The benefits of budgeting go way beyond just giving you more money. You’ll discover a life full of more freedom and less anxiety too.

You keep hearing about how to budget your money. It seems like it must be the thing to do, right? Have you ever wondered why budgeting is so important? Turns out it’s not just good for your financial health, but good for your mental health too.

Keep reading and find out some of the 12 most surprising benefits of budgeting your money.

Surprising Benefits of Budgeting

It seems like one of the first things everyone tells you about being an adult – learn how to manage your money. Set a budget. Meet your financial goals.

These are all amazing things, but if you have ever wondered why you should make a budget, I have 12 reasons. Some of them are surprising – and others you might already know.

All in all, proper money management is a very good thing – for your life and for your mental health.

1. Increases Communications In Families

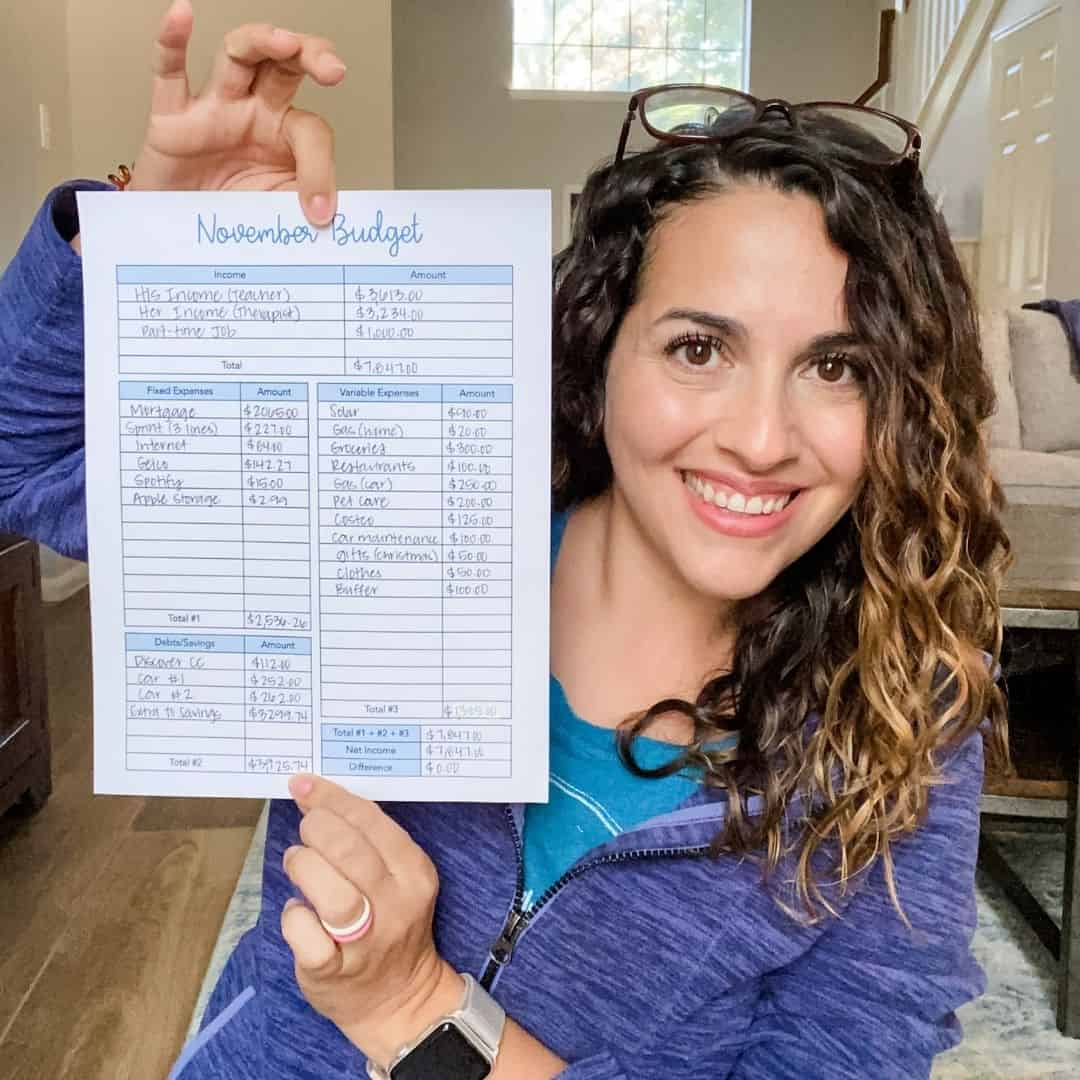

Whether you have a spouse or you are a single-parent, creating a budget gives you a safe and healthy way to communicate about money.

The simple act of going through your expenses and discovering where you spend your money is the best place to start. You only have a set amount that you can earn each month (unless you pick up a side hustle).

When you create a budget together as a team, it helps everyone understand the boundaries. Instead of one person feeling like the person nagging all the time, create the budget together. Everyone should have a say in where the money goes and how much should be spent in each category.

An easy way to do this is to set up weekly budget meetings. This is a great time to set up or review your budget, write a meal plan, and get on the same page with your weekly schedule and activities.

2. Helps You Save For Unexpected Expenses

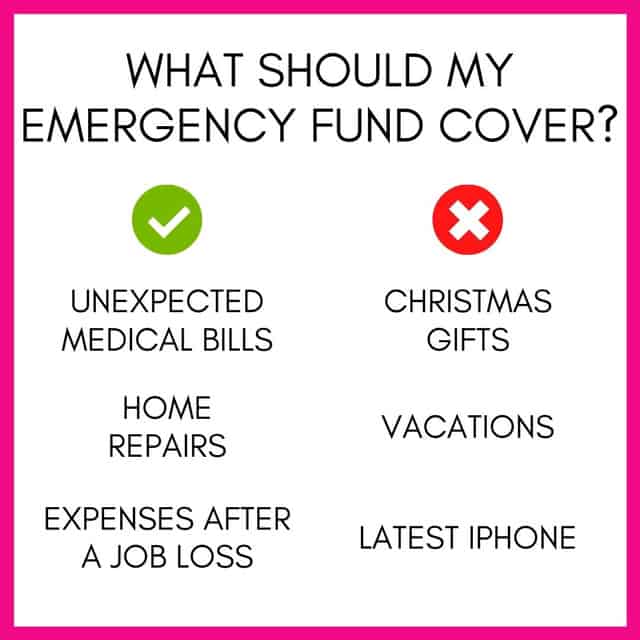

Budgeting also helps you save up for things that you can’t predict will happen – like a deer jumping out in front of your car or your hot water heater leaking.

Part of creating a budget is setting aside money in an emergency fund, you will prevent these unexpected things from throwing you into financial disaster.

It is very important that you establish an emergency fund. Then, when you have to use money from it, build it back up. The best way to create one is to make a budget.

3. Creates More Emotional Security

When you know where your money is going and how to plan ahead for emergencies, you will feel more secure and in control. Instead of always being a victim and not knowing where your money is going, you will be the one controlling it.

Financial insecurity is one of the leading causes of anxiety. Stress can cause all sorts of health effects too.

Part of setting a budget is problem-solving. Look at places you can cut back and find ways to pay off debts so you keep more of your money. When you do all of this, you will feel happier and less stressed.

4. There Are Long-Term Planning Benefits

What are your long-term financial goals? When you create a budget, you will be able to see how to reach those goals. It all starts with a simple budget. In fact, when you control your spending and set a good budget, you will be able to set a roadmap that will lead you to your goals.

The good decisions you make today – like creating an emergency fund and paying off your debt – will pay off in the long run. Soon, you will be able to move from saving your money to investing it.

5. Gives You Control Over Your Money

If you have ever looked at your bank account and had no idea where your money went, you need a budget. A budget takes all the surprise overages out of the equation.

Instead of being clueless, you become the boss, completely in control of how much you spend and how much you save.

This doesn’t mean that unexpected expenses won’t happen. It does mean that when they pop up, you’ll be ready. You’ll know how to react because you know how much money you have and how to pay for it. Ultimately, you’ll feel in more control of your money than ever before.

6. Enables You To Teach Your Kids About Finances

When you set and stick to a well-managed budget, it gives you the foundation you need to teach your kids how to handle money. Instead of teaching your kids to “do as I say, not as I do,” you will be able to show them your budget and teach them the lessons you learned from it.

It’s no secret that children learn from the examples their parents live out. Show them what financial security looks like.

This is one parenting benefit most people don’t talk about, but it’s so true!

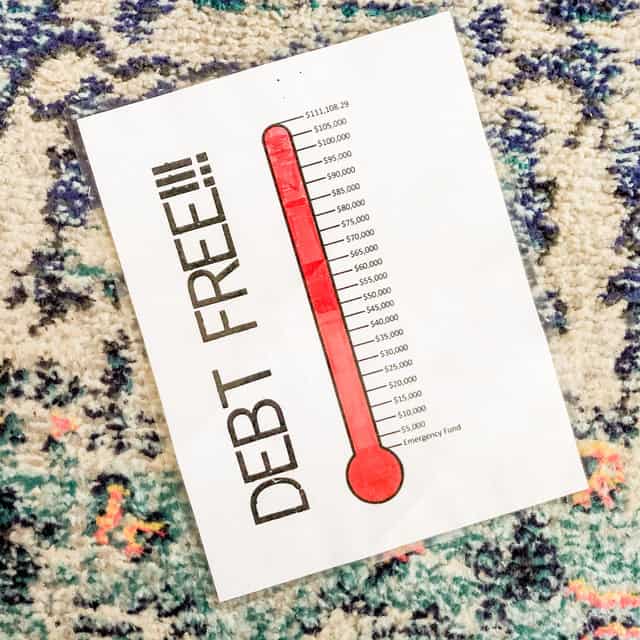

7. Allows You To Get Rid Of Debt

When you set and stick to your budget, you will be able to pay down your debt quicker.

There are lots of ways to pay down debt – my favorite is the debt snowball. With this method, you start out paying off your smallest debt first. Then, you apply that amount to your next biggest debt.

Keep doing this until you are completely debt free.

No matter which way you choose to pay off your debt, the way you will do it is by planning ahead. You need a budget that will allocate a specific amount towards debt payment.

Otherwise, you’ll spend your money on anything else besides your debt.

8. Prevents Overspending

Another benefit of setting up a good budget is that it prevents you (and anyone else in the family) from overspending.

It is way too easy to check your bank balance and see that you have money, so you spend it – all while forgetting that you have a large bill that’s coming due in a few days.

Instead of falling into the trap of spending and then not having money later, plan out a specific amount of “spending money” each month in your budget. When you know how much you can afford to spend, you’ll keep more of your money in the bank.

One of my favorite ways to prevent overspending is the cash envelope system. It takes the idea of a budget and makes it visual. When you see that you have $20 to spend, you won’t spend $30.

It’s that simple!

9. Sets Your Priorities

Another one of the benefits of budgeting is that it helps you set your financial priorities. As you sit down and plan how much you will spend on food for the month, you’ll know whether you value eating out more than cooking at home.

A budget will help you live frugally and stay within your means.

Before you create your budget, think about your deeper priorities.

- Is travel really important to you?

- What about living debt free?

- What else is so important to you that it will affect how you spend your money?

Answer all of those questions, then plan out your finances. Knowing why you are doing it will keep you motivated and focused too.

10. Shines A Light On Your Character

Are you a spender or a saver? Do you prefer to live life according to a strict plan or do you feel like that’s too restrictive?

The simple act of setting a budget will bring your character to light and help you (and your partner) get to know more about what you really care about.

A budget should never be something that you do with resentment. It should be a time you look forward to. As you set your budget, if you feel stressed out for any reason, deal with that first. If you feel like your values aren’t being understood, speak up about it.

Talking about money shouldn’t lead to a fight or an emotional breakdown, but it can be a very tough thing. Sometimes, these hard conversations need to come out.

That’s why setting a budget can actually be really enlightening. It can help you learn more about yourself and what you value.

11. Resolves Financial Stress

While talking about money might cause some people to feel uneasy or worried, if you set a strong budget and make a plan for how you will live within your means, it can actually reduce your stress.

One of the leading causes of financial stress is the passive feeling like it is happening to you and you don’t know what to do about it.

Setting a budget puts the control back in your hands. You will know which expenses are eating away at your income the most and make a plan for minimizing them.

Knowledge really is power – especially when it comes to your money.

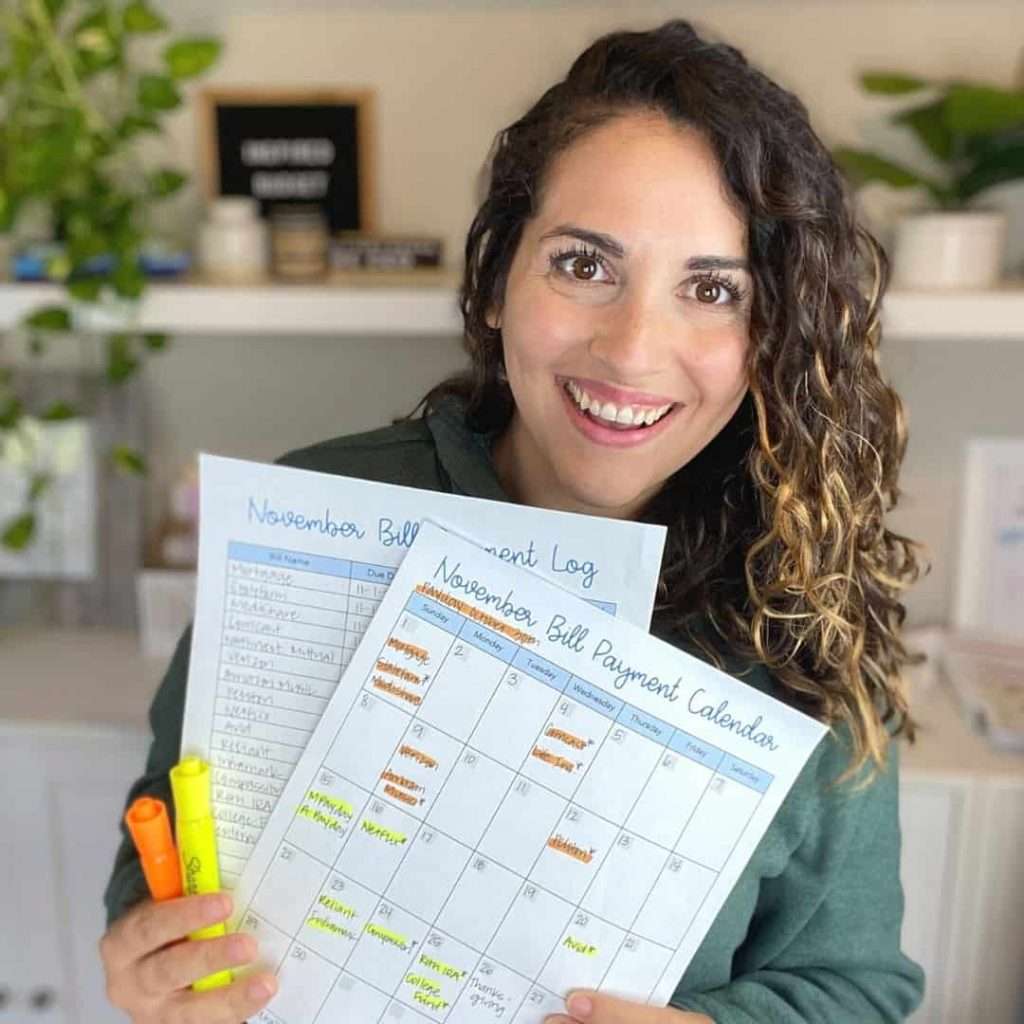

12. Keeps You Organized

When you organize your finances, you will be more likely to organize other areas of your life too.

Instead of always being behind in your bills, a budget will keep you organized and on top of them. You’ll know what to pay and how much money you have left after you pay it.

The beautiful thing about a budget is that it makes it easier to organize your calendar and other parts of your life. When you know how much money you can spend on groceries, you’ll be more likely to organize your menus and be smarter as you shop for food.

It all works together.

The Benefits Of Budgeting: Final Thoughts

There are so many benefits when it comes to budgeting. Some of them are financial – like paying off debt while other benefits are more emotional. You’ll be more in control and less stressed out.

All of these benefits add up to one thing – a proper budget will pay off!