I have a secret for you. Well, I guess it’s not a secret if I’m sharing it on the internet, but I’m still calling it a secret. Okay, so here it is: I am a spender at heart. That’s right. The person who founded a business based solely on teaching people how to write a budget and making saving money a priority used to love spending money. And part of me still loves it!

In fact, it wasn’t until about 2 years ago that I actually started to enjoy saving money. Let’s be honest, the adrenaline you get from buying a pair of shoes or a cute picture frame from Target does not compare to the rush of sending $100 to a savings account. There’s just no competition (at least in my mind)!

Thankfully, I can now say that I enjoy saving money more than I enjoy spending money (well, most of the time). Now don’t get me wrong, I still enjoy the occasional shopping trip and who doesn’t love them some Target? But I’m much better about spending money intentionally and within my means. Because although I used to love spending, I hated that feeling you got the next day when the guilt set in.

If you’ve ever been there then you know this guilt. It eats at you. You start questioning your purchase. But then the other part of you defends that dress that you just had to have. The cycle continues on and on as you spend more and save less.

But here’s where I tell you that there’s hope! You might love spending money right now, but I promise that you CAN start to enjoy saving money as well! Here are the 6 things I did to start enjoying saving money each month!

1. Accept that something needs to change.

One day, the realization just hit me (as I can only imagine it hits other people as well). I woke up and realized that I had filled my closet, home, and stomach with stuff.

Purchases that started as joy had faded into frustration because everything around me was so crowded. My closet was full. My home was cluttered. And my waistline was expanding. I was spending so much money and what did I have to show for it?

I felt out of control with my finances and I knew that something had to change. Can you relate? Sometimes the first step is just realizing that something needs to change. Accept the fact that you are spending too much and saving too little. Let it sink in. And then get pumped up to do something about it!

2. Give yourself an allowance.

By far the number one way I curbed my spending habits was to give myself an allowance. Now I know what you may be thinking. I’m not a child, Allison. I don’t need an allowance.

But I’m going to give you some tough love here. If your spending habits are childish, then you need an allowance.

I will be the first to admit that my spending habits were downright childish. So I gave myself an allowance. I started out with only $20 a month and soon bumped it up to $30. This allowance was just for me, and no one else. I would spend it on whatever I wanted, or I’d save it for a larger purchase that I had my eye on.

The genius behind giving yourself an allowance is that you are telling yourself that it’s okay to spend money. And that’s the truth! It is absolutely okay to spend money. But it should be money that you planned for and included in your budget. An allowance will teach you to spend money on what is important, and not on what is convenient. It also allows you to save more money than you ever thought possible!

It will teach you patience (and who out there doesn’t need more patience?) and discipline. And when you screw up and spend more than your allowance (which you will), then you’ll learn how to give yourself grace and set goals for the next month.

Allowances aren’t just for children. In fact, I believe that allowances might be for you!

3. Make it a competition.

I’m not a huge proponent of competing against others when it comes to saving money and finances (plus I’m just not a naturally competitive person). However, I’m not against competition against yourself! Yes, I mean you!

One way you can train your mind to enjoy saving money is to try and send more money to savings than you did last month. If you sent $400 to savings (or debt!) last month, can you send $500 this month? Compete against your past self as that extra motivation! You can even calculate how much money you sent to savings last year and try to beat it this year.

Making saving money a competition against myself has worked wonders for me in the past. The idea of comparing my present to my past self is very motivating. So set goals and start saving money!

4. Track your progress.

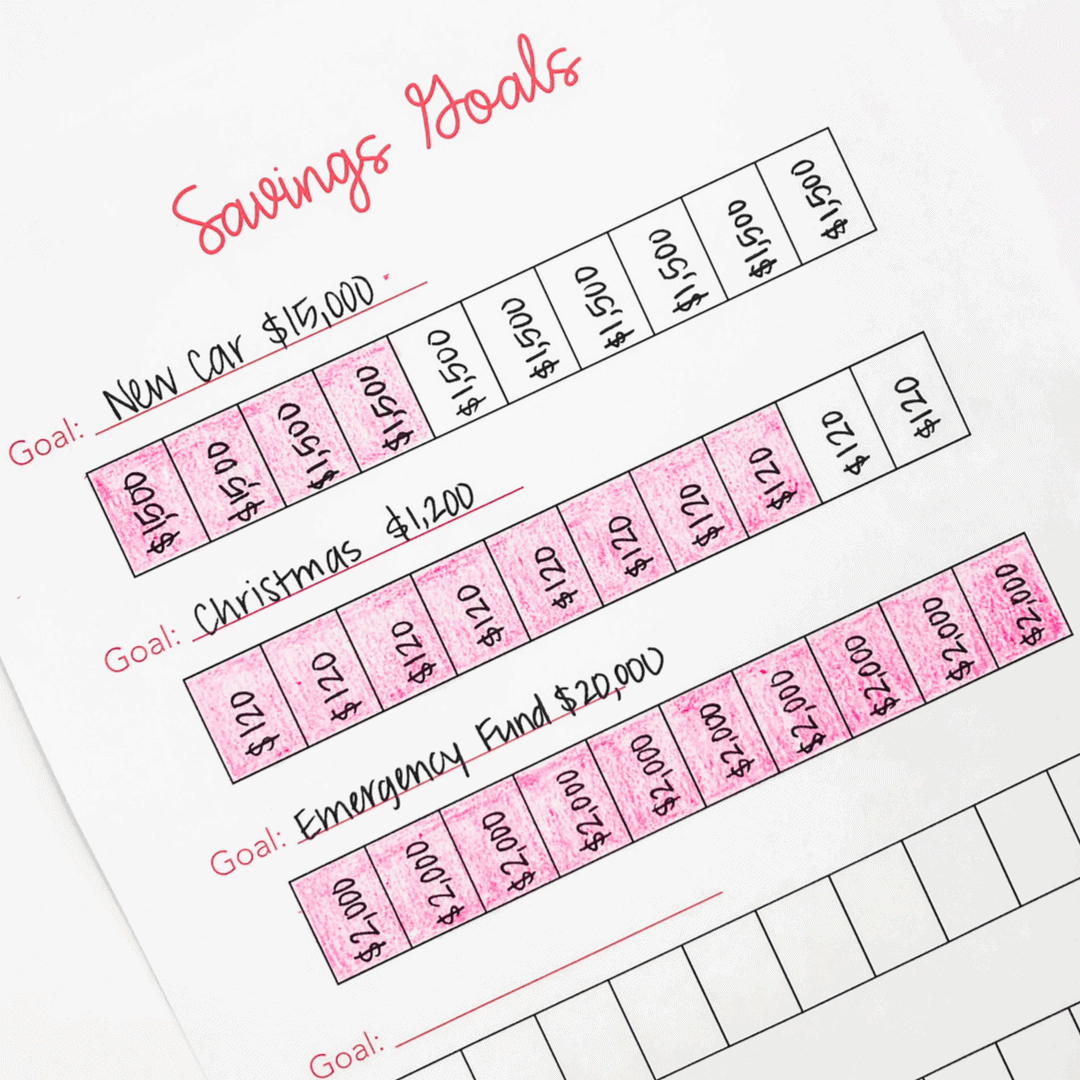

If you’re working toward saving money for an emergency fund, vacation, or large item, then track your progress along the way! Find a chart online (or use the one in my Budget Life Planner) and keep it somewhere visible. You’ll be surprised how much fun it is to shade in your chart showing that you’ve made more progress toward your savings goal!

5. Surround yourself with other savers.

I’m sure you’ve heard the famous saying “You are the average of the five people you spend the most time with.” This is such a true statement! If you surround yourself with people that are spending money like crazy, you’ll start wanting to spend money as well.

If you’re following influencers on Instagram that are constantly telling you why you need the newest product, you’re going to want the product. Instead, guard yourself! You don’t need to follow people on social media that make you want to spend money. And you can limit conversations with friends who are always telling you about the new item they bought.

Instead, surround yourself with other people who like saving money, not spending it. Search on Instagram or Facebook for people who have made it their mission to inspire others to save money. Consume their content! You’ll be surprised how much it helps you want to start saving money, not spend it.

6. Give yourself grace.

Learning to enjoy saving money (or even send a large chunk of your income to debt) can take some getting used to. I’m not going to lie to you and tell you that it came easy. There was no magic moment where I woke up and decided that I enjoyed saving money. It just doesn’t happen that way.

Instead, it was a gradual process with bumps along the way. I like to think of it as training for a race. Back when I was first out of college, I started running. What began as a mile around my massive apartment complex grew into many more miles. In fact, I even paid to be part of a running club (and if that’s not a commitment, then I don’t know what is!). But there were times when I just didn’t want to run. I wanted to sleep in or binge Netflix instead. So I would skip my run and (surprise!) I’d end up feeling bad afterward.

The same is true when you’re training yourself to enjoy saving money when all you want to do is to spend. You will work on saving and then make a mistake. You’ll spend money somewhere and there will be a setback. But you’ll get back up again because no one is perfect. Plus, it’s perfectly okay to spend money when you budget for it! There are things you can put in place to make saving money and spending less easier on yourself.

Ultimately, give yourself grace, an allowance, and motivate yourself to keep saving money.

Eventually, you will walk into Target and you won’t want all the stuff. You’ll come out with only what you intended to buy. And you will feel free because money doesn’t control you. Instead, you are in control of your money. I promise this is possible and you’ve got this!