Are you tired of sending all your hard-earned money to debt while struggling with living paycheck to paycheck?

If you’ve taken the time to sit down and write out how much money you are paying towards debt, you might be sick to your stomach. I know I was in shock the first time we totaled up our minimum debt payments.

In fact, our minimum payments were more than our mortgage! I hated knowing that our family was living paycheck to paycheck every single month. We had very little savings and if we encountered a financial crisis we would have to borrow more money. Can you relate?

The good news is that you likely the ability to stop the paycheck to paycheck cycle that they’re living in. It all boils down to spending less than you make.

If you’re sick of working 40 hours a week and sending all your money to student loans or car loans, then it’s time to make a change. The strategies outlined in this article are proven to help you pay off debt even if you live paycheck to paycheck.

What Does “Paycheck To Paycheck” Really Mean?

When someone says they live “paycheck to paycheck,” that means that they need their next paycheck to cover their expenses. Without that paycheck, they won’t be able to pay all their bills or feed their family. They likely have little or no money in savings.

If you currently live paycheck to paycheck, you aren’t alone. In fact, 78% of US Workers currently live paycheck to paycheck. The good news? You don’t have to live this way forever.

The Secret To Paying Off Debt

If you want to make progress on your debt free journey, then there’s one thing you’ll HAVE to do…stop going into debt. If you are no longer willing to take out loans or add purchases to your credit card then you WILL make progress.

If you struggle with the idea of no longer swiping your credit card, then read about how I had to stop using my credit card. Also, this might be the time to try out the cash envelope system!

This system will help you no longer rely on your credit card and will help you have better control over your spending. If your ultimate goal is to become debt free, then take the first step by committing to stop going further into debt.

Below are 12 steps to pay off debt when you live paycheck to paycheck.

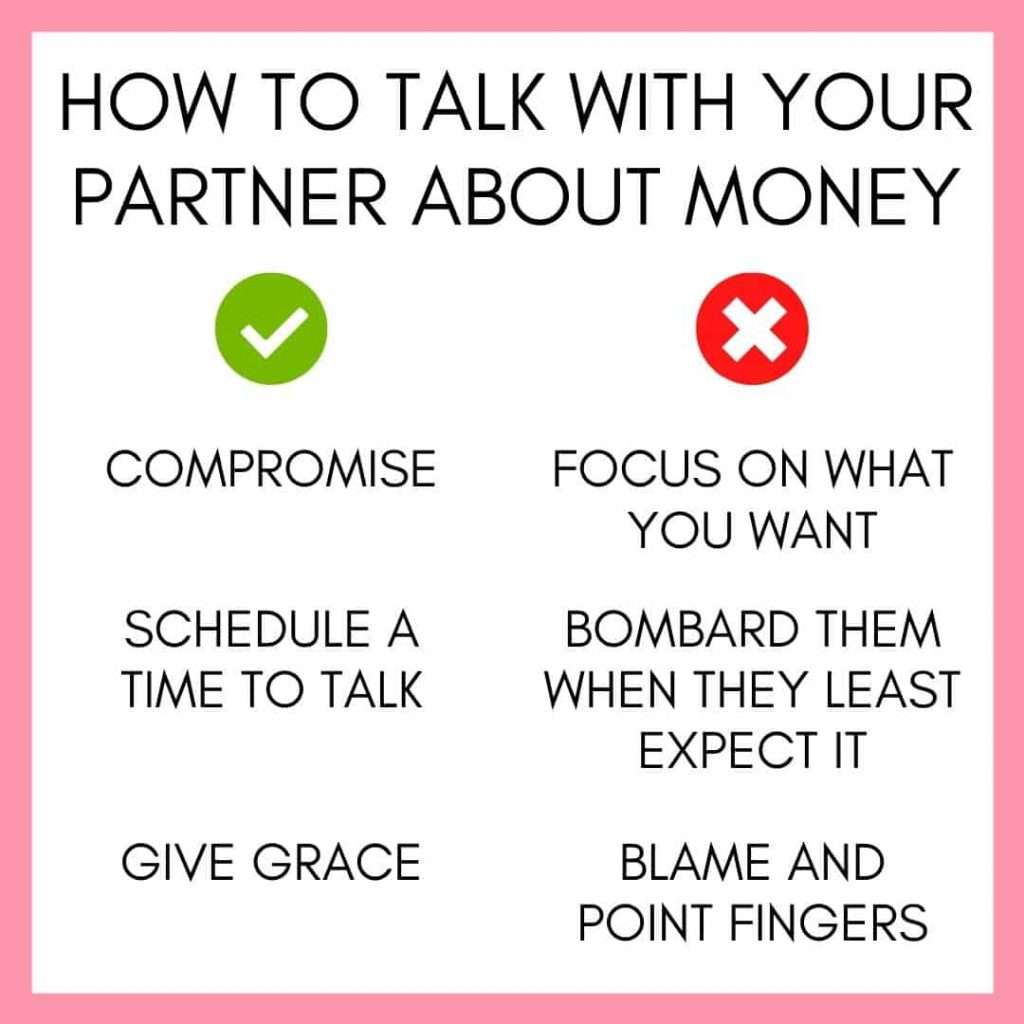

1. Get On The Same Page

Convincing your partner to get on board with paying off debt and making a budget can feel like quite the daunting task. In fact, getting a spouse on board with anything that takes them out of their comfort zone can be difficult.

However, a couple that works together toward the same goal will make greater progress than a couple that isn’t on the same page! If you want to pay off debt and stop living paycheck to paycheck, then it’s time to sit your partner down and have a chat.

Have a reluctant spouse? You’re not alone! Check out this article about how to get your spouse on board with budgeting. It’s full of practical tips and strategies to approach the conversation in the best way possible.

2. Write A Budget

Chances are you’ve heard it a thousand times. “You need to be on a budget.” There is a reason why people who write a budget each paycheck are more likely to succeed with their money! It’s because they are being proactive with their finances. The truth is that a budget is simply YOU telling your money where to go. It’s not in charge of you, you’re in charge of it.

Want to go on vacation? Great! Add a vacation fund to your budget.

Want to splurge on an expensive pair of jeans? Perfect! Just add it to your budget.

Writing a budget can be tricky at first. But after a few months, you’ll learn how to write a budget that matches your unique life. Will it look like someone else’s? Probably not…and that’s totally okay!

Check out the entire guide on the Easiest Budgeting Method ever. It’s what I personally do every time I write a budget!

3. Identify Wants Vs. Needs

If you want to make progress on your debt free journey, it’s important to know the difference between your wants and your needs. So often people confuse the two. But being a responsible adult means that you know the difference.

For instance, you might want cable, but you don’t need it.

You might want the latest iPhone, but you certainly don’t need it.

Every time you make a purchase or sign up for a subscription service (like Netflix, Hulu, or even a gym membership) ask yourself if it’s a want or a need.

You can certainly spend money on some of your “wants,” but limit them to what’s most important to you. The more you’re able to cut back on extra expenses, the more progress you’ll make. And isn’t that your goal? To make progress and pay off debt!

4. Stop Comparing Yourself To Others

It’s easy to compare your life to others around you. Especially when it feels like people around you are constantly taking nice vacations or buying new cars.

Sometimes people will go into debt simply because they want what others have. But when you stop trying to keep up with everyone else, you’ll start spending less. This will ultimately help you break the paycheck to paycheck cycle.

Suddenly you’ll realize that you have enough money in your checking account to make amazing progress on your debt free journey. But you can’t get there if you’re constantly trying to keep up with others.

5. Change Your Money Habits

To truly stop living paycheck to paycheck, you have to be ready to face your money habits. When you’re ready to face your money habits, you’ll make amazing progress on your financial journey. Today we will start by looking at different categories of spending.

When you consistently make small choices that are good for your finances, you’ll make amazing progress.

For instance, I want to buy coffee from Starbucks every day, but I choose to brew my own pot of coffee every morning instead. I desperately want to pick up dinner every night so I don’t have to cook, but I choose to make a meal plan and cook at home instead.

Take a look at your financial habits and determine what you need to break up with. Is it a subscription to a mail-order clothing service? Or maybe it’s online shopping in general. You might already know what your bad financial habit is. If that’s the case, then make a point to change your habit.

But what if you don’t know how you can improve? What if you aren’t sure where you’re overspending?

If this is the case, then print off your past 2 months’ bank statements. Go through and categorize each and every purchase. Add up how much money you spent on groceries, eating out, entertainment, and gas. Put every purchase into a category.

When you take the time to do this, your money habits will stand out to you.

6. Minimize Monthly Expenses

If you’re serious about becoming debt free, then one major way to do that is to minimize your monthly payments. We live in a world where banks and lenders tell us that we can borrow much more money than we can actually afford. Is it possible that your monthly rent or mortgage payment is more than you can handle?

Many Americans can’t truly afford their mortgage payment. Are you willing to downsize and take on a smaller monthly payment? If so, this can seriously help you make progress on your debt free journey.

If your car payment is more than you can handle then consider selling your car and buying a much less expensive used car. House payments and car payments can greatly affect the speed at which you are able to become debt free!

There are many other ways you can decrease your payments as well. Shop around for home insurance and car insurance. You’ll be shocked by how much money you can save when you switch up policies. Even small changes add up! Check below to see the most competitive car insurance rates in your area!

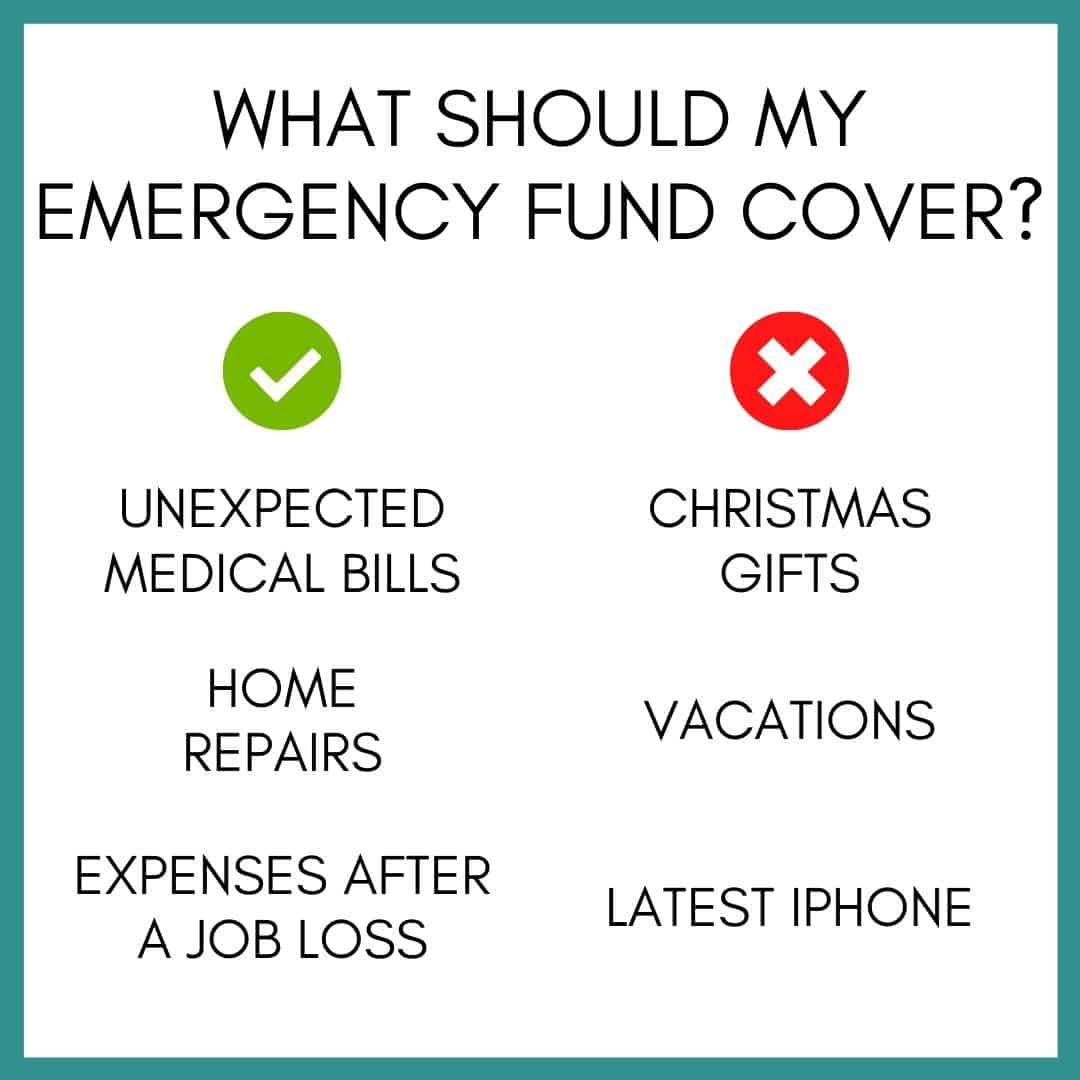

7. Build Up An Emergency Fund

When you live paycheck to paycheck and there’s unexpected financial stress, it can throw your whole month off. Here you were thinking that you were finally rocking this budgeting thing, and something goes wrong. It can make you want to give up entirely. To keep this situation from making you want to quit, it’s smart to have extra money in savings.

It’s smart to have at least 3 months of necessary expenses in savings. This includes what you need to live. Rent, utilities, food, gasoline, and your minimum debt payments would be included in this amount.

You don’t need to include any unnecessary subscriptions or expenses such as cable, Netflix, or restaurants.

When you encounter an unplanned financial emergency or job loss, you can use the money from savings to keep you from dipping into your checking account. As soon as you can, replenish your savings back up to its normal amount because we all know that life can be unexpected!

Learn more about setting up an emergency fund here.

8. Total Up Your Debt

Take time to total up how much debt you actually have. Simply log into all your accounts and write down your loan balances. Be sure to include any debt that has gone to collections. You can pull your credit report to help you know exactly how much debt you have in collections.

Although this step might be scary and overwhelming, it is 100% necessary. I’ll never forget the first time my husband and I totaled up our debt. I had no idea that we had THAT much in debt (over $111,000 to be exact!).

But we knew that if we wanted to become debt free, we had to face our financial truth. And for us that looked like sitting down and knowing exactly how much debt we had to the penny.

9. Start Paying Off Debt

Once you’ve totaled up your debt, it’s time to develop a plan to pay it all off. There are several ways you can pay off debt. The two most popular ways are the debt snowball method and debt avalanche method.

The debt snowball method is perfect for people who need a quick win or motivation. With this method, pay off debt in order from smallest balance to largest balance. This allows you to pay off your smallest balances first and see immediate progress. You’ll get a boost of motivation from paying off loans quickly. Then, take the payments you were sending to your small loans and add them to your next largest loan.

The debt avalanche method is for people who want to focus on paying off their higher interest loans first. With this method, pay off debt in order from highest interest rate to lowest interest rate. This allows you to tackle those loans that are costing you more first.

Not sure which method is right for you? Read more about the debt snowball method and debt avalanche method.

10. Save Money Daily

To help you make progress on your financial journey, find ways to save money every day. This might look like decreasing your grocery spending or cutting back on your restaurant’s budget.

When it comes to finding even more ways to save, think about the bills that you pay on a monthly basis. Take time to shop around for a better rate or call your company and ask for a better rate. Most businesses want to keep you as a customer and will be willing to work with you.

This might take a few phone calls, but it can save you hundreds, even thousands every single year. All of the money saved can help you pay off debt so that you can stop the paycheck to paycheck cycle!

11. Increase Your Income

One of the best ways to help you break free from the paycheck to paycheck cycle is to increase your income while keeping your standard of living the same.

It’s no secret that extra money will help you make significant progress on your debt free journey. Find a way to bring in extra money, even if it’s just for a few months.

Some ideas are to ask for a raise, find a part-time job, or even sell items around your home. Get creative when it comes to earning more money! Be willing to use the skills you have to your advantage.

For instance, I’ve known teachers that do yard work all summer to earn extra money. I also know people who flip furniture. They buy used furniture on Facebook Marketplace, give it an update, and fix it up. You’ll be shocked to learn that this is an easy way to make more money!

Check out 20 High Paying Part-Time Jobs that will help you increase your income.

12. Track Your Spending

Your money and finances are one of the most important aspects of your life! This means that you should know your finances inside and out. So many people don’t know much about their spending habits because they are in denial or ashamed of how they overspend.

If you’re willing to track your spending, then you can face these fears head on! Find a way to track every single penny that you spend and make. This will help you know exactly how much money you’re spending on every category of your budget.

There are many ways to track your spending. It’s important to find what works for you! The goals is to find a system that you can work with consistently over time. You can use an app, paper and pencil, or a software program like Quicken.

Read more about the two most popular financial tracking systems out there!

Set Goals And Track Them

As you’re working to pay off debt, it’s important to set goals that you can track along the way. Not only will setting goals keep you on track, but they will also help you stay motivated when you want to give up.

Be sure to set a few goals to help you stay on track:

- Debt Payoff Goal: Set a goal date for when you want to be completely debt free.

- Monthly Payoff Goals: Set a monthly goal for how much money you want to send to debt. This might change every month.

- Non-Money Related Goals: Set daily, weekly, or monthly goals that aren’t money-related, but help you develop better financial habits. For instance, you might set a goal to cook dinner at home 6 nights each week or track your expenses every day. These are the goals that will help you develop great habits over time!

Be Prepared For Big Purchases

There’s going to come a time when you need to make a large purchase. Sometimes these are expected, but other times they are unexpected expenses that pop up out of nowhere.

By setting up specific sinking funds, you can save money for both the expected and unexpected expenses in your life.

Expected expenses include things like Christmas, birthdays, and HOA dues.

Unexpected expenses include car repairs, home repairs, and medical bills.

These big purchases and expenses can potentially lead you back into debt if you’re not prepared for them. To help alleviate the costs of these expenses, start saving money right now. This can look like a separate savings account specifically for home repairs or car repairs.

The most important thing is to be prepared for big purchases because they will happen.

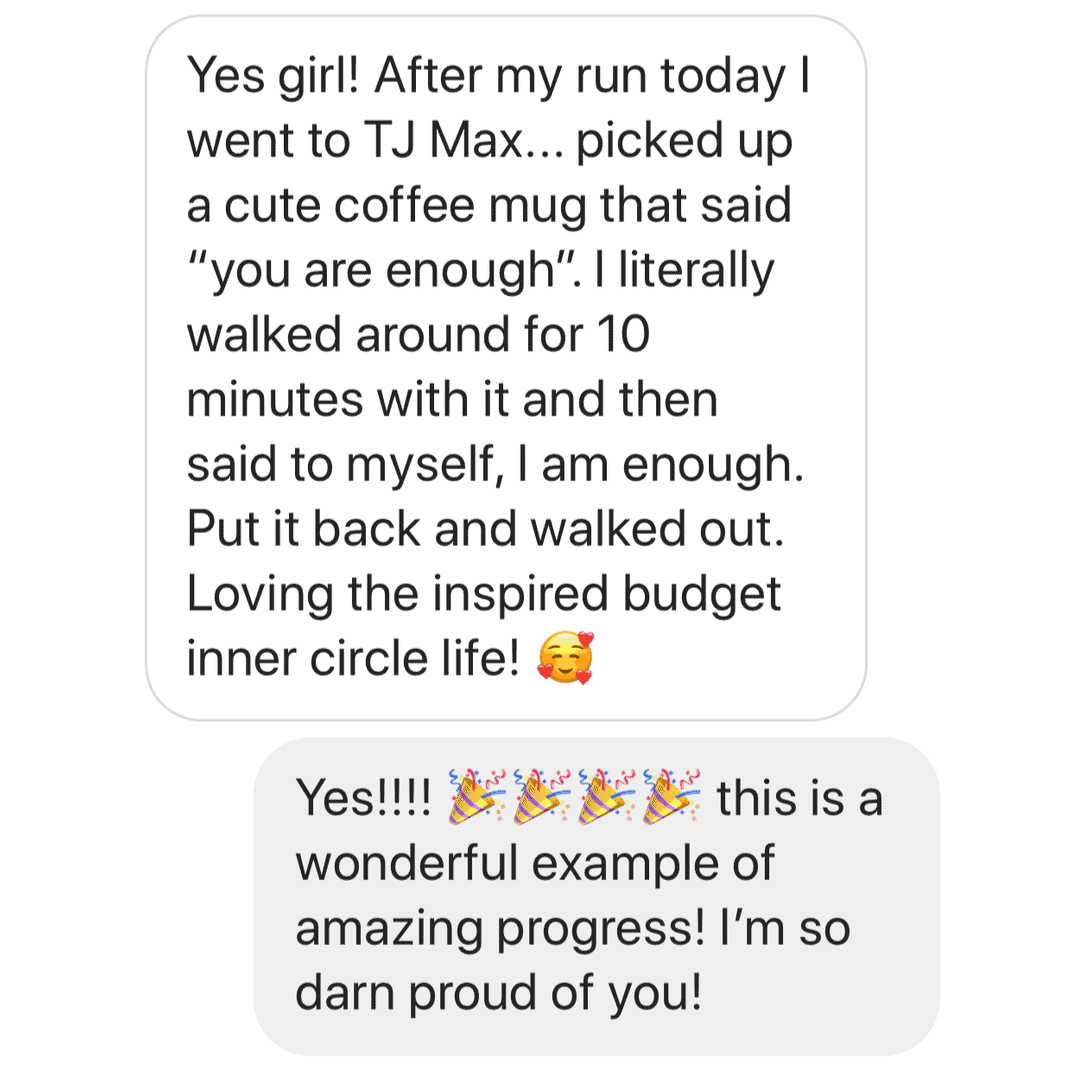

Find A Support System

As you work on paying off debt while living paycheck to paycheck, you’ll be faced with temptations along the way. There will be times when you want to buy something that isn’t in your budget. There might even be times when you want to give up and go into further debt. That’s why having a support system in place is essential.

Your support system is there to encourage you to keep going and not give up. They are your listening ear when you want to buy something you can’t afford. They are there to celebrate your progress, whether big or small.

Your support system can be a family member, friend, or even an online community! Lean on your system when you need them so that you can continue making progress on your journey.

The Bottom Line

Living paycheck to paycheck doesn’t have to be a way of life. When you’re focused and willing to do the work, you’ll be able to pay off debt in the process!

Need more support when it comes to budgeting and paying off debt? Check out my FREE Budgeting & Debt Payoff Cheat Sheet. It is full of simple and actionable tips to help you create a realistic budget and payoff debt for good. I believe it’s totally possible for you to break the paycheck to paycheck cycle for good!