I was standing in the small lobby of a car repair shop on a hot summer day wishing I had set aside sinking funds for this very moment. I was fresh out of college and had no idea that I should have been saving money for car repairs.

I’ll never forget standing there and handing over my debit card. I had just transferred over every penny from my small savings account to cover the cost of the repairs.

Looking back, I cannot for the life of me remember what had to be fixed on my car. But I’ll never forget that moment of fear, anxiety, and stress. I knew deep down that I wasn’t prepared to pay for the car repair. I was scared to have zero dollars in savings. And what would I do if my car broke again?

It wasn’t until a few years later that I actually took action and started using sinking funds to save money for the expected (and unexpected) events that life throws at you.

If you are ready to start using sinking funds, then I’ve got you covered! I’m answering all your questions so that you don’t find yourself in the same position I found myself on that summer day.

What is a sinking fund?

A sinking fund is a strategic way to set aside money for upcoming events, payments, or unexpected costs.

For instance, we all know that cars don’t last forever. Eventually, you’ll need new tires, oil changes, or even large expenses such as new brakes. Because you are expecting these types of costs in the future, you can set up a sinking fund to help with these future costs.

Put as much (or as little) money each month into your sinking fund. When the inevitable happens, you’ll have money saved for that specific situation. It takes the burden of paying for that expense out of your monthly budget. It also keeps you from going into debt to cover unexpected expenses.

Why should I have sinking funds?

Let’s be real for a second.

Life happens.

Whether you like it or not, there’s going to come a time in your life when you need extra money to cover an unexpected expense. Likewise, there will come a time when you need money to cover expected expenses such as birthdays and Christmas.

But so many people aren’t prepared for both the expected and unexpected situations that life throws at us!

Sinking funds provide a savings solution so that you aren’t stressed, anxious, or overwhelmed when life happens.

When you start saving money with sinking funds you can:

- Prepare for things you KNOW are happening. You KNOW that come December, you’ll have to spend extra money for Christmas. You also know that when birthday months come around, you’ll need to buy gifts for your family. Sinking funds are perfect for preparing for life events that you know are happening in advance.

- Save money for what you WANT to happen. If you know deep down that your family is going to want to go camping this summer – then set up a sinking fund for it! Determine how much money your family will need for a camping trip and simply calculate how much you’ll need to save each month. This way when it is time to head out on the camping trip, you have zero guilt for spending money!

- Prepare for an event that might happen. If you own a car, then you should have a car repairs sinking fund. Deep down, you know that you’ll likely have to make car repairs one day. Setting aside money for these types of repairs not only helps you cover the bill, but it eases the stress and anxiety that comes from large repair bills.

How sinking funds work.

Sinking funds aren’t as complicated as they sound.

When you sit down to write your budget each month, be sure to include them as a line item in your budget. Just like you’d include electricity or Netflix in your budget, make sure your sinking funds are given a priority!

As you start saving money, be sure to keep track of how much money you have in each sinking fund.

When you’re ready to spend the money in your sinking fund (like when December hits and it’s time to go Christmas shopping), simply pull the money out of your sinking fund. If you need to refill your sinking fund, then continue to add the cost into your monthly or biweekly budget.

I don’t know about you, but I learn better through examples. Let’s say you want to start saving money for vacation, car repairs, birthdays, and Christmas. You might save:

- $150 each month for vacation

- $100 each month for car repairs

- $50 each month for birthdays

- $120 each month for Christmas

- In this example, you would be saving $420 in total each month.

If you start these sinking funds in January, by the end of the year you will have saved:

- $1,800 for vacation

- $1,200 for car repairs

- $600 for birthdays

- $1,440 for Christmas

- $5,040 total!

How incredible is that? Not only will you be prepared to pay for a vacation in cash, but you’ll have money in car repairs, birthday money covered, and Christmas taken care of!

Even if you have to pull money out of car repairs and birthdays along the way, you’ll still probably have money leftover by the end of the year.

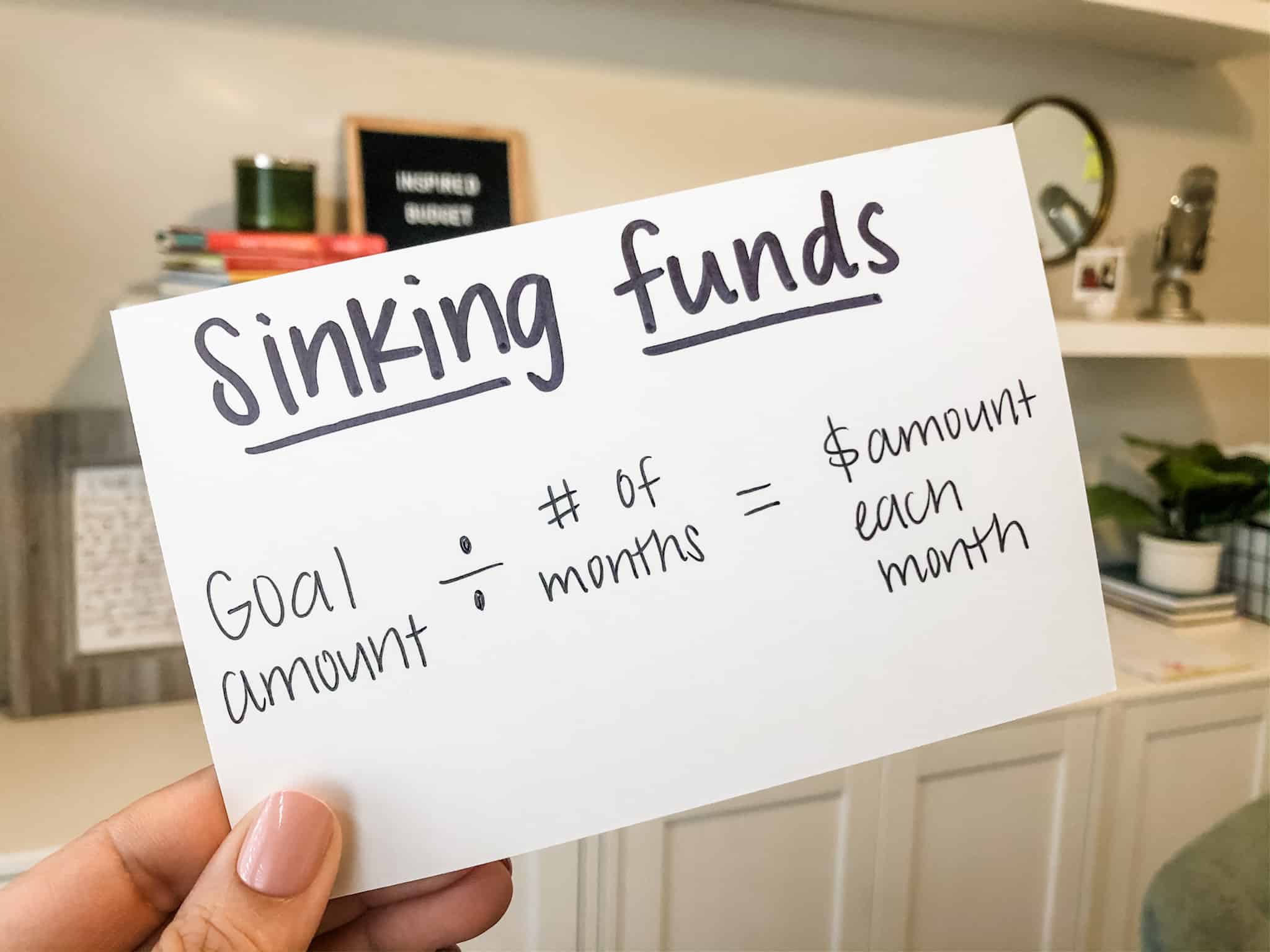

How much money to put in sinking funds each month.

When it comes to saving money, the first step is to determine how much money you want to save. For example, let’s say that you want to have $1,000 saved for Christmas. This will include both Christmas gifts as well as anything else Christmas-related (like pictures with Santa).

Simply take the amount you want to save and divide it by the number of months you have until you need the money.

If you want to save $1,000 for Christmas and you start saving in January, then you’ll take $1,000 and divide it by 12 months. That comes out to $83.33 each month. This means you’ll want to set aside about $84 each month. Personally, I’d just round it up to $100 each month.

Types of Sinking Funds

Below are several ideas of sinking funds that you might want to have in place. Start off small by choosing 2-3 essential sinking funds to begin with. As you grow more comfortable with saving money, you can increase how many types of sinking funds you have (or just keep a few)!

- Car Repairs: Cars are going to break, so you should be prepared for it!

- Christmas: Christmas is on the same day every year! Save a small amount of money each month to help cover the costs of the holiday season. To read more about how to budget for Christmas, click HERE.

- Home Repairs: Just like a car will need new tires, a home will need new appliances, air conditioners, etc. If you have a home repair sinking fund, you are sure to be less stressed when things don’t go as planned.

- Vacations: If you know that you want to take a vacation in a year, then why not set up a sinking fund to help cover the cost of the trip? Even if you don’t save enough for the entire trip, try saving for ¾ of it. Vacations are more fun when you pay for them in cash!

- Taxes/Insurance: When property values increase, your taxes will increase as well. Plan in advance by saving $50 each month to take the edge off the increased costs.

- Birthdays/Anniversaries: Don’t blow your monthly budget just because your family goes all out for birthdays and anniversaries!

- Medical Visits: If your insurance is not the best, or you aren’t able to put money into a pre-tax savings account, then have a medical sinking fund. Let’s face it, someone is going to get sick or break a bone.

Be sure to include types of sinking funds that work well with your unique situation.

How many sinking funds should I have?

If you are working to pay off debt right now, then choose the 2 or 3 essential sinking funds to include in your monthly budget. While we were on our debt free journey (read more about how we paid off $111,000 on 2 teacher salaries), we only had a Christmas sinking fund and car repairs sinking fund.

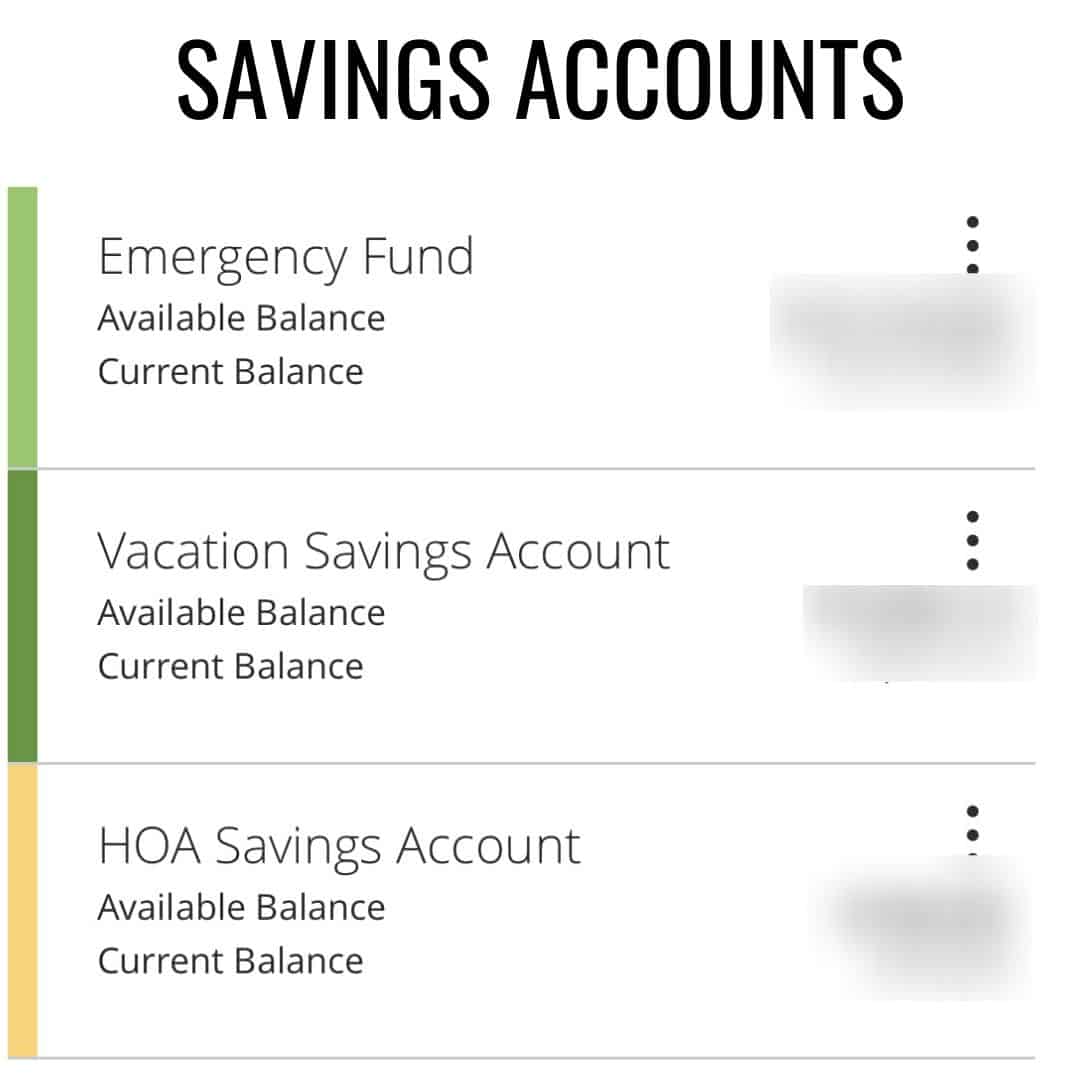

Now that we are debt free, we have more sinking funds set up. We are currently saving money for:

- Car repairs: We both drive cars that are over 10 years old. We wan to be prepared if they break.

- Pet care: Our dog is 13 and on his last leg (well, he actually only has 3 legs!)…so we know that emergency vet visits could happen any minute.

- Vacation: Not only do we take a family vacation each year, but we also take a couples vacation (just me and my hubby) every summer. This was one of our biggest reasons for wanting to become debt free…we want to travel the world!

- Christmas: The season is less stressful when we have money set aside.

- HOA Dues: Our HOA dues cost over $1,000 every January. We are currently setting aside $100 each month to prepare for this yearly expense.

Remember that every person’s situation is unique. Your sinking funds probably won’t look like anyone else’s….and that’s okay! Make them work for you and your family.

How to organize sinking funds

When it comes to keeping your sinking funds organized, you have a few options.

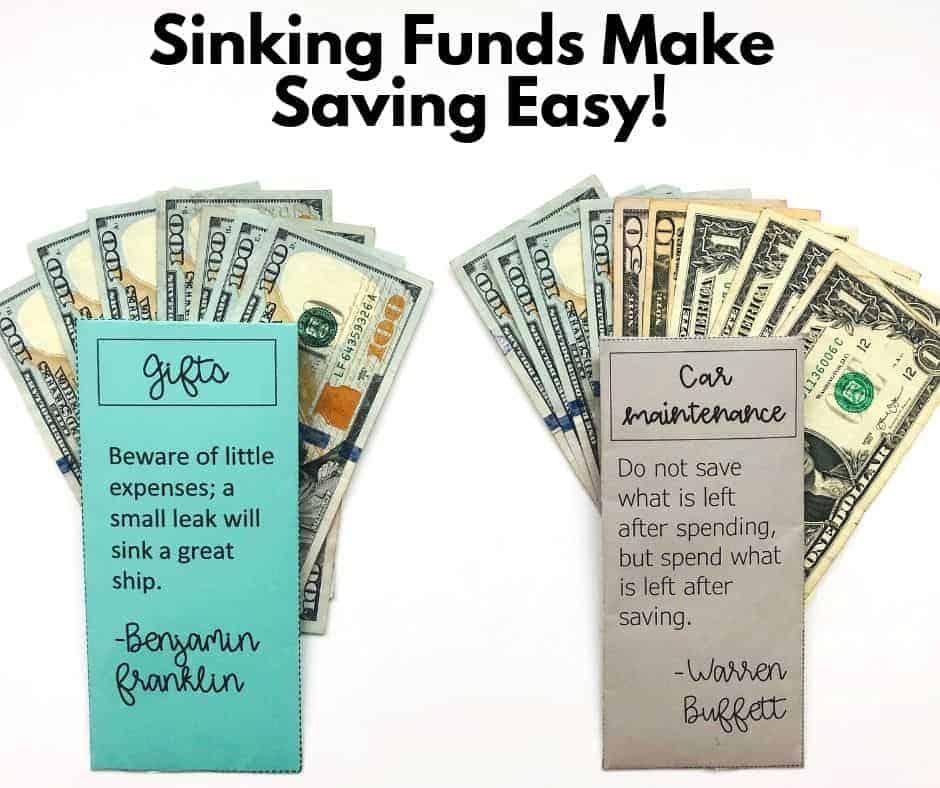

- Option 1: Use cash envelopes to organize your sinking funds. If you know that you’ll struggle with using money that’s linked to your checking or savings account, then consider keeping using cash envelopes to save your money. This is perfect for those funds that you might need to “grab and go” such as car repairs.

- Option 2: Create a separate savings account for your sinking funds. Most banks will allow you to have multiple savings accounts. You can even rename the savings account to be the name of your sinking fund! For instance, our family has separate savings account for HOA dues and another account for vacation.

What’s great about saving money this way is that you can mix and match how you save your money! We personally use both cash envelopes and savings accounts to save money.

The most important thing is to organize your sinking funds so that they make sense to you.

Sinking Funds vs. Emergency Fund

You might be thinking “why should I save more money if I already have an emergency fund?”

Look, I totally get it!

But emergency funds and sinking funds have completely different purposes.

An emergency fund is there to cover the cost of major (and unexpected) expenses. For instance, when our son had to have emergency surgery for a ruptured appendix, we used our emergency fund to cover those hospital bills.

Your emergency fund should only be touched in case of an EMERGENCY. It should not be used for vacations, oil changes, or birthday gifts. Christmas is never an emergency because you know it’s coming.

Sinking funds are meant to cover the cost of expenses that you know will happen or expect to happen. They typically aren’t emergencies.

How sinking funds saved our sanity

To be honest, we started using saving money over 6 years ago because I struggle with anxiety (read more about dealing with money-related anxiety). Anytime we would have an unexpected purchase, my anxiety level would increase.

I tend to want to be in control of things (if you know me you’re probably nodding right now), so I felt completely out of control when we didn’t plan in advance for something.

My anxiety usually centers around unexpected expenses like when a car needs to be fixed. Once we set up our car maintenance sinking fund, I immediately felt relief. I cannot tell you how many times one of our cars has needed an unexpected small (or large) repair and our sinking fund came to the rescue!

If you also struggle with feeling defeated any time there is an unexpected expense, then set up a sinking fund. You’ll be so thankful when you know that you have money in place to cover any problems that come your way!

The bottom line

Ultimately, these essential funds are here to help you reach your financial goals. They are a proactive way of acknowledging that not everything will go as planned.

Instead of relying on a credit card to help you cover an expense, sinking funds allow you to save your OWN money for what life throws at you.

Don’t let situations control you. Have essential sinking funds in place so that you are in control of your money and finances.