There’s bound to be a time in your life when you’re faced with an emergency. Whether you encounter an unexpected medical expense, a huge change in your family relationship (such as a divorce), or a global pandemic, it’s a great idea to create an emergency budget.

Right now, our world is facing the COVID-19 pandemic. Millions of people’s finances are being impacted by this global pandemic. Small businesses have been forced to close and companies have been laying off their employees.

If you’re feeling anxious right now…you’re not alone! It’s completely normal to feel nervous and unsure when a crisis like this hits. And when something like this happens, it’s best to set up your emergency budget.

Learn how to set up an emergency budget so that you don’t get behind on your bills or go into debt.

What is an emergency budget?

An emergency budget is simply a budget that you set up in case an emergency happens.

This is the budget you’ll turn to if someone in your family gets laid off or loses a job. It’s also perfect if you suddenly need to start saving a lot of money.

Basically, if there’s ever an emergency (let’s say…a global pandemic), you’ll use this budget. It’s going to be your go-to strategy to cut your expenses so you can save a ton of money.

How to create an emergency budget

An emergency budget is very different from a regular budget. In your everyday budget, you might have extra expenses or luxuries added in.

But in an emergency budget, you’ll want to cut these out so that you can save as much money as quickly as possible. It’s best to sit down with your spouse or partner to complete an emergency budget together. You’ll both want to be on the same page with your finances. It’s best to communicate about finances at least once a week.

When it comes to creating an emergency budget, you’ll want to do several things to make it effective.

1. Know where you stand financially

If you’re in a situation where you need to start saving money fast, then it’s good to know where you stand with your money. Sometimes it can be nervewracking to face your financial truth, but it’s important for everyone (yes, EVERYONE) to know exactly how much money is in their checking account and savings accounts. It’s also important to know how much debt you have.

Before you do anything, get a clear picture of your finances. Log into your accounts and write down where you stand. This information will help you develop a better plan for moving forward.

2. Stop paying extra toward debt.

Even if your hope is to become debt free, now is not the time to be making extra debt payments. During an uncertain time, it’s best to save up as much money as possible.

Instead of following the debt snowball or debt avalanche plan, simply make minimum payments on your loans.

3. Set up a separate savings account.

Once you’ve stopped paying extra toward debt, it’s time to set up a separate savings account where you can start saving any extra money. This money can be used to help you cover future bills, the mortgage, or buy your groceries if you get low on money.

During a crisis or emergency, you’ll want to be able to have quick access to your money. It doesn’t matter if you set up an online savings account (I personally love Ally Bank) or open another savings account with your local bank.

The goal is to just get one set up immediately.

Once everything settles down and you go back to your normal life, you can always take any extra money you saved and send it to debt.

4. Cancel any unused or unnecessary subscriptions.

I’m going to guess that you probably have a few unnecessary subscriptions or monthly bills coming out of your checking account each month. You can save a good amount of money each month by simply canceling any subscriptions that just aren’t worth your money right now.

To do this, print out your last three months’ worth of bank statements. Grab a highlighter and highlight every single subscription or regular monthly payment you make. If it’s something that comes out monthly, quarterly, or yearly, highlight it.

Comb through each of these expenses. Ask yourself if they are truly necessary. Can you live without it for a couple of months? Are you willing to sacrifice that expense to save money?

If you’re truly in an emergency such as a job loss, then it’s probably worth cutting out extra subscriptions (like Amazon Prime) so that you can have enough money to cover necessary bills.

5. Cut out any unnecessary or extra spending.

Once you cut out any unnecessary subscriptions, it’s time to have an honest conversation with yourself about your spending habits.

It might be time to hit pause on the manicures, extra lattes, or eating out. If you’re truly facing an emergency, then now is the time to be ruthless!

Remember, You can always add these things back in your normal budget once everything settles down.

6. Lower your monthly bills.

After you’ve removed any unnecessary expenses and subscriptions from your budget, it’s time to lower your monthly bills.

Did you know that you can call your bill companies and negotiate a lower rate? Start by calling the billing department and explain your situation. Tell them that your goal is to still be able to pay your bill every single month however, to do this you’ll need to lower your bill.

Ask the person that you’re speaking with if they can help you come up with a solution so that you can continue business with them during this emergency.

Most companies are willing to negotiate with you because they would rather keep you on as a paying customer.

7. Lower your credit card interest rate.

Just like you can call and get your monthly bills lowered, you can also call your credit card companies to lower the interest rate on your credit cards.

This will help lower your monthly payment because your overall interest rate will be lower. Simply call the credit card company and explain your current situation. Ask them if there’s any way you can get a lower interest rate.

Let’s be honest, it doesn’t hurt to ask! The worst they can say is no.

8. Lower your food budget.

Food is by far one of the largest variable expenses in most people’s budgets.

Chances are you can cut back on your food budget to help you save money every single month. By simply planning out your meals, keeping dinner simple, and shopping the sales you will be able to save so much money every single month.

And remember…just, because you aren’t going out to dinner now, doesn’t mean you’ll never go out to eat again. Sometimes when you’re faced with an emergency you have to make a few sacrifices.

Want to learn more about meal planning on a budget? Check out one of my most popular articles here.

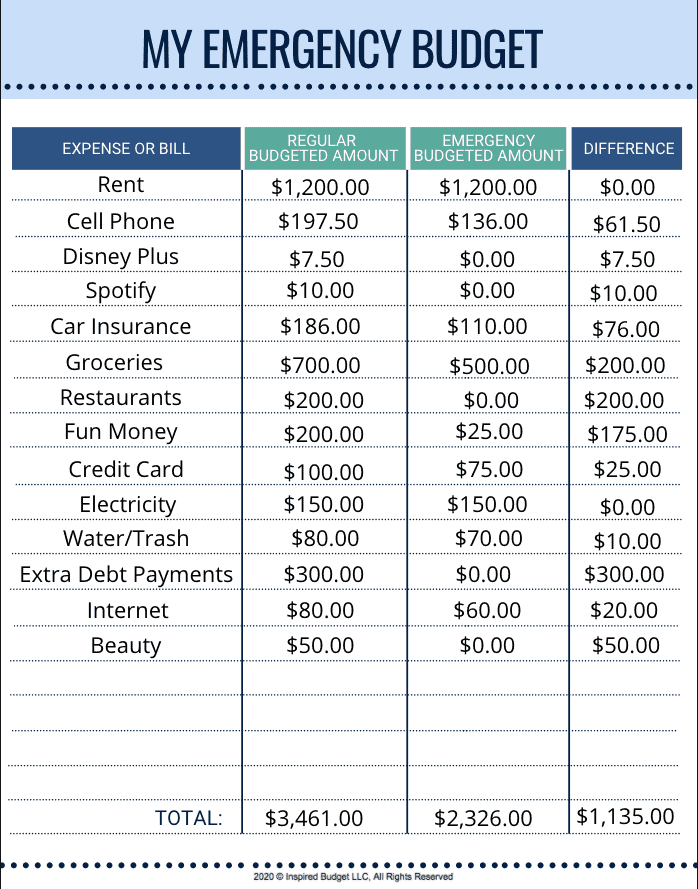

An example of an emergency budget

If you’re anything like me then you might be a visual learner.

To help you see just how much money you can save by writing an emergency budget, I’ve created an example emergency budget. This budget shows just how much one family is able to save when they have to live on less.

Track your spending

As you move forward with your finances, it’s important to know if you are actually following your budget. So often people write a budget but don’t stick to it.

By tracking your expenses and spending down to the penny, you’ll be holding yourself accountable to following through with the budget and money goals that you set.

Tracking your spending will also help you write a budget that’s realistic for your family. You’ll quickly learn the areas where you tend to overspend each month.

So often people ask me how they should be tracking their spending. To be honest, it doesn’t matter how you track your spending! Whether you’re a paper and pencil kind of person, you use an app, or you have a spreadsheet on your computer, all that matters is that you find a system that works for you!

Our family has personally used Quicken to track our spending and expenses for 10 years. I love that I’m able to insert bills and expenses into Quicken before they come out of my checking account on auto-draft. This allows me to know how much money I have in my account at all times.

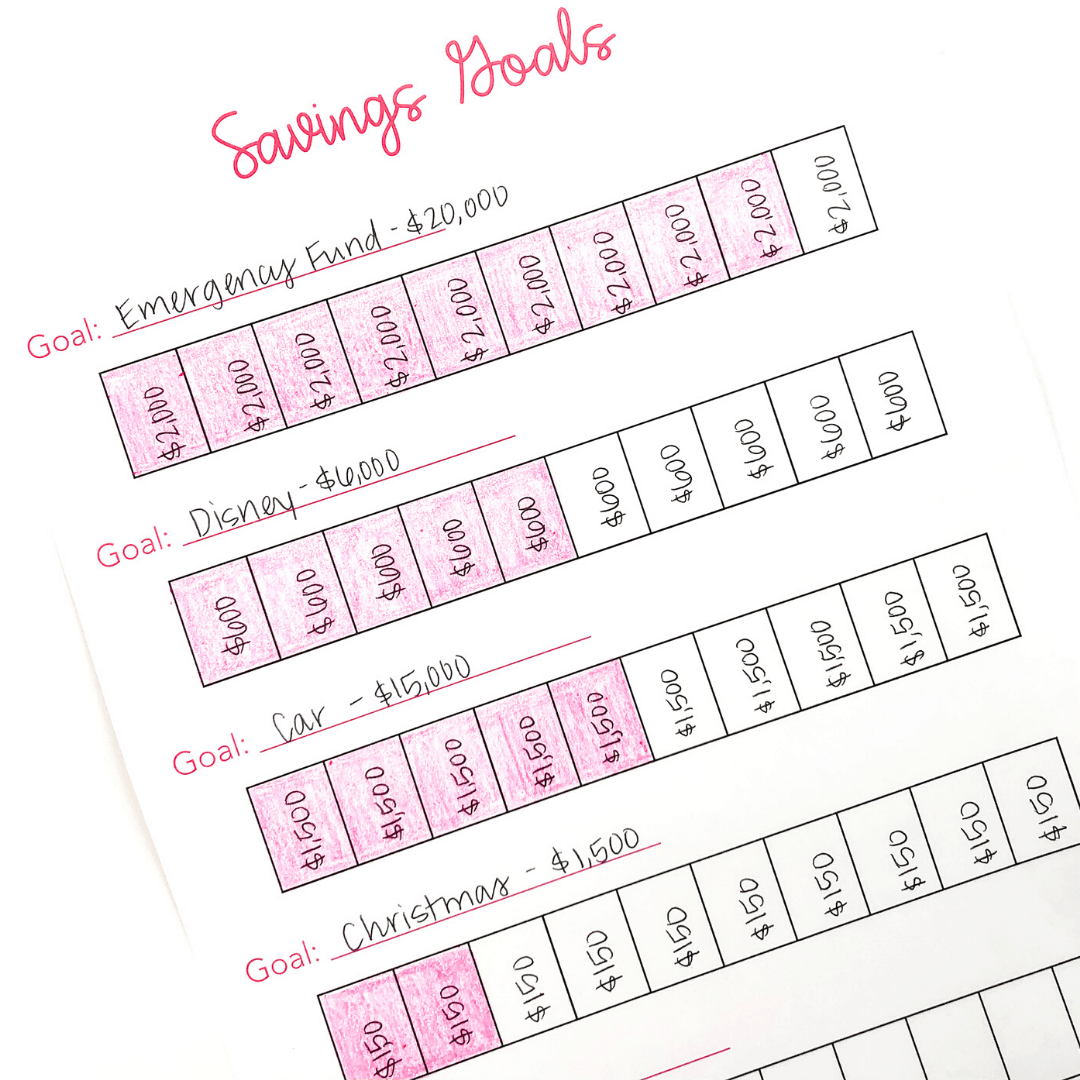

Hit “pause” on your financial goals

If you’ve lost your job or if you’re facing another financial emergency, then it’s time to hit pause on your financial goals. That might mean you’re no longer sending extra money to debt, your retirement account, or saving for a vacation.

Just because you’re no longer making progress right now doesn’t mean that you won’t make progress in the future. Remember: the goal is to not go into debt during an emergency.

Why you need an emergency fund NOW

If you don’t have an emergency fund already, then now is the time to set one up. An emergency fund is perfect for covering unexpected expenses that come up such as medical bills, house repairs, or car repairs. An emergency fund can even be used to cover regular bills if one person loses their job.

Although some people might advise you to use credit cards when an emergency arises, it’s better to have money set aside in savings for these types of unexpected expenses.

Not only will you skip out on any interest rates that accrue from using a credit card, but you will also be less stressed when you have an emergency fund in place.

How much money should be in your emergency fund

Although some people might tell you that you only need $1,000 in your emergency fund, it’s better to have between 3-6 months’ worth of expenses inside your emergency fund. Remember that a single month of expenses doesn’t necessarily equal the amount you bring home each month.

To determine how much money you’ll need to save, total up all your necessary monthly expenses. Multiply that number by the number of months you want to have saved.

This will give you a good idea of a reasonable amount to aim for when starting your emergency fund.

What to do if you don’t have an emergency fund

If you don’t have an emergency fund in place right now, then it’s time to pause any extra spending and start saving immediately.

If you find yourself in a situation where you don’t have enough money saved to cover a bill or expense, then ask if there is an option for a payment plan. Most people and companies will be willing to work with you. Then, find a way to make or earn extra money as soon as possible.

You can learn more about setting up emergency funds here.

Remember, this too shall pass

If you’re in a difficult situation with your money, remember that this won’t last forever. Chances are this is just a season. You might have to create an emergency budget for now, but that doesn’t mean you’ll be living on it forever.