Here’s the truth. Wherever any of us are on our debt-free journey, we all face discouragement, reluctance, or flat-out caving when it comes to following through with our commitments and meeting our goals. That’s why debt payoff motivation is so important!

Crazy as it may sound, it’s not a question of if we’ll need motivation but when. Even the best intentions and a can-do spirit can often give way to despair if we aren’t mindful about our own approach to getting rid of debt once and for all!

You may be so on fire about getting out of debt that you can’t imagine needing any more motivation than that. But, that enthusiasm can flicker over time in the long term. In order to keep that enthusiasm going, I have some tips and tricks to keep that fire burning for months (or years) to come.

Tips For Keeping Up Your Debt Payoff Motivation

Whether you are on a debt-tackling high or struggling to keep your spirits up along the journey, the following easy pointers and reminders will encourage you to stay the course to eliminate crippling debt.

1. Keep your progress visual.

Nothing motivates like progress, and it’s especially true for debt payoff motivation.

As debt shrinks, the stress lifts! Progress helps to build momentum and keeps your eyes on the prize. Both of these things are excellent motivators.

The best way to keep your progress in focus and allow it to drive you farther on your debt-free journey is to make it visual. Any graphic representation will do, but you may have your own specific preferences or twists on how to illustrate your progress.

Charts and graphs are just one approach. You can use percentages to add more completion to an image, such as one you keep in a bullet journal, an app, or even a corkboard/poster in your room.

The important thing about this is that a) you can see it, and b) it illustrates positive movement.

It’s nice to have a dream board and visualize the end result, but it’s more important to celebrate the everyday small steps that you take along the way!

If you like to visualize the end and you have a clear image of what being debt-free would be like, use that. Make that image literal. Print it out. Cut it up to pieces and make it into a puzzle. It can be a 20 piece puzzle or 100.

The important thing is that each piece of the puzzle represents a block of progress that you have made, so when you reach your goal, you also complete the picture and have simultaneously fully realized your dream!

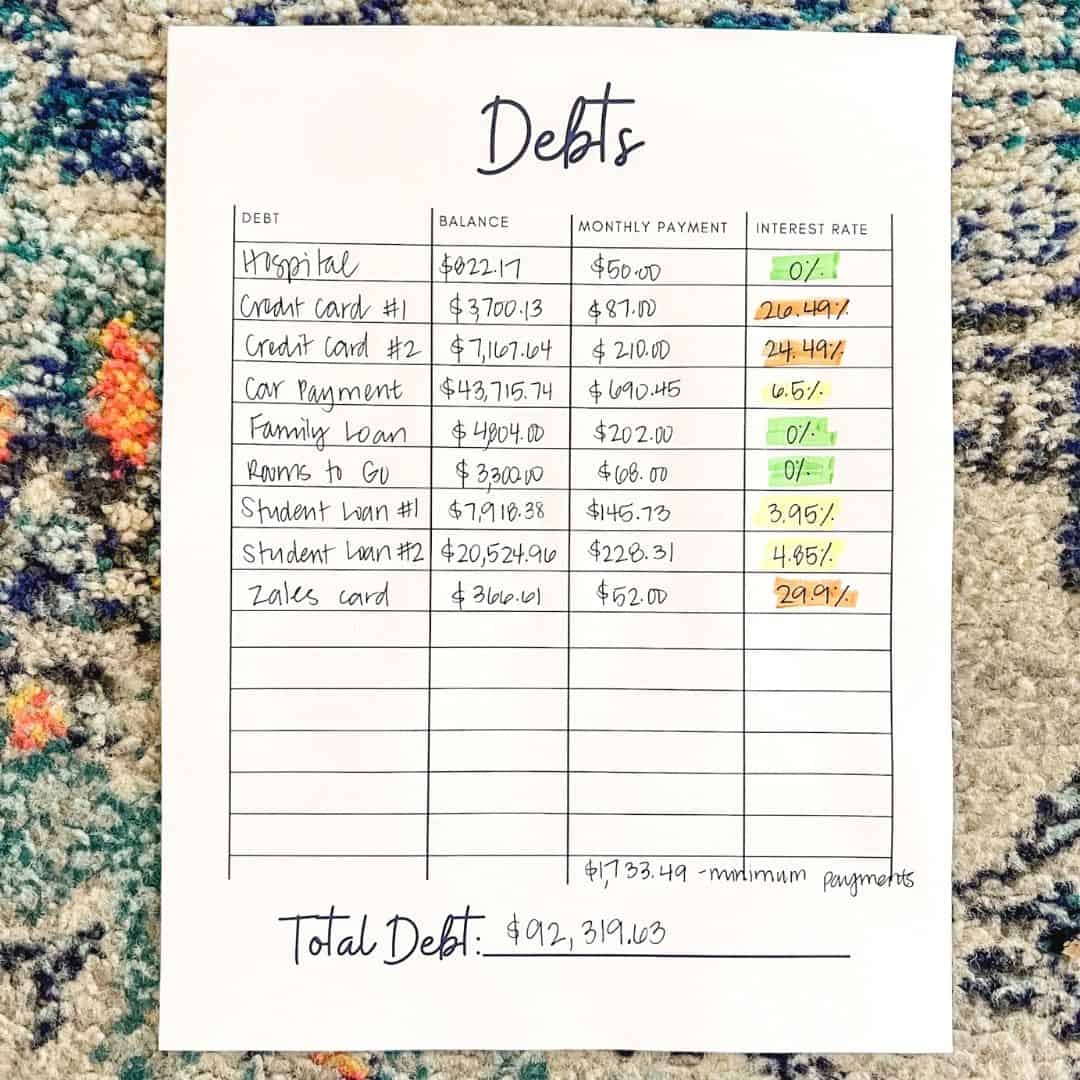

2. Stay updated on your numbers.

Let’s face it. Some of us are numbers people, and some of us aren’t. But, unfortunately, in order to make your dream of being debt-free a reality, you have to be a little bit of a numbers person.

The good news is that that doesn’t necessarily require you to be good at math (woo hoo!). It does mean that you may have to train yourself to look at numbers more often, however.

The trade-off is worth it. By doing this, though, you will unlock a level of debt payoff motivation that avoiding numbers simply cannot help you with.

When you boil it all down, debt is an equation, and equations are solved with numbers. The way you succeed on your debt-free journey is by changing those numbers in meaningful ways.

Change what you make. Change what you pay for this or that. Reduce costs, eliminate costs. It all has the potential to be really exciting when you see how your equation starts to result in a $0 balance (or more!) at the end.

Staying on top of your numbers might sound tedious at first, but it can become an addiction that will keep you motivated to keep moving toward your goal of a debt-free life.

3. Make every step count.

Mapping progress and visually seeing improvement are so essential to motivation that it can’t be understated.

The times you need the most debt payoff motivation are the times when you feel you’ve slipped and have lost progress. However, that just shows how important progress is in your overall mood and attitude.

So although you do need a pick-me-up when you are down, it’s also important to keep up your momentum by making calculated moves to continue gaining an edge over your debt. This can entail a variety of approaches. See what works best for you and be sure to celebrate the small things. If you opt to cook dinner and save $20 to put towards your debt, it’s a big deal!

4. Appeal to your own perceptions for debt payoff motivation.

There are different approaches to paying off debt that have either a psychological benefit to them or a time benefit. It essentially boils down to whether you focus on tackling your interest payments or your balances.

The snowball method is popular because it allows you to start small, gain an early victory, and roll that small effort over into tackling larger and larger debt. It requires commitment but not too much sacrifice. While it is a proven method, it does take time. While the level of sacrifice is less than an approach that first tackles high-interest debt, it can feel more drawn out.

I’m a big fan of the debt snowball – read more about it here!

Some people get their debt payoff motivation by first kicking out a major debt before tackling less serious ones. The answer is different for everybody, so you have to listen to your own perspective and do what makes the most sense to you.

5. Make more aggressive moves.

If you are the type to tackle higher interest debt first, you may be a fan of making bold, aggressive moves. The slow and steady approach will get you where you want to go incrementally, but sometimes a big, dramatic move is just the action you need to stay motivated.

There is a rush you get when you transfer a large sum of money to knock out a debilitating interest rate. Or when you take on another income source to pay down debt faster. Freezing your spending accounts, canceling subscriptions, negotiating with creditors can each make a big impact on your bottom line.

Large chunks of debt get demolished, making the end feel closer and more attainable. That, in turn, creates more debt payoff motivation.

6. Stay on your feet.

Let’s not lose sight of the fact that we are human. As important as it is to optimize our budget, we should remember that we all falter at some point. Losing traction, or losing an edge, is not losing the war. It’s at times when we find ourselves slipping that we need to stay the course and not lose hope.

Overemphasizing mistakes or being overly critical has a backwards effect. It can lead to a loss of motivation if you slip up and spend too much or use your money less effectively than you could have. The irony here is that if you submit to that sense of defeat, you will continue to backslide and take yourself farther from your goal.

At times like this, you can find your debt payoff motivation in looking at how far you have already come on your debt-free journey. The two best motivators are looking ahead at where you want to be and looking back at where you don’t want to be.

Let that fear of backsliding chase you forward when you feel discouraged! You’ve got this.

7. Create incentives for debt payoff motivation.

A very easy way to continually encourage yourself while you climb out of debt is to include little incentives for reaching benchmark goals on the way to eliminating debt. A small reward here and there is excellent debt payoff motivation as long as it doesn’t hurt your own progress too much.

You can indulge yourself in some way that is either free or the cost is built into your budget plan. When you work your numbers, give yourself some room to splurge a little bit when a goal has been met.

Not only will this motivate you to reach that next benchmark, but it will also allow you to let off some steam in a way that is planned.

This way, there’s not a negative effect on your progress that could send you spiraling into hopeless despair. Instead, it gives you a chance to breathe for a moment, bask in your accomplishment, and then get right back to work on reaching your next target.

8. Grow a savings balance while you pay down debt.

Sometimes it can feel helpless or useless to throw all of your money into paying off debt. Especially if that debt doesn’t seem to move enough right away. It feels like throwing money into a bottomless hole.

But, on the other hand, you don’t want to make that hole worse by continuing to spend money you don’t have, thereby generating even more interest.

One rule I love to use is the pay yourself first model.

If you can find it in your budget to set a little bit of money aside each month, it can provide huge debt payoff motivation! Paying yourself does not mean treating yourself, though. That money should be invested, first in a savings account and later in a retirement account or other higher interest investment.

Growing a balance of saved income while paying off debt is exciting because you can see it accrue over time, and once you are debt-free, that savings account balance will still be there bigger than ever, to start everything over with.

Watching your savings account get bigger each month even while you pay down debt helps to relieve that sense of hopelessness and ensures that you have enough money for emergency expenses without having to fall further behind on debt.

9. Stay motivated with inspiring quotes.

When all else fails, I like to turn to a good inspiring quote. I write them on sticky notes on my mirror, put them in my notepad on my iPhone, and doodle with them on the side of my budget notebook. It really does help reignite my motivation!

Here’s a list of 101 inspiring quotes to get you started. I believe in you – you’ve got this!