If you’ve ever felt lost, confused, or completely disorganized with your finances, then I feel you! It wasn’t until I set up a budget binder that I finally felt like I had everything in one place when it came to one of the most important parts of my life: my finances.

In fact, using a budget binder helped my husband and I pay off over $111,000 of debt while living on 2 teacher salaries! We never missed a due date because our budget binder helped us stay organized.

If you’re struggling with paying off debt or getting back on track with your money, then you NEED a budget binder! It is hands down the easiest way to organize your finances and get your money under control. Plus it’s the best way to stay motivated and on track when it comes to reaching your money goals!

What Is A Budget Binder Or Financial Binder?

A budget binder is exactly what it sounds like…a binder for your budget. But what makes a budget binder even better is when it holds all of your other essential financial information.

A budget binder should contain everything that you would need to grab in case of a fire. Or if something happened to you, it would contain everything so that your spouse, partner, or friend could take over the finances. It’s basically the hardest working binder in your house!

3 Benefits Of A Budget Binder

If you’re not a type-A person, then the idea of making a budget binder might seem daunting or even unnecessary. But I promise you that creating your very own budget binder will benefit you in so many ways!

1. You won’t ever miss a due date.

Have you ever missed a bill’s due date because you couldn’t find the bill? Maybe it was stacked high in a pile on the counter and it was left forgotten. I know I’m guilty of this!

When you don’t have everything in one place, it’s easy to let things go and miss due dates. Too often bills and incredibly important papers pile up over time. Then, the high pile is simply too overwhelming to deal with.

Creating a budget binder will help you never be late on a bill again. You’ll have everything in one place and your due dates will be listed on a calendar. Think of it as your very own personal finance assistant!

2. A budget binder will save you time.

Although setting up your budget binder will take time and intention, you’ll ultimately save HOURS every week when you have a budget binder.

You’ll no longer waste time sifting through papers or hunting down important documents. You won’t have to log into accounts to double check that a bill is on auto-draft. And when all your important financial documents are in one place, budgeting will be faster (and easier) than ever.

Your time is one of the only things in life that you can’t get back. And creating a budget binder will help you spend less time on your finances and more time with your family.

3. You and your partner will be on the same page.

It’s no secret that money and finances can be stressful. Throw in a spouse or partner and it can lead to even more stress! A budget binder helps you and your significant other get on the same page with your budget and money. It will give you the opportunity to communicate about your money because everything is laid out right in front of both of you.

A budget binder can help you dream about the big goals you want to take. It can help you communicate better about money. And ultimately, it can lead to less stress in your finances and in your marriage.

How To Make A Budget Binder

Creating a your binder doesn’t have to be difficult. In fact, it can even be fun! You’ll want to grab these supplies to get started:

Be sure to look around your house before you go shopping for any of these items! You might be surprised to find that you have most of these on hand at home.

Once you have your supplies, it’s time to print out your budget binder pages. You can either print just a month at a time or the entire year! Place all of the yearly budget binder pages in the front of the dividers and place the monthly pages behind each month.

What Should Be Included In A Budget Binder

When it comes to your budget binder, it’s best to go through each page of the budget binder printables and decide which pages fit your needs. You can even print the entire document and simply recycle the papers that don’t fit your life.

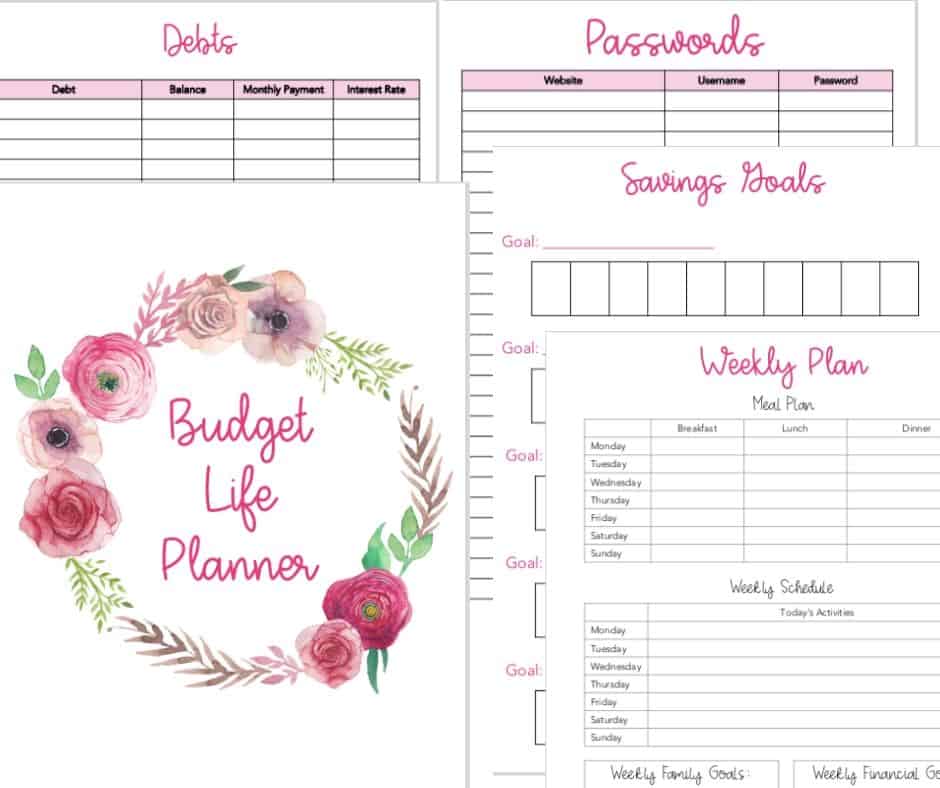

Below are the printables that are included in the Budget Life Planner – these are exactly what you need to get started with your own budget binder. I also have two other versions you might like to check out as well! (Find the ultimate version here and modern version here.)

Cover Page

A pretty cover page not only makes your budget binder beautiful but might even make you want to use it! You can choose to create your own cover page or use the one included in the budget binder printables.

Passwords List

You can keep a list of your passwords inside your binder. If you’d rather not keep these passwords written out, then download an app like LastPass to keep your passwords safe and written down.

Debt Tracker

Keep track of all your debts, their balances, interest rates, and minimum payments. If you’re working toward paying off debt, then list your debts in the order that you’d like to pay them. After you pay off each debt, highlight it so you know it’s GONE. Then, celebrate a little!

Savings Goals Tracker

Stay on track with your savings goals with an easy to use tracker. No matter if you’re saving for Christmas, a vacation, or even a new car a savings goals tracker can help keep you motivated!

Yearly Expense Tracker

A yearly expense tracker is a single sheet of paper where you can track all your major expenses in one place. Simply check off after you’ve paid an expense each month. This year at a glance page is helpful for never missing another due date on your bills!

Weekly Plan Page

Who said that a budget binder was limited to budget pages? This weekly plan page is perfect for anyone who wants to keep their week and life organized. It includes a spot for your meal plan, weekly activities, family goals, and even financial goals. Hang it on the fridge so everyone in the family knows what’s coming up this week!

Monthly Goals Pages

It’s just as important to set small monthly goals as it is to set big yearly goals. These small monthly goals should support your 1-year, 5-year, and 10-year goals. By writing out your monthly goals, you’ll be more focused on reaching those big dreams!

Monthly Bill Payment Calendar

A monthly bill payment calendar is the best way to organize your bills visually. It allows you to see exactly when your bills are due and which paycheck will cover each and every bill. You’ll want to print out this page every month so that you can highlight and organize your bills.

Budget Page

This might be the most important aspect of your budget binder! Print out as many budget pages as you need each month. When you learn how to budget, you’ll be able to save more money than you ever imagined so that you can spend it on what’s important to you.

Monthly Bill Payment Log

A monthly bill payment log allows you to keep track of each bill and its confirmation number. You can also use this page to look back at past bills and how much you spent on variable expenses such as electricity, water, and gas.

Monthly Meal Plan

Not only can a budget binder help you keep track of your money and stop living paycheck to paycheck, but it can help you get organized in the kitchen too! Print off the monthly meal planner page every month and write a meal plan to help you save money.

Why Are Printable Budget Binders Better?

I’m a firm believer that a printable budget binder is better than a physical book or binder you can buy online or in store.

Printable budget binders are better for a few reasons:

- They leave room for error. Your budget isn’t going to be perfect. You might end up throwing away your budget page and starting over from scratch. A printable budget binder allows you to print your pages as many times as you’d like!

- You only have to buy it once. When it comes to a physical book, you’ll have to buy a new budget binder every year! When you buy a printable budget binder, you can print it as many times as you’d like.

- It saves you money! Once you buy your downloadable and printable budget template pages, all you have to do is provide the paper and ink to print! You’ll save a ton of money over time with a product you can download.

What To Do With Your Budget Papers At The End Of The Year

The year is over, now what? You have all these pages and important financial information but what should do with it?

I personally remove all the important papers and clip them together. I store them in a small plastic file box for 5 years and then shred them after 5 years. By keeping your financial documents, you’ll have easy access to them in case you need them in the future!

Where Can I Get A Copy Of A Budget Binder?

Click here to grab a copy of your Budget Binder! Feel free to also check out my other two versions that have a similar set-up! (Find the ultimate version here and modern version here.) These budget binders have everything you need to get yourself organized with your finances.I recommend setting aside an hour or two to put your budget binder together. Pour yourself your favorite drink and turn on your favorite song! Working on your budget and finances can be fun!