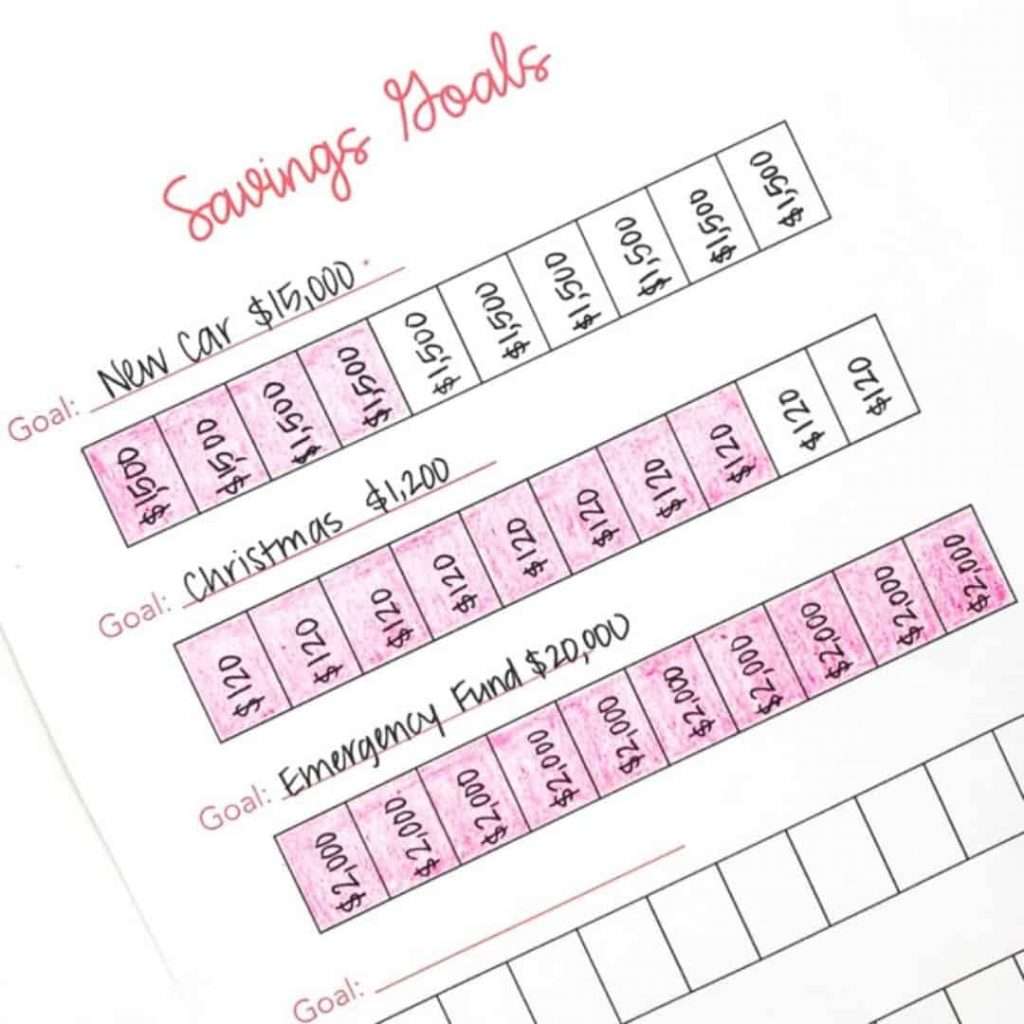

This really does need to be the first step. Set your financial goals – and make both short-term and long-term ones.

Start with your short-term goals. These are things you can accomplish in a week, a month, or even a year.

Short Term Goals

Some examples of short-term financial goals are:

- Pay off a small debt

- Set a budget

- Stick to the budget

- Track your spending

- Put a certain amount of money into savings

- Give more money to charity

Give yourself deadlines for these goals so that you can go back and see if you’ve met your goals or not. If you are married or have a partner, do this together so you can help keep each other accountable.

Long Term Goals

After you set your short-term goals, make your long-term ones. Write them down somewhere that you can go back and look and remind yourself what you are working towards.

These goals should motivate you to stick to your short-term ones. Some examples include:

- Pay off all debts

- Have enough passive income to be able to travel

- Maintain a passive income

- Establish a retirement plan

2. Create A Budget

Next, you need to create a budget! Budgets are essential when working towards fiscally responsible and they can be as detailed or as general as you want, as long as they allow you to control your money, not the other way around.

I have lots of resources for you if this is your first time setting up a budget like:

- How To Use Cash Envelopes

- Sample Monthly Budget To Help You Create Your Own

- 45 Monthly Expenses to Include In Your Budget

Basically, your budget should include your income and your expenses and give you an understanding of how you are going to spend what you have.

This is the best way to manage your money!

It helps you spend only what you currently have and makes you aware of how many bills you have each month. Knowing this will help you make smarter decisions (maybe even cut back on things you don’t need) so you can use your money in smarter ways.

3. Continually Educate Yourself About Money

No one is born knowing how to handle money. It is something we all must learn. As you discover more about yourself and how you spend or save, you can also learn new habits.

After you master sticking to a budget, keep learning about other financial situations. Maybe ask yourself:

- What is investing?

- What counts as passive income?

- How can I work smarter not harder?

There are tons of books and online courses (this one is my personal favorite – and super affordable too!) out there that can help you turn your monthly income into future wealth without you working more hours.

A very real part of financial responsibility is learning how to grow your wealth – and it is very possible.

4. Live Frugally Within Your Means

Another habit that you’ll need to learn in order to be fiscally responsible is to live within your means. This is why setting up a budget is so important!

Ideally, you will set up your budget, only spend what is in it, and then have money left over for charitable giving, investments, and savings.

One thing that is really important to understand is that it is possible to be a poor wealthy person. No matter how much income you earn, if you spend more than you earn, you won’t have enough money left over for retirement or future plans.

This is why a budget is crucial. Set a plan for how much you will spend on your expenses and then save the rest.

5. Build Up Your Savings

I highly recommend setting up your savings account when possible! However you save money, just do it.

If you enjoy challenges then try one of these 21 money-saving challenges.

When you have money in savings, you will be equipped to handle surprise expenses like large medical bills or car repairs.

Another way to save money is to create sinking funds. These are amounts of money in your savings account that you will use for specific purposes. For example, if you know your roof will only last 10 years, you should save up a sinking fund for the amount of a new roof so that when it comes time you can afford to replace it.

You should also keep at least 3 months worth of money in an emergency fund. This is money you can rely on and live on if you unexpectedly cannot work!

6. Pay Off Debt

Debt will hold you back in so many ways. Be smart with your money and pay it off. Don’t carry the debt for too long or else you will run the risk of owing more than you can afford to pay back!

Piece of advice- Keep your money and use it on things that you enjoy, not on interest payments for credit cards or loans.

7. Start Investing

Another key part of fiscal responsibility is learning how to set up passive income. This is the idea behind investments.

The best thing to invest in are retirement accounts! They are low-risk and will provide you with an income after you retire.

There are many types of retirement accounts available. It’s best to do the research and choose which one is best for you.

Index funds are a popular way to invest because they are comprised of a list of funds from the stock market. Want to learn more about how to build wealth by investing in index funds? Check out this super affordable course. I’ve personally taken it and loved it!

Real estate is a popular investment that has the potential to pay off years down the road.

8. Calculate and Understand Your Net Worth

As you keep learning about how to manage your finances, learn how to calculate your net worth.

What is net worth? It is basically assets minus liabilities.

Assets are anything of value that can be converted into cash. Some popular types of assets are:

- Cash in bank accounts

- Real Estate

- Investment Accounts

Liabilities are things that cost you money and don’t have cash value. Some examples are:

- Credit Card Debt

- Car Loans

- Mortgages

So the house you own is an asset because you can sell it, but the mortgage you owe is a liability.

Knowing your net worth will help you understand how your life will look financially when you get to retirement. If you have more liabilities than assets, you have a negative net worth and you’ll probably have to work longer to live and pay your bills.

9. Get The Right Insurance

Another thing that will protect your finances is making sure you have fantastic insurance!

The best insurance will protect you from financial ruin when bad things happen. Not if they happen but when they happen, because they will.

These are the main kinds of insurance you need:

- Medical Insurance

- Car Insurance

- Homeowners or Rental Insurance

- Disability Insurance

- Life Insurance

Keep learning about insurance and make sure you are protected so that a disaster doesn’t ruin you financially. It also pays to shop around for better rates! My husband and I actually ended up saving hundreds of dollars every year simply by lowering our homeowner’s insurance. Check out and compare different home insurance rates below:

10. Continue To Optimize Your Finances

The more you grow and learn about being fiscally responsible, the more you will have to tweak your budget and change how you approach money and spend it.

Make money management a lifestyle choice! It isn’t a “set it and forget it” kind of thing. Keep learning and adjusting and your financial situation will improve too.

11. Build Generational Wealth

Finally, a very real part of wealth is knowing how much you will be able to pass down to your family someday.

Look at your net worth and your investments. Will you have anything to pass along to them?

This guide explains how to build generational wealth. Dig into it and leave a legacy that will benefit your children and their children.

How To Be Fiscally Responsible: Final Thoughts

Being fiscally responsible is about so much more than just staying within a budget. It’s all about preparing for the future and making sure that you are getting the most out of your money.

Keep learning more about how to prepare and you’ll soon realize how rewarding it is!