I’m guessing you have BIG money goals that you want to achieve in your life. Maybe you want to be debt free, own your own home, or save a ton of money for retirement.

I applaud you! In fact, most people are terrified to admit that they want to achieve something that others would say is impossible. They are afraid that if they even speak it out loud that they will come off as crazy. Or maybe, just maybe…they will fail.

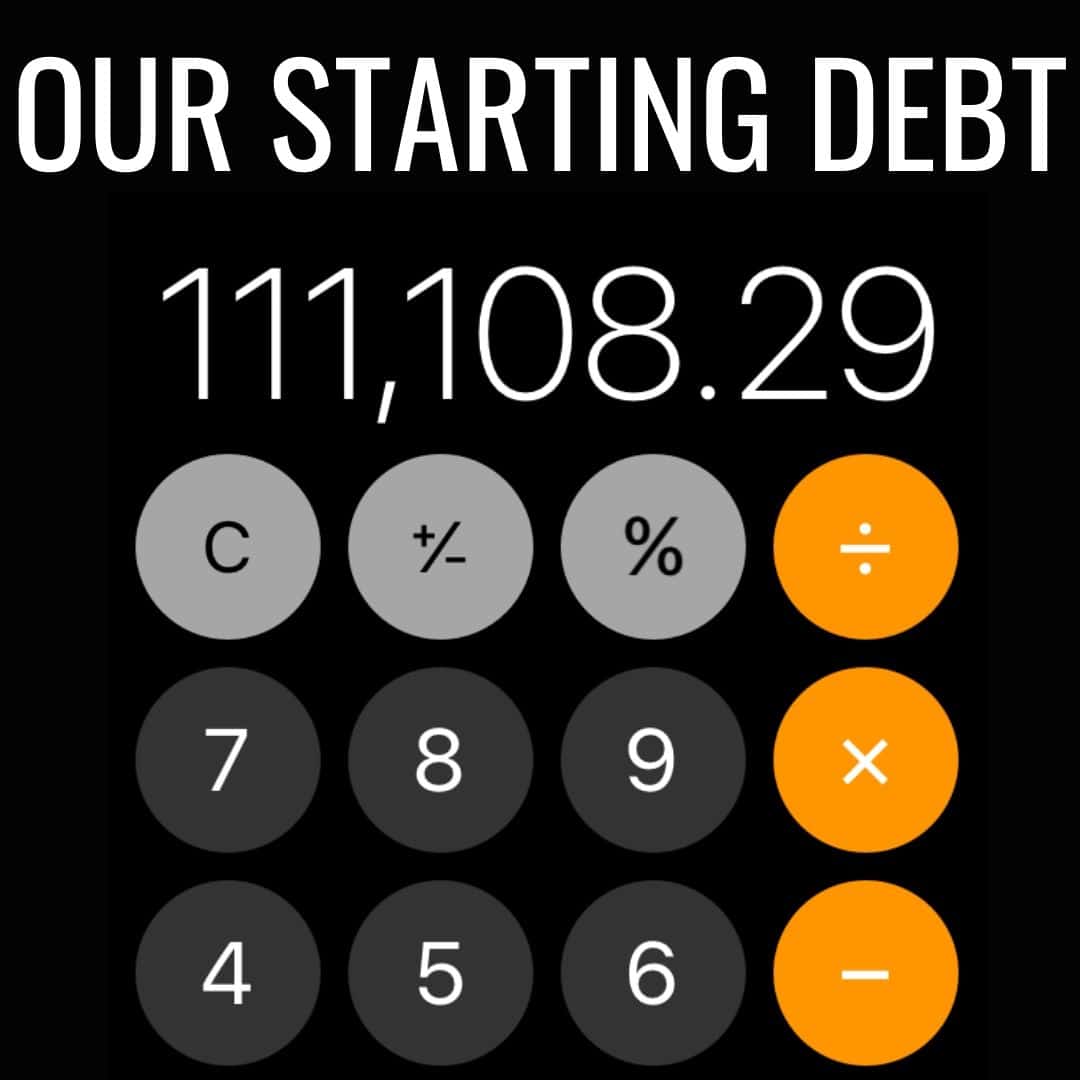

We’ve been there before. When we were just in our twenties, my husband and I had the goal of becoming debt free (you can read more about that story here). With over $111,000 of debt hanging over us, our goal felt ABSOLUTELY impossible. And did I mention we only had two measly teacher salaries?

It wasn’t easy. And if I’m being completely honest, part of me kept saying “why even bother?”

Why even bother trying to pay off the debt?

The world tells you that you can’t do it.

The world tells you that you’ll have student loans forever.

There’s no way you’ll be successful.

Why even bother?

But I knew deep down that we had to try. My husband and I wanted to become debt free more than we wanted the vacations we would be missing.

We wanted to become debt free more than the fancy house that the bank told us we could afford.

And yet, that goal still felt SO HUGE. It felt overwhelming. And that’s when most people give up on their goal.

Goals Don’t Have To Be Overwhelming

During the short term ups and downs of our journey, I clung to the long term truth that goals don’t have to be overwhelming.

The ability to reach those BIG goals and dreams that you may have set comes down to everyday habits. Simple, small habits ultimately help you reach the BIG goal you’ve set.

Our family would not have become debt free if we hadn’t created the daily habit of meal planning every week. This single habit helped us cut down our budget so that we could pay off debt quickly.

If you want to be successful, it comes down to setting small monthly goals that can truly change your finances!

3 Ways We Set Small Money Goals To Pay Off Over $100K

When I look back on our debt free journey, I realize that we did 3 specific things to help us reach our goal faster than we thought we would.

1. We chose to pay off one debt at a time.

Although I don’t believe everyone needs to use the debt snowball method, it definitely worked for us! We started by making minimum payments on all our loans except one. This gave us the ability to make HUGE payments on one loan.

I started to actually look forward to making debt payments. Seeing a loan decrease so suddenly was exhilarating. Being able to focus on one debt at a time helped us stay motivated on our debt free journey.

I believe that if we were focusing on ALL our loans, we would have become overwhelmed, frustrated, and might have given up.

2. We tried to “beat” our previous month.

When it came to paying off debt, I used to always have a competition against myself. If I paid $1,000 to a loan last month, then this month I wanted to send MORE than I did the month before. Essentially, I continued to be in competition against my former self.

Was I always able to send more to debt than I had the month before? Nope! But in the months that I did, I was so proud of our family!

3. We intentionally set weekly and monthly goals.

Setting smaller goals that support your large goal is a great way to make progress all around! During our debt free journey (and still to this day!) I write out weekly, monthly, and yearly goals. I make sure that my weekly goals support my monthly goals and that my monthly goals support my yearly goals.

For instance, if I want to save money this month, then one of my weekly goals might be “cook at home all week” so that we spend less on eating out. Setting small goals like these have helped our family develop the habits we needed to pay off over $100,000 of debt.

How You Can Set Small Money Goals That Will Help You Make Amazing Progress

If you want to actually make progress toward your big financial goals, then you’ll want to do the following:

1. Break your big goals into yearly and monthly goals.

Let’s say that you have a $20,000 car loan that you want to pay off in 2 years. You’ll want to break that big goal up into yearly goals. That means you’ll need to pay $10,000 toward your car payment this year. Then, divide the $10,000 by 12 months. This means you’ll need to make an $833.33 payment toward your car every single month.

The idea of making an $833 payment each month is a LOT less overwhelming than the idea of paying $20,000! Breaking your goal up into yearly and monthly goals is necessary.

2. Identify the daily habits that will support your monthly goals.

If your goal is to save $1,000 this month, what daily habits can you put in place to help you reach that goal? For instance, maybe you have 15 no-spend days or you plan to cook at home 6 nights each week. Setting daily habits will help make reaching that monthly goal easier.

3. Track the progress you’re making.

If you’re working toward setting small monthly goals to help you develop better money habits, then you’ll want to track the progress you’re making. Being able to go back and look at how far you’ve come will help keep you motivated on the days that you want to give up.

Find a progress tracker that works for you! It doesn’t matter if you download a progress app, write it down in the notebook, or grab my free money goals tracker. Just find something that works for you!

But What If I “Fail?”

No one is perfect! There will be moments in your life that you don’t make as much progress as you wanted. And guess what…that’s okay! Just because you don’t meet a goal you set doesn’t mean you failed.

If you had a goal to send $1,000 to debt, but you only sent $850 to debt you’re still making incredible progress! That’s $850 that you sent toward debt!! When you set intentional goals with your money you are likely still making progress even if you don’t meet a specific goal.

The people who continually try month after month or day after day are the ones that will be successful!

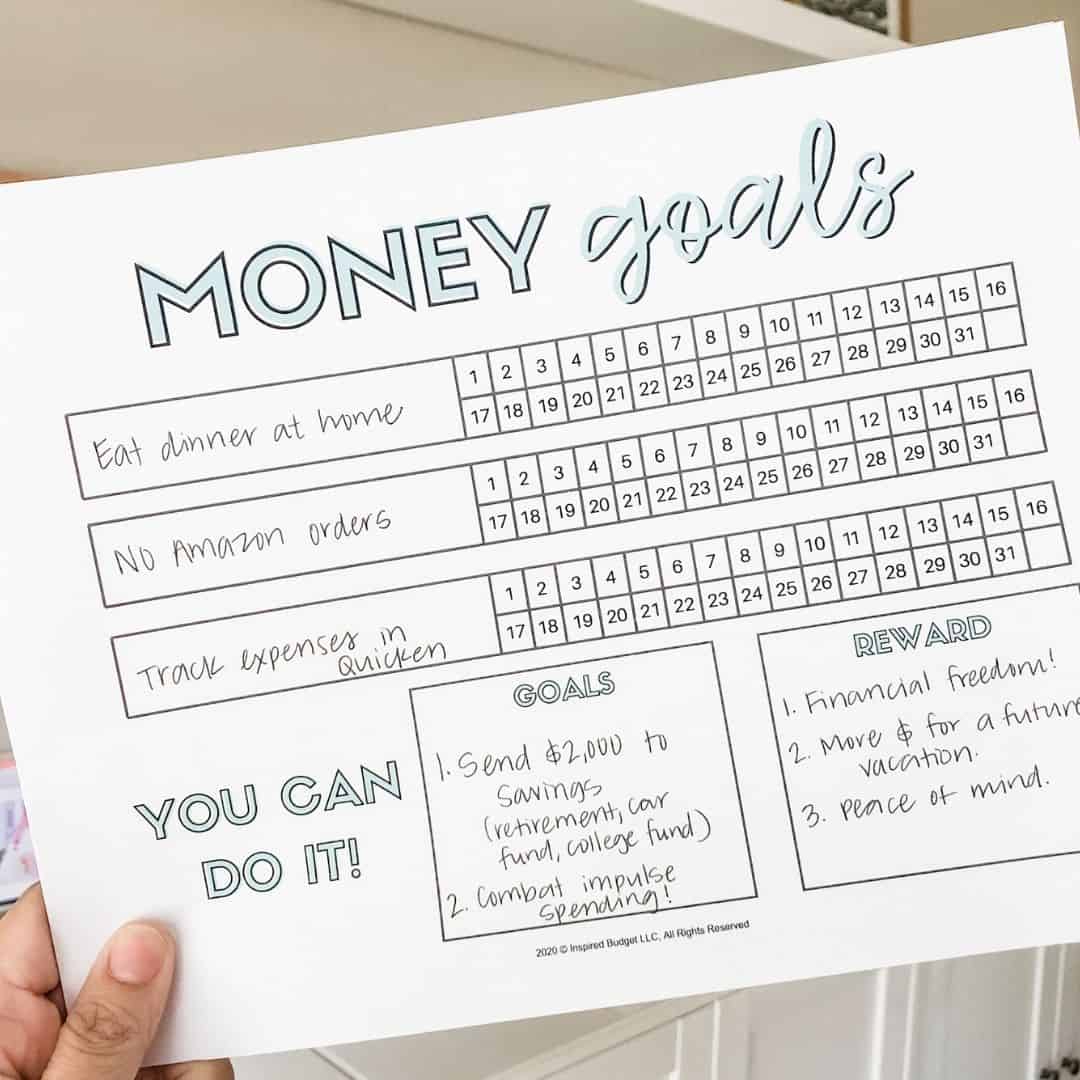

Get Your Free Money Goals Tracker

Ready to break your big goals down into daily goals you can track? If so, I’ve got you covered! Grab your FREE Money Goals Tracker HERE.

Identify 3 goals that you want to track for the month. Write each goal down in the box. Then, color in each day that you were successful.

For instance, let’s say that you want to save money by cooking dinner at home. Each night that you cook dinner at home you’ll color in a box. If you cook dinner at home on the 5th, 6th, and 8th of that month, you’ll color in boxes 5, 6, and 8.

Or maybe you want to cut the online shopping habit that is costing you money. This allows you to track (and celebrate!) the days that you don’t buy anything online!

By the end of the month, you’ll be able to visually see the progress that you’ve made! This is perfect for you if you tend to get started on a goal but always seem to give up after a while.

Ultimately, remember that you are capable of more than you or anyone else gives you credit for! Your money and financial goals won’t be as big and scary when you break them down into smaller goals. Then, simply take it day by day or week by week. Track your small goals so that you can make unthinkable progress on your finances!

What goals will you be working on? Let me know in the comments!