*This post is sponsored by Digit. All opinions are 100% my own.

Several years ago, I accidentally forgot to pay my car payment. Before I realized I missed my payment, I checked my bank account balance and gave myself a pat on the back for doing so well with my money that month. Sitting in my bank account was an extra $300. I immediately started daydreaming of what I would do with all my extra cash.

It wasn’t until the late notice arrived in my mail that I realized why I had so much money left in my checking account. It’s not that I had reigned in my spending that month…it’s that I completely forgot to make my car payment!

If you’ve ever been late on a bill, then you know the headache that comes with paying a late fee. Or maybe you don’t enjoy budgeting, and you’d rather just have someone tell you how much money you can spend. Imagine having a system in place to automatically pay your bills for you each month. What if you didn’t even have to think twice about setting aside money in savings for any emergencies, that Caribbean vacation you’ve been dreaming about, or the new car you can’t wait to get?

Thankfully, Digit announced today the introduction of Direct by MetaBank® – a bank account that budgets for you – to make all of this possible for you! Digit takes the work off of you so you can focus on the more enjoyable things in life.

But what is Direct? And how does it work? In this article I’ll be sharing my honest opinion of the new version of Digit with a bank account powered by MetaBank®, who it’s for, and its benefits.

What is Digit?

Before we dive into Digit Direct by MetaBank®, let me introduce you to Digit – it was the first intelligent automated savings tool that helps consumers save and achieve their financial goals. Essentially, they make saving money automatic!

Digit helps its users consistently save and pay down debt. The app analyzes a user’s income and expenses daily, saves what they can afford, and directs the right amount of money toward a user’s goals. Digit currently has over 246,000 5-star reviews making it a favorite tool to help people reach their money goals.

With the introduction of Direct – a bank account that budgets for you – Digit has become the first AI based, personalized, and automatic money management tool that simplifies how you budget, save money, and pay bills. Digit makes managing money easy for all. The best part? It’s simple to understand. Get on the waitlist now so you can get a chance to try it early!

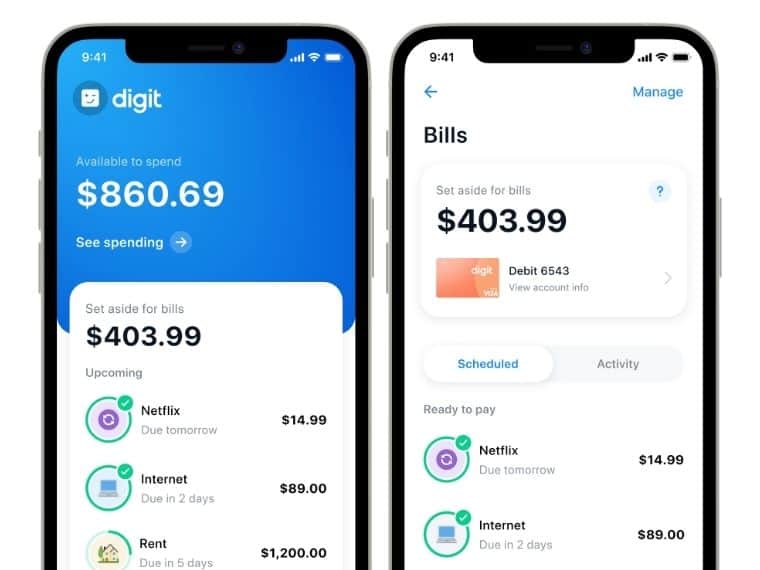

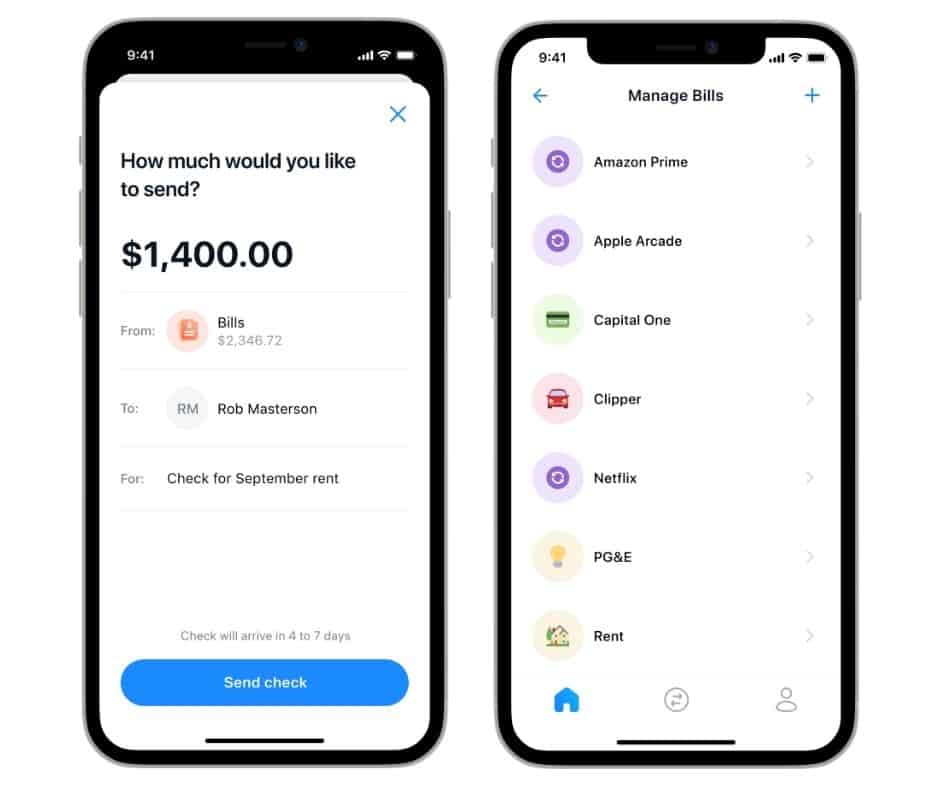

The new version of Digit separates your money into three buckets: saving, spending, and bills. Let’s take a look at each of them below.

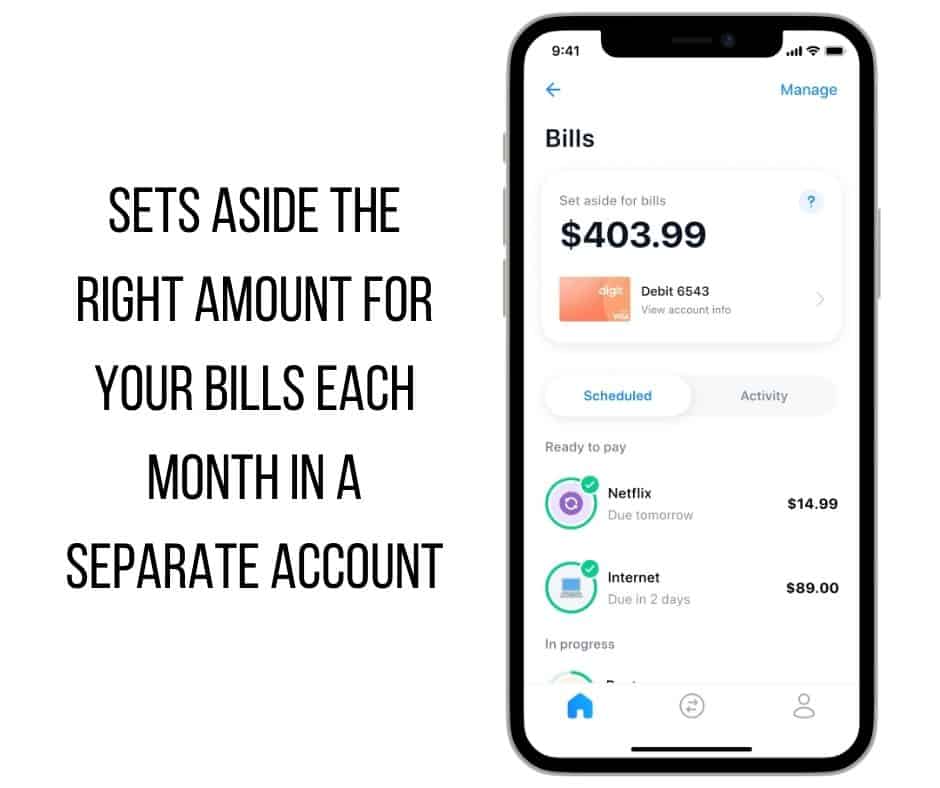

Bills

Direct will hold onto all the money to cover your upcoming bills. This ensures that you’ll never miss another due date again! The app will automatically determine how much money you need to cover your bills by analyzing your past bills. Direct comes with a separate virtual debit card to pay bills directly from within the app.

This is the account I needed years ago when I was late on my car payment! Digit makes bill paying and managing your expenses effortless.

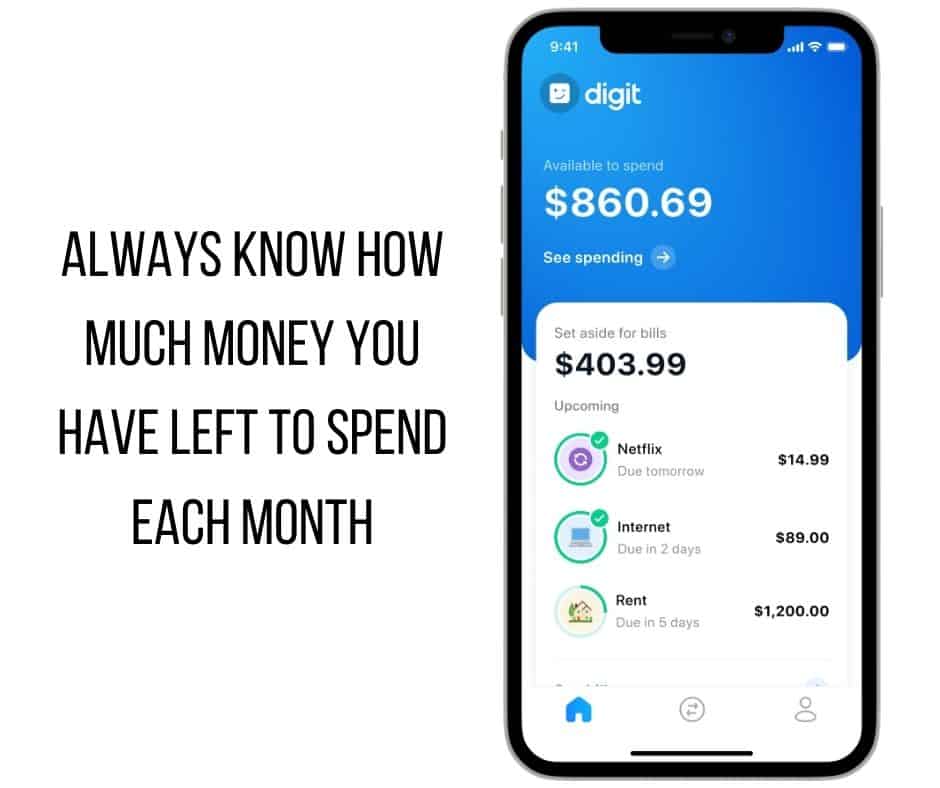

Spending

The spending allocation contains your spending money for variable expenses such as groceries, restaurants, gas, etc. and comes with its own physical debit card making it easy to spend money while you’re out and about. Digit will move money to this account based on your past spending habits. Now you’ll never have to wonder how much money you can spend on your variable expenses!

The best part is that you will always know exactly how much money you have to spend on everything else in life. This makes balancing bills and spending easy for everyone.

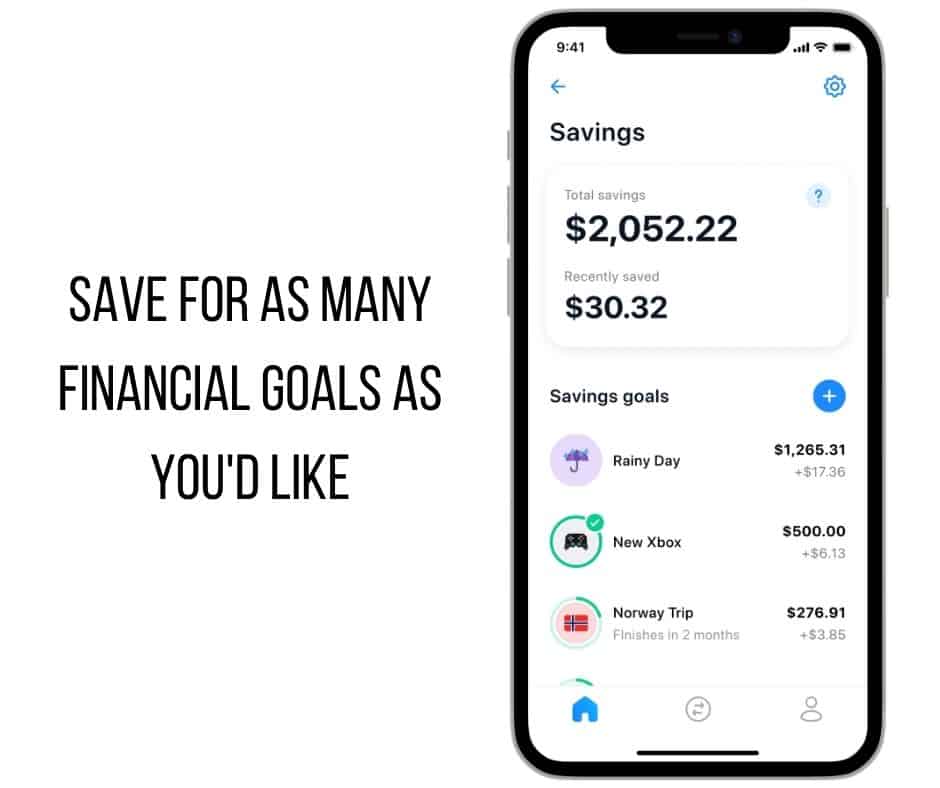

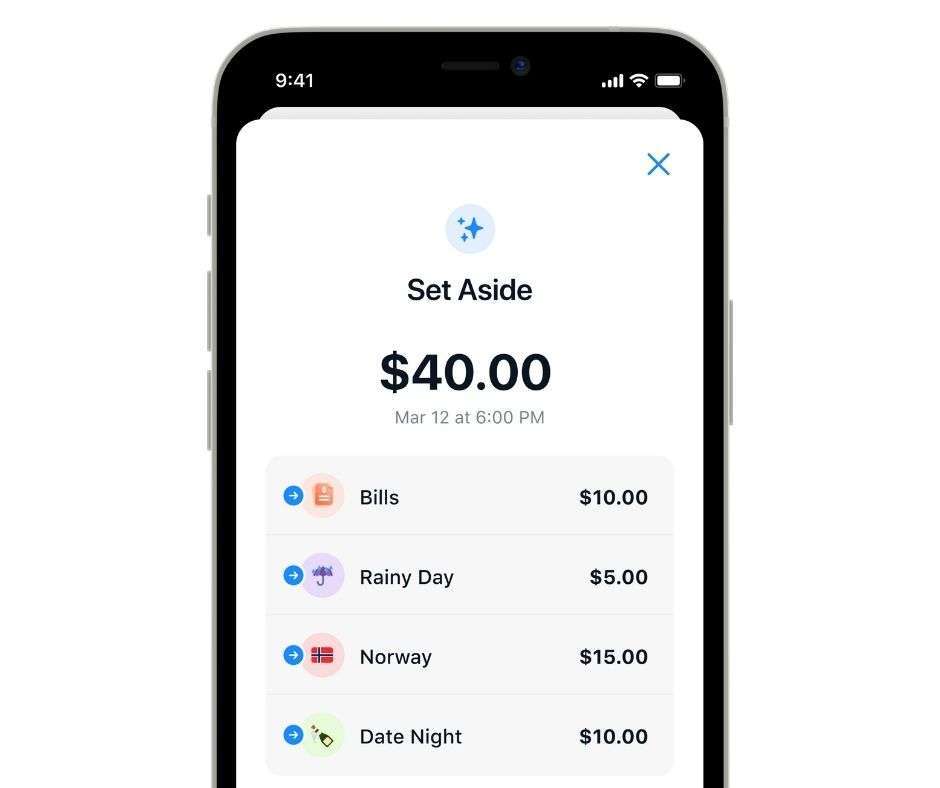

Savings

Your Digit savings allocation allows you to not only save for a rainy day fund, but other financial goals as well. Simply set up custom savings goals to fit your needs. You’ll also have access to saving for retirement or a long-term investment account.

Digit makes saving money for your future vacation, new car, or home down payment easy.

Who is Digit Direct by MetaBank® for?

You might be wondering if this is for you! I believe that this comprehensive, intelligent banking solution can help many people, specifically people who…

- want less stress in their life. If managing money feels stressful, then Digit helps create systems to make managing your money, paying bills, and understanding your budget simple.

- want to make saving money easy. If you have big money goals and want to make saving money effortless, then Digit is for you.

- never want to miss another due date. Keeping up with bills and their due dates can be complicated. But Digit has you covered! The app already knows when your bills are due and how much they will be. They make paying bills painless.

Ready for Digit and make managing your money easier? Sign up for their waitlist and be one of the first to get access!

Benefits of Digit Direct by MetaBank®

Life is complicated. And to be honest, finances can sometimes make life even more complicated. There have been times in my life that I needed support when it came to organizing my money and finances. Thankfully, my mom stepped in as someone to help me learn about managing my money better.

But what if you don’t have someone to step in and help you get organized? What if you aren’t quite sure how much money you can spend on expenses such as food, clothing, and fun? Thankfully, Digit uses artificial intelligence to answer this question for you!

Below are 3 benefits of using Digit:

1) Easily pay bills and save money.

No more wondering if you have enough money to cover your bills. No more calculating if you can pay your bills AND save for your upcoming weekend getaway. The new version of Digit separates your money so you don’t have to wonder if you can meet your goals.

Essentially, this intelligent bank account allows you to easily save money and pay your bills without the stress of wondering if you’ll have to face late fees due to paying a bill late.

2) Always know how much money you can spend.

I used to be scared to spend money on myself because I had no earthly idea if I had enough money in my bank account to cover my bills and pay for brunch. This led to financial anxiety because I was completely unaware of what was going on with my money.

Direct takes away anxiety because it separates your money into its own separate spending account. This allows you to know just how much money you can spend at the grocery store and other areas at a quick glance. No more mental math needed to see if you have enough money left after all your bills are clear!

3) Allows you to spend less time managing your money.

Writing a budget and managing money takes time. It’s likely you’re spending many hours each year doing the math to figure out how much you’re paying in bills, how much you’ll need to set aside for vacation, and balancing your checking account.

Digit takes many tasks off your plate when it comes to your money so that you can spend more time doing what you love.

More about the New Version of Digit

Currently, Digit has a 30-day free trial period. After your free trial, the new version of the app will cost $9.99/month or $95/year. Sign up on the waitlist here to get early access before it opens to the public in the Fall.

Direct is powered by MetaBank® which is an FDIC Insured bank. Essentially, this is a bank backed by the government to ensure that your money is safe.

Be the first to try Direct by MetaBank®

With the introduction of Direct, Digit is making changes in the way we handle our money…amazing changes, if you ask me! They are making bill paying, spending, and saving money effortless and approachable for everyone.

Want to be one of the first to try the new Digit experience with Direct? If so, be sure to sign up for their waitlist so you can join before they launch to the public in the Fall!