When my husband and I were dating, being debt free was NOT on our radar. We were just two twenty-somethings who were living in the moment. To be painfully honest, I was looking forward to us living in a big city and just being married.

We’d go out to dinner all the time and have a fun social life. We’d sleep in late on the weekends and head to happy hour each weeknight. Life would be easy.

Ha! It’s just when you think life is going your way when it throws you a curveball. Does that seem to happen to you too?

After the initial wave of nausea (is that morning sickness or panic setting in?), we immediately buckled down and created our first budget.

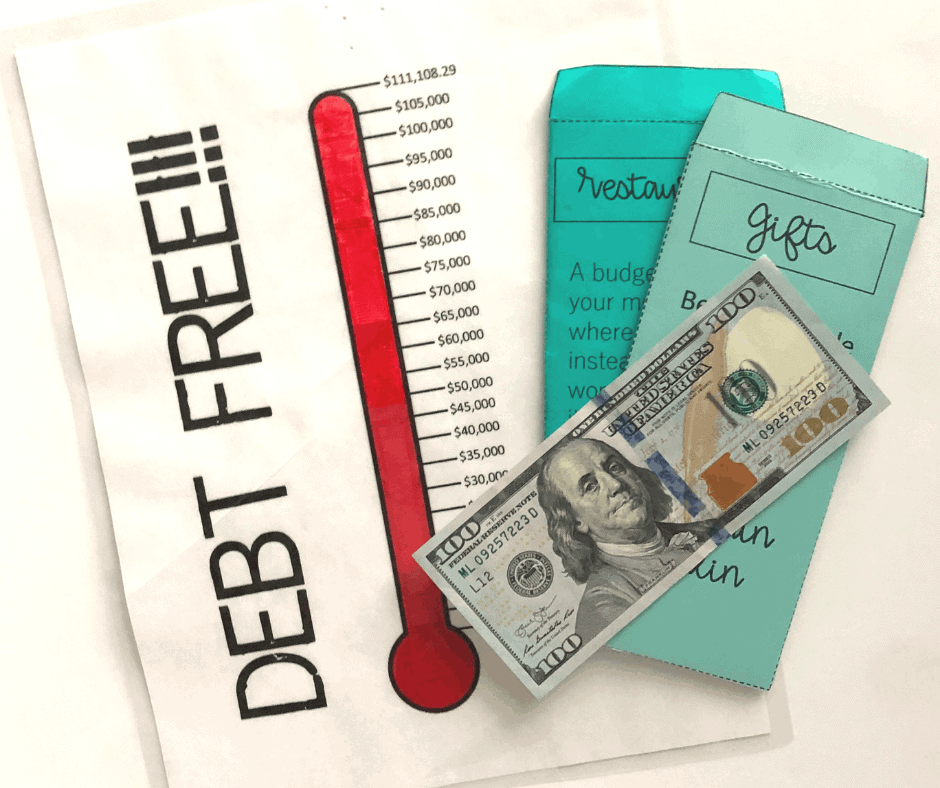

Our curveball came in the form of a positive pregnancy test. We were newly married, pregnant, and had absolutely no idea what we were doing. It wasn’t until this moment that we were forced to come face to face with our looming debt. Facing your truth can be hard, and it was definitely difficult for us! When we totaled all of our debt (which we had never done before). We had over $111,000 in student loans and car loans. In fact, our minimum debt payments each month totaled to $1,400!!!

The truth about budgeting

I’m not going to sit here and tell you that budgeting was easy for me. The first month we wrote a budget was terrible! I couldn’t get over the fact that we were two adults with college degrees and yet we couldn’t write a budget that worked for us. To be 100% honest, I didn’t want to keep budgeting. I wanted to live freely and spend my money how I wanted. I didn’t want a piece of paper controlling my life.

But you know what’s funny about life? Sometimes you end up enjoying the thing that you once despised. After months of absolutely hating our budget, I grew to love it. Heck, I even looked forward to working on our budget each month! I loved how having a budget made me finally feel like I had control over my money. I knew that after I paid all my bills I would still have enough money to buy groceries and anything else I’d need for the rest of the month. There were no more “what ifs.”

For the first time in my life I was controlling my money, not the other way around.

A bumpy road

Our debt free journey was not an easy one. We had our fair share of surgeries to pay for, broken cars to fix, and medical bills to pay. There were times when I didn’t want to be the adult anymore. I wanted to take a grand vacation instead of sending an extra $1,000 to my car loan. I wanted to shop at Pottery Barn instead of Ikea. And every part of me detested the fact that we cut our restaurants budget down to barely anything.

But you know what I hated more than all of that? I hated that I had loans that hung over my head. I hated that I couldn’t save money for my kid’s college because we were still paying for our degrees. Our finances were unstable, and I hated knowing that if something went wrong, we couldn’t handle it ourselves. Because here’s the deal…something will go wrong. It’s just a matter of time.

Through it all, we stuck to our goal and focused on the light at the end of the very long tunnel. We stuck to our debt snowball plan (you can read more about the debt snowball method HERE) and made progress month in and month out. There were times when our progress was very minimal, but it was still progress.

Becoming debt free

In August 2016 we made our last and final payment to a student loan company. I couldn’t believe it! After 4.5 years, we had paid off over $111,000 on two teacher salaries. We were a young family with little kids and finally felt free. No more car loans. No more student loans. We freed up $1,400 each month on our debt free journey.

Staying the course

So here’s the thing: looming debt can be paralyzing. It’s honestly much easier to not think about it and just simply make your monthly payments. But when has life been easy? Instead, I’d like to encourage you to face your financial truth. Add it up and develop a plan on how you can take back control of your finances. Sit down each month and create a budget. Have the discipline to stick with it. Then you won’t just see the light at the end of the tunnel, you’ll be in the light.