Budgeting is easy. I just want to put that out there in case the word “budget” makes you cringe! It’s also fun. No, I’m not just pulling your leg. All budgeting is, is taking control of your money, so it doesn’t control you. And it all starts with knowing your household budget percentages.

If you aren’t a fan of math and percentages, you soon will be. In fact, I’d go as far as to say that knowing your household budget percentages is empowering and it’s addictive.

Once you know the balance of your income and spending, you can start to shape how you balance your budget. You can move from debt to wealth, and suddenly, you will find yourself in a position where you can leverage that wealth to do important things.

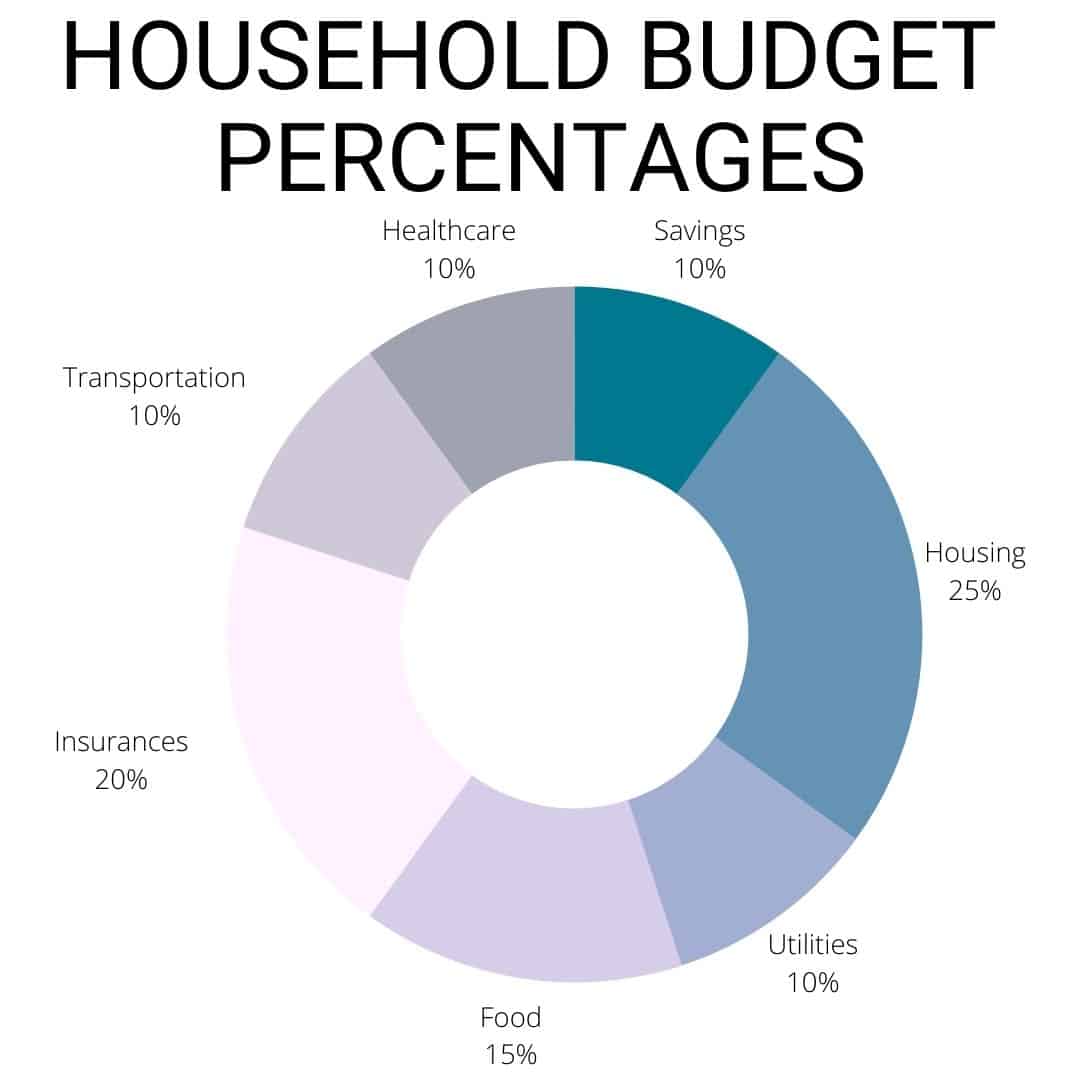

Knowing your household budget percentages is an essential part of creating your budget. These are the amount per hundred dollars you spend on things like utility bills and food.

It not only helps you break up your expenses into manageable segments, but it also tells you where you are overspending and need to cut costs. These percentages are an excellent starting point if you are just starting to get a grip on your finances.

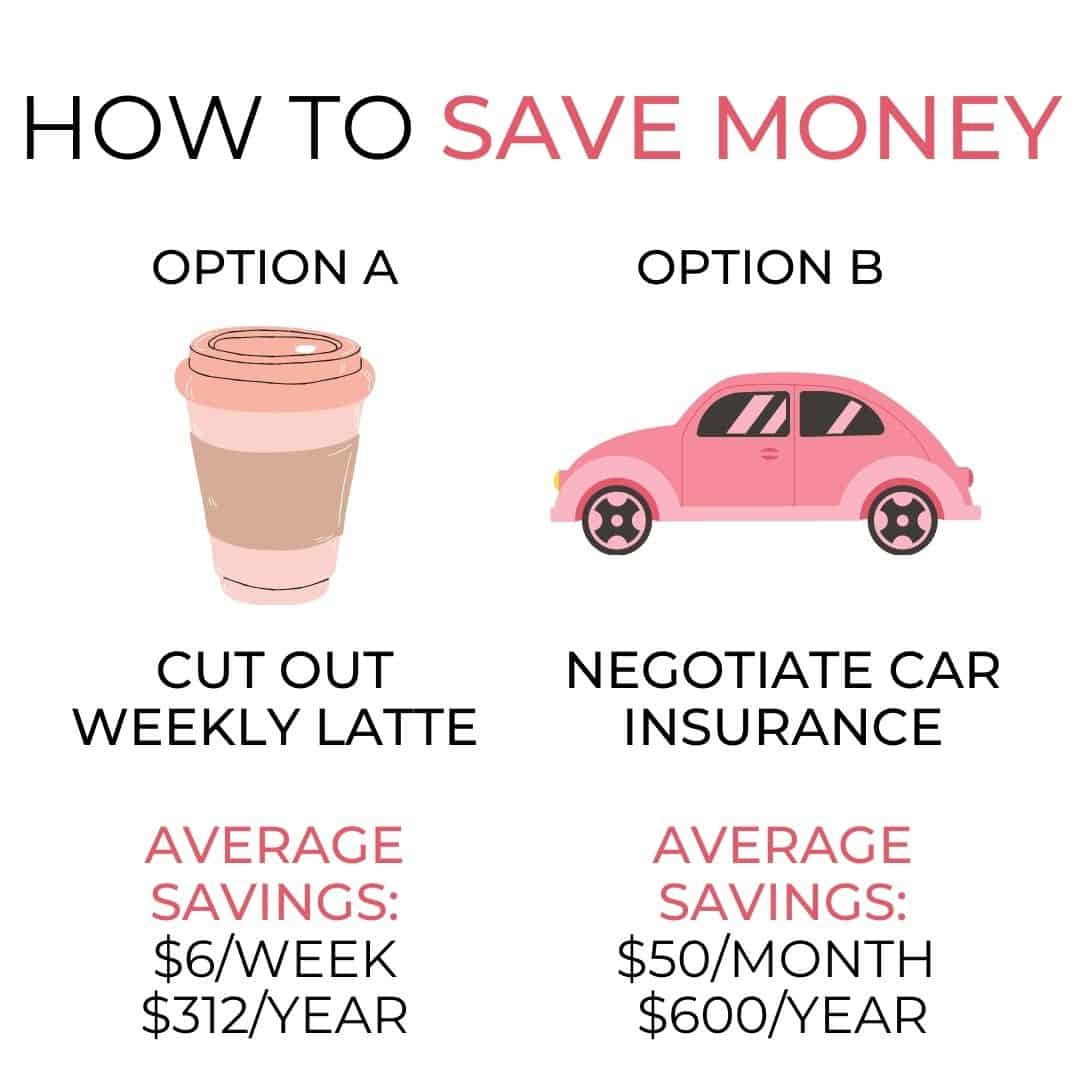

As you gain confidence, you can make more room in your budget by cutting the amount you need for expenses like insurance.

The Ideal Household Budget Percentages

1. Pay yourself 10%.

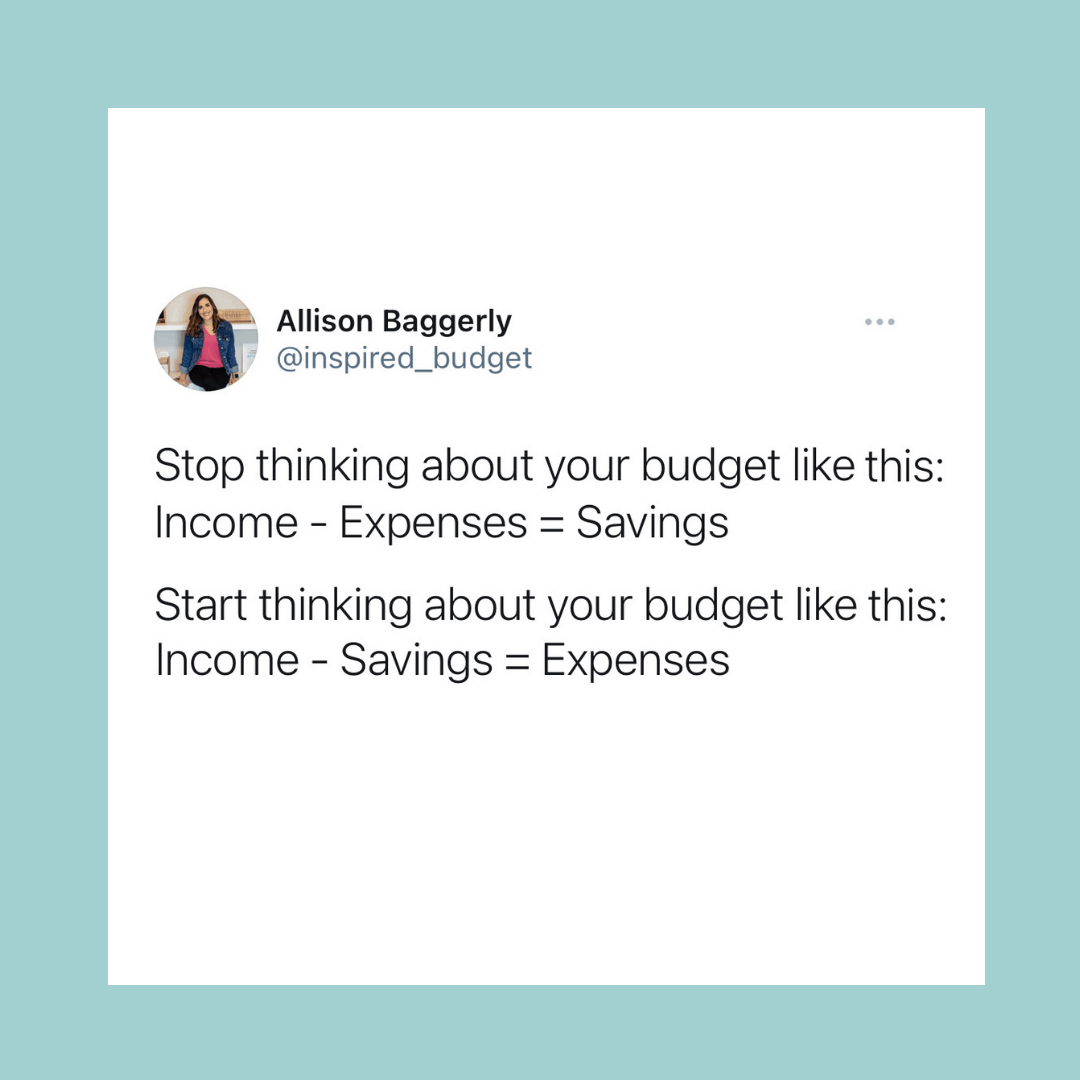

You come first. Why? Because if you wait until everything is paid, you won’t have anything for yourself. That’s just how it works.

Budget how much you want to bank each month and set that money aside right away so that you can’t lose it to other types of spending. It’s one thing to have a budget, and it’s another thing to stay within that budget.

It’s always possible to go over budget. One way to guard against that is to make sure your money goes to the right place, especially for categories like saving that is easy to get pushed aside.

When it comes to saving money vs. investing money with your 10%, consider when you want to be able to use those funds. If you want to use your money within 5 years, save it in the bank. If you want to let it go longer than that, then invest it to help you build wealth.

2. 25% to keep a roof over your head.

The largest household budget percentages are not always the most important ones, but this one certainly is. Housing accounts for 1/4 of your total household budget.

It’s a major life decision whether you rent or own and how much (if any) real estate you purchase. There is the primal necessity to have shelter, but there are different ways of doing that.

Percentages help you figure out where your sweet spot is on that spectrum because you can make an informed decision on housing based on your income.

According to many finance gurus, many budget categories have room to budge, but housing costs are not one of them. You should allot the right portion of your income to a housing cost that is sustainable and reliable for you.

If you are having trouble with your budget, it could be any number of things. But, paying too much for housing may be one of them. Some people’s households find a dramatic improvement in their finances overall when they meet this household budget percentage.

3. 10% to keep the lights on.

Here’s another thing you’ve probably heard a lot in terms of necessity over frivolity. There are all kinds of ways to spend money, but one thing you will always need to do is, “keep the lights on.”

Of course, the electric company doesn’t get all of that green. This category covers all utilities. Be sure to include gas, water, garbage, etc., in this part of the budget.

It’s possible your utility bills are high. It’s funny how the most important things on your household budget are often the things that need the most tweaking.

Believe it or not, 10% is a relatively high number for utility costs. You might be able to cut it in half. There are lots of tips and tricks for how to save money by conserving water and electricity alone.

4. 15% to put food on the table.

When it comes to your monthly budget, this one simply cannot be skipped. You’ve got to put food on the table.

But for many, UberEats takes about 40% of their monthly household budget!

Okay, I can’t back that claim, but if you’ve ever paid $20 in service fees for a McDonalds’ cheeseburger, you can easily appreciate how fast your food budget can go.

Food is essential to life, and it can be very inexpensive as long as you emphasize keeping your food costs down. That means doing some sort of meal planning and using what you have. Resist spending all your money on take-out and delivery indulgences, because that’s what they are.

You can keep your grocery costs low just by buying the right food and making sure there is no waste. You can also save money at the grocery store using money-back apps, coupons, and store reward programs.

In addition to food, you can include regular household items such as cleaning supplies and other hardware you would find at any grocery store. Larger funds for repairs and home maintenance should fall under protecting assets.

5. 20% to protect your assets.

Insurance (not counting health) can account for up to 25% of your household budget. That’s a lot. You don’t want your insurance costs to match your housing costs, but it is important to protect what you own and protect yourself against liability.

Thankfully, insurance is one of the easiest areas to maintain your budget by reducing your insurance costs on a regular basis. There are two important things to consider with insurance as an overall expense that you need to pay:

Are you over or underinsured?

If you are underinsured, you need to look at that. It won’t help your budget, but it will improve your level of protection.

However, you may be overinsured. That’s great. Well, not totally great. It means you’re spending too much. But it also means that is an easy budget cut you can make if you are struggling with your bills.

Find out if you are overinsured by looking at your coverage. You may need to meet with your insurance agent to discuss what your true insurance needs are. If the thought of doing that makes you cringe, then it’s time to find a new agent. No joke.

Are you overpaying?

Here are other reasons you may be overpaying. Insurance companies regularly increase costs for a variety of reasons.

You may have switched companies for a reduced premium, but that turned out to be an introductory cost. Whatever the reason, another agent may be offering a lower rate for the same level of protection.

While cost is not the only thing you should look at when trusting a company to protect you, reduced bills on an apples-to-apples policy is a good reason to switch companies. This is one cost my family looks at every year or two!

6. 10% on healthcare.

Like it or not, we live in a world where medical costs are not subject to free-market competition. Have you seen how much some hospitals charge for a tissue box? Oh, I’m sorry – “mucus recovery system.”

With that in mind and all of the pros and cons of wellness visits, it’s hard to know what you need to spend, what you shouldn’t spend, and what would be smart to spend as a preventative measure. Health insurance takes a huge piece of the pie, but your overall healthcare costs should be only a tenth.

There are a lot of ways to manage this part of your household budget. One is by seeing what you qualify for in terms of Medicaid. Another is to get lower insurance premiums by opening a Health Savings Account.

Medical bills are no joke, and they can land you in a lot of debt, so it’s important to use your resources wisely. If you are really good at managing your money, you can even cut your health expenses by half.

Remember, living a healthy lifestyle can have a financial benefit as well as a health benefit. Your health habits can impact what you pay in healthcare down the road.

7. 10% on transportation.

Depending on where you live and what your lifestyle is, transportation can be important to your livelihood. Or, just a general necessity.

Don’t spend too much on a vehicle though. If you just need something that will “get you there,” vehicles depreciate almost instantly, so a car purchase should never be considered an investment.

Don’t borrow too much to buy a car and make sure you are paying a fair price for the car you buy. Buy used cars that run well. You don’t want to be paying for repairs constantly, but you also don’t want to pay for more car than you need, or “upgrading” to the newest model.

8. Charitable Giving

If you’re counting along, you probably noticed that we’ve reached 100%. But what about charitable giving? Well, giving is important – I agree.

You have to find the money in your budget to give. If it’s not there, it’s not something to stress over. However, it is something to work toward.

Just about every category in your household budget has wiggle room. If you steward your money well, you will have 10% that you can give. Why isn’t giving a top priority like paying yourself? It is. In fact, most of us do it automatically when we pay our taxes.

If you have wealth, then you should definitely give according to your conscience. But if you don’t, then it’s important to prioritize your household budget and find those areas where you can improve how and where your money is spent.

Have Too Much Money?

These household budget percentages don’t give a lot of wiggle room for discretionary spending. Instead, they are designed to give you the best margins for the most important things.

The percentages leave room for you to fine-tune your budget over time and make space for discretionary spending like entertainment, recreation, and other luxuries.

As you start learning how to write a budget that works for you, you might consider additional categories for the personal costs such as beauty, entertainment, and spending money.

With a little practice, your budget percentages will feel like second nature – give it a try and see what I mean!