Are you wondering how to stop overspending?

If so, you’re probably dealing with one (or maybe all) of the following feelings: stress, anxiety, guilt, shame, and even depression. These feelings are likely what led you here and if so, you’re in the right place! I’m going to show you exactly how to stop overspending so that you can break this cycle for good and start setting your financial future up for success!

But first, I think it’s very important to recognize the common signs of overspending in order to help you spot when you’re heading down that slippery slope!

7 Common Signs You’re Overspending:

1. You buy things before paying bills.

Instead of paying your bills first then spending the leftover money you do have, you go on shopping sprees and order a ton of takeout first. Payday hits and that’s your green light to start swiping away without a care in the world before actually sitting down, writing your budget , or pay bills…FIRST.

2. You can only afford to make the minimum credit card payment.

Do you owe a ton of money on credit cards? If you find yourself struggling to pay it off, it’s probably because you can barely fit all of the minimum payments into your budget.

3. You stop saving money.

If you’re struggling with overspending, then your savings are likely taking a hit or being neglected altogether. According to a recent article published on CNBC, 56% of Americans can’t even cover a $1,000 emergency. I personally believe that overspending plays a big part in that percentage.

4. You recently started earning more money.

Are you guilty of increasing your lifestyle every single time you get a raise instead of saving some of the money or paying down debt? This is called lifestyle creep and it happens to enough people that there’s actually a term to define it and even courses teaching you how to overcome it!

5. You spend more than you earn.

53% of people in America spend more than they earn. Wow! That’s over half. It’s really easy to do. You spend more this month than you plan which causes you to try and make up for it next month. So you send less to savings, pay your power bill on your credit card, or pull money from savings to cover the shortage. You don’t adjust your spending to stop the cycle.

6. All of your credit cards are maxed out.

You keep using your credit cards to cover your budget instead of adjusting your spending habits. This causes every single one of them to be maxed out and have zero available balance. You can’t even charge a penny on any of them.

7. Your credit card debt exceeds your monthly income.

If you added up all of your credit card balances, it would be more than you make in a month. You owe more than your monthly income.

Now that we’ve gone over some of the signs that you’re struggling with spending too much money, let’s talk about common budget categories that often take the biggest hit when it comes to overspending. This will help you learn how to stop overspending by taking focused action in the areas that matter most!

3 of the Largest & Most Common Overspending Areas

1. Online Shopping

If you’re wondering how to stop overspending, then it’s likely you need to evaluate your online shopping habits. America is a fast-paced society where we’re all about convenience. We live busy lives and we try to optimize our time. One of the ways we do this is by shopping online. The stores make it so easy, too!

They save your debit/credit card numbers, email you coupons, and even offer suggested items right before checking out just like all those brick and mortar shops do. They literally have tons of people working full-time to help them figure out how to get people to spend more money. Americans are estimated to spend $690.84 billion shopping online in 2020.

2. Food

The average family of 4 statistically spends up to $1,068 a month just on groceries and an average of $250 a month on restaurants and dining out. Food is one of the biggest variable expenses for households, especially during the busy holiday season.

3. Subscriptions

The average American family spends about $287 a month on subscriptions. That’s a lot of subscriptions! It’s really easy to overspend because the temptation of one subscription only being $10 a month lures you in. It doesn’t sound like much, but when you add on a few more low-ticket subscriptions, it can really add up. On top of that, many subscribers don’t even use the product forget to cancel the subscription when they’ve gained what service they were seeking. Essentially, the likelihood that you’re paying for something you don’t even use is pretty high!

Now that you know for sure that you’ve been struggling with spending too much money and have learned the top budget categories to monitor, let’s talk about WHY you’re struggling with overspending money in the first place so you can learn how to stop overspending from the inside out and create lasting change.

7 Reasons You Can’t Stop Overspending Money

1. Your card information is saved on websites for easy access

We’ve all been there. We’ve all seen a sale advertised, browsed around, clicked add to cart, and checkout faster than you can blink. Not only do online retailers allow you to save your credit or debit card information to your profile to make shopping even easier, but Apple Pay and Google even store your information that make online shopping easier than ever.

You know this is true for you because you’ve also stopped spending before because you didn’t feel like getting up and hunting down your card to checkout. This pause made you stop and think. After contemplating your purchase, you decide you really don’t “need it” anyway.

2. Social media causes you to spend without thinking.

People spend a lot of time on their phones mindlessly scrolling on social media. This makes it extremely easy to get caught up in overspending. Think about it, social media developers are marketing wizards. You can be talking about one thing and within 10 minutes, you have an ad pop up on Facebook or Instagram for the product you were just discussing. It’s kinda weird how it happens, right? Add in the “swipe up” feature and Apple Pay and it’s game over for your budget.

Or maybe it’s an indirect ad from an influencer. A simple advertised video of someone trying on this season’s latest fashion trends can lead you down an unplanned online shopping spree…I know this because I’ve been there!

3. You shop to feel better and improve your mood.

When you’re in a bad mood, it’s human nature to start searching for ways to feel better. You know shopping will give you that quick shot of happiness, so you take off to Target or Home Goods.

Before you know it, you have a full cart of items you didn’t plan on purchasing. You feel bad for a moment, but you still head to the checkout counter. Everything goes on the credit card because you know it won’t hurt as much and you can pay for it at a later time.

You have the $50 minimum payment in the budget anyway, so technically that means it’s in the budget, right? Wrong!

4. Peer pressure

1). Direct Peer Pressure

Have you ever been out with friends and felt the pressure to overspend outside of your budget? Maybe you budgeted for lunch together, but they decided last minute to hit up the nail salon. You did NOT budget for this. But their response is “the pedicure is ONLY $20. You can afford to spend $20, can’t you? Come on, we never get to hangout!” Suddenly, you feel the pressure to say yes.

2). Indirect Peer Pressure

I like to call indirect peer pressure “Keeping up with the Joneses.” Take a second to think how it makes you feel when you see people you’re following on social media taking vacations, wearing the latest fashion trends, or showing off their newly renovated beautiful home? Does this make you want to spend money? Does it make you feel like you deserve these things too and you’ll do anything to make it happen? It really only takes a few minutes on social media to find yourself wanting something that someone else

5. Stores make it easy impulse spend.

Stores are geniuses at making you spend more money. Here are a few ways they can cause you to overspend:

- Stores always having tempting sales – they text you, email you, and put up a big sign in front of their brick and mortar shop so you are tempted to spend money NOW.

- Most stores have a “have you seen this” or “add this to your cart for just $5” when you checkout. In brick and mortar storefronts, these items line the checkout aisle so you add just one more thing to your cart. After all, it’s only 5 bucks, right?

- They send you emails or texts filled with coupons so you’ll spend money on items at a small discounted rate.

- Many stores have anniversary clubs and birthday clubs to give you coupons and promote spending money in their store.

- They have rewards cards that analyze shopping patterns and give you points to get “free stuff”.

6. You are unaware you’re even overspending

In fact, you just swipe your card at the checkout without looking at the total. You saw the price tag but you didn’t take into account taxes and those couple of items you added to the cart on your way to the cashier. When you look at your receipt on the way to the car, you see the total is actually $89, not $50.

This points to a bigger issue: you’re not tracking your expenses. In your head you think you’ve only spent $200 this month on groceries. You think you still have $50 more to spend. But in reality, you’ve spent $275.

7. You’re paying with plastic

According to recent studies, people who are paying with cards (debit or credit), spend 12 – 18% more than those that pay in cash. A study from 2016, shows that the average cash transaction is $22 and the average credit card transaction is $112. That’s a 409% increase!

Study after study shows that when you’re paying with plastic (especially with a credit card), that you spend a lot more money.

Now, onto the most important part of this article. Let’s talk about some real action steps you can take that will address how to stop overspending so you can take back control of your finances, ditch debt, and start saving!

22 Tips To Help You Stop Overspending Money

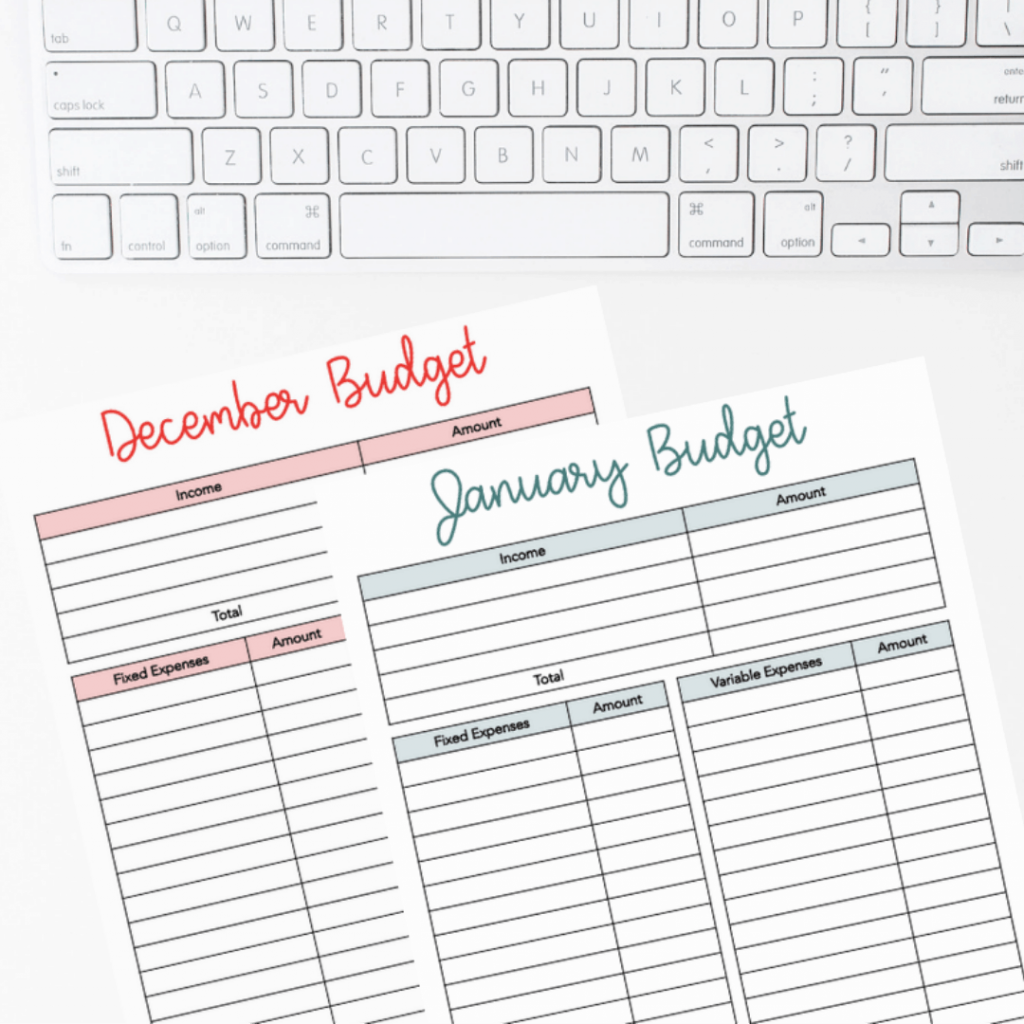

1. Create a realistic budget.

Creating a budget and re-adjusting it frequently will help you with spending less. You can decide where you want your money to go and use it as a guideline before making a purchase.

If it’s in the budget- great, make the purchase. If it’s not in the budget- wait and re-evaluate. Some people have reservations about creating a budget. Just think of it as creating a money plan for yourself just like you would create a food plan or a fitness plan.

A budget is simply a guide. It’s a plan for where your need and want your money to go each month.

Create your budget BEFORE you get paid and before you spend. Do this with a clear mind. Then, when you’re in the moment, you are less likely to give into temptation to overspend because you know where and how you need to spend your money this month.

I really like budgeting by paycheck and finds that this method helps to combat overspending.

- Learn how to write a budget when you’re paid bi-weekly here.

- Learn how to write a budget when you’re paid weekly here.

Need help creating a budget you can actually stick to? Take my free budget class here!

2. Use cash envelopes.

Spending cash hurts a lot less than using plastic. It is statistically proven to make you spend less.

You can start small and just take 2-3 categories where you typically overspend and start pulling the money out of your account every payday. For those 2-3 categories, you will not use your debit card. You will only use the cash in the envelopes.

If you’re new to cash envelopes, you can get started here.

3. Stop storing your debit/credit cards on websites.

Like I said, a lot of websites save your card information to make it easier to checkout. Stop clicking the “Remember this card’ button when buying things online. If you have any cards on any website, remove them. If you have Apple Pay, unlink your bank account! Is your information stored on your internet browser? If so, delete it!

This one small action will help you put up a barrier and make it harder to complete the purchase.

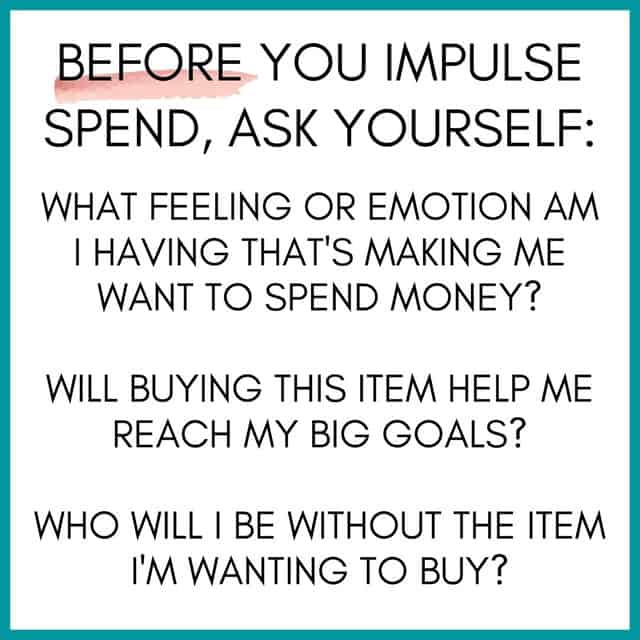

4. Think before you spend.

Really think about an item before you spend the money. Below are two questions to ask yourself before spending money:

- Do I really need it?

- Can I live without it?

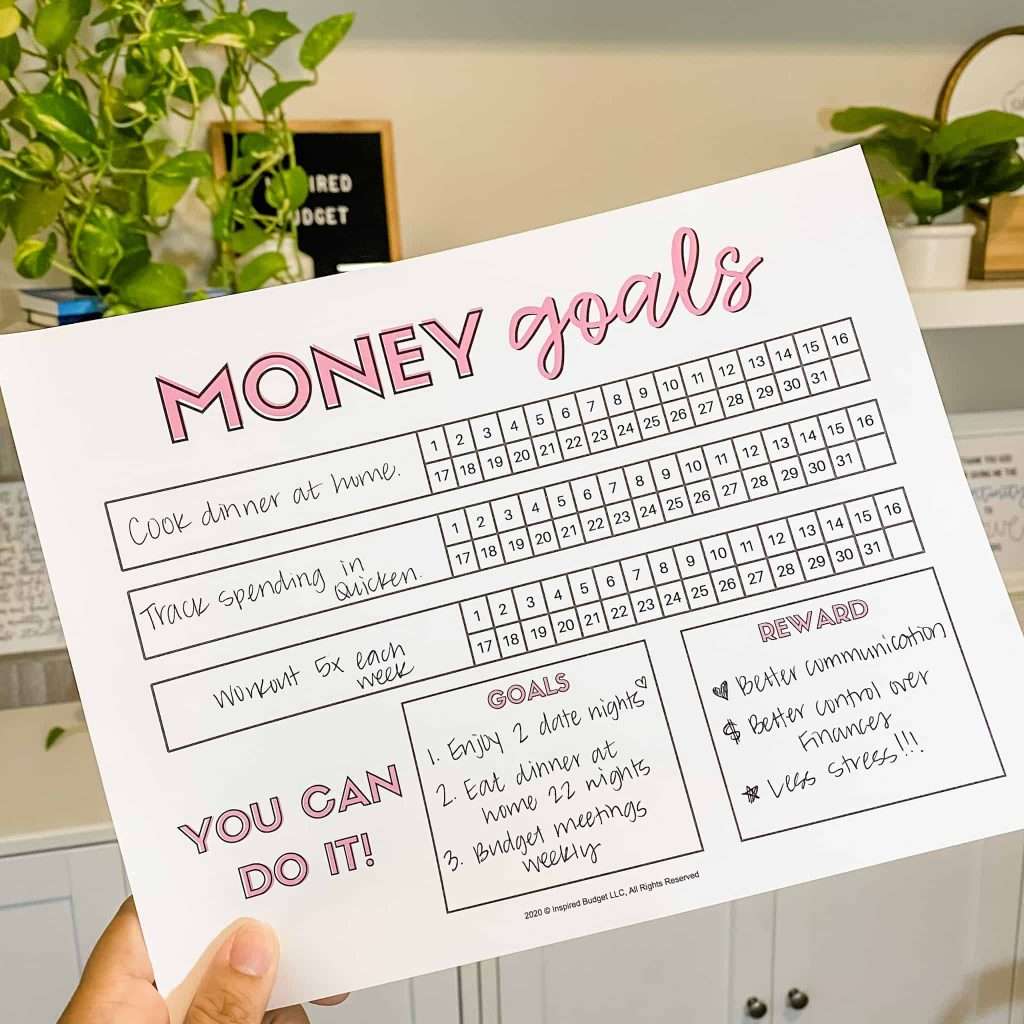

We have a freebie available for you to help with this step. I use it all of the time to track my money goals. You create 3 money goals and track your progress daily. This reminder helps me with so much unnecessary spending. Grab your free money goals printable!

5. Take back control.

Actually making yourself stop overspending is easier said than done, right? You want to stop swiping your card and blowing your paychecks, but you just can’t seem to do it.

No matter how hard you try, the urge to hit “add to cart” is stronger than your willpower. Maybe you make decent money but you’re still living paycheck to paycheck.

I’ve been there and I want to help you. That’s exactly why I created Stop the Swipe. Stop the Swipe is a course to help you with overspending. I will help you kick your bad money habits to the curb for good!

Stop the Swipe will teach you how to:

- recognize your desire to spend.

- find the REAL problem.

- create a step-by-step plan to stop overspending.

I want to show you that it’s totally possible to change your money habits and win with money. You can view additional information about this transformational course HERE.

6. Never shop without a list.

Stop shopping without a list. Chances are you will more likely pick up things you don’t need (especially at the checkout counter). When you go into the store without a list, you’re more likely to go down every aisle to make sure you can “remember” everything, but you ALWAYS end up spending more than you intended.

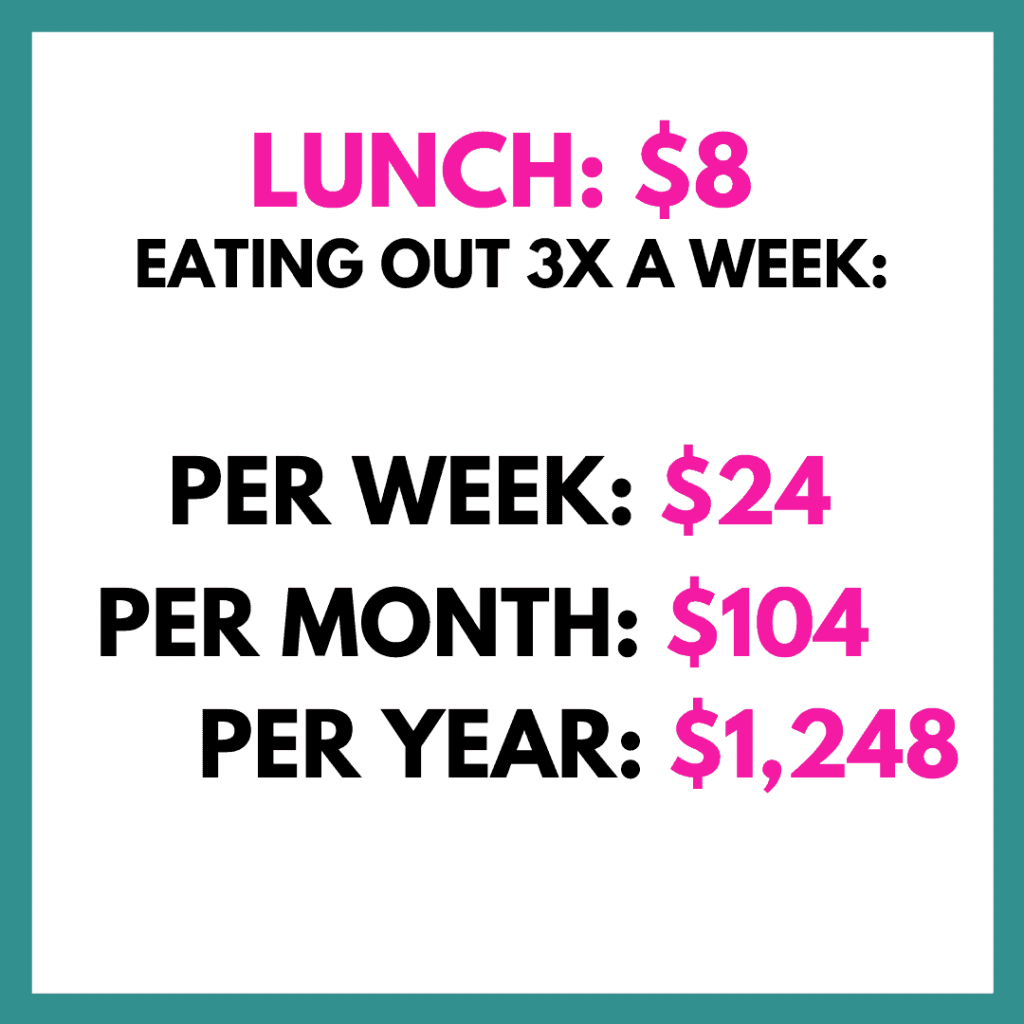

7. Stop going out to eat for lunch.

Going out to lunch is expensive. You can easily spend $8 or more for one meal. Here’s some math to put it into perspective.

Eating lunch 3x a week for an average of $8 a pop looks like this:

This isn’t counting your spouse. This is just for you. You could be so much farther ahead on your debt snowball with $1,248 a year!

Even if you only go out to eat one time each week, you’ll be cutting the cost to only $416 each year. That’s a lot of savings!

8. Unsubscribe from store emails and text messages.

Stop getting all of the sales notifications. Just say no thank you when the cashier asks you for your email address or phone number. If you are already on a ton of mailing lists for sales (which I bet you are), try unsubscribing from them. Instead of unsubscribing from them one by one, you can actually go to Unroll.me and do it the easy way and save a ton of time.

You go to the website Unroll.Me and sign into your email account on their site. Then it will bring up all of the emails in your inbox.

You can decide to do 1 of 3 things with the email.

- Unsubscribe.

- Keep in your inbox and keep subscribing.

- Send to the rollup. The rollup email adds in all of your emails and sends you one email a day instead of 10. You get one email with a snippet of each email. You can scroll through and see all of the emails at one time.

This will really clean up your inbox and help you stop spending money.

9. Track your spending.

Tracking your spending each day is extremely powerful. If you put any of this article’s advice into action, please, let it be this one: Track your spending! Not only is tracking eye-opening, but it helps you create mindful spending habits. If you track your spending, you know how much you have left in each of your budget categories. There’s no more guessing. You won’t accidentally overspend, because you know where you stand for the month.

I personally use Quicken to keep track of my expenses. They have an app so you can keep track of your expenses on your phone. Your spouse can even download the app on their phone too.

10. Realize your triggers.

What triggers you to overspend? Is it to feel better? Is it when you’re out with your friends on a girl’s day? This isn’t to judge yourself. It’s to become aware. Awareness is the first step in solving any problem.

You have to know a problem exists first. What were you thinking when you purchased the item? What made you throw those extra pair of leggings into your cart at Target?

11. Decrease your expenses.

If you’re spending more than you like on food or another category, make a plan to change it. Can you work on spending 20% less each month? If your goal is to spend $600 a month on food (groceries and restaurants), but you’re currently spending $1,200, you can’t go from $1,200 to $600 in one month. Just decrease your spending by 20% each month until you reach your goal.

Use can decrease your spending several ways. Try using coupons, switching to generic, making cheaper meals, etc. Go through each category you’re spending too much on and create a plan to decrease the amount you’re spending.

12. Create money goals.

Creating goals helps you figure out where you want to go with your money. It’s hard to get to your destination when you haven’t planned out where you’re going.

Don’t go crazy and try to create a ton of goals at one time. Just create 3 small goals/habits you want to work on each month. You can use our money goals sheet and keep track of your goals every single day and even keep track of your reward for making your goal at the end of the month.

13. Know where you stand with your budget.

Before you go out to spend money, check your budget and expenses BEFORE leaving the house or hitting checkout on the computer. Now that you’ve started tracking your expenses, you’re able to see if you really can afford it or not.

This will prevent you from overspending. You know how much money you have to work with when you go to the restaurant or for a girl’s night.

14. Double-check your subscriptions.

Check your subscriptions.

- Are there any you can stop that you’re not using anymore?

- Can you decrease the cost in any way (like lower your package or decrease the number of deliveries)?

- Can you find a cheaper alternative that will meet your needs?

15. Create a meal plan to save on food.

Creating a meal plan will help you save a ton of money on food. When you don’t have a meal plan in place, you tend to spend more on going out to eat or you go shopping without a list.

Either way, you end up spending way more than you intended. Meal planning doesn’t have to be complicated.

Hint: You can put frozen pizza and takeout on your meal plan if that’s what you plan on eating. People tend to make meal planning super complicated, but it’s really just writing down what you say you’re gonna eat on a certain day. That’s it.

16. Leave the cards at home when you shop.

If you’re going shopping, take cash and leave the cards at home. If you know you only have $100 to spend at the grocery store, you’re going to be more cautious of what you’re spending. You will be able to fight the temptation to add in all of those extra purchases. You’ll actually save a ton of money because you’ll have to add up your purchases as you go along.

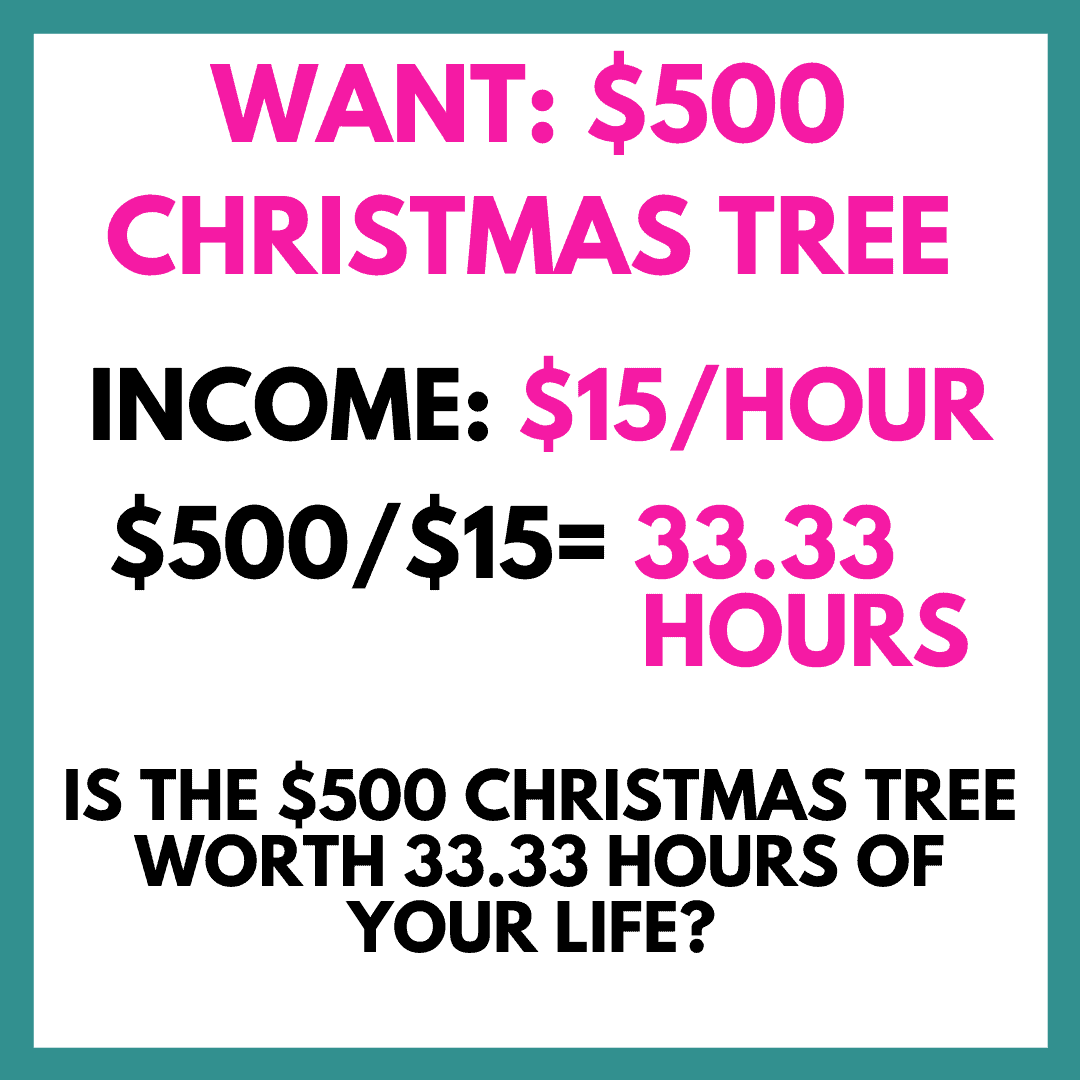

17. Calculate the cost of an item in time.

When you want to make a purchase (say that $500 Christmas tree speaking to you at Home Depot), calculate the number of hours you need to work to buy the Christmas tree.

Essentially, you’ll have to work almost an entire week (or a little over 4 days) to buy the Christmas tree. Then you can determine if the tree is worth you working 33 hours for. It’s probably not and you’ll likely be able to resist the purchase.

18. Order grocery pickup.

Ordering groceries for pickup saves you a ton of money and time. You won’t spend precious time walking through all of the isles at the grocery store and throwing things in your cart like crazy.

One perk is that you’re able to see your grand total after every single item you add to the cart. If you go over budget then you can always remove an item from your list before you check out!

19. Budget personal spending money.

Spending money isn’t just for kids. You don’t need to cut yourself or your spouse out of the budget. Give yourselves pocket money. Once your cash is gone, you’re done spending until you can refill the envelope again.

One perk is that you can quickly add up the cash to see how much you have left to spend. This really helps me with overspending. I can decide if the purchase is worth it or not right away.

20. Do a no-spend challenge.

A no-spend challenge is a great way to stop your overspending habit. You can do a no-spend challenge for a day, weekend, week, or month. You don’t have to do it for a whole month. If you’re just starting out, I recommend doing it for a day or a weekend.

21. Get an accountability buddy.

Having an accountability buddy really helps you with overspending.

An accountability buddy can help in several ways:

- Set a limit for spending. If an item you want to purchase is over that limit you have to discuss it with your buddy first.

- Discuss one category of your budget with them and they can help you stay on track with that category. (Like food!)

If your spouse isn’t on board with budgeting, just ask a friend. It doesn’t have to be your spouse. It can be anyone who will help hold you accountable.

22. Stop shopping with a shopping cart.

I love spending money at Target. Like really, really love it! I had to stop myself from getting a shopping cart when I went into the store. I now carry the items in my hand.

This prevents me from throwing a bunch of things into the cart without thinking. It prevents me from overspending at Target. Wherever your weak spot is, don’t use a shopping cart in that store either. Maybe you overspend at Hobby Lobby or Home Goods. Either way, skipping out on a cart is a great way to stop overspending.

How To Stop Overspending: The Bottom Line

Overspending doesn’t have to define you. You can overcome your habit of overspending. You can choose to rewrite your story. Start today with a new you. It’s totally possible to change your money habits.