Do you find that it’s harder to stay on track with your budget and keep your spending in check during the summer months?

You might even be going into the season with a good hold on your finances, a budget that’s been working for you, and a money routine that helps you stay on track. But by the end of the summer, all the vacations, summer outings, new patio furniture, and new summer wardrobe for the family has caught up to you and you’re left with a massive amount of guilt hanging over you along with a large credit card bill to reinforce that feeling. I’ve been there. My husband and I had the summers off from teaching, meaning we had a lot more time on our hands to spend money. If you can relate, this episode is for you! I’m going to be sharing the 4-step framework to help you avoid going overboard with your spending while taking back control by creating a plan for your summer money. I’ll be showing you exactly how you can free up money in your budget to be able to adjust for summer fun!

Step 1: Look

The first thing I want you to take an honest look at your money and ask yourself the following questions

- Am I tracking my spending and expenses?

- What does the past 2-3 months of my past spending actually look like?

- Am I happy with my spending patterns and what I am spending my money on?

- Am I able to easily pay all of my necessary bills right now? If not, what is getting in the way? Do you not have enough money coming in? Or, are your overspending?

- Do I have any money leftover at the end of the month that I’m able to send to debt or savings?

- What areas of my budget am I overspending on?

- Are there any changes I want to make in my bills or spending for the summer months?

A lot of people are actually really surprised by the habits and trends they’re able to identify once they review and evaluate their previous month’s spending. If you know that you have not been tracking your spending, I want you to look through your bank statements and determine how much you’re spending in each budget category. Then I want you to ask yourself, are you happy with this? Can you look at your past spending and say, “Hey, you know what, no one’s perfect. This month wasn’t perfect spending wise. But yeah, I feel really good about what I spend money on and I can actually move forward confidently with this type of spending pattern.” If you’re NOT happy with, if you’re thinking, “Oh my gosh, I did not want to spend this much money on restaurants! I didn’t want to spend this much money on entertainment!,” then I want you to ask yourself, are you willing to change it? Are you willing to cook dinner more at home so that way your restaurant spending isn’t so high.

Step 2: Edit

After you’ve taken an honest look at your money and entered a period of reflection on your spending habits and patterns, I want you to to start to edit your spending and expenses. So here’s the truth, a lot of people think that if you write a budget once, it’s going to stay the same year in and year out. Every single month should be matched – you shouldn’t have to change it. That’s the people’s idea of a budget. While that can be true when it comes to your fixed expenses, (rent, mortgage, internet), your spending on the other hand will change from month to month, season to season. Here me when I say this is normal! It’s not that this is bad. What you spend money on in the winter will be different than what you spend money on this summer. For example, in the winter time, our family tends to stay home more, so we might not spend as much money on entertainment. However, in the summer, we tend to go on more camping trips. We travel more. Therefore, our gas bill for our car dramatically increases in the summer. Our entertainment bill also increases significantly. And when we look at that, it’s okay that you’re spending changes from season to season.To adjust for these changes, what you need to do is to edit your how you will spend your money and what you will spend it on! Ask yourself these questions:

- are there an expenses I can remove, temporarily for the summer months, from my budget altogether?

- are there areas of my spending that I can reduce, temporarily?

So for example, maybe you’re looking through your spending and expenses, and you you realize that you don’t spend as much time watching TV over the summer because you’re traveling, you’re more active, or you’re spending a lot of free time at the pool. If that’s the case, then you can decide if you’d like to temporarily remove some of my streaming subscriptions for the summer months. Maybe you decide you don’t want to remove an item from your budget completely. In this case, you can see if you can reduce your spending in that area (temporarily for the summer!). So in the case of the streaming subscriptions, maybe you decide to remove 1 or 2 subscriptions from your budget during the summer.

Step 3: Replace

Once we edit our spending and expenses for the summer months, now it’s time for the fun part! And the fun part is to replace! You want to replace what you removed or reduced from your budget with anticipated summer expenses. During the summer months, people often keep everything about their spending the same. Then, they add on their new summer expenses, when they don’t have more income coming in to account for that. This is how people find themselves in debt or with a drained savings account come September. Instead of getting into that situation, which can lead to financial stress and financial anxiety, I want you to edit some of your spending, and then replace it with what you know you’re going to want to do over the summer. Just because you’re living on a budget doesn’t mean you can’t enjoy your summer. It’s just that we have to be intentional about our summer spending. This is where you get to just sit down and brainstorm and think through your wants and goals. Ask yourself the following question:

- What part of my budget (which category) do I want to increase?

Maybe you decide to increase your entertainment budget, or your restaurant budget, or add in for local festivals or local events. No matter what you decide, it’s important for you to think through it intentionally and make sure that the math works so that you can actually afford it.

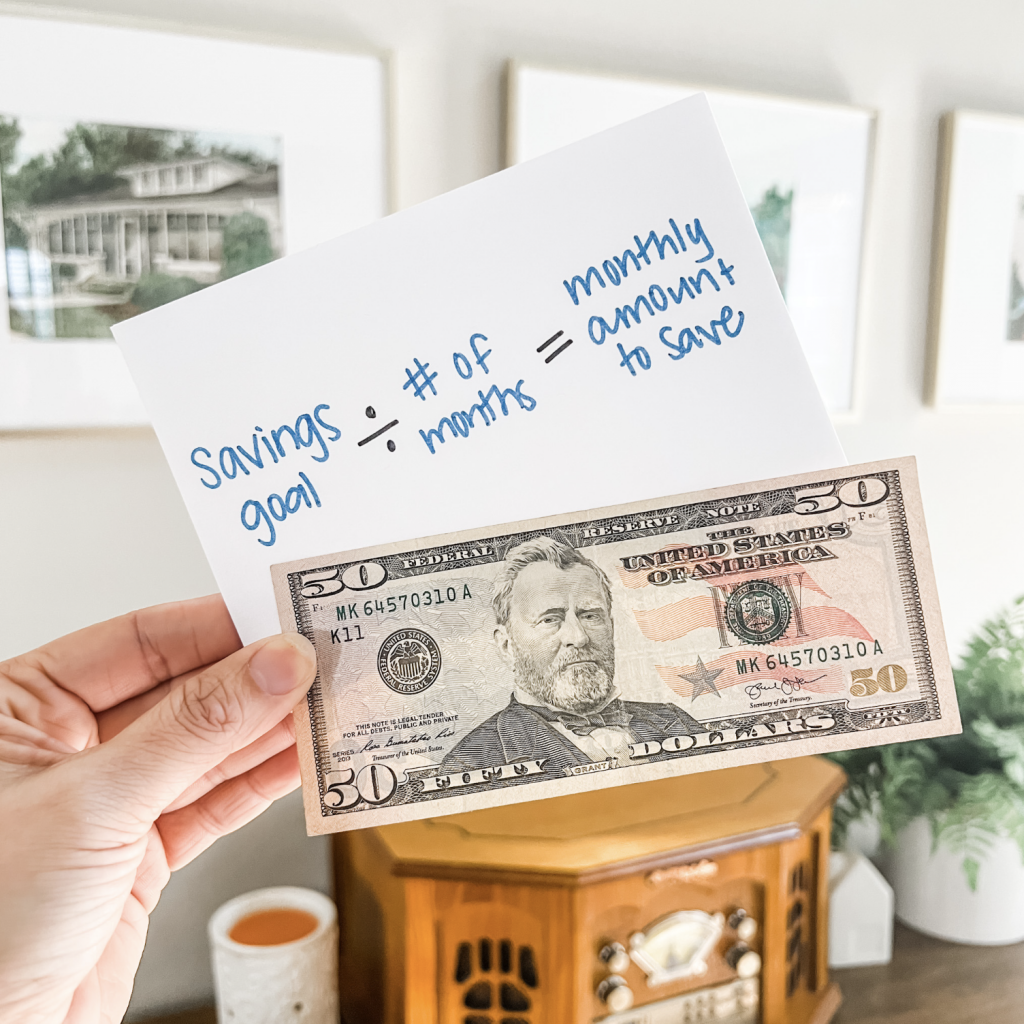

Step 4: Divide The Expenses

This last step is really to help make spending money on bigger expenses easier, and that is to divide a large summer expense over several months. So for instance, I know that this July, my husband and I are going to take a little short getaway for our anniversary. I know we’re probably going to be spending about $800, including a hotel for two or three nights away. So instead of getting to the July month and realizing I need to add this full $900 expense into my budget, which can be really overwhelming and make us feel strapped in other areas of our budget, I’m going to divide that large expense across several months. So I’m going to save maybe $300 in the month of May, $300 in June, and $300 in July. Now I have my full $900. Dividing this big expense up makes it really easy for you to honestly just feel less stressed and make it work financially. It allows you to become very intentional with your summer budget because you know you’re not going to want to spend over a certain amount since you need to save money for that trip!

Well, there you have it. I hope you’re entering the summer months feeling like you have more control over how you’re going to spend your money along with a plan that you can follow that will actually work for you. My hope for you is that when you leave the summer months, there’s no leg