After more than 8 years of living on a budget, our family has had a ton of experience when it comes to developing better money habits. During that time, we’ve discovered (and tested) a ton of budget and money hacks that helped us stop living paycheck to paycheck. After lots of trial and error, we were able to finally pay off debt and make saving money a priority.

Although we don’t always stick to our budget (we are still human!), we’ve learned how to get back on track before the month ends.

If you’re ready to live on a budget so that you can reach your money goals, then check out these 30 budget and money hacks. They will help you take back control of your finances so that you can reach your money goals and live the life you’ve always dreamed of!

1. Order your groceries online.

If you struggle when it comes to impulse shopping in the grocery store, then consider ordering your groceries online. The great thing about ordering your groceries online is that you will know how much you’re spending before you actually check out. That way, if you go over your grocery budget you can always remove something from your cart. You can also filter by price from lowest to highest which is always helpful!

I’ve personally known people who have cut their grocery budget back by hundreds of dollars every month by simply committing to order their groceries online. Plus, it saves you time and energy in the long run!

2. Always bring a list when you go to the store.

One of the easiest ways to go over budget when you’re at the grocery store is to walk up and down every single aisle without a plan. I’m personally guilty of going into a grocery store not knowing what I needed and walking out wondering what on earth happened. I ended up spending WAY TOO MUCH money because I didn’t have a plan in place.

To keep this from happening, always be sure you have a list with you when you go to the grocery store. Even better, only go down the aisles that you truly need to go down and skip the rest. Skipping the extra aisles will help you stick to your list and only grab what you need.

3. Make a meal plan so you aren’t tempted to go out to eat.

By far one of the biggest budget busters is food. Every month people overspend on food by hundreds of dollars. If you want to stick to your budget each month, then create a meal plan before the week begins. Be sure to cook simple meals that you’ll actually enjoy so you won’t want to run by and pick up food on your way home from work. Read all about how to write a meal plan here.

4. Keep your savings account separate so you aren’t tempted to touch it.

If you struggle with impulse shopping then chances are you might have dipped into your savings in the past to buy something you wanted. To keep this from happening again, keep your savings completely separate. Find an online savings account or keep your savings account completely separate from your checking account. Make it a little more difficult to take money out of savings. Your future self will thank you!

5. Use cash envelopes to help you control spending.

If you find yourself grabbing too many coffees or overspending every month, then consider using cash envelopes to help you take back control of your spending. Cash envelopes are the perfect way to learn how to live on a budget so that you can reach your financial goals. Not only will cash envelopes help you stick to your budget every single month, but you’ll be surprised by how much less you actually spent!

Ready to get started with cash envelopes? Click here to get my absolutely free guide on cash envelopes. You’ll even get printable cash envelopes sent directly to your inbox. This is one of the budget and money hacks that will help you stop living paycheck to paycheck!

6. Pay debt FIRST.

Trying to pay off debt? Instead of waiting to send extra money to debt at the end of the month, send it right away! I’ve personally learned over time that if you let extra money sit in your checking account, you are likely going to spend it on something you hadn’t planned for. Simply paying off debt right away will help you stay on track and reach your money goals quicker.

7. Have a budget check-in every week with your spouse or family.

To help keep you and your spouse (or your entire family) on the same page, commit to having a budget meeting each week. During these meetings, you can track your expenses, check-in on how you’re doing for the month, and discuss any weekly financial goals you might have. Who knows…you may even start to look forward to your weekly meetings. And I can almost promise you that you’ll experience better communication overall with your spouse.

8. Write a mini-budget when things go wrong.

This might be my all-time favorite money and budget hack! There will come a time in your life when you write a budget and something unexpected comes up. In that moment you’ll be tempted to throw the budget out the window and utter the word “I’ll start over next month.” Instead, commit to writing a mini-budget. A mini-budget is a smaller budget that will last you from now until your next payday. It will help get you back on track with your money so that you can still see success this month! Click here to read about how a mini-budget will help you stay on track with your finances.

9. Be prepared for unexpected expenses.

Life is full of surprises! There will come a time when your car breaks down, your pet needs to visit the vet, or you have an unexpected house repair. To help prepare for these types of expenses, set up sinking funds in your budget each month. A sinking fund is a savings account you set up for expenses that you know are going to occur eventually. Read more about how to get started with sinking funds HERE.

10. Agree to check-in with someone before you spend a large amount of money.

When my husband and I first started budgeting, we agreed that we would check in with each other before spending more than $30. This might sound a little silly, but it kept us from spending money impulsively on things that weren’t in our budget. Find someone you can check in with and hold you accountable for your spending. Just the idea of checking in with them will probably deter you from buying something in the first place.

11. Stay out of the stores that tempt you.

If you’re cutting sugar out of your diet, you’re not going to walk into a cupcake shop. So why would you walk into stores that might tempt you to spend money if you’re trying to live on a budget? Simply stay out of the stores that make you want to spend money. This will help you ultimately reach your money goals! I’ve personally had to detox from Target in the past and let me tell you…although it wasn’t easy, it was worth it!

12. Remove your credit card and debit card information from online store websites.

Online shopping has made it so easy and convenient to spend money these days. You can literally buy something with just a click of a button on Amazon. To help curb impulse spending, remove all of your debit card and credit card information from the websites and online stores where you like to shop. The extra step of grabbing your wallet and pulling out your debit card might just keep you from going through with the purchase altogether. This is one budget and money hack that will keep extra money in your checking account!

13. Let items sit in your cart for a few days when shopping online.

If you’re anything like me, then you’re guilty of buying things online without even thinking about it. Chances are you found a way to justify the purchase saying that you “needed it.” Next time you’re tempted to buy something online, let the item sit in your cart for at least 3 days. I’m guessing you won’t even want the item after 3 days. And if you do still want it, work it into your next budget!

14. Don’t get a cart when you go to the store.

Have you ever walked into a store, grabbed a shopping cart, and suddenly it’s filled to the top? I know I can’t be the only one! When you walk into stores like Target and HomeGoods do not get a cart. Let me repeat myself… Do not get a cart! Just don’t do it. Instead, carry everything you need. Make it uncomfortable for you to buy something else!

15. Make saving money automatic.

One of the easiest budget and money hacks is to set up automatic withdrawals for your savings. Instead of forcing yourself to save money every single month, have it done for you. You can have money directly withdrawn from your paycheck, or withdrawn the day after you get paid.

Over time you won’t even notice that the money is missing. This is perfect if you want to contribute more money to a Roth IRA or a separate savings account.

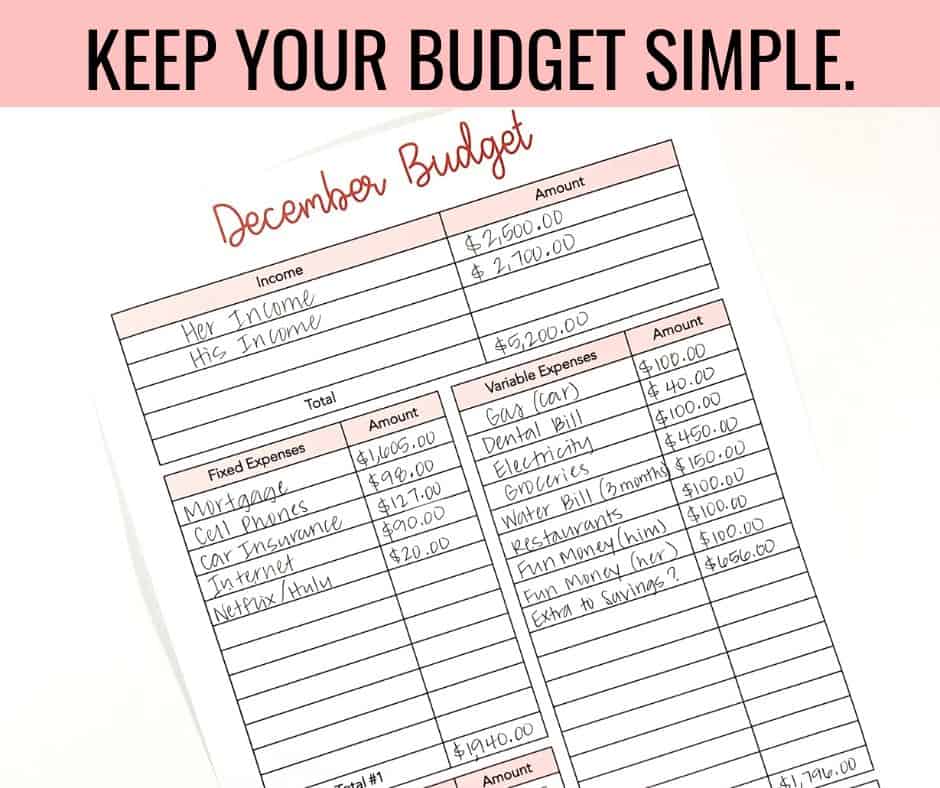

16. Keep your budget simple and live on less.

More and more people are jumping on the minimalist lifestyle. And to be honest, I can see why! You don’t have to go full-blown minimalism to reap the rewards of living a simpler life. Try keeping your budget simple and living on less. You’ll be surprised that you might even like it. Living on less will help you focus on the things that are more important in life (rather than all the stuff you’re buying).

17. Keep your finances organized with a budget binder.

Are you guilty of not paying a bill because it was stacked in a corner with the mail that you just hadn’t gotten to yet? I’m 100% guilty of doing this many years ago. To help make budgeting easy, set up a budget binder! Check out my Budget Life Planner here. It is a 100% digital product, so you can print it out as many times as you’d like!

18. Track your spending down to the penny.

You can’t take back control of your finances if you’re not aware of how much money you are spending each month. To help you truly know your spending habits inside and out, start tracking your expenses down to the penny. You might be surprised where you tend to go over budget and where you can cut back!

19. Set savings challenges for yourself.

Sometimes saving money just isn’t fun at all. To help make saving enjoyable, create a challenge for yourself! You can find tons of savings challenges online, or create one on your own! Get your friends and family involved to help hold you accountable along the way

20. Earn cash back when you shop online.

If you’re going to shop online you might as well earn money back while you do it! When you sign up for websites like Rakuten, you’ll earn money back on everyday purchases. So before you head to Amazon or any other online store sign up for Rakuten first. Click here to sign up now. Plus you’ll get $10 instantly added to your account when you make your first purchase!

21. Earn free gift cards by scanning receipts.

Fetch Rewards is one of the only apps out there that will allow you to earn gift cards by simply scanning receipts. This popular and growing app is hands down one of my favorites! You can redeem your points for gift cards to places like Amazon and Target. Sign up here and use the code KP5WK to get 2,000 points instantly added to your account.

22. Stick to water.

If you’re ready to cut back on your budget, then it’s time to cut out extra sodas, drinks, and alcohol. This is one of the easiest budget and money hacks that can save you a ton! Try it for just a month and see how much money you can save.

23. Track the progress you’re making.

If you’re a visual person, then it might be difficult to stay motivated when you’re just looking at numbers on a spreadsheet. Instead, track the progress you’re making in a visual way! You could color in a page to track how much money you’ve saved or use a thermometer to track debt pay off! The fun part is actually SEEING how much progress you’ve made over time. Grab your free savings tracker or debt free tracker when you sign up for my Budgeting Basics Email Course.

24. Follow people on social media that encourage you to save more and spend less.

Have you ever followed someone on social media and just looking at their pictures makes you want to spend money? You know…it’s that person who always shares what they’ve been buying or the trips they’ve taken. Their feed is practically a highlight reel. Well, I want you to do the opposite! Fill your Facebook or Instagram feed with people who are encouraging you to take back control of your money, pay off debt, and live on less.

25. Cut cable for good.

Have you noticed that cutting cable has become popular? With so many online streaming services, cutting cable is a no brainer! It will save you a ton of money over the course of a year. Whether you sign up for Netflix, Hulu, Disney Plus, (or all three!) you’ll still be spending less than you would on traditional cable. It’s time to cut the cable cord for good!

26. Limit subscriptions.

Have you noticed that more and more companies are moving toward the subscription model? I bet you are signed up for more subscriptions than you even realize! It’s time to print off your bank statement from last month and count up your subscriptions. Keep the ones that you’re actually using and ditch the rest. Remember, if you aren’t using it then you are wasting money.

27. Negotiate large purchases when you pay with cash.

Next time you’re making a large purchase in cash, break out those negotiating skills. Whether you’re buying furniture, appliances, or getting your car fixed, you can likely get a discount when you pay in cash upfront. It doesn’t hurt to ask so what are you waiting for?

28. Negotiate your medical bills.

Did you know that you can actually negotiate your medical bills for less than you owe? I didn’t until we were faced with thousands of dollars of medical bills from my son’s unexpected surgery. Check out this article that shares exactly how to pay less on your medical bills. It even comes with a complete script so you know exactly what to say when you call! Negotiating your medical bills down is one of the most overlooked budget and money hacks!

29. Give yourself a monthly allowance.

Allowances aren’t just for kids. If you struggle with overspending, then it’s time to give yourself a monthly allowance. This will help you learn how to take back control of your spending, stop making impulse purchases, and learn how to save up for what you want. Simply pull out your allowance every single month in cash and stick it in an envelope. Once it’s gone it’s gone. This is one of the budget and money hacks that my husband and I still use today!

30. Have clear goals with your money…and refer back to them often!

If you want to see a change with your money, then it’s time to get serious about setting goals. Be sure to set goals that are specific and can be measured over time. When you feel yourself losing focus, refer back to the goals you set. Post them on your bathroom mirror, refrigerator, or even the bedroom door. Remember, just writing a goal won’t get you there. You have to do the work to reap the rewards!

So there you have it! 30 budget and money hacks that will help you live on less, pay off debt, and stop the paycheck to paycheck cycle! What’s one of the budget and money hacks that you’ll try out this year?