When my husband and I were on our debt free journey, I was determined to save money. One day I stumbled upon a couponing site. My eyes widened, the clouds parted, and suddenly it was obvious: This was it. I would become a couponer to save money. There were so many couponing sites dedicated to saving me money. Sign. Me. Up.

A few days later I had my coupons in hand, ready to hit up CVS. One website had let me in on a little secret about how to get Dawn dish soap for crazy cheap. After the coupons, sales, and Extra Cash from CVS, I would be saving money.

My husband and I headed to CVS and he waited in the car with our 2 month old baby while I ran in the store to “just grab a few things.” I walked out of the store with no less than TEN Dawn dish soaps and a mile long CVS receipt.

I’ll never forget my husband’s reaction when I climbed in the car. He was in shock. I was immediately bombarded with questions.

“Why would you buy so many dish soaps?”

“Is this really saving you much money?”

And my personal favorite…

“We live in a tiny apartment…where on earth are these going to go?!”

After too much time searching coupon sites and spending my energy finding the best deals, I had enough dish soap to last me four years…and in the end I had only saved a few dollars.

I quickly realized that this entire couponing thing wasn’t for me. It took too much time, too much work, and left me storing stuff that I simply didn’t have room for. In the end, couponing was not an easy way for me to save money.

That entire experience taught me to focus on finding easy ways to save money. Ways that will give me a bigger bang for my buck and leave me with more room in my kitchen cabinets.

No matter if you have a goal to invest in your Roth IRA, pay off that annoying credit card loan that keeps you up at night, or save for a family vacation – finding extra money each month can help you get there.

In this article I’ll be sharing 5 easy ways to save money this year – no matter if you’re a seasoned saver or brand new at this whole “adulting” thing.

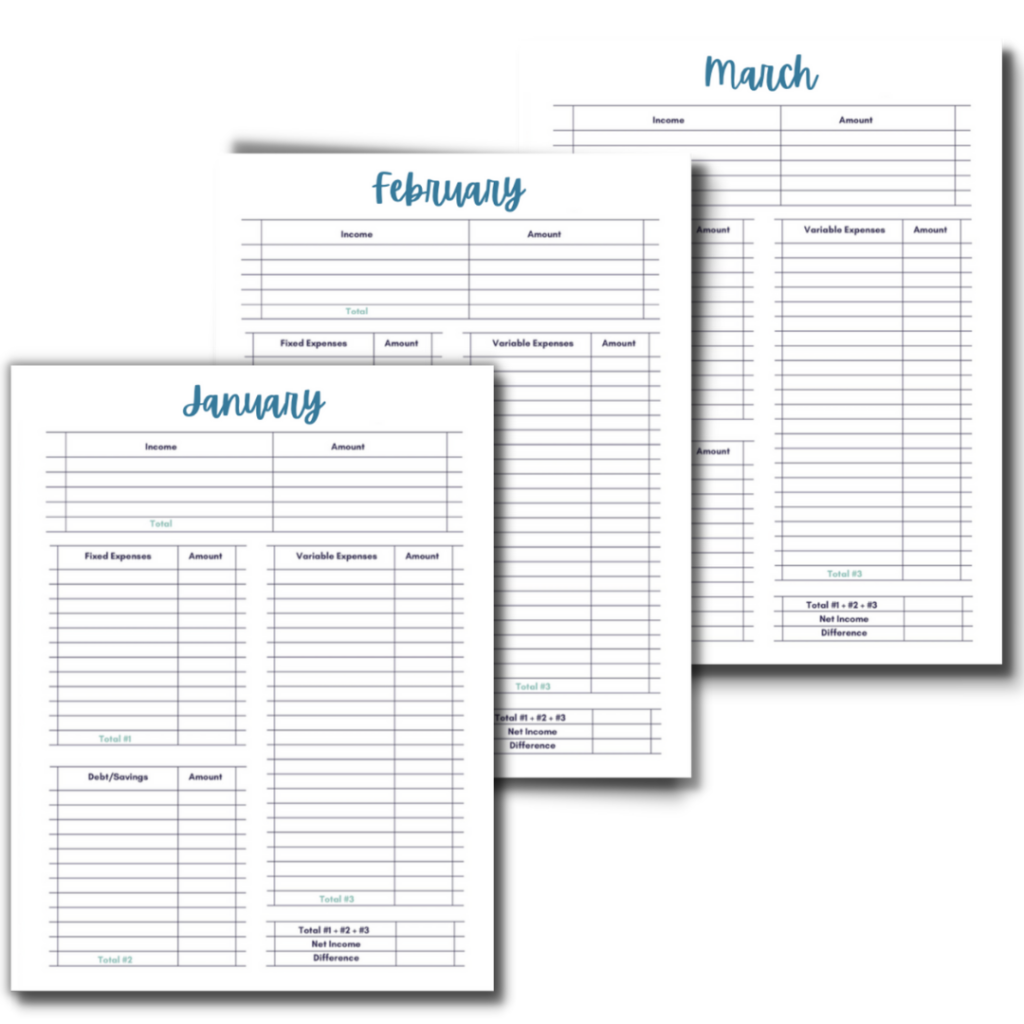

Money Saving Tip #1: Create A Budget

I used to think that budgets were terrible. Even the word “budget” sounded like a punishment. I likened it to a timeout for my money and fun.

Mostly, I viewed a budget as a limit on my life. In my eyes it was something that would hold me back from spending money on what I wanted. I was sure that a budget would keep me from enjoying life.

Many people view their budget the same way I did.

Why?

It’s because we fail to think about what a budget can offer us. Instead, we only focus on what a budget will take away from our lives.

Instead of hating the word “budget” like I did, I want you to think of it this way: a budget is simply your spending plan or road map for your money.

When I was in high school, I went with my friend’s family to a college football game. This was incredibly exciting for me, and I enjoyed the entire experience. On the way back, however, there was a terrible wreck that shut down the entire highway. Now, this was way before GPS systems were readily available, and a phone could only call and text.

My friend’s dad got off the highway and pulled out a large map of Texas. He peered over the map determined to find another way home. A way that would not have us sitting in traffic for an extra three hours.

After a few minutes we were on our way: driving down small roads while everyone else was stranded on the highway. We ended up making it home hours before we would have all thanks to a map. It helped my friend’s dad determine another route to our destination. Without the map, he wouldn’t have known where to go. We would have been stuck like everyone else. But we weren’t!

Your budget is your map, but for your money. It’s your opportunity to pick the best route to reach your destination, or money goals. Your budget is simply a plan. It doesn’t have to be limiting unless you want it to be. Your budget can include as much, or as little, as you’d like.

Do you want to pick up coffee for yourself and a pup cup for your dog every Friday morning? Perfect! Put it in your budget.

Do you want to plan a girls’ trip every summer with some of your best friends? I do. Add it to your budget.

Your budget gives you the opportunity to be intentional with your money. It allows you to decide what you want to spend money on. It gives you the freedom to prioritize what you value most.

Without a budget, many people don’t take the time or energy to think about how they want to spend, or save, their money. Instead, they are stuck in a cycle of spending when the opportunity arises. Instead of being proactive with their money, they are reactive.

With a budget in place, you’ll be able to prioritize saving money, instead of just “hoping” that you’ll have money leftover to send to savings.

Money Saving Tip #2: Automate Your Savings

When my husband and I first moved into our home, we were told that our Homeowners Association dues would be due in January. “Perfect,” I thought. I can save up enough money to cover the $1,000 dues before then.

I bet you can guess what happened. Even though I am a budgeter at heart, I completely forgot to set aside money for our HOA dues. It wasn’t intentional by any means, it was just an absent thought.

Fast forward to January and a bill for over $1,000 appears in our mail. That’s when I remembered that I had told myself I would set aside money each month for this upcoming cost. Oops.

Needless to say, I wouldn’t have been caught off guard by our HOA bill if I had automated my savings.

Automating your savings is a great way to save money without even thinking about it. Set up automatic transfers from your checking account to your savings account so you can save a little bit each month without having to remember to do it manually.

This is exactly how we make saving automatic. Every month on the 4th, about five days after we are paid, I have money automatically transferred to my online high yield savings account. I have $175 set aside for Christmas each month and another $175 set aside for HOA dues as well as flood insurance. This way, when Christmas rolls around in December, I have money set aside to cover the costs.

The same is true when our flood insurance comes due in the summer or our HOA bill hits in January. The fact that it’s automatic makes saving money easy and a non-negotiable in my life.

Now it’s your turn! Think about two areas of your life that you’d like to save money. Maybe it’s your emergency fund or summer camp for your kids. Now, determine how much money you’d like to set aside each month for you to reach your goal. Then, set up easy automatic transfers from your checking account to your savings account.

Money Saving Tip #3: Shop For Better Prices

Every January my husband and I embark on the same tradition: we shop around for cheaper car and home insurance. We set aside 30 minutes to shop for more affordable car and home insurance.

In the past we’ve used sites like thezebra.com. This site will ask you questions such as where you live, your car make and model, and how much you drive each day. Then, they will give you quotes from many companies to choose from. They won’t ask for your phone number, so you won’t be spammed with random calls. Other times we’ve gone directly to insurance websites to receive a quote.

Another way to get the best price on car or home insurance is to check for discounts. You can also check your current insurance company for discounts. Insurance companies often offer discounts for things like having multiple policies, having a good driving record, and installing safety features on your car.

You can also ask about bundling discounts. Most insurance companies offer discounts if you bundle your car and home insurance policies with them. This is exactly what our family did to save money on insurance.

And of course, don’t be afraid to negotiate: If you find a better price from a different insurance company, don’t be afraid to ask your current company if they can match or beat it.

My friend shopped around for a better price on insurance recently and saved his family $1,000 over the entire year! The best part is that you can complete this task once and enjoy the savings all year long.

Money Saving Tip #4: Cut The “Extra”

Can we agree that there are times we don’t actually know what we are spending are money on? Sure, we might have the best intentions with our money, but in the moment it’s easy to spend money on non-essential items, or even things that you don’t even use!

Just a few weeks ago we canceled another streaming service that we were no longer using. Sure, this service only costs us about $15 each month, but if I’m not using it, why would I spend money on it?

It’s time to go through everything you’re spending money on and cut out the “extra.” Start by making a list of all your expenses. An easy way to do this if you’re not currently tracking your spending is to print your bank or credit card statement from last month.

Then, grab 3 different colored highlighters. One color will be for the essentials, such as rent, utilities, minimum debt payments, and other fixed expenses. The second color will be for expenses that you want to keep, but can likely lower – such as groceries, restaurants, or even spending money. The third color will be for expenses that you are willing to cut out of your life completely – this is the “extra” that you’ve been holding onto.

Once you have your three colors, scan through your bank statement and categorize every single transaction.

- Color A: The essentials

- Color B: Expenses that you can likely lower or spend less on

- Color C: Extra expenses that you’re willing to cut out of your life

While this task might take some time, I promise it will be worth the effort. This is a wonderful way for you to review what you’re spending money on and make sure that it aligns with your goals and values.

The truth is that you can save money while still spending money on what brings you joy. You just have to be intentional about it.

Money Saving Tip #5: Use Cash

One of my favorite ways to save money is to use cash envelopes. A recent MIT study showed that people spend 100% more with a credit card than with cash. Implementing small tips like this one add up and can help you save serious money.

The cash envelope system is a way for you to take back control and track how much money you’re spending on certain categories in your budget. Instead of using a debit card or credit card, you’ll use cash for areas in your budget where you tend to overspend.

If you struggle with grabbing takeout or fast food too often, then you can have a cash envelope specifically for restaurants. Use the money you’ve set aside for restaurants any time you go out to eat.

Once you’ve used up your budgeted amount, you won’t have any cash left in your envelope! This helps keep you on budget and not overspend each month.

I don’t recommend pulling cash out to pay your rent or electricity bill. Those are both expenses where you aren’t likely to overspend each month. Instead, pull cash out for areas in your budget where you tend to spend too much money.

Chances are you know where you tend to overspend. A few common budget categories for cash envelopes include groceries, restaurants, and personal spending money.

If you’ve never used cash envelopes before, don’t go overboard in the beginning. Start with a few envelopes and build up from there. You are changing a habit and that takes time. Committing to one cash envelope category at a time will help you make lasting changes so you won’t worry about slipping back into your old habits.

I got into detail on how to use cash envelopes in episode 21 of the Inspired Budget Podcast. I highly recommend checking it out if you want to implement cash envelopes in your spending plan.

Easy Ways To Save Money: The Bottom Line

If you’re willing to implement even a few of these easy money saving tips, you’ll be sure to save serious cash over the next year. The best part is that you’ll end up with more cash in your checking account instead of 10 extra Dawn dish soaps under your kitchen sink.