Having trouble making ends meet? You’re not alone. According to Forbes, nearly half of Americans expect to live paycheck to paycheck this year. If you’re strapped for cash, it might be time to look at your spending and cut things from your budget.

If you find yourself needing to find extra money each month, consider scaling back (or cut out completely) on these 25 expenses.

1. Cable

We saved $70 each month when we finally said goodbye to cable! We got rid of cable before it was common to live off of Netflix and Hulu. People thought we were weird. However, we not only saved an extra $70 each month, but we also had the TV on less. HGTV and ESPN weren’t on in the background all the time.

We talked more and read more. We played more and were less distracted. If you still have cable, I’m a huge proponent of saying your farewells. Your wallet (and family time) will thank you!

Popular Alternatives to Cable:

2. Cell Phones

Years ago, you had to use one of the big-name cell phone companies if you wanted to have good service. Thankfully, things are different these days!

There are many cell phone companies, such as Mint Mobile and Republic Wireless that have received high ratings lately. In fact, switching to a smaller cell phone company could potentially save you hundreds each month, and thousands each year. These companies are perfect for large families with several lines.

Before you switch, do your research. Check out the best cell phone company for your area to be sure you’ll have great reception at home. Chances are you’ll be able to find a company and cut back on your budget significantly.

3. Home & Auto Insurance

My husband and I shop for better deals on home and car insurance nearly every year. Several years ago we saved $397 each year by switching our home insurance to a different company.

Here’s the crazy part: the deductible is exactly the same. No joke! We have the exact same deductible, but we pay almost $400 less per year. That’s $33 each month. I know that $33 is not a ton of money, but if you add it up to other savings then it helps you save some serious cash.

Next time you have 20 minutes, sit down and get a quote from 3-4 insurance companies. Sometimes you can even save more if you bundle your home and auto insurance together. By simply shopping around for insurance or using a bill negotiation service each year, you’re bound to cut back on your budget.

Check out the best rates for home insurance in your area below:

4. Going out for Lunch

Can I be honest here? Lunch out is one of my guilty pleasures. I love picking up lunch for myself, however, I don’t make it a habit. Why? Because spending $5-10 for lunch even three times a week can be extremely costly. You could save hundreds each month by simply bringing your lunch to work.

To help make bringing lunch to work a no-brainer, consider preparing your lunches in advance. Take time on Sunday to prep and pack lunches for the entire week. This makes it easy to grab your lunch and go in the morning. Another option is to make dinner and immediately pack yourself leftovers for lunch before you serve anyone. This is exactly what we do for my husband!

5. Memberships and Subscriptions

Years ago, our family saved $65 each month when we canceled our gym membership. For years we only worked out at home. Our family invested in a few sets of dumbbells, a chin-up bar, and a few workout DVDs to use at home. We were still able to get a good workout without the monthly cost of a gym membership.

What other memberships or subscriptions could you cancel? If you have any magazines, you can most likely read those online for free through your local library. Take a look at any of these extra costs and ask yourself if they are really necessary. Are they worth the extra money that you could be saving or using to pay off debt? Be honest with yourself!

Common Memberships and subscriptions to check:

- Club Memberships (like Costco & Sam’s)

- Magazines

- Razors

- Beauty boxes or any other monthly subscription boxes

- Amazon

- Monthly online memberships

To find more monthly charges, pull out your most recent bank statement and comb through it. You’re likely to find areas where you can cut back right away.

6. Entertainment

It’s easy to spend a lot of extra money each month on entertainment. It’s especially easy to spend that money if you have children that you feel like you have to entertain on the weekends. Did you know that your local library has DVDs to check out? Instead of spending $40 at the movies, stay home and watch a movie that you borrowed for free! You can even make popcorn, buy candy, and cuddle on the couch.

When it comes to other free entertainment ideas, check your town for any parades, festivals, or free classes. Explore a new park or go hiking outdoors. Fly a kite or go fishing for a few hours. Entertainment doesn’t have to cost a lot of money (or any money at all)!

You can save a ton of money on entertainment with Groupon. Groupon is a website where you can buy vouchers (kind of like gift cards) to a business for a discount. For instance, you can buy a $50 gift card to a local movie theater for $30. Or buy an annual family membership to the local museum for 50% off.

These are great ways to save a ton of money on local things to do. You just go to the Groupon website, add your city and click on things category > local > things to do.

Need more ideas for family fun on a budget? Check out 30 Cheap Family Fun Night Ideas.

7. Clothes

I love buying new clothes. And yet, when my husband and I sat down to complete our first budget, I had $0 to spend on clothes. It was like that for many months until I just broke down. I wanted clothes BAD. They felt forbidden, so I did what any adult in control of their actions did (she says sarcastically). I said “forget the budget!” and went on a shopping spree.

After that shopping trip, I talked with my husband about including a monthly clothing allowance in our budget. We worked it out and I no longer felt the need to impulse spend on clothing.

Over the years I have had to learn how to control my shopping sprees. It’s not easy and I’m not great at it, but I definitely don’t spend as much money on clothing as I used to.

Have you considered giving yourself a clothing allowance? Give yourself a set amount that you can spend each month and save up your money over several months to make a big purchase. You’ll become more disciplined and you will save money all at the same time!

8. Extra Groceries

When I started my first teaching job I felt like a millionaire. Here I was with the biggest paycheck I had ever seen and I felt like I was on top of the world!

Turns out I was under a ton of debt, but I was so unaware and in denial about that.

So what did I do? I went grocery shopping at WholeFoods and spent over $120 each week on groceries.

For one person.

And I still went out to restaurants at least 4 times per week! Let me put this into perspective for you. I currently budget $150 each week for groceries for 4 people.

The difference now is that I don’t buy food on a whim. Instead, I sit down every Friday night and make my meal plan for the following week (I know, I know. I’m wild and you’re totally jealous). I look at my grocery store’s ads and I check my coupons. I inventory the food in my pantry and I write out our family’s meals based on what is on sale and what I already have. These meals are not glamorous (cooking has never been my favorite way to spend time). But guess what! They feed my family and provide them with (most of the time) healthy ingredients.

So sit down, write out a meal plan, and buy only the food you need. You have no idea how much you can save if you stick to your plan!

9. Getting takeout for dinner

Food is one of the largest variable expenses for most families. Restaurant tabs can add up quickly. A family of four can drop $50 in a restaurant faster than you can blink. Even McDonald’s could cost $30 or more a pop. If you eat out a few times a week you can spend over $400 a month on restaurants.

If you love getting takeout to get a break from cooking, you don’t have to totally cut out restaurants. Instead, you can just scale it back to once a week.

10. Buying drinks at restaurants

Getting water at restaurants is a quick and easy way to save money. You can still go out to eat, but you will save $10-$12 each time for a family of 4. If you go out once a week, you can save up to $48 a month just by getting water.

This is a great way to save money without giving up something you love like going out to eat.

11. Car Washes

Car washes can cost around $9 or more depending on which package you purchase. If you do that once a week that equals $36 a month or $72 a month if you and your spouse do weekly car washes.

You can purchase a car wash cleaning kit from Amazon or Target for under $15 and it will last you several washes. You can save a ton of money by washing your car at home.

12. Hair and Nail Care

Getting your nails and hair done can add up quickly too. I used to get a pedicure once or twice a month at $50 per visit. That added up over the year. The good news is you can do your nails at home. There are plenty of great nail polishes and acrylic nail sets available for at home manicure/pedicures now.

Getting your hair done can rack up too. You can dye your hair at home and/or go longer in between cuts if you want to save some money.

13. Cut Every Category Down a Small Amount

If you really need to cut your budget, you can just knock off 10% on all of your variable budget categories. That way, you’re just taking a little bit off each one.

It’s easier to cut your groceries down by 10% than by a higher number like 50%. Plus the 10% adds up quickly. You can really save a ton of money by using this trick.

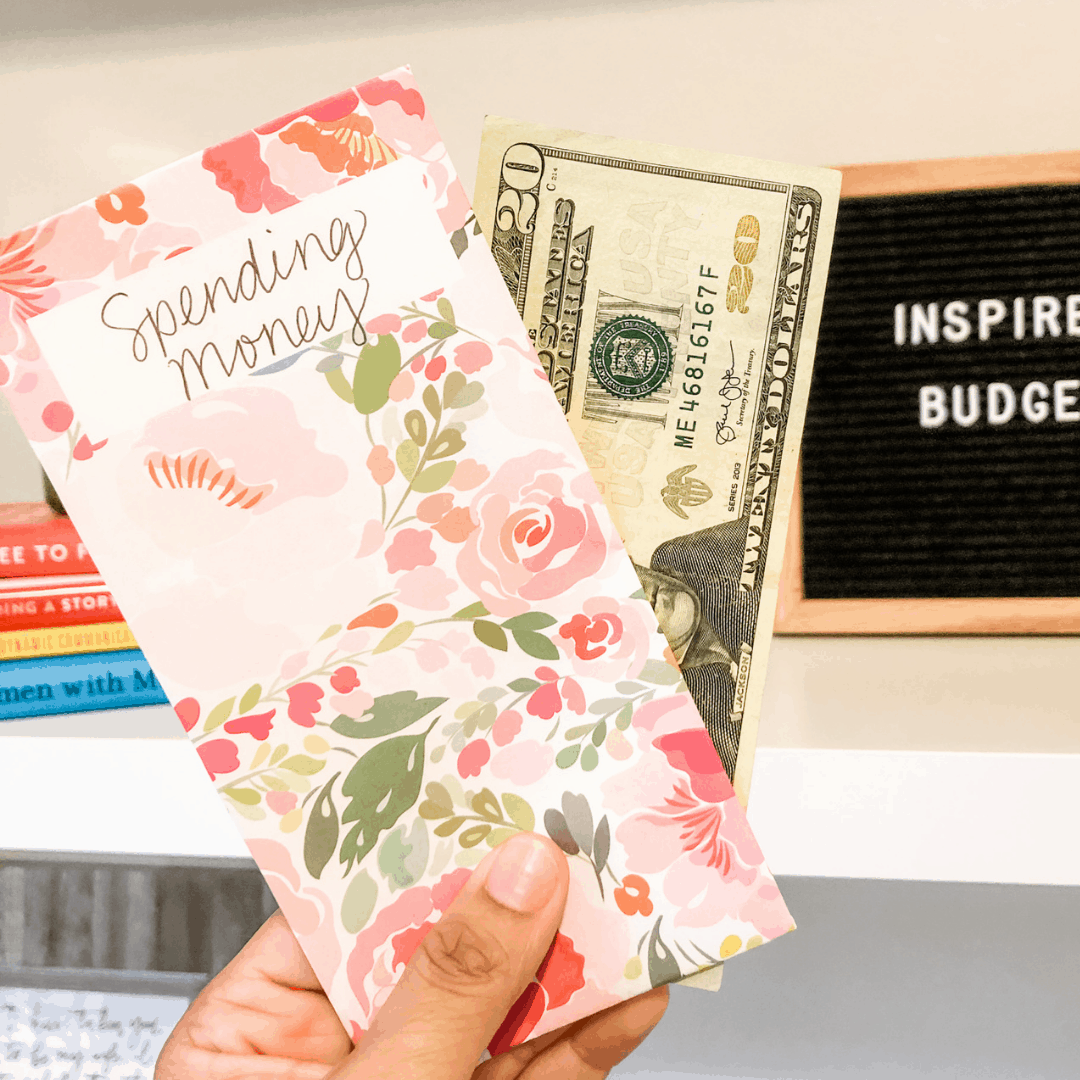

14. Pay with Cash for Categories Where You’re Prone to Overspending

If you find yourself overspending in one particular category (or more), start using cash envelopes. A recent MIT study showed that people spend 100% more with a credit card than with cash.

Implementing small tips like this one add up and can end up being huge savings.

Here are some common budget categories for cash envelopes:

- Groceries

- Restaurants

- Personal Spending Money

- Christmas

- Entertainment

- Gifts

If you’ve never used cash envelopes before, don’t go overboard in the beginning. Start with a few envelopes and build up from there. You are changing a habit and that takes time. Just doing a little at a time will help you make lasting changes so you won’t worry about slipping back into your old habits. You can read more about cash envelopes HERE and get some free printable envelopes to get started.

15. Impulse Purchases

Impulse purchases can really blow your budget. It can be really easy to get caught up in the movement at the store and put a few of those Bath & Body Works candles on sale into your basket.

It’s so easy to get caught up in impulsive spending. It’s hard to stop spending money. I get it. If you had the willpower to stop spending money, you would have done that already, right?

That’s exactly why I created Stop the Swipe. Stop the Swipe is a great quick-win course geared towards helping you identify your bad money habits and change them for good. It allows you to manage your money instead of the other way around. I believe it’s totally possible for you to win with money!

16. Bottled Water

Bottled water doesn’t really seem like a big deal to most people. It only costs like $1.50 a bottle for the most expensive brand at the store, right? But when you buy bottled water every day or week, it can really add up.

Find cheaper alternatives for water and still get your daily ounces in.

Cheaper Alternatives to Bottled Water:

- Buy a water bottle

- Use tap water (Search water recipes on Pinterest for great-tasting fruit water recipes)

- Buy a filter for your faucet

- Buy a filtered water pitcher

17. Expensive Coffee

There’s no need to spend $7 a day for coffee. You can still make great-tasting coffee from home. Below are a few tips on how to save money while still making a delicious coffee from home.

- Use flavored coffee from the grocery store to brew at home.

- Sprinkle cinnamon on top of your coffee.

- Add cream or whipped cream to your coffee.

- Buy a cute coffee mug that you look forward to drinking out of.

- Buy a better coffee maker – this could save you money in the long run!

- Stock up on your favorite coffee grounds when they go on sale.

18. Lower Your Bills (Negotiate)

Did you know you can negotiate your bills? Yes, if you’re a good customer (long-term and your account is in good standing), you can negotiate for a lower rate.

Here are some bill negotiation tips:

- Make yourself look good.

Remind them how long you’ve been a customer, you’ve never been late, you’ve referred business to them, etc.

- Be nice and assertive

Be very nice to the person you’re speaking with, but also assertive. When you remind them how great of a customer you are, don’t make it sound like a question. Sound confident when you say you’re a good customer.

- Ask for a larger rate decrease than you really want

This gives you some room for negotiation and in the end, everyone wins! You’ll decrease your rate and they will keep you as a customer.

- Know the rate of their competitors.

Know the price of their competitors. If I switch my phone to XYZ company, I will save $50 a month right off the bat. And I don’t have to sign a contract.

- Don’t be afraid to call back

My internet company runs sales periodically for new customers. If they don’t have a better rate at this time, you can just call back in a few months and see if it’s lower at that time.

19. Monthly Bank Fees

You shouldn’t have to pay a monthly service fee just for having a checking account at your bank. If you are paying a monthly fee, ask your bank if there are any other options for you. Most banks have several types of checking accounts. Another type of checking account might be better suited for you and not charge a monthly fee.

When you change your type of checking account, you don’t have to change your account number, debit card, or anything. The bank literally just does this on their end and you don’t notice any changes on your end (other than a free account).

If you have to “jump through a few hoops” to get a free account, just make sure you can meet the monthly expectations. For example, some banks require you to have direct deposit set up to enjoy their free account. You might also need to use your debit card a certain amount each month or even maintain a minimum balance.

20. Overdraft Fees

Overdraft fees are where most banks make a TON of money. They have no problem with you swiping your debit card when you don’t have money. Most people can pay an average of $250 a year in overdraft fees. That’s a lot of unnecessary fees!

An overdraft fee is basically a high-interest loan. The bank allows your transaction to go through and charges you a fee for the transaction.

You can stop overdraft fees by creating a budget, using cash envelopes, and balancing your checkbook. You don’t have to pay overdraft fees.

21. Paper & Other Disposable Products

If you really want to save money on groceries, you can cut out paper towels, napkins, paper plates, and disposable utensils. Simply replace them with reusable supplies. That way you’re not giving them up, you’re just using a less expensive alternative.

22. Switch to Generic Brands

Switching to generic brands is a great way to save. Your family might barely recognize the change too. You can save up to $1,000 a year by switching to generic brands at the grocery store.

Most generic foods don’t even taste that much differently than the name brand. Some stores even have a policy that they will give you a full refund for the generic product if you don’t think it tastes as good as the name-brand. You literally don’t have anything to lose by trying it.

23. Save on groceries by 20%

You can slowly save money on groceries. You don’t have to implement all of them at one time. Just pick a few habits and change them one or two at a time and create new habits around buying groceries.

Here are some money-saving tips for the grocery store:

- Start with a meal plan.

- Create your meal plans around things that are on sale at the grocery store.

- Always use a list.

- Shop at a discount store like Aldi (90% of the food they sell is their store brand and therefore makes the price significantly lower).

- Stock up on sale items- just buy 1 or 2 extras of the items you use frequently.

- Buy produce in season.

24. Transportation

Transportation is another large household expense. You’ll be able to save a lot of money each month if you’re willing to cut costs by:

- Walking

- Carpooling to work

- Riding a bike

25. Extras (Personal $)

Give yourself a budget for personal spending money. Withdraw that money from your account and put it in a cash envelope. Study after study has shown that you spend less when you use cash over using a card. After you finish your personal money, work on saying no to impulse spending.

The Bottom Line

Take the time to sit down and choose what expenses you are willing to live without. What can you get rid of? Which of these items are not as important as your financial peace? Add up the expenses (even the small ones) and see just how much money you can save!