Dreaming of a bigger income? This is a close look at what a six figure salary actually looks like and what you can do to build wealth. Building wealth is the key to financial security.

What is the American dream? Many people would say it’s to graduate college, own your own home, and make 6 figures a year. Is this really the dream that everyone thinks it is? What does 6 figures a year actually get you?

In this guide, I’m going to look closely at what this income gives you. Then, I’ll explain clearly how to live a life of abundance even if your salary isn’t 6 figures.

What Is A Six-Figure Income?

A salary between $100,000 – $999,999 is considered a 6-figure income. Anything over $200,000 would be considered a multiple six-figure income. Just because someone earns 6 figures does not mean they are wealthy. A lot of factors play a part in wealth. Let’s dig into those factors!

What A Six-Figure Salary Gets You

Are you one of the people that has dreamed about earning enough money so you don’t have to worry about your finances ever again?

Lots of people think that a higher salary is the answer. They keep six figures as the high and lofty goal for which they always aim. If that’s the target, let’s look at what exactly this salary will give you.

If you break it down, a salary of $100,000 per year comes out to a minimum of $8,333 per month. Here is what that monthly and annual salary will get you.

Jobs That Earn Six Figures

The first thing that a six-figure salary will get you is a full-time job. This will become your life – so what kinds of jobs pay this well?

These types of jobs are usually going to include positions like doctors, lawyers, and other specialized careers. They require training and education.

Here are some of the most common six-figure careers and the average income they commonly pay.

- Anesthesiologist – $350,000

- Dentist – $175,000

- Financial Manager with MBA – $127,000

- Pharmacist – $120,000

- Petroleum Engineer – $138,000

- Software Developer – $105,000

What about jobs that don’t require a college degree? Yes, you can still earn 6 figures without student loan debt!

These are just a few of the high-paying jobs that don’t require a degree:

- Real Estate Broker – $150,000 a year

- Air Traffic Controller – $140,000 a year

- Construction Manager – $100,000 per year

- Commercial Pilot – $100,000 per year

Some jobs that pay really well in some areas (like dental hygienists) don’t require 4-year degrees, but they do require an Associates.

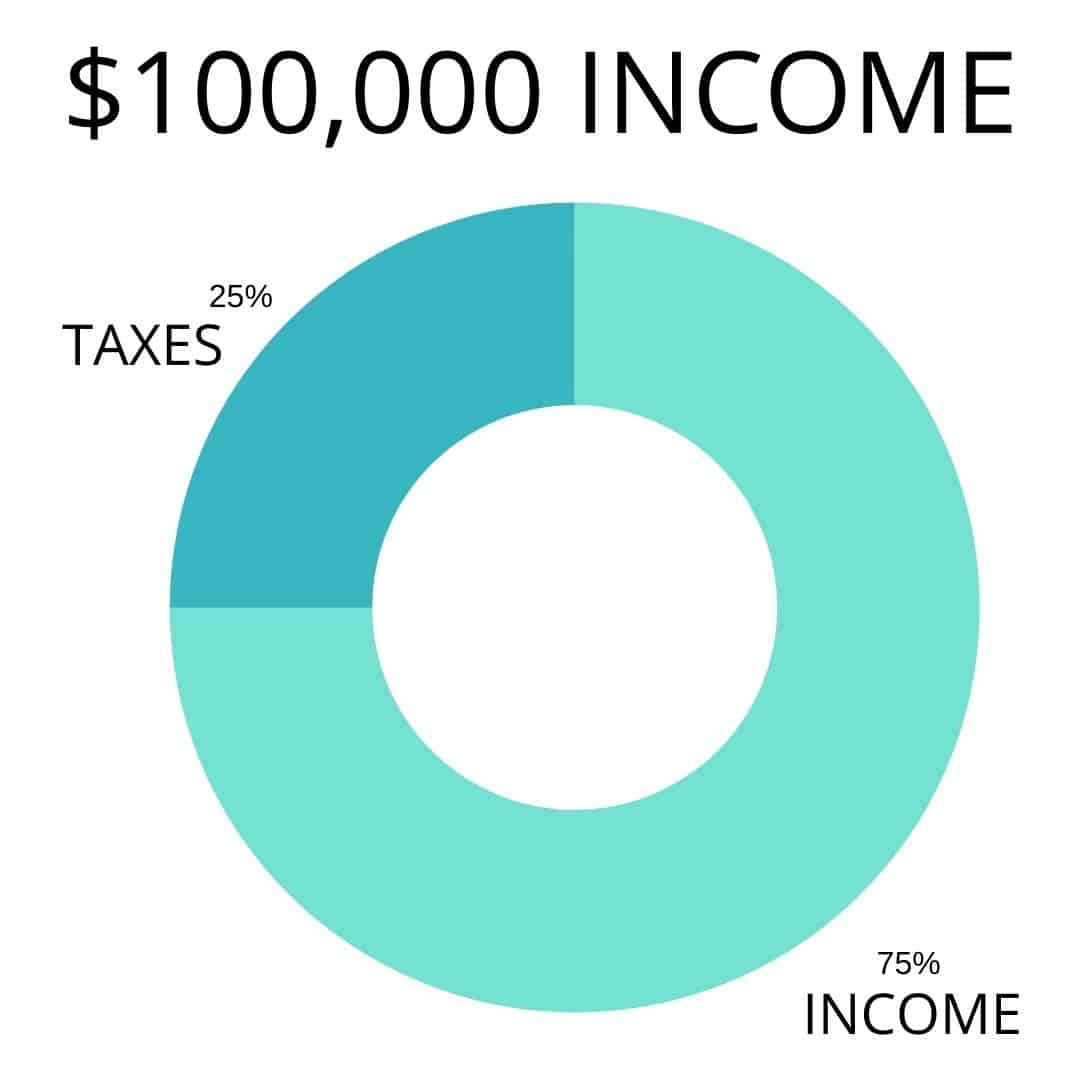

Taxes On Six Figure Salary

Another thing six figures will give you is higher taxes because you’ll be in a higher tax bracket now.

Let’s look at it closer. If your salary is $100,000, then you are in the 25% tax bracket. That means your take home pay is only $75,000.

This is why so many people aim for much higher than just $100,000 per year. Essentially, they will be able to actually bring home more money each month after taxes.

The Six Figure Lifestyle

The lifestyle is what everyone dreams of – and it really can be fun. With the right budgeting, this income could give you access to different homes, cars, and trips.

As fun as this can be, it’s also dangerous. “Keeping up with the Joneses” is a real struggle for some people.

Trying to live in a larger house, drive a newer car, and buy the clothes that everyone admires all costs money and could quickly eat away at your income.

This is one of the things that causes even well-paid professionals to live paycheck to paycheck.

Cost Of Living In Well-Paying Cities

A good number of the jobs that pay well are located in big cities. This also means that the cost of living in these cities is much higher, so that income will dwindle much faster. You will pay higher taxes, a larger rent or mortgage payment, and more for food and other amenities.

Let’s look at this closer.

These are the cities that pay the best, along with the average price of rent for a 2-bedroom apartment.

- Chicago, Illinois – $2,243

- Portland, Oregon – $2,307

- Philadelphia, Pennsylvania – $2,241

- Baltimore, Maryland – $1,812

- Los Angeles, California – $3,091

- Denver, Colorado – $2,409

- Seattle, Washington – $3,150

- New York City – $4,032

- Washington D.C. – $3,650

- Boston, Massachusetts – $3,284

- Miami, Florida – $2,750

What about owning a home? If you buy a home for around $500,000, you will pay about $2,387 per month for the mortgage. This doesn’t even include property taxes or insurance on the house!

As you can see, rent or even mortgages in these cities (and in the suburbs around them) will affect how much of your income you actually have available to use.

Student Loan Debt

A lot of the jobs that will pay you six figures require a college degree. This college degree might come with student loan payments every month.

Student loan debt is one of the worst for anyone to ignore. If you don’t pay it, they can garnish your wages and take what you owe out of your income tax refund.

How much is a student loan payment? The average American pays about $400 per month for their student loans. Those with master’s degrees tend to pay even more toward student loans. This number depends on the amount of the loans. Private colleges will leave people with more debt than public universities or community colleges.

Investments

Even people that make six figures have to make and stick to a budget. If they stick to a budget and invest their extra money wisely, it can pay off in the long run.

Smart investments will earn compound interest the longer it stays in the account. In fact, some investments even pay out dividends while you have them.

Time

Traditionally, those that earn six-figures end up spending more time working each week and year. With only 24 hours in a day, we all have a choice when it comes to how we will spend that time.

So often high-earners spend more than 40 hours each week to earn their six-figure income. This time away from home and family can cause a strain on someone’s mental health and relationships.

Many people who earn six-figures are willing to trade time for money by hiring outside help with household duties. Although this might give back personal time, it’s also increasing their monthly expenses.

How To Build Wealth Without 6 Figures

The good news is, it’s possible to live the same kind of financially free life that you dream of even without a 6-figure salary. It’s possible to build wealth and have extra money for things like trips and new purchases on your current income.

Here’s how to make your current life your dream life.

Pay Off Debt

The very first way to keep more of your income is to pay off your debt as quickly as possible. The debt snowball method is the most effective way to do this.

The debt snowball looks like this: you pay off your smallest debt first. Then, you take the payments you were making and apply them to your next largest debt. When that is paid off, you take this total payment and apply it to the next one.

Before you know it, your debt will be paid off and you will have so much more money in your budget every month.

It’s a magical and exciting experience.

After you pay off your debts, make a plan not to get back into this position again.

Build Up Savings

Another thing that will help you build wealth is creating a rainy day savings account. This is something that you’ll use to pay for surprise expenses like a new air conditioner or large engine repairs.

Try to save up 2-3 month’s rent. This way, if something happens to your job, you’ll still have money to pay your bills while you look for another job.

This savings account will fund expenses that might otherwise derail your finances. You can’t predict the things that will go wrong, but you can be prepared to pay for them.

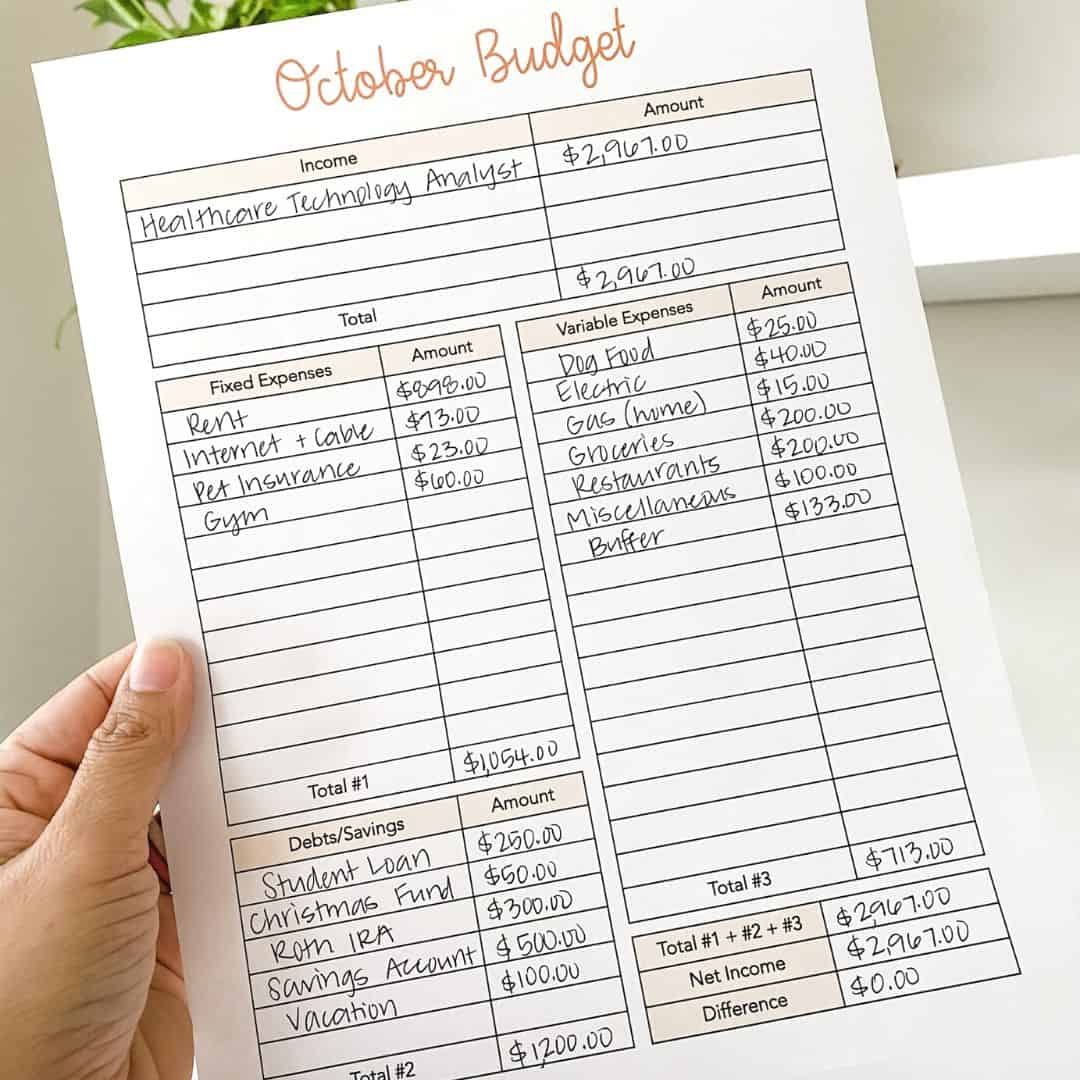

Create A Budget

Everyone, no matter what their salary is, benefits from a well-planned budget. When you create a budget, you are setting yourself up for success.

This can be as simple as the cash envelope system or as complex as something with a budget software – just make sure it fits the way you look at money.

You will know exactly what your expenses are and you’ll be able to see where you can cut back and make smarter choices.

A budget will also give you the freedom to know ahead of time how long it will take you to save up for that large dream purchase.

If you want to build wealth, it all starts with a budget.

Invest Wisely

You don’t have to make $200,000 a year to have investments. Talk to an investment professional and find smart ways to invest your money that will pay off when you retire.

Investments that earn compounding interest are one of the best ways to build wealth. Some people suggest investing in real estate, others in the stock market. There are pros and cons to every type of investment, so it’s very important to talk to someone you can trust.

Even simply investing in your 401K or retirement account is a great way to get started with investing. Don’t wait until you’re older to invest. Start young and start early!

Get On The Same Page With Your Partner

Money problems are often listed as reasons behind divorce in America. It’s no secret that money seeps into our everyday lives. Merging finances with another person can be very stressful.

By getting on the same page with your spouse or partner, you’re more likely to save money and write a budget that actually works. This will help you in the long run when it comes to paying off debt and building wealth.

If your partner is hesitant to get on board with a budget, then start by simply discussing your family’s goals and dreams. What age do you want to retire? What do you want to be able to do or see in the future? Do you want to be able to take your grandkids or friends on a trip?

Start the conversation early on in your relationship because it can literally save you money.

Downsize

Finally, take a look at where you live and what you drive. Sometimes by simply downsizing, you can save a lot of money.

Selling your home and moving into a smaller one in a different neighborhood could mean a huge difference in mortgage payments.

Don’t just downsize your house or car, but look at your spending habits too. Are there any spending habits that you could curtail a bit?

Every little bit helps. The less you spend, the more you will save and keep.

Take Up A Temporary Side Hustle

Finally, if you want to build your wealth, take up a temporary side hustle. Pour the income from this side hustle into paying off your debts and building up your savings account.

When you are comfortable financially, you can quit this side hustle. You’ll have more time on your hands and enough money built up that you won’t feel like you have to work so much.

Examples of side hustles include:

- Freelance Writing

- Dog Walking or Babysitting

- Instacart or Door Dash

- Virtual Assistant

- Freelance Graphic Design

To learn more about becoming a virtual assistant and making GREAT money in your spare time, checkout this free checklist from my friend Abbey to see if it’s right for you.

Learn To Budget No Matter Your Income

Just because you make six figures doesn’t mean you shouldn’t write a budget. Likewise, if you don’t make six figures then a budget is for you as well!

Learning how to write a budget that will work for you and your family can be overwhelming. By signing up for the Free Budgeting and Debt Payoff Cheat Sheet, you’ll learn step-by-step how to write a budget that will work for you so you can payoff your debt for good.

In the end, you’ll learn how to save money, manage your finances better, and get started on paying off debt. Ready to get started? Sign up below.

Final Thoughts on the Six Figure Salary

That dream of earning six figures a year is a very popular one for people in America. You might think that with all that money, you’ll never have to worry about budgeting or financial stress again.

What might surprise you is that even people that earn this wage have to watch their budget. If they don’t, they will also live paycheck to paycheck.

Learn to live within your means and build wealth at your current income level. It’s definitely possible!