Learning how to develop discipline with credit cards is not easy! With high credit limits and so many fun things to buy, it can feel like the sky is the limit. That’s why it’s so important to be careful with how your use your credit card and spend wisely.

Even for us budgeting pros, we can have moments where we slip. The last time we moved, I got a little too excited when it came to decorating and furniture shopping. While I had saved for bigger expenses, I found myself turning to my credit card again and again for smaller items.

And they really started to add up!

While not a fun money lesson, it was a good reminder that everyone needs to take a step back sometimes. Managing money is a constant thing as expenses and income in your life are always changing. But that’s why it’s important to adjust accordingly.

Despite my mishap, I went back to using credit cards. This time, I did it right! Like every money tool, credit cards are a major asset when used correctly. There’s a reason so many people have them!

If you’re just getting your first credit card or looking to reel things back with your spending, learn how to develop discipline with credit cards so you can reap all of the good and none of the bad.

Why Credit Cards Aren’t The Bad Guys

A lot of people warn against the dangers of having a credit card. While they can cause debt for many people, it only occurs when used irresponsibly. When used correctly, you can actually be in a better financial situation.

One of the major positive aspects of credit cards is building credit. The higher your credit score, the more likely you are to get a mortgage, loans, apartment rentals, and even better auto rates.

For those just getting started or looking to repair their credit, using a credit card correctly can help get you to recover from a bad credit score.

Credit cards are also more secure than debit cards. If someone were to obtain your debit card, they would have direct access to your entire bank account. Plus, with a credit card, fraud is easier to prove. You can easily flag suspicious activity to be removed from your statement immediately.

One of my favorite things about credit cards is the rewards. Typically, you earn either cash back or points that can be used for things like flights, hotels, and gift cards. For our family, this is how we are able to afford most of our vacations!

And while you should only use credit cards when you know it can be paid off, sometimes it’s nice to have that little buffer room.

If you have irregular income and are in the process of paying off debt and building out savings, you might need to use a credit card for everyday expenses while you wait for payment. We also used to have a credit card on hand for emergencies when we didn’t have much money saved yet.

How To Develop Discipline With Credit Cards

If you’re on board the credit card train, it’s time to learn how to use them properly! You can’t just swipe them whenever you please. Here are some ways you can develop discipline with your credit card spending.

1. Only spend what you have.

This may be the biggest rule of credit card usage of them all. Even though it has what feels like unlimited money, only use your credit card as if it were a debit card. AKA, when the number in your bank account is at $0, you have nothing left to spend. Ideally, when the amount in your credit card budget hits $0, you stop spending.

Even if you know that you’re going to have money soon, wait until you physically have it before you start spending it. You never know what will come up that could stop that income from coming in or need the money instead. So, wait to book that vacation for when you’ve saved enough money rather than putting it on the card.

This is meant to protect you rather than restrict you. So when that bill comes, you can immediately afford to pay it with cash right away.

2. Pay on time and in full.

The second-best rule is to always pay your credit card bill. When you sign up for your credit card, you will have an annual percentage return. This refers to the amount of interest you will be charged annually. Every time you don’t pay off a bill in full, you will accrue interest.

This can get nasty quickly and is how people build credit card debt.

When it comes time to pay, do so on or before the due date to avoid any fees. While it will list a minimum payment, pay off the full balance. Having zero interest is the key to using credit cards responsibly!

3. Delegate when to use your credit card.

When first starting out with your credit card, it’s good to keep spending to a minimum. Rather than using it for all your purchases, consider using it only for certain circumstances. For instance, only for online shopping or perhaps for groceries or gas.

This ensures you are consciously deciding when to use your credit card and are more aware of the money being spent.

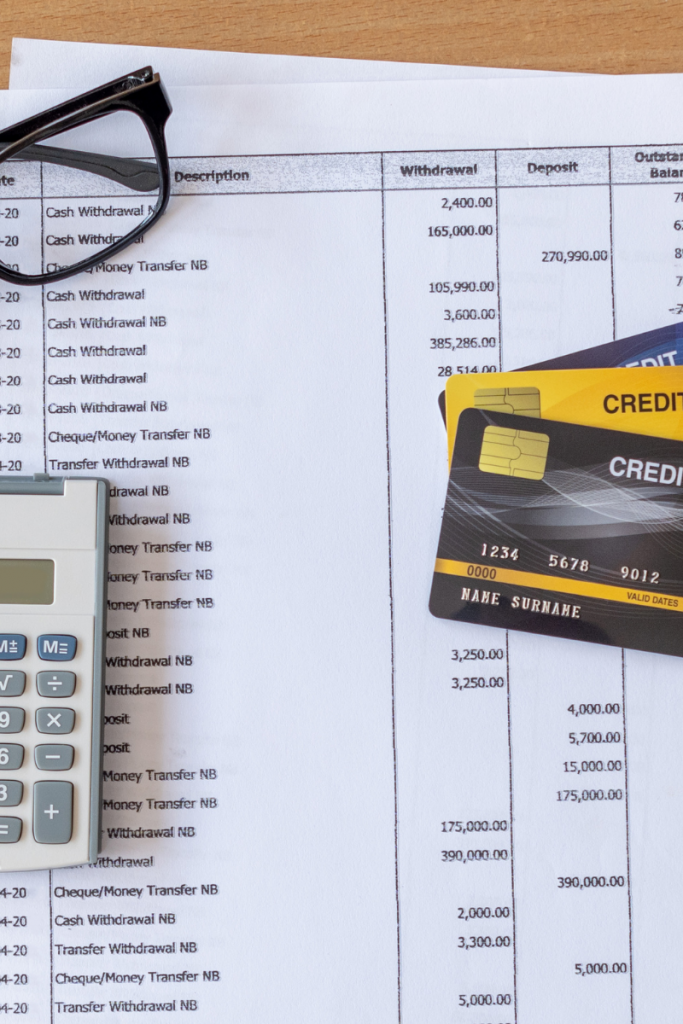

4. Track your expenses.

When budgeting and doing your monthly finances, check in on how much money you’re spending with your credit card. Hopefully, you shouldn’t be one bit surprised at what you see. If consciously spending, you will remember every time you used your credit card.

If you add up your total credit card spending and it doesn’t align with what you budgeted, it’s time to bring that number down for the following month.

5. Examine each expense.

While tracking your expenses, look at your credit card statement and examine every expense. You should recognize every expense. If you don’t, try googling the name of the expense if it doesn’t make sense to you.

Any accidental double charges or suspicious activity should be flagged to the credit card company.

Also, look for any recurring expenses you don’t need. Cough cough, unused gym memberships, and subscription boxes, I’m looking at you!

For every expense, you should feel good about every purchase. Note any moments of surprise or regret for next month’s budgeting.

What To Do When Your Discipline with Credit Cards Slips

Sometimes, you may find you’ve gone a little swipe happy with your credit card spending. It can happen to anyone, myself included. It’s very common that as your income increases, your spending increases. This means you find yourself saving just as much money as you were before despite having a greater income.

Go cold turkey.

If you have ever gone so much overboard that looking at your credit card statement makes you want to hide away, this is going to be your best bet. For those who have been overspending, it may be best to simply stop using the credit card altogether.

When I first found myself overspending, this is exactly what I did. I had forgotten how much all these little expenses could add up. While I was paying off my credit card in full each month, I was taking away money that would normally go into my savings.

That doesn’t mean I wouldn’t ever use credit cards again. Instead, it resets my relationship with my credit card.

By not using it for a while, I won’t immediately turn to it for overspending. Eventually, I worked it back into my budget and stuck with the money habits I had redeveloped after going cold turkey for a while.

Set small money goals.

If cutting off credit cards completely feels a little drastic, then set that goal to be something smaller. Consider only using your credit cards for specific purchases or cutting usage for as little as a week.

Rather than quitting them all together, this makes cutting them down more manageable.

Maybe credit cards aren’t right for you.

While I am pro credit cards, I know that they don’t always work for everyone. Sometimes people need to visually see with cash or a bank account just how much money they have to spend.

I would much rather you get rid of credit cards rather than use them incorrectly. The benefits are never worth going into credit debt! Credit cards are wonderful money tools but are difficult to use for many.

If you can follow the tips above on how to develop discipline with credit cards, you’re well on your way to being a money master. Learning to control spending is the first step to paying off debt, saving money, and reaching your financial goals.

If you’re brand new to budgeting, I’ve got tons of free resources to help you get started. Budgeting with your credit cards will help you stay well on track! Sign up below and I’ll send you a FREE budgeting and debt payoff cheat sheet to help you get started!