These are the best apps and tools that you need to learn how to balance your checkbook each month so that you can manage your budget. Even if you are a beginner at budgeting and money management, this guide is just for you!

Do people even balance their checkbooks anymore? What does that phrase mean?

When it comes to balancing your checkbook, it’s important that you:

- learn some tools that make it simple

- discover real-life benefits of looking at your account every month

- 6 steps to balance your checkbook

- best apps to help you balance your checkbook or checking account

What Is Balancing A Checkbook?

The phrase “balance checkbook” means something different today than it did years ago. Another term for it is reconciling your account. It basically means double-checking that the records you kept match the ones your bank has on their monthly statement for your account.

Here is where the phrase came from!

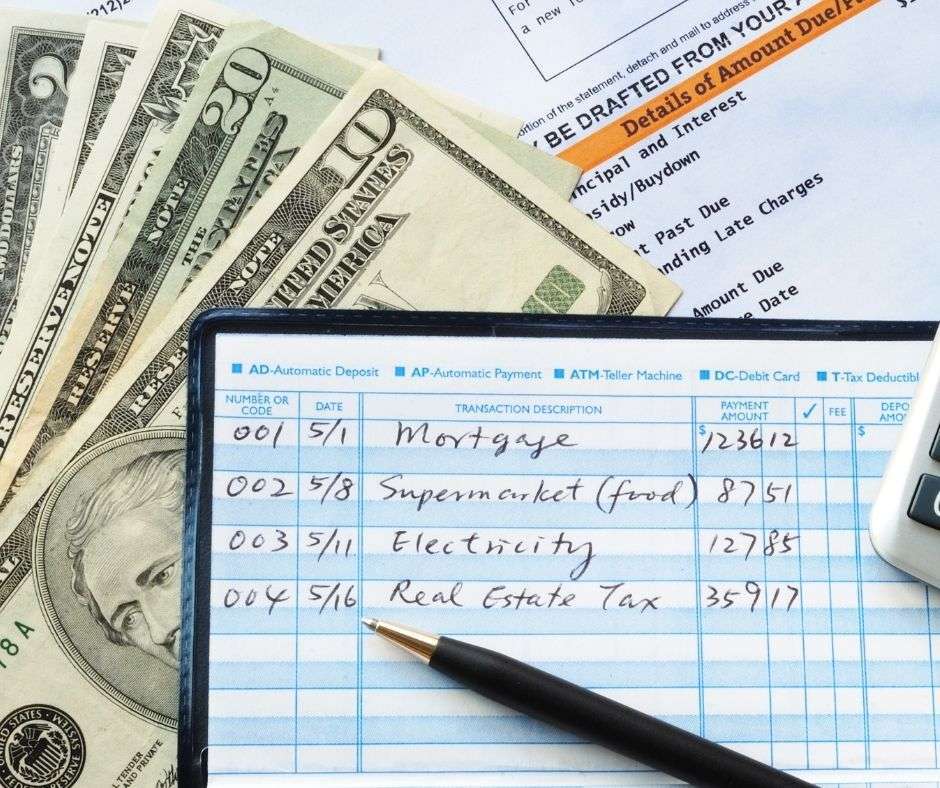

Back before online banking and debit cards were the norm, people used to use a checkbook to write checks. Then, they would record the amount in their checkbook in their register.

At the end of the month, they would receive a bank statement of all of the checks that cleared and the withdrawals and deposits to and from their account. They would compare the ending balance they have with what their bank said they have and then see if there are any mismatched records.

Why People Balance Their Checkbook

Even if you don’t own a checkbook, it is important to read through your bank statements at least once a month and verify that the transactions match what you spent and/or deposited.

It might seem like a really annoying chore, (does anyone balance their checkbook anymore?) but it is so important.

Spot Fraud Early

When you reconcile your account each month, you will be able to catch instances of fraud quickly and respond to them appropriately.

A very sneaky method that identity thieves use is to withdraw a tiny amount at first (sometimes as small as a few dollars or as much as $20) just to see if it triggers a response. If that tiny amount goes unnoticed, they might go for even more money the next time.

Catch these small errors fast and you could avoid a big headache later.

Catches Bank Mistakes

It’s true- banks make mistakes too. It’s very important that you keep records of all your transactions and compare them to what your bank says happened.

This way, if they recorded an incorrect deposit or withdrawal amount, you can let them know within the proper time frame. Some banks have a 60-day limit within which you can resolve errors before they are not liable anymore.

Spot Merchant Mistakes

Sometimes, retailers get hacked and this can lead to larger debits than the purchase you made. Other times, their point-of-sale system might charge you twice for the same transaction.

Either way, when you reconcile your account, you can catch these errors and resolve them quickly.

Helps You Avoid Overdrafts

One of the best ways to save money is to avoid paying overdraft fees. The best way to do that is to keep excellent track of how much you spend and going over your checking account transactions each month.

Assess & Manage Your Budget

Finally, lots of people also use this time each month to compare their ending balance with their budget.

- How accurately did you follow your budget?

- Do you need to adjust it at all?

This is also a time to look at the various ATM fees you paid.

- Can any of them be avoided?

Catch the small transactions and make a plan for how to save every cent that you can.

How To Balance Your Checkbook

Now that you know how important it is to balance your checkbook, how do you even do it? These are the steps!

This is how you balance your checkbook from start to finish.

Step 1: Record Every Transaction

The very first step you need to do is to have a list of transactions that you can compare to your bank’s monthly statement. If you aren’t in the habit of keeping a list of every transaction, you will need to skip this step, but make it a point to start.

There are lots of apps that you can use to record every single transaction you make. YNAB (you need a budget) and Quicken are fantastic.

Or, you can use free options like tracking your debits and deposits in your own spreadsheets or even a small spiral-bound register!

Whether you use a computer, app, or hand-write your transactions, keep records of them so that you can compare them to what your bank has listed on their statements.

Tip: Always keep receipts for really large transactions and write down any time you write a check (debit card included) or make a purchase that might take a few days to clear.

Step 2: Read Your Monthly Bank Statement

This next step will be different depending on if you kept a record of transactions during the previous month.

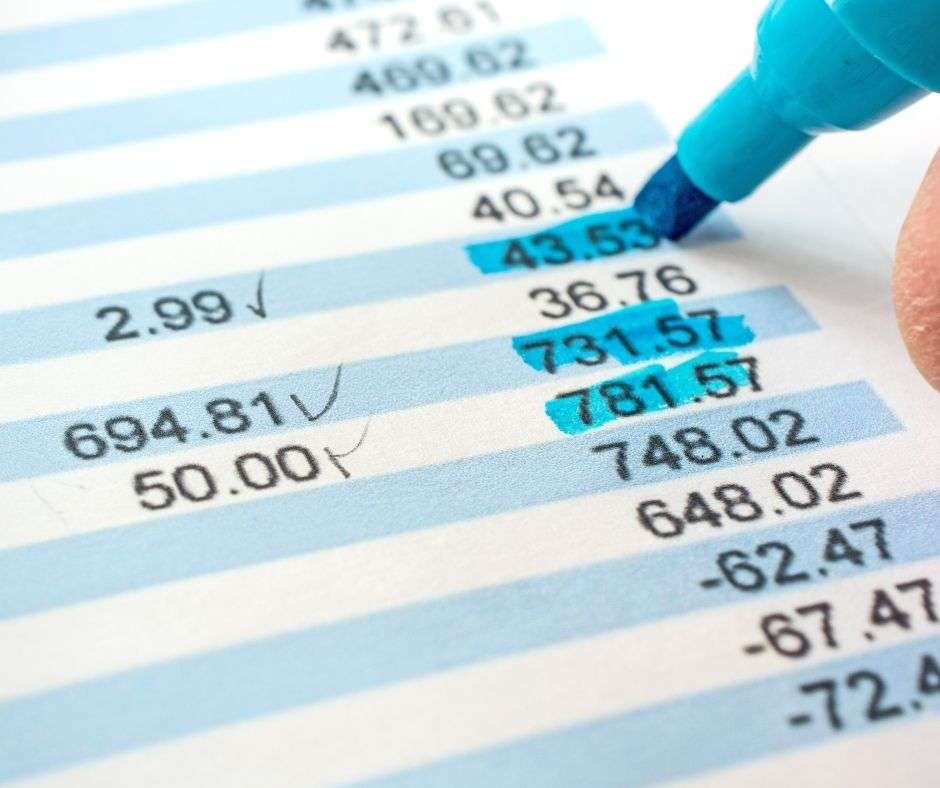

If you kept records, read through the list of transactions and then quickly compare it to the transactions listed on your bank statement. Highlight or mark anything that stands out as missing/foreign or something that you did not do.

You will look closer at the amounts later, but you need to read through entire thing first.

Step 3: Highlight Pending Transactions

Now, look at your transaction log and highlight any transactions that have not cleared your bank yet (or that might not be on your monthly statement).

This includes debit card debits or checks you wrote that the other person didn’t cash/deposit yet.

This is very important because these items could be what makes your balance not match what your bank says it is.

Step 4: Compare Your Balance With The Bank’s

The next step is to compare the current balance you have in your transaction log with the balance on your bank’s statement.

There are a few ways you can do this – pick the one that is easiest for you.

- First, you can just take all the pending transactions and add or subtract them from your bank statement. The final balance should match your transaction log.

- Another option is to go through every single transaction and compare it to your transaction log. This might take longer, but it doesn’t involve any math.

No matter how you do it, it’s important to identify any discrepancies between your records and your bank’s.

Note: It’s called balancing your checkbook because the goal is for your personal records to match your bank’s completely – like a perfect balance.

Step 5: Problem-Solve If Balances Or Transactions Do Not Match

This is the step that usually gives people the biggest headache. What do you do if your balance and your bank’s balance do not match?

If you struggle with math, the problem could be as simple as an addition or subtraction error. In that case, just compare each transaction with your records. If the numbers and records match, then you know there was an error with your math.

Different balances can also be a sign of overlooked bank fees, payments you didn’t make, or a bank error.

Go through the entire month and verify that you made all the transactions and that there isn’t any fraudulent activity going on. If you discover something that you did not do, contact your bank immediately.

Step 6: Prepare For Next Month

Finally, set yourself up for success! What did you learn from this experience that you can use to make next month easier?

A few things that you can do to set yourself up for success next month is to keep better track of your financial activities and maybe even check your online banking transactions more often.

You might also consider using an app or computer software (I personally use and love Quicken) to track your activity too – that way you don’t have to rely on manually adding or subtracting the amounts.

At this point, some people decide that they want to do the cash envelope system instead. This means a lot fewer debits and an easier way of keeping track of how much you spend.

Best Balance Checkbook Apps

Thankfully, there are apps and software programs that will do all the math for you! If you prefer to us an app instead of a hand-written ledger or a spreadsheet, these are the highest-rated ones out there.

Mint

Mint is one of the most popular personal money management apps out there. It’s made by Intuit – the same company behind TurboTax and QuickBooks.

With Mint, you can set up a budget and track your expenses.

Quicken

Quicken has been around for over 30 years and has a great reputation for helping people keep track of their money better. Their software program allows you to track your spending, saving, and even balance your checkbook or checking account directly in the software.

Quicken is a great option if you want to track your spending using a computer. More interested in an app. They have their own app too!

Free Checkbook Ledger

A free Android app, Free Checkbook Ledger is a very simple app that anyone can use. It allows you to record your transactions as you make them.

It works just like a pen and paper, but it does the math for you.

Checkbook – Account Tracker

If you want something that works on both iOS and Android, check out Checkbook -Account Tracker. It allows you to manage all of your accounts, even credit cards, and savings accounts. Then, it creates charts showing you where your money goes.

Numero

This iOS app is robust, fast, and easy to use! You can record transactions easily and then use its monthly summary to compare to your bank’s statement. You can also export reports to a spreadsheet.

ClearCheckbook

Finally, if you want something that you can use online or on an app, then you need ClearCheckbook. This app allows you to sync your online banking to the app, so you don’t have to manually enter things.

If you prefer having control over the transactions, you can choose to enter each one manually as well. This is one of the most popular checking account management tools because you can use it on Android, online, and on iOS.

Final Thoughts

Even though it might seem archaic to balance your checkbook, it’s a very important task that could save you thousands of dollars and avoid the misery of fraud and forgotten subscriptions.

Keeping track of your money will help you stay within your budget. Make this a normal part of your monthly routine so that you can begin to manage your money with ease.