*This post is sponsored by Simplifi by Quicken. All opinions are 100% my own.

A few times each week someone will reach out and ask me if there’s a budgeting or finance app that I love. They want to know if there’s something where they can track their finances, spending, and saving all in one place. And to be honest, I’m always at a loss. I usually share a few apps that might work for them, but I know that none of the apps I’m recommending are all-encompassing.

You see, I’ve tried using apps to manage my money before. To be honest, they either have way too many ads, don’t have enough features, or are just plain confusing. And as someone who loves to budget and be in control of my finances, I know I’m not the only one that feels this way!

That’s why I was SO EXCITED when Quicken released their new Simplifi app. If you’ve known me for a while, then you know that I personally use Quicken to track my finances. And I love Quicken even more now that they’re releasing their own app!

The new Simplifi by Quicken app has so much to offer. Everything you need to track your spending and saving…all in one place. It’s what people have been asking for (plus some!). The Simplifi by Quicken app will change the way you view your money and could possibly have a lasting effect on your finances!

Simplifi Makes It Easy To Track Your Spending

Are you guilty of overspending every now and then? Maybe you swiped your debit card too much when Starbucks released their new cold brew lattes. Or maybe you grabbed one too many items at the Target Dollar spot (they add up quickly!).

Yeah, me too.

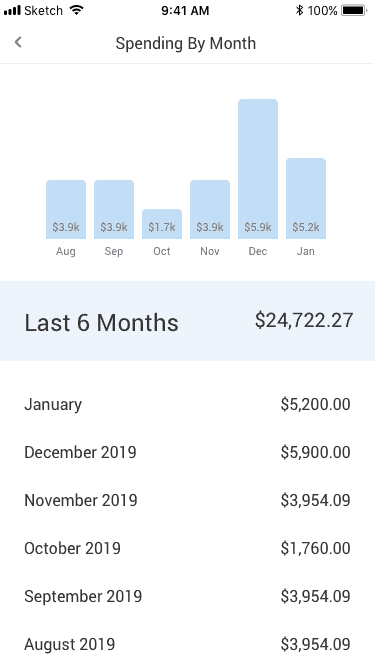

No one is perfect. Some months you’ll spend more than you had planned. But the power of the new Simplifi app is that you’ll see those patterns of spending so that you can make changes with your money! You’ll only be able to take back control of your finances when you KNOW your spending inside and out. And Simplifi helps you get there!

Not only does Simplifi allow you to view all of your accounts in one place, but they have several features to help you track spending over time.

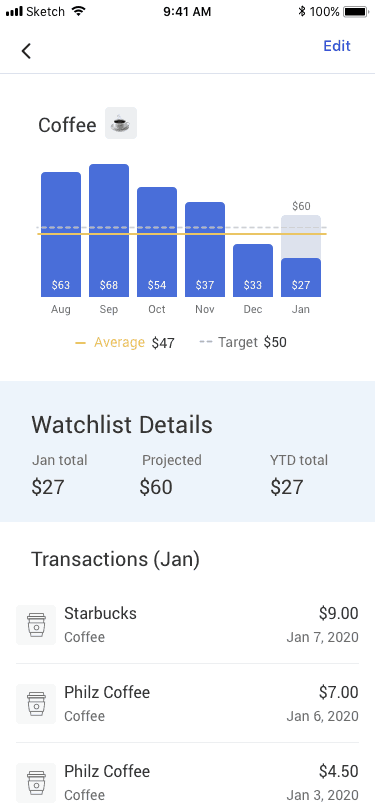

Spending Watchlist

As someone who loves to track their spending, the spending watchlist might be my absolute favorite feature! If you feel like budgeting is too hard to stick to (or requires too much work) then this feature is for you. The spending watchlist will give you an average of how much money you’re spending on certain categories over the course of several months. You can even customize it to your unique needs.

For instance, if you want to track how much money you’re spending on coffee, you’ll be able to set a target amount. As you buy coffee, Simplifi will track how much you’re spending each month and also give you an average of how much you’re spending over time.

The spending watchlist is perfect for you if you want to be sure you aren’t overspending on a specific category. You’ll know if you are going overboard with spending or if it’s time for a splurge!

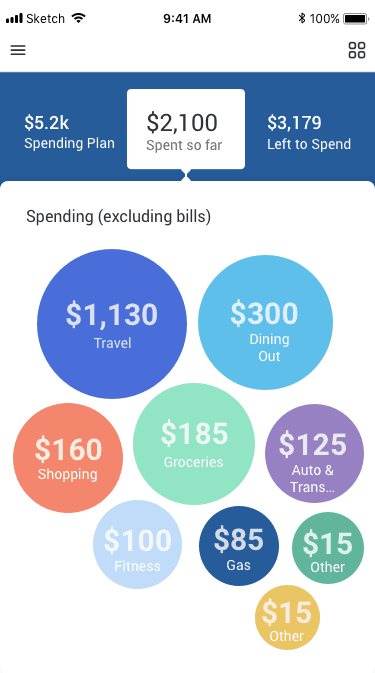

Spending Plan

Simplifi’s spending plan takes your spendable income (money that is not going into savings or to bills) and breaks down how much money you are spending on variable expenses. This is a great place to see where you can cut back on extra purchases so that you can save more money on what’s important to you!

Because Simplifi is 100% customizable to your needs, you can create categories for your spending. As you make a purchase, simply add a category to each transaction. Simplifi will then start categorizing your spending for you!

Not only will the spending plan give you a quick overview of where you are sending your spendable income, but you can click on each circle to see each transaction. The spending plan will help you see how little purchases can add up over time!

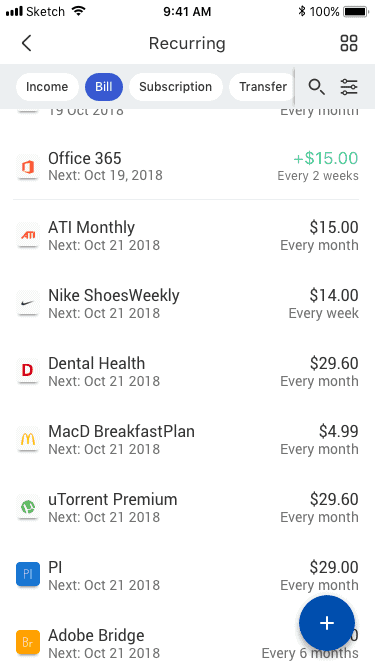

Tracking Upcoming Bills And Recent Spending

If you struggle with remembering which bills are being automatically drafted out of your account, then Simplifi has you covered! The upcoming bills section of the app will tell you which bills are scheduled to be taken out of your account in the next few days. All you have to do is let Simplifi know which transactions are bills and if they are recurring. This is perfect for you if you tend to forget that your Netflix bill will be coming out soon!

Want to quickly see how much money you’ve spent the past few days? Simplifi’s recent spending feature will let you know how much money you spent the past 4 days. You’ll be able to easily see if you’re overspending so that you can cut back on those unnecessary purchases. This is also a great place to check your recent transactions and change the categories that Simplifi has assigned to them.

Simplifi Helps You Set (And Reach!) Your Savings Goals

I’m guessing you have BIG goals when it comes to your money. You likely want to buy or pay off a house, take a big vacation, or buy something you’ve always wanted. Sometimes setting large financial goals can feel daunting. You might even feel like you’re running a marathon and don’t know if you’ll ever reach the finish line.

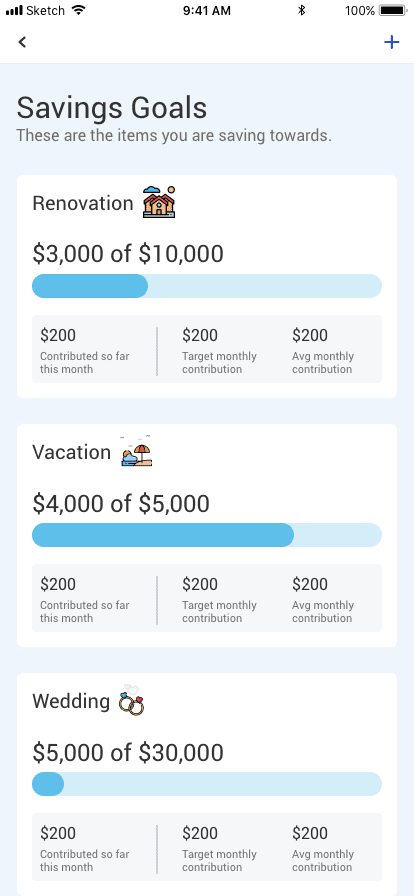

Simplifi by Quicken helps you break down and organize your goals so that you can track your progress along the way! Not only will this help you know exactly where you are in your goal, but it will keep you motivated to save money for what’s important in life.

Simplifi allows you to create virtual buckets for the money in your savings account. Now you don’t have to open separate savings accounts for each of your goals! You simply need one savings account and Simplifi will help you separate this money into categories for each goal.

Want to know the coolest part? You can set target goal dates and the app will let you know if you’re on track to reach that goal! This feature makes tracking your savings not only easy, but fun as well!

3 Reasons Why Simplifi By Quicken Will Change The Way You View Your Money

1. Your finances are all in one place.

Simplifi has a web version, but I’m loving the fact that they have an app too! As someone who has used a desktop version of Quicken for the past 10 years, I LOVE that I can track my finances on the go. I don’t need to be home to check how much money I spent last month on groceries. All I have to do is pull up the app and all my data is there! Plus, my husband can also log in to track our finances as well. This will help us always be on the same page about money.

2. You’ll be more aware of your spending than ever before.

Have you ever heard the saying “Show me your bank account and I’ll show you your priorities?” This is 100% true, but so often people don’t take the time or energy to truly track how they are spending their money. Simplifi makes tracking your spending a no-brainer.

You’ll be able to tag and categorize your spending so that it fits YOUR needs. The more you use Simplifi, the more aware you’ll be of your spending habits and patterns. Chances are you have big financial goals! Using the Simplifi app will allow you to identify the patterns in your spending so that you can do what it takes to reach those goals!

3. It’s easy to use.

Let’s be real here…if you have an app that is difficult to use or filled with ads then you’re likely to abandon it altogether. The Simplifi app is incredibly user-friendly and straightforward. Chances are you’ll actually enjoy tracking your spending for the first time ever!

Simplifi vs. Quicken

For the past 10 years, I’ve used Quicken to track my expenses and spending. In fact, this is the program that helped me realize that something had to change with our finances!

Tracking your spending is vital to taking back control of your finances. As someone who loves what Quicken can do, I’m excited to say that I love and appreciate Simplifi as well!

Although Simplifi doesn’t have all the extensive tools Quicken does to manage your investments and customize budgeting, it still offers a powerful way to stay on top of your finances.

But to be honest, most people are looking for something that is simple and will do the work for them! That’s why Simplfii is a wonderful option for those that want an app that will quickly allow them to get a consolidated snapshot, monitor spending, and set savings goals.

Get Started For Free

You can get started with Simplifi by Quicken with a free 30-day trial. Try it for 30 days and see if it changes the way you see your money for the better! Sign up for your 30-day free trial.